Use these links to rapidly review the document

TABLE OF CONTENTS

INDEX TO FINANCIAL STATEMENTS

Exhibit 99.1

May 9, 2018

Dear Wyndham Worldwide Corporation Stockholder:

I am pleased to inform you that the board of directors of Wyndham Worldwide Corporation ("Wyndham Worldwide") has approved the spin-off (the "spin-off") of Wyndham Hotels & Resorts, Inc. ("Wyndham Hotels"), a wholly-owned subsidiary of Wyndham Worldwide. Upon completion of the spin-off, the stockholders of Wyndham Worldwide will own 100% of the outstanding shares of common stock of Wyndham Hotels, and will continue to own 100% of the outstanding shares of common stock of Wyndham Worldwide. Wyndham Hotels will be a new, publicly traded hotel franchising and management company with a portfolio of renowned brands. This business is comprised primarily of the operations that have constituted the Hotel Group operating segment of Wyndham Worldwide. Wyndham Hotels is the global leader in the economy segment of the hotel industry and has a substantial and growing presence in the midscale and upscale segments. In conjunction with the spin-off, Wyndham Worldwide will be renamed Wyndham Destinations, Inc. ("Wyndham Destinations") and, following the spin-off, it will continue to be the world's largest developer and marketer of vacation ownership products and the world's largest vacation exchange company.

We believe the spin-off is in the best interests of Wyndham Worldwide, its stockholders and other constituents, as it will result in two publicly traded companies, each with increased strategic flexibility and an enhanced ability to maintain its focus on its core business and growth opportunities, facilitate future capital raising as needed, and make the changes necessary to respond to developments in its respective markets.

The spin-off will be completed by way of a pro rata distribution of Wyndham Hotels common stock to Wyndham Worldwide's stockholders of record as of 5:00 p.m., Eastern time, on May 18, 2018, the spin-off record date. Each Wyndham Worldwide stockholder will receive one share of Wyndham Hotels common stock for each share of Wyndham Worldwide common stock held by such stockholder on the record date. The distribution of these shares will be made in book-entry form, meaning no physical share certificates will be issued. Wyndham Worldwide stockholder approval of the distribution is not required, and you will automatically receive your shares of Wyndham Hotels common stock.

The distribution is subject to the satisfaction or waiver of certain conditions, including among other things: final approval of the distribution by the Wyndham Worldwide board of directors; the Registration Statement on Form 10, of which this information statement forms a part, being declared effective by the Securities and Exchange Commission; Wyndham Hotels common stock being approved for listing on the New York Stock Exchange; the receipt of opinions with respect to certain tax matters related to the distribution from Wyndham Worldwide's spin-off tax advisors; the receipt of solvency and surplus opinions from a nationally recognized valuation firm; the receipt of all material governmental approvals; no order, injunction or decree issued by any governmental entity preventing the consummation of all or any portion of the distribution being in effect; and the completion of the financing transactions described in this information statement. We expect that your receipt of shares of Wyndham Hotels common stock in the spin-off will be tax-free for U.S. federal income tax purposes, except for cash received in lieu of fractional shares. You should consult your own tax advisor as to the particular tax consequences of the distribution to you, including potential tax consequences under state, local and non-U.S. tax laws.

Immediately following the spin-off, you will own common stock in Wyndham Destinations and Wyndham Hotels. In connection with the spin-off, we intend to continue to have Wyndham Destinations common stock listed on the New York Stock Exchange under its new symbol, "WYND." We intend to have Wyndham Hotels common stock listed on the New York Stock Exchange under the symbol "WH."

We have prepared the enclosed information statement, which describes the spin-off in detail and contains important information about Wyndham Hotels, including historical financial statements. Wyndham Worldwide stockholders will receive via mail a notice with instructions on how to access the information statement online. We urge you to carefully read the information statement.

For more than a decade, we have remained focused on providing great experiences for our millions of guests around the world and delivering value and return on capital for our stockholders. Throughout this journey, we have

remained guided by a fundamental commitment to deliver reliable growth in a disciplined and responsible way. These stockholder-focused principles will continue to guide Wyndham Hotels in the years to come. We thank you for supporting our mission to welcome people to experience travel the way they want, and look forward to your continued support in the future.

| Very truly yours, | ||

/s/ STEPHEN P. HOLMES |

||

| Stephen P. Holmes | ||

| Chairman and Chief Executive Officer Wyndham Worldwide Corporation |

May 9, 2018

Dear Wyndham Hotels & Resorts, Inc. Stockholder:

It is my pleasure to welcome you to Wyndham Hotels & Resorts, Inc. ("Wyndham Hotels"). We are the world's largest hotel franchisor, with more than 8,400 affiliated hotels located in over 80 countries and with the largest network of franchised hotels of any global hotel company. We are the leading brand provider to economy hotels in the world, and we have a substantial and growing presence in the midscale and upscale segments of the global hotel industry. Our portfolio of 20 renowned brands, including Wyndham, Super 8 and Days Inn, enables us to franchise hotels in virtually any market at a range of price points, catering to both our guests' and franchisees' preferences. Following the consummation of the spin-off, we will be a separate, publicly traded company, and we intend to have our common stock listed on the New York Stock Exchange under the symbol "WH."

Our business model is asset-light and easily adaptable to changing economic environments due to low operating cost structures, which, together with our recurring fee streams and limited capital expenditures, yield attractive margins and predictable cash flows.

We invite you to learn more about Wyndham Hotels by reviewing the enclosed information statement. We look forward to our future as an independent, publicly traded company and to your support as a holder of Wyndham Hotels common stock. We also look forward to welcoming you as a new or returning guest at one of our hotels around the world.

| Sincerely, | ||

/s/ GEOFFREY A. BALLOTTI |

||

Geoffrey A. Ballotti President and Chief Executive Officer Wyndham Hotels & Resorts, Inc. |

Information Statement

Distribution of

Common Stock of

WYNDHAM HOTELS & RESORTS, INC.

by WYNDHAM WORLDWIDE CORPORATION

to Wyndham Worldwide Corporation Stockholders

This information statement is being sent to you in connection with the separation of Wyndham Hotels & Resorts, Inc. from Wyndham Worldwide Corporation (collectively with its consolidated subsidiaries, "Wyndham Worldwide"), following which Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company. In conjunction with the separation, Wyndham Worldwide Corporation will be renamed Wyndham Destinations, Inc. As part of the separation, Wyndham Worldwide will undergo an internal reorganization, after which it will complete the separation by distributing all of the outstanding shares of common stock of Wyndham Hotels & Resorts, Inc. on a pro rata basis to the holders of Wyndham Worldwide Corporation's common stock. We refer to this pro rata distribution as the "distribution" and we refer to the separation, including the internal reorganization and distribution, as the "spin-off." We expect that the distribution will be tax-free to the stockholders of Wyndham Worldwide Corporation for U.S. federal income tax purposes, except to the extent of cash received in lieu of fractional shares. Each Wyndham Worldwide stockholder will receive one share of our common stock for each share of Wyndham Worldwide common stock held by such stockholder on May 18, 2018, the record date. The distribution of shares will be made in book-entry form only. Wyndham Worldwide will not distribute any fractional shares of Wyndham Hotels common stock. Instead, the distribution agent will aggregate fractional shares into whole shares, sell the whole shares in the open market at prevailing market prices and distribute the aggregate net cash proceeds from the sales pro rata to each holder who would otherwise have been entitled to receive a fractional share in the spin-off. The distribution will be effective as of 11:59 p.m., Eastern time, on May 31, 2018. Immediately after the distribution becomes effective, Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company.

No vote or other action of Wyndham Worldwide stockholders is required in connection with the spin-off. We are not asking you for a proxy and you should not send us a proxy. Wyndham Worldwide stockholders will not be required to pay any consideration for the shares of Wyndham Hotels common stock they receive in the spin-off, and they will not be required to surrender or exchange their shares of Wyndham Worldwide common stock or take any other action in connection with the spin-off.

All of the outstanding shares of Wyndham Hotels common stock are currently owned, directly or indirectly, by Wyndham Worldwide Corporation. Accordingly, there is no current trading market for Wyndham Hotels common stock. We expect, however, that a limited trading market for Wyndham Hotels common stock, commonly known as a "when-issued" trading market, will develop at least one trading day prior to the record date for the distribution, and we expect "regular-way" trading of Wyndham Hotels common stock will begin on the first trading day following the distribution date. We intend to list Wyndham Hotels common stock on the New York Stock Exchange under the ticker symbol "WH."

In reviewing this information statement, you should carefully consider the matters described in "Risk Factors" beginning on page 28 of this information statement.

Neither the Securities and Exchange Commission (the "SEC") nor any state securities commission has approved or disapproved these securities or determined if this information statement is truthful or complete. Any representation to the contrary is a criminal offense.

This information statement is not an offer to sell, or a solicitation of an offer to buy, any securities.

The date of this information statement is May 9, 2018.

A Notice of Internet Availability of Information Statement Materials containing Instructions describing how to access this Information Statement was first mailed to Wyndham Worldwide stockholders on or about April 30, 2018.

Unless otherwise indicated or the context otherwise requires, references herein to "Wyndham Hotels & Resorts," "Wyndham Hotels," "we," "our," "us," the "Company" and "our company" refer (i) prior to the consummation of our internal reorganization described under "The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization," to the entities holding substantially all of the assets and liabilities of the Wyndham Worldwide Hotel Group business used in managing and operating the hotel business of Wyndham Worldwide Corporation (the "Wyndham Hotels & Resorts businesses") and (ii) after the consummation of such internal reorganization, to Wyndham Hotels & Resorts, Inc. and its consolidated subsidiaries. Unless otherwise indicated or the context otherwise requires, references herein to "Wyndham Worldwide" and "Parent" refer to Wyndham Worldwide Corporation and its consolidated subsidiaries prior to the consummation of the spin-off. In conjunction with the spin-off, Wyndham Worldwide Corporation will change its name to Wyndham Destinations, Inc. Unless otherwise indicated or the context otherwise requires, references herein to "Wyndham Destinations" refer to Wyndham Destinations, Inc. and its consolidated subsidiaries following the consummation of the spin-off.

Unless otherwise indicated or the context otherwise requires, all information in this information statement gives effect to the effectiveness of our amended and restated certificate of incorporation and amended and restated by-laws, the forms of which are filed as exhibits to the registration statement of which this information statement forms a part.

I

FINANCIAL STATEMENT PRESENTATION

This information statement includes certain historical combined financial and other data for the Wyndham Hotels & Resorts businesses. To effect the separation, Wyndham Worldwide Corporation will undertake an internal reorganization, following which Wyndham Hotels & Resorts, Inc. will hold, directly or through its subsidiaries, the Wyndham Hotels & Resorts businesses. Wyndham Hotels & Resorts, Inc. is the registrant under the registration statement of which this information statement forms a part and will be the financial reporting entity following the consummation of the spin-off. Our historical combined financial information as of and for the years ended December 31, 2017, 2016 and 2015 has been derived from our audited Combined Financial Statements included elsewhere in this information statement.

Our historical combined financial information as of and for the years ended December 31, 2014 and 2013 has been derived from our unaudited combined financial statements that are not included in this information statement. We have prepared our unaudited combined financial statements on the same basis as our audited Combined Financial Statements and, in our opinion, have included all adjustments, which include only normal recurring adjustments, necessary to present fairly in all material respects our financial position and results of operations. Our selected historical financial data is not necessarily indicative of our future performance and does not necessarily reflect what our financial position and results of operations would have been had we been operating as an independent, publicly traded company during the periods presented, including changes that will occur in our operations and capitalization as a result of the spin-off from Wyndham Worldwide.

In January 2018, Wyndham Worldwide Corporation agreed to acquire the franchising and management businesses of La Quinta Holdings Inc. ("La Quinta"). Accordingly, this information statement includes certain historical combined financial and other data for of Lodge Holdco II LLC and its related subsidiaries, and LQ Management L.L.C. and its related subsidiaries (collectively referred to as "New La Quinta"), wholly-owned subsidiaries of La Quinta, which comprise its hotel franchising and management businesses. The audited Combined Financial Statements of New La Quinta include the balance sheets as of December 31, 2017 and 2016, and the related statements of operations, changes in equity, and cash flows for the years ended December 31, 2017, 2016 and 2015, and the related notes thereto.

This information statement also includes an unaudited pro forma combined balance sheet as of December 31, 2017 and unaudited pro forma combined statements of operations data for the year ended December 31, 2017, which present our combined financial position and results of operations after giving effect to the spin-off, including the internal reorganization and the distribution, the acquisition of La Quinta and the other transactions described under "Unaudited Pro Forma Combined Financial Statements." The unaudited pro forma combined financial statements are presented for illustrative purposes only and are not necessarily indicative of the operating results or financial position that would have occurred if the relevant transactions had been consummated on the date indicated, nor is it indicative of future operating results.

You should read the sections titled "Selected Historical Combined Financial Data" and "Unaudited Pro Forma Combined Financial Statements," each of which is qualified in its entirety by reference to our audited Combined Financial Statements and related notes thereto, the audited Combined Financial Statements of New La Quinta and related notes thereto and the financial and other information, including in the sections titled "Risk Factors," "Capitalization" and "Management's Discussion and Analysis of Financial Condition and Results of Operations," in each case included elsewhere in this information statement.

Wyndham Hotels & Resorts, Inc. was formed in connection with the spin-off. Other than the audited balance sheet as of December 31, 2017, the financial statements of Wyndham Hotels & Resorts, Inc. have not been included in this information statement as it is a newly incorporated entity and has no business transactions or activities to date. In connection with the internal reorganization, Wyndham Hotels & Resorts, Inc. will become the parent of the Wyndham Hotels & Resorts businesses.

II

The market data and certain other statistical information used in this information statement are based on independent industry publications, government publications or other published independent sources. These sources generally state that the information they provide has been obtained from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. The forecasts and projections are based on industry surveys and the preparers' experience in the industry, and there is no assurance that any of the projected amounts will be achieved. We believe that the surveys and market research others have performed are reliable, but we have not independently verified this information. STR is the primary source for third-party market data and industry statistics and forecasts. STR does not guarantee the performance of any company about which it collects and provides data. The reproduction of STR's data without their written permission is strictly prohibited. Nothing in the STR data should be construed as advice. Some data are also based on our good faith estimates.

III

Except where the context suggests otherwise, we define certain terms in this information statement as follows:

IV

This summary highlights information contained in this information statement and provides an overview of the Company, our spin-off from Wyndham Worldwide and the distribution of our common stock by Wyndham Worldwide to its stockholders. For a more complete understanding of our business and the spin-off, you should read this entire information statement carefully, particularly the sections titled "Risk Factors" and "Unaudited Pro Forma Combined Financial Statements" and our audited Combined Financial Statements and the notes thereto included in this information statement.

Wyndham Hotels is the world's largest hotel franchisor, with more than 8,400 affiliated hotels located in over 80 countries. We license our 20 renowned hotel brands to franchisees, who pay us royalty and other fees to use our brands and services. We are the leader in the economy segment and have a substantial and growing presence in the midscale and upscale segments of the global hotel industry. We have grown our franchised hotel portfolio over time both organically and through acquisitions, and we have a robust pipeline of hotel owners and developers looking to affiliate with our brands. In 2017, Wyndham Hotels generated revenues of $1,347 million, net income of $243 million and Adjusted EBITDA of $395 million.

We enable our franchisees, who range from sole proprietors to public real estate investment trusts, to optimize their return on investment. We drive guest reservations to our franchisees' properties through strong brand awareness among consumers and businesses, our global reservation system, our award-winning Wyndham Rewards loyalty program and our national, local and global marketing campaigns. We establish brand standards, provide our franchisees with property-based operational training and turn-key technology solutions, and help reduce their costs by leveraging our scale. These capabilities enhance returns for our franchisees and therefore help us to attract and retain franchisees. With over 5,700 franchisees, we have built the largest network of franchisees of any global hotel company.

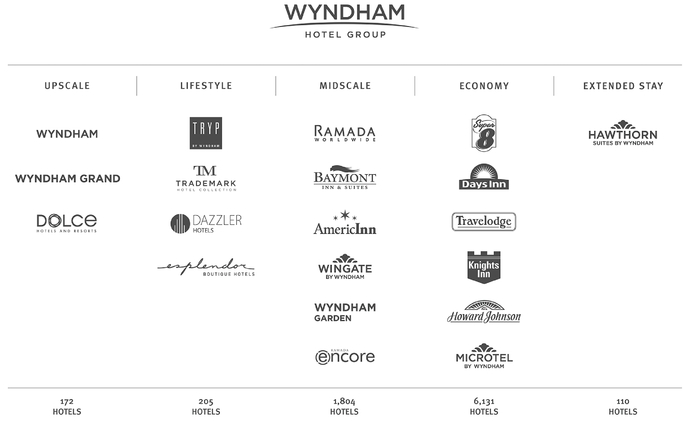

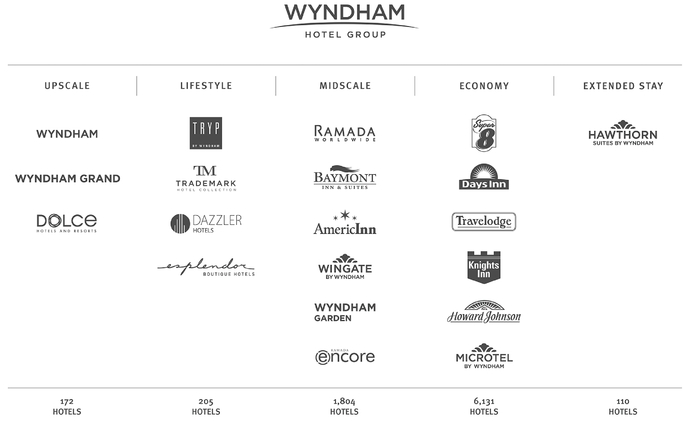

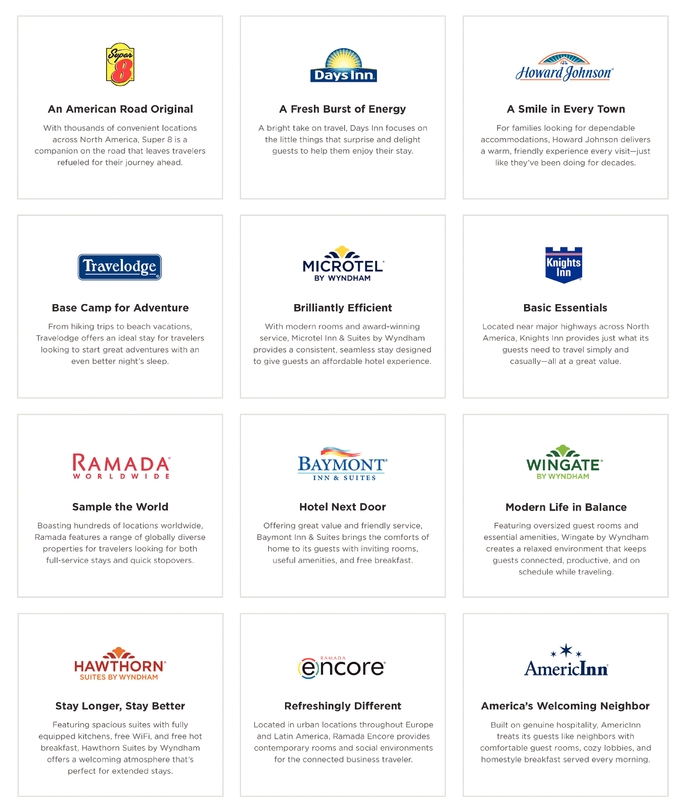

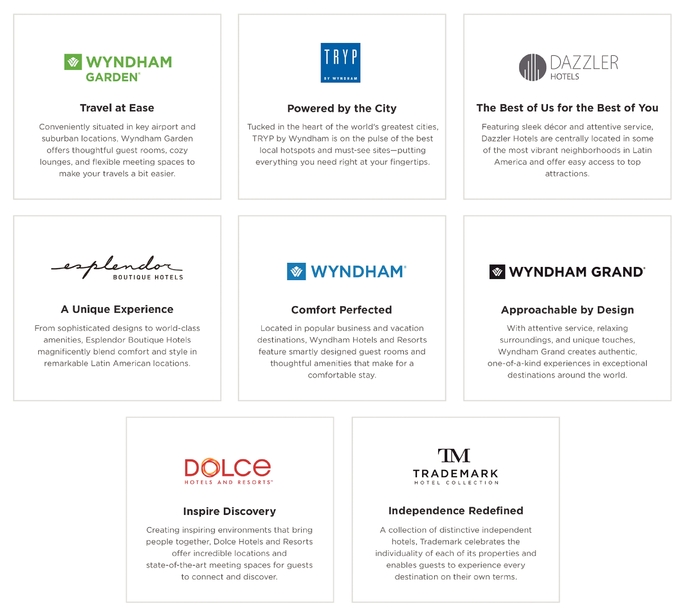

Our portfolio of brands enables us to franchise hotels in virtually any market at a range of price points, catering to both our guests' and franchisees' preferences. We welcome nearly 140 million guests annually worldwide. We primarily target economy and midscale guests, as they represent the largest demographic in the United States and around the world. We have the leading position in the economy segment, where our hotel brands represent approximately two of every five branded rooms in the United States. Approximately 68% of the hotels affiliated with our brands are located in the United States and approximately 32% are located internationally. The following table summarizes our brand portfolio as of December 31, 2017:

1

Our business model is asset-light, as we generally receive a percentage of each franchised hotel's room revenues but do not own the underlying properties. Our business is easily adaptable to changing economic environments due to a low operating cost structure, which, together with our recurring fee streams and limited capital expenditures, yields attractive margins and predictable cash flows. Our franchise agreements are typically 10 to 20 years in length, providing significant visibility into future cash flows. Under these agreements, our franchisees pay us royalty fees and marketing and reservation fees, which are based on a percentage of their gross room revenues. We are required to spend marketing and reservation fees on marketing and reservation activities, enabling us to predictably match these expenses with an offsetting revenue stream on an annual basis. We also license the "Wyndham" trademark and certain other trademarks and intellectual property to Wyndham Worldwide through existing license agreements under which we receive royalty fees, and will continue to earn royalty fees following the spin-off under a long-term licensing agreement. In addition to hotel franchising, we provide hotel management services on a select basis. Our portfolio of managed hotels includes 116 third-party-owned properties and two owned properties. Approximately 99% of the hotels in our system are franchised to third parties, and substantially all of our Adjusted EBITDA is generated by our Hotel Franchising segment.

We pursue multiple avenues of growth to generate returns for our stockholders. We use our scale, brands, guest loyalty and franchisee network to add new hotels to our system. Our long-established franchising experience and ability to innovate, together with favorable macroeconomic and lodging industry fundamentals, continue to support our organic growth around the world. Additionally, we intend to use our cash flow to continue to return capital to stockholders and to invest in the business and pursue external growth opportunities.

2

Our Competitive Strengths

We believe our success has been and will be driven by significant competitive strengths that we have developed over time:

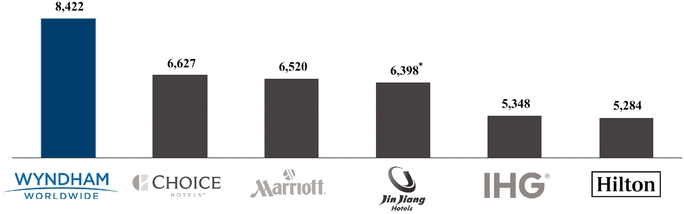

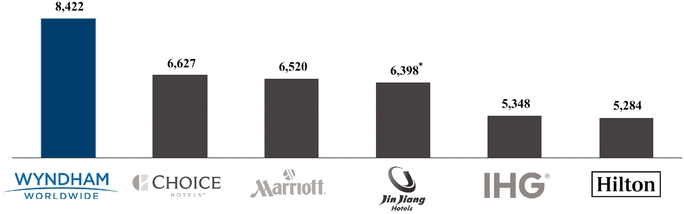

Industry-leading footprint in the hotel industry

Wyndham Hotels is the world's largest hotel franchisor, with more than 8,400 affiliated hotels in over 80 countries. Our brands have substantial presence, welcoming nearly 140 million guests annually worldwide. The following chart presents the number of branded hotels associated with each of the six largest hotel companies:

Global Hotel Companies by Number of Branded Hotels as of December 31, 2017

* As of June 30, 2017.

Source: Companies' public disclosures.

Our scale enhances brand awareness among consumers and businesses and provides numerous benefits to franchisees. Our global reservation system, extensive distribution network and our award-winning Wyndham Rewards program drive over 60 million guest reservations annually to our franchisees. We also help our franchisees reduce overall costs through our marketing campaigns, our technology solutions and our purchasing programs with third-party suppliers. Our ability to provide these benefits helps us to attract and retain franchisees.

Strong portfolio of well-known brands

We have assembled a portfolio of 20 well-known hotel brands, from leading economy brands such as Super 8 and Days Inn to upscale brands such as Wyndham and Dolce. Our Super 8 brand, with over 2,800 affiliated hotels, has more hotel properties than any other hotel brand in the world. Our brands are located in primary, secondary and tertiary cities and are among the most recognized in the industry. Over 80% of the U.S. population lives within ten miles of one or more of our affiliated hotels.

Our brands offer a breadth of options for franchisees and a wide range of price points and experiences for our guests, including members of our award-winning Wyndham Rewards loyalty program. Our brands have also won numerous industry awards, both for guest satisfaction and as franchise opportunities for entrepreneurs. With many of our affiliated hotels located along major highways, our brands not only drive online and telephone reservations to hotels, they also help attract guests on a "walk-in" or direct-to-hotel basis.

3

Global leader in the economy segment

We have built a leading position in the economy segment of the hotel industry, with our brands representing approximately 30% of the branded global economy hotel inventory. Our central reservation channels generate nearly half of our franchisees' occupied room-nights annually and approximately 60% of guests at our franchised hotels in the United States. In addition, we have substantial experience in property design, establishing brand standards, advertising, structuring promotional offerings and online marketing for economy brands. Four of our hotel brands have been consistently ranked in the top five in J.D. Power's North American Hotel Guest Satisfaction Index Study for the economy segment.

Our strength in the economy segment is attractive to potential franchisees and positions us well to benefit from favorable demographic and consumer demand trends. According to the Brookings Institution, the global middle class is expected to more than double from 2.0 billion to 4.9 billion people by 2030. As this population increasingly participates in the global travel and leisure industry, we expect the economy segment will be a natural entry point.

Award-winning loyalty program

Wyndham Rewards, our award-winning loyalty program, is a key component of our ongoing efforts to build consumer and franchisee engagement while driving more guest reservations directly to our affiliated hotels. Nearly 55 million people have enrolled in Wyndham Rewards since its inception, and substantially all 8,422 hotels affiliated with our hotel brands participate in the program. In addition, over 20,000 Wyndham Worldwide vacation ownership and rental properties participate in the program. Wyndham Rewards generates significant repeat business by rewarding frequent stays with points. Since being redesigned in 2015, Wyndham Rewards has been recognized as one of the simplest, most rewarding loyalty programs in the hotel industry, providing more value to members than any other program. It has won more than 50 awards, including "Best Hotel Loyalty Program" from US News & World Report and "Most Rewarding Hotel Loyalty Program" from IdeaWorks.

Wyndham Rewards loyalty program members now account for approximately one-third of occupancy at our affiliated hotels. Total membership has been growing by approximately 10% annually. Our franchisees benefit from the program through increased guest loyalty and the more than one million room-nights for which award points are redeemed each year. These members are an important driver of our growth, as they stay nearly twice as often and spend 95% more than other guests, on average.

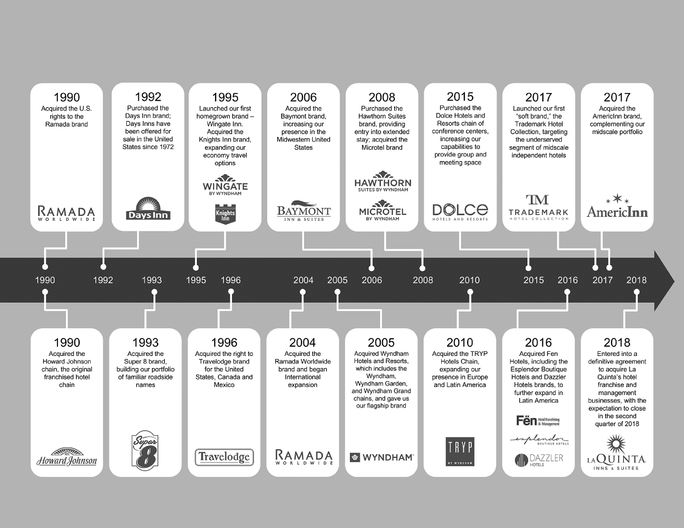

Proven ability to create value through acquisitions

We have built our portfolio of renowned hotel brands primarily through acquisitions, beginning with the Howard Johnson brand and the U.S. franchise rights for the Ramada brand in 1990. Since then, we have acquired 17 economy, midscale, upscale and extended-stay brands, enabling us to meet travelers' leisure and business travel needs across a wide range of price points, experiences and geographies. We have established an extensive track record of successfully integrating franchise systems and enhancing the performance of brands post-acquisition by leveraging our operating best practices, significant economies of scale, award-winning Wyndham Rewards loyalty program and access to global distribution networks, while producing significant cost synergies for us and our franchisees. We intend to build upon our past success as we continue to opportunistically acquire and integrate brands into our franchising platform.

In addition, we have grown many of the franchise systems we have acquired to be significantly larger than at acquisition. For example, after acquiring the economy-focused Baymont Inn portfolio in 2006, we re-positioned the brand within the midscale segment as Baymont Inn & Suites and have more than tripled its size from 115 hotels to 483 hotels in North and Latin America. Similarly, we have nearly doubled the size of our flagship Wyndham brand since we acquired it in 2005. We believe these capabilities, combined with our scale, enable us to be highly competitive for acquisition opportunities.

4

Strong and experienced management team

Our executive management team is focused on building upon Wyndham Hotel Group's past success and track record of growth through its deep industry experience and leadership continuity. We benefit significantly from the experience of our executive officers who have an average of 18 years of experience in the travel and hospitality industries. Our chief executive officer, Geoffrey Ballotti, spent 20 years with Starwood Hotels & Resorts before joining Wyndham Worldwide in 2008 and has been instrumental in transforming our business over the past several years through acquisitions and technology-related initiatives. Our non-executive chairman, Stephen Holmes, has more than 27 years of experience in the hospitality industry and has served as Wyndham Worldwide's chief executive officer since 2006. Our chief financial officer, David Wyshner, has 18 years of experience in the travel industry and previously served as president and chief financial officer of Avis Budget Group. As a group, our executive officers have extensive experience with leading global hospitality and consumer-brand companies.

Our objective is to continue to strengthen our position as the world's leading hotel franchisor and help our franchisees drive profitability through the brands, technology and reservation services we provide. We expect to achieve our goals by focusing on the following core strategic initiatives:

Attract, retain and develop franchisees

We intend to attract and retain franchisees and to grow our system size by maintaining and increasing the value we provide to franchisees. With more than 5,700 franchisees, we have built the largest network of franchisees of any global hotel company. These hotel owners and developers provide the engine and platform for future growth. In order to attract, retain and serve franchisees, we plan to:

We are focused on building brand awareness, brand preference and reservations by presenting the value propositions of each of our hotel brands in all relevant channels to consumers who are likely to have the greatest propensity to stay with us. We also provide our franchisees with fully integrated, turn-key property management, reservations and revenue management systems that have capabilities that were not previously affordable to hotels in the economy and midscale sectors. We continuously innovate in our e-commerce channels, including websites and mobile applications for our brands, to enhance the consumer experience and drive reservations to our franchisees. We also operate telephone reservation and customer service centers around the world, and provide easy access to third-party distribution channels for our franchisees. Finally, we develop strong, consultative relationships with our franchisees, beginning with the sales process, where we work with hotel owners to determine how our brands will optimize their investment. We nurture this relationship throughout the life of the contract, continually assessing our franchisees' needs, providing solutions to meet those needs and partnering with them to grow their business. These efforts help us to retain approximately 95% of our total properties each year and to welcome an average of two new hotels into our system every day.

"Elevate the economy experience"

We believe every type of traveler should have a great travel experience, regardless of price point. We are building on our leading position in the economy hotel segment to reshape and elevate the economy hotel experience. This process starts with our iconic economy brands—Days Inn, Super 8, Howard Johnson and Travelodge—which we have redefined to create new brand standards and new guest experiences. For

5

instance, we have developed innovative new construction prototypes and have introduced new design concepts and plans for conversion properties and renovations, such as the Super 8 Innovate room package. These changes enable our franchisees to create an upscale guest experience at an economy price point.

Our economy brands are among the most respected in the industry and have won numerous awards for the quality and consistency of service they provide. We intend to continue to drive favorable consumer perception of our brands through our brand standards, quality assurance, marketing and franchisee relations. As a result, we believe our reshaped and elevated economy brands will be a natural entry point for millennials and other price-conscious travelers, who are looking for quality branded experiences at an economy price point.

Expand our presence in the midscale space and beyond

Our leading position in the economy segment provides a strong platform for our accelerated growth in the midscale sector, where our share of branded rooms is approximately 15%. We are able to effectively and easily leverage our industry-leading technology, marketing platform and infrastructure to serve midscale and upscale hotels. This capability provides an opportunity for our existing franchisees to "trade up" as their businesses grow and for us to attract hotel owners and developers focused on these segments.

In addition to expanding our revenue opportunities, growing our presence outside the economy segment offers many advantages, including strengthening brand equity and building brand loyalty among higher-paying guests. Growth in the midscale and upscale segments, all within the Wyndham Rewards loyalty program, will provide our loyalty members with increased flexibility to redeem points at a Wyndham Hotels brand that fits a member's specific preferences, further increasing brand loyalty.

Grow our footprint in new and existing international markets

With a diverse, global network of brands already represented in more than 80 countries, we intend to expand in new and existing international markets. Over the past five years, our international portfolio has grown at a compound annual rate of 12%, to nearly 2,700 hotels, and now represents approximately 32% of the hotels in our system.

We have built a strong, flexible international franchise sales platform, with more than 100 sales professionals in key locations around the world, including in Europe, Latin America, India, China, Singapore and Australia. We typically focus on rapidly developing countries that are under-served by the hotel industry. We also look for flagship opportunities in higher-traffic markets throughout the world to aid international brand awareness and loyalty. We believe our flexibility as a sales organization and our diverse portfolio of brands enable us to effectively adapt our sales strategies in response to franchisees' and hotel developers' needs, and to changes in global supply and demand.

Currently, our pipeline of franchise contracts and applications consists of approximately 1,200 hotels with 148,000 rooms, of which more than half are international. As we grow internationally, we are particularly focused on brand quality and property design, with approximately 90% of our existing international pipeline being new-construction projects.

Use cash flow to create value for stockholders

We intend to use the cash flow generated by our operations to create value for stockholders. Our asset-light business model, with low fixed costs and stable, recurring franchise fee revenue, generates attractive margins and cash flow. In addition to investments in the business, including acquisitions of brands and businesses that would expand our presence and capabilities in the lodging industry, we expect to return capital to our stockholders through dividends and/or share repurchases. We expect to pay a regular dividend and use excess cash to repurchase shares.

6

The La Quinta Acquisition

In January 2018, Wyndham Worldwide Corporation entered into an agreement with La Quinta Holdings Inc. to acquire its hotel franchising and management businesses for $1.95 billion in cash. The La Quinta brand is one of the largest midscale/upper midscale brands in the hotel industry, with 902 hotels (585 third-party franchised and 317 managed) in the United States, Mexico, Canada, Honduras and Colombia. The acquisition is expected to close in the second quarter of 2018.

With the acquisition of La Quinta's asset-light, fee-based hotel management and franchising businesses, Wyndham Hotels will span 21 brands and over 9,000 hotels across more than 80 countries. In addition to adding over 900 hotels to the world's largest hotel network, the acquisition of La Quinta will strengthen our position in the midscale and upper midscale segments of the hotel industry, which has been and continues to be one of our strategic priorities. Following the La Quinta acquisition, Wyndham Hotels will have the largest number of midscale and economy hotels in the industry. We expect to leverage our development capabilities to further grow the La Quinta brand in the United States and across Latin America where we already have 198 properties. The transaction will also expand our managed hotel network by more than 250%, from 116 hotels today to more than 430 properties, making us the sixth-largest hotel manager in the United States. Hotel management represents an attractive expansion opportunity to grow our asset-light business and further penetrate the midscale and higher segments.

The La Quinta Returns loyalty program, with over 15 million enrolled members, will be combined with the award-winning Wyndham Rewards loyalty program, with nearly 55 million enrolled members.

We expect to generate substantial synergies when integrating La Quinta into our existing business by eliminating redundant public company expenses and reducing operating costs associated with technology, distribution and marketing as we leverage our scale and existing infrastructure. Additional revenue benefits are expected to come from incremental domestic and international expansion as well as RevPAR growth from a broader distribution platform.

The table below provides key system metrics as of December 31, 2017 giving pro forma effect to the La Quinta acquisition:

| |

Wyndham Hotels | La Quinta | Pro Forma Combined |

Rank* | ||||

|---|---|---|---|---|---|---|---|---|

Number of Hotels |

8,422 | 902 | 9,324 | #1 | ||||

Rooms |

728,195 | 88,400 | 816,595 | #3 | ||||

Brands |

20 | 1 | 21 | #2 | ||||

Managed Hotels |

116 | 317 | 433 |

Sale of Knights Inn

In April 2018, Wyndham Hotel Group, LLC, a wholly owned subsidiary of Wyndham Worldwide Corporation that will be a wholly owned subsidiary of Wyndham Hotels & Resorts, Inc. upon completion of the spin-off, entered into a definitive agreement to sell the Knights Inn brand to a subsidiary of RLH Corporation for $27 million in cash, subject to customary closing conditions and certain post-closing adjustments. The sale is expected to close during the second quarter of 2018.

Adding "By Wyndham" to Brands

In April 2018, Wyndham Worldwide announced that it would be adding the "by Wyndham" hallmark to twelve of its brands: Super 8, Days Inn, Howard Johnson, Travelodge, AmericInn, Baymont, Ramada, Ramada Encore, Dolce, Dazzler, Esplendor and Trademark. Updated brand names and logos will begin appearing in April 2018.

7

There are a number of risks relating to our business, our industry, the spin-off, the La Quinta acquisition and our common stock, including:

8

These and other risks relating to our business, our industry, the spin-off and our common stock are discussed in greater detail under the heading "Risk Factors" in this information statement. You should read and consider all of these risks carefully.

The following provides only a summary of the terms of the spin-off. For a more detailed description of the matters described below, see "The Spin-Off."

Overview

On August 2, 2017, Wyndham Worldwide announced its intention to implement the spin-off of Wyndham Hotels from Wyndham Worldwide, following which Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company, and Wyndham Worldwide will have no continuing stock ownership interest in Wyndham Hotels. In conjunction with the spin-off, Wyndham Worldwide Corporation will be renamed Wyndham Destinations, Inc.

Before our spin-off from Wyndham Worldwide, we will enter into a Separation and Distribution Agreement and several other agreements with Wyndham Worldwide related to the spin-off. These agreements will govern the relationship between us and Wyndham Worldwide, which will then be known as Wyndham Destinations, after completion of the spin-off and provide for the allocation between us and Wyndham Destinations of various assets, liabilities, rights and obligations. These agreements will also include arrangements with respect to employee matters, tax matters, the licensing of trademarks and certain other intellectual property between us and Wyndham Destinations, transitional services to be provided by Wyndham Destinations to us, and by us to Wyndham Destinations, and participation in the Wyndham Rewards loyalty program. See "Certain Relationships and Related Party Transactions—Agreements with Wyndham Worldwide Related to the Spin-Off."

The distribution is subject to the satisfaction or waiver of certain conditions. In addition, until the distribution has occurred, the board of directors of Wyndham Worldwide Corporation (the "Wyndham Worldwide board of directors") has the right to not proceed with the distribution, even if all of the conditions are satisfied. See "The Spin-Off—Conditions to the Distribution."

9

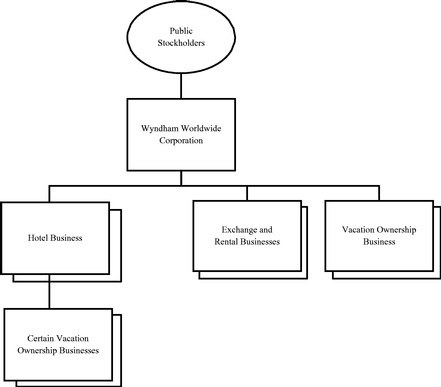

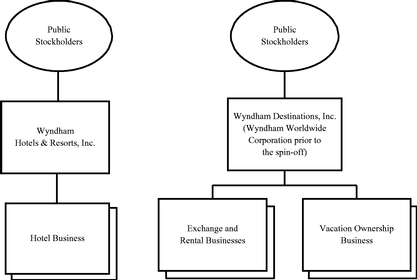

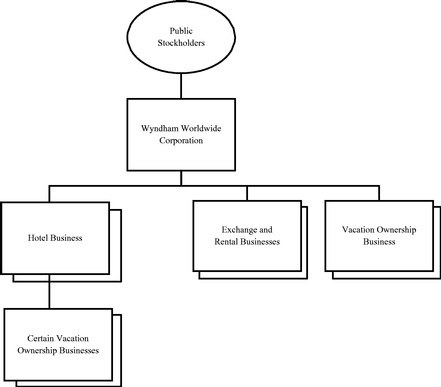

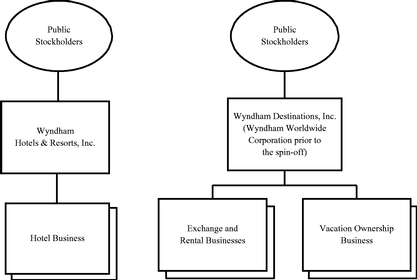

Organizational Structure

The diagrams below, simplified for illustrative purposes, show (i) the current structure of the entities conducting the Wyndham Worldwide business and (ii) the structure of Wyndham Worldwide, which will then be known as Wyndham Destinations, and Wyndham Hotels immediately after completion of the spin-off.

Structure Before

the Spin-Off

10

Structure Following

the Spin-Off

Financing Transactions

In April 2018, Wyndham Hotels issued $500 million aggregate principal amount of 5.375% Notes due 2026 (the "Notes") at par. In addition to the Notes offering, Wyndham Hotels has arranged for new senior secured credit facilities (the "Credit Facilities"), comprised of a seven-year $1,600 million senior secured term loan B credit facility (the "Term Loan Credit Facility") and a five-year $750 million revolving credit facility (the "Revolving Credit Facility"), to be entered into as of the closing of the La Quinta acquisition. The Revolving Credit Facility is expected to be undrawn at the closing of the La Quinta acquisition and the spin-off. As a result of the Notes offering and the Credit Facilities, we expect to have total indebtedness of approximately $2.1 billion as of the spin-off (not including the $750 million we expect to have available for borrowing under the Revolving Credit Facility and capital leases). The closing of the Credit Facilities remains subject to customary closing conditions.

The proceeds from the Notes offering, together with the borrowings under the Credit Facilities, are expected to be used to finance the cash consideration for the La Quinta acquisition, to pay related fees and expenses and for general corporate purposes. For a more detailed description of the financing transactions, see "The Spin-Off—Financing Transactions" and "Description of Certain Indebtedness."

Prior to the issuance of the Notes and arranging for commitments for the Credit Facilities, Wyndham Worldwide Corporation obtained financing commitments for a $2.0 billion 364-day senior unsecured bridge term loan facility (the "bridge term loan facility") related to the La Quinta acquisition. We replaced a portion of the bridge term loan facility with the net cash proceeds of the Notes, reducing our outstanding bridge term loan facility commitments to approximately $1.5 billion, and we anticipate replacing the remaining bridge term loan facility with borrowings under the Credit Facilities. The remaining commitments under the bridge term loan facility are expected to be assigned to us if we do not obtain other long-term financing.

11

Questions and Answers About the Spin-Off

The

following provides only a summary of the terms of the spin-off. For a more detailed description of the matters described below, see "The Spin-Off."

Q: What is the spin-off?

A: The spin-off is the method by which we will separate from Wyndham Worldwide. In the spin-off, Wyndham Worldwide Corporation will distribute to Wyndham Worldwide stockholders all of the outstanding shares of Wyndham Hotels common stock. We refer to this as the distribution. Following the spin-off, Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company, and Wyndham Worldwide will not retain any ownership interest in Wyndham Hotels.

Q: What will I receive in the spin-off?

A: As a holder of Wyndham Worldwide common stock, you will retain your shares of Wyndham Worldwide common stock and will receive one share of Wyndham Hotels common stock for each share of Wyndham Worldwide common stock you own as of the record date. The number of shares of Wyndham Worldwide common stock you own and your proportionate interest in Wyndham Worldwide will not change as a result of the spin-off. See "The Spin-Off."

Q: What is Wyndham Hotels?

A: After the spin-off is completed, Wyndham Hotels & Resorts, Inc. will be a new independent, publicly traded hotel franchising and management company with a portfolio of well-known hotel brands. Wyndham Hotels & Resorts, Inc. is currently a wholly owned subsidiary of Wyndham Worldwide Corporation.

Q: Why is the separation of Wyndham Hotels from Wyndham Worldwide structured as a spin-off?

A: Wyndham Worldwide determined, and continues to believe, that a spin-off that is generally tax-free to Wyndham Worldwide and Wyndham Worldwide stockholders for U.S. federal income tax purposes will enhance the long-term value of both Wyndham Worldwide and Wyndham Hotels. Further, Wyndham Worldwide believes that a spin-off offers the most efficient way to accomplish a separation of its hotel business from Wyndham Worldwide, a higher degree of certainty of completion in a timely manner and a lower risk of disruption to current business operations. See "The Spin-Off—Reasons for the Spin-Off."

Q: What are the conditions to the distribution?

A: The distribution is subject to the satisfaction, or waiver by Wyndham Worldwide Corporation, of the following conditions:

12

limitations described therein, the distribution of Wyndham Hotels common stock, together with certain related transactions, will qualify as a reorganization under Sections 368(a)(1)(D) and 355 of the Code in which no gain or loss is recognized by Wyndham Worldwide Corporation or its stockholders, except, in the case of Wyndham Worldwide stockholders, for cash received in lieu of fractional shares;

See "The Spin-Off—Conditions to the Distribution."

Q: Can Wyndham Worldwide decide to not proceed with the distribution even if all of the conditions to the distribution have been met?

A: Yes. Until the distribution has occurred, the Wyndham Worldwide board of directors has the right to not proceed with the distribution, even if all of the conditions are satisfied.

Q: What is being distributed in the spin-off?

A: Approximately 100 million shares of Wyndham Hotels common stock will be distributed in the spin-off, based on the number of shares of Wyndham Worldwide common stock expected to be outstanding as of May 18, 2018, the record date, and assuming each holder of Wyndham Worldwide common stock will receive one share of Wyndham Hotels common stock for each share of Wyndham Worldwide common stock. The actual number of shares of Wyndham Hotels common stock distributed will be calculated as of the record date. The shares of Wyndham Hotels common stock distributed by Wyndham Worldwide Corporation will constitute all of the issued and outstanding shares of Wyndham Hotels common stock immediately prior to the distribution. See "Description of Capital Stock—Common Stock."

Q: When is the record date for the distribution?

A: The record date will be the close of business of the New York Stock Exchange on May 18, 2018.

Q: When will the distribution occur?

A: The distribution date of the spin-off is May 31, 2018. We expect that it will take the distribution agent, acting on behalf of Wyndham Worldwide, up to two weeks after the distribution date to fully distribute the shares of Wyndham Hotels common stock to Wyndham Worldwide stockholders.

Q: What do I have to do to participate in the spin-off?

A: Nothing. You are not required to take any action, although we urge you to read this entire information statement carefully. No stockholder approval of the distribution is required or sought. You are not being asked for a proxy. No action is required on your part to receive your shares of Wyndham Hotels

13

common stock. You will neither be required to pay anything for the new shares nor be required to surrender any shares of Wyndham Worldwide common stock to participate in the spin-off.

Q: Do I have appraisal rights in connection with the spin-off?

A: No. Holders of Wyndham Worldwide common stock are not entitled to appraisal rights in connection with the spin-off.

Q: How will fractional shares be treated in the spin-off?

A: Fractional shares of Wyndham Hotels common stock will not be distributed. Fractional shares of Wyndham Hotels common stock to which Wyndham Worldwide stockholders of record would otherwise be entitled will be aggregated and sold in the public market by the distribution agent at prevailing market prices. The distribution agent, in its sole discretion, will determine when, how, at what prices to sell these shares and through which broker-dealers, provided that such broker-dealers are not affiliates of Wyndham Worldwide or Wyndham Hotels. The aggregate net cash proceeds of the sales will be distributed ratably to those stockholders who would otherwise have received fractional shares of Wyndham Hotels common stock. See "The Spin-Off—Treatment of Fractional Shares" for a more detailed explanation. Receipt by a stockholder of proceeds from these sales in lieu of a fractional share generally will result in a taxable gain or loss to those stockholders for U.S. federal income tax purposes. Each stockholder entitled to receive cash proceeds from these shares should consult his, her or its own tax advisor as to such stockholder's particular circumstances. We describe the material U.S. federal income tax consequences of the distribution in more detail under "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution."

Q: Why has Wyndham Worldwide determined to undertake the spin-off?

A: The Wyndham Worldwide board of directors has determined that the spin-off is in the best interests of Wyndham Worldwide, Wyndham Worldwide stockholders and other constituents because the spin-off will provide a number of benefits, including: (1) enhanced strategic and management focus on the core business and growth of each company; (2) more efficient capital allocation, direct access to capital and expanded growth opportunities for each company; (3) the ability to implement a tailored approach to recruiting and retaining employees at each company; (4) improved investor understanding of the business strategy and operating results of each company; and (5) enhanced investor choice by offering investment opportunities in separate entities. For a more detailed discussion of the reasons for the spin-off, see "The Spin-Off—Reasons for the Spin-Off."

Q: What are the U.S. federal income tax consequences of the spin-off?

A: The spin-off is conditioned on the receipt of opinions of Wyndham Worldwide's spin-off tax advisors to the effect that, subject to the assumptions and limitations described therein, the distribution and certain related transactions will be treated as a reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Code in which no gain or loss is recognized by Wyndham Worldwide Corporation or its stockholders, except, in the case of Wyndham Worldwide stockholders, for cash received in lieu of fractional shares. Although Wyndham Worldwide has no current intention to do so, such condition is solely for the benefit of Wyndham Worldwide and Wyndham Worldwide stockholders and may be waived by Wyndham Worldwide in its sole discretion. In addition, Wyndham Worldwide has received certain rulings (the "IRS Ruling") from the U.S. Internal Revenue Service (the "IRS") regarding certain U.S. federal income tax consequences of aspects of the spin-off. The material U.S. federal income tax consequences of the distribution are described in more detail under "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution."

14

Q: Will the Wyndham Hotels common stock be listed on a stock exchange?

A: Yes. Although there is not currently a public market for Wyndham Hotels common stock, before completion of the spin-off, Wyndham Hotels will apply to list its common stock on the New York Stock Exchange under the symbol "WH." It is anticipated that trading of Wyndham Hotels common stock will commence on a "when-issued" basis at least one trading day prior to the record date. "When-issued" trading refers to a sale or purchase made conditionally because the security has been authorized but not yet issued. "When-issued" trades generally settle within three trading days after the distribution date. On the first trading day following the distribution date, any "when-issued" trading with respect to Wyndham Hotels common stock will end, and "regular-way" trading will begin. "Regular-way" trading refers to trading after a security has been issued and typically involves a transaction that settles on the second full trading day following the date of the transaction. We cannot predict the trading prices of our common stock before, on or after the distribution date. See "Trading Market."

Q: Will my shares of Wyndham Worldwide common stock continue to trade?

A: Yes. In connection with the spin-off, Wyndham Worldwide Corporation will be renamed Wyndham Destinations, Inc. and its common stock is expected to continue to be listed on the New York Stock Exchange under its new symbol, "WYND."

Q: If I sell, on or before the distribution date, shares of Wyndham Worldwide common stock that I held as of the record date, am I still entitled to receive shares of Wyndham Hotels common stock distributable with respect to the shares of Wyndham Worldwide common stock I sold?

A: Beginning on or shortly before the record date and continuing through the distribution date for the spin-off, Wyndham Worldwide common stock will begin to trade in two markets on the New York Stock Exchange: a "regular-way" market and an "ex-distribution" market. If you hold shares of Wyndham Worldwide common stock as of the record date for the distribution and choose to sell those shares in the "regular-way" market after the record date for the distribution and on or before the distribution date, you will also be selling the right to receive the shares of Wyndham Hotels common stock in connection with the spin-off. However, if you hold shares of Wyndham Worldwide common stock as of the record date for the distribution and choose to sell those shares in the "ex-distribution" market after the record date for the distribution and on or before the distribution date, you will still receive the shares of Wyndham Hotels common stock in the spin-off.

Q: Will the spin-off affect the trading price of my Wyndham Worldwide common stock?

A: Yes. The trading price of shares of Wyndham Worldwide common stock, which will be Wyndham Destinations common stock as a result of the renaming of Wyndham Worldwide Corporation upon the consummation of the spin-off, immediately following the distribution is expected to be lower than immediately prior to the distribution because its trading price will no longer reflect the value of the hotel business. However, we cannot predict the price at which the shares of Wyndham Destinations common stock will trade following the spin-off.

Q: What financing transactions will be undertaken in connection with the spin-off?

A: In April 2018, Wyndham Hotels issued $500 million aggregate principal amount of 5.375% Notes due 2026 at par. In addition to the Notes offering, Wyndham Hotels has arranged for the Credit Facilities, comprised of the Term Loan Credit Facility and the Revolving Credit Facility to be entered into as of the closing of the La Quinta acquisition. The Revolving Credit Facility is expected to be undrawn at the closing of the La Quinta acquisition and the spin-off. As a result of these financing transactions we expect to have total indebtedness of approximately $2.1 billion as of the spin-off (not including the $750 million we expect to have available for borrowing under the Revolving Credit Facility and capital leases). The closing of the Credit Facilities remains subject to customary closing conditions. The proceeds from the Notes offering, together with

15

the borrowings under the Credit Facilities, are expected to be used to finance the cash consideration for the La Quinta acquisition, to pay related fees and expenses and for general corporate purposes. Prior to the issuance of the Notes and the receipt of lending commitments for the Credit Facilities, Wyndham Worldwide Corporation obtained financing commitments for a $2.0 billion bridge term loan facility related to the La Quinta acquisition. We replaced a portion of the bridge term loan facility with the net cash proceeds of the Notes, reducing our outstanding bridge term loan facility commitments to approximately $1.5 billion, and we anticipate replacing the remaining bridge term loan facility with borrowings under the Credit Facilities. The remaining commitments under the bridge term loan facility are expected to be assigned to us if we do not obtain other long-term financing. See "The Spin-Off—Financing Transactions" and "Description of Certain Indebtedness."

Q: Who will form the senior management team and board of directors of Wyndham Hotels & Resorts, Inc. after the spin-off?

A: The executive officers and members of the board of directors of Wyndham Hotels & Resorts, Inc. ("our Board of Directors") following the spin-off will include: Stephen P. Holmes, Non-Executive Chairman of our Board of Directors; Geoffrey A. Ballotti, President, Chief Executive Officer and a member of our Board of Directors; Myra J. Biblowit, a member of our Board of Directors; James E. Buckman, a member of our Board of Directors; Bruce B. Churchill, a member of our Board of Directors; Mukul V. Deoras, a member of our Board of Directors; the Right Honourable Brian Mulroney, a member of our Board of Directors; Pauline D.E. Richards, a member of our Board of Directors; David B. Wyshner, Chief Financial Officer; Thomas H. Barber, Chief Strategy and Development Officer; Robert D. Loewen, Chief Operating Officer; Barry S. Goldstein, Chief Marketing Officer; Paul F. Cash, General Counsel; Mary R. Falvey, Chief Administrative Officer; and Scott R. Strickland, Chief Information Officer. See "Management" for information on our executive officers and Board of Directors.

Q: What will the relationship be between Wyndham Worldwide and Wyndham Hotels after the spin-off?

A: Following the spin-off, Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company, and Wyndham Worldwide, which will then be known as Wyndham Destinations, will have no continuing stock ownership interest in Wyndham Hotels. We will have entered into a Separation and Distribution Agreement and several other agreements with Wyndham Destinations, as Wyndham Worldwide will then be known, related to the spin-off. These agreements will govern the relationship between us and Wyndham Destinations after completion of the spin-off and provide for the allocation between us and Wyndham Destinations of various assets, liabilities, rights and obligations. These agreements will also include arrangements with respect to employee matters, tax matters, the licensing of trademarks and certain other intellectual property between us and Wyndham Destinations, transitional services to be provided by Wyndham Destinations to us, and by us to Wyndham Destinations, and participation in the Wyndham Rewards loyalty program. See "Certain Relationships and Related Party Transactions—Agreements with Wyndham Worldwide Related to the Spin-Off."

Q: What will Wyndham Hotels' dividend policy be after the spin-off?

A: We intend to pay regular quarterly cash dividends. However, any decision to declare and pay dividends will be made at the sole discretion of our Board of Directors and will depend on, among other things, our results of operations, cash requirements, financial condition, contractual restrictions and other factors that our Board of Directors may deem relevant. There can be no assurance that a payment of a dividend will occur in the future. See "Dividend Policy."

Q: What are the anti-takeover effects of the spin-off?

A: Some provisions of Delaware law, certain of our agreements with Wyndham Worldwide, and the amended and restated certificate of incorporation of Wyndham Hotels & Resorts, Inc. and the amended

16

and restated by-laws of Wyndham Hotels & Resorts, Inc. (as each will be in effect immediately following the spin-off) may have the effect of making it more difficult to acquire control of Wyndham Hotels in a transaction not approved by our Board of Directors. For example, our amended and restated certificate of incorporation and amended and restated by-laws will, among other things, require advance notice for stockholder proposals and nominations, place limitations on convening stockholder meetings, authorize our Board of Directors to issue one or more series of preferred stock and provide for the classification of our Board of Directors until the third annual meeting of stockholders following the distribution, which we expect to hold in 2021. Further, under the Tax Matters Agreement, Wyndham Hotels will agree, subject to certain terms, conditions and exceptions, not to enter into any transaction for a period of two years following the distribution involving an acquisition (including issuance) of Wyndham Hotels common stock or certain other transactions that could cause the distribution to be taxable to Wyndham Worldwide. The parties will also agree to indemnify each other for any tax resulting from any transaction to the extent a party's actions caused such tax liability, regardless of whether the indemnified party consented to such transaction or the indemnifying party was otherwise permitted to enter into such transaction under the Tax Matters Agreement, and for all or a portion of any tax liabilities resulting from the distribution under certain other circumstances. Generally, Wyndham Worldwide will recognize a taxable gain on the distribution if there are (or have been) one or more acquisitions (including issuances) of Wyndham Hotels capital stock representing 50% or more of Wyndham Hotels common stock, measured by vote or value, and the acquisitions are deemed to be part of a plan or series of related transactions that include the distribution. Any such acquisition of Wyndham Hotels common stock within two years before or after the distribution (with exceptions, including public trading by less-than-5% stockholders and certain compensatory stock issuances) generally will be presumed to be part of such a plan unless that presumption is rebutted. As a result, these obligations may discourage, delay or prevent a change of control of Wyndham Hotels. See "Description of Capital Stock—Anti-Takeover Effects of Our Amended and Restated Certificate of Incorporation, Amended and Restated By-laws and Delaware Law" and "The Spin-Off—Treatment of the Spin-Off" for more information.

Q: What are the risks associated with the spin-off?

A: There are a number of risks associated with the spin-off and ownership of Wyndham Hotels common stock. These risks are discussed under "Risk Factors."

Q: Who will be the distribution agent, transfer agent and registrar for Wyndham Hotels common stock?

A: The distribution agent, transfer agent and registrar for Wyndham Hotels common stock will be Broadridge Corporate Issuer Solutions, Inc. ("Broadridge"). For questions relating to the transfer or mechanics of the stock distribution, you should contact Broadridge toll-free at (800) 504-8998.

Q: Where can I get more information?

A: If you have any questions relating to the mechanics of the distribution, you should contact the distribution agent at:

17

Address:

If using UPS, FedEx or Courier:

Broadridge,

Inc.

Attn: BCIS IWS

51 Mercedes Way

Edgewood, NY 11717

If using USPS Service:

Broadridge,

Inc.

Attn: BCIS Re-Organization Dept.

P.O. Box 1342

Brentwood, NY 11717-0693

Toll-Free Number: (800) 504-8998

Before the spin-off, if you have any questions relating to the spin-off, you should contact Wyndham Worldwide at:

Wyndham

Worldwide Corporation

Investor Relations

22 Sylvan Way

Parsippany, New Jersey 07054

Phone: 973-753-6000

Email: ir@wyn.com

http://investor.wyndhamworldwide.com

After the spin-off, if you have any questions relating to Wyndham Hotels, you should contact Wyndham Hotels at:

Wyndham

Hotels & Resorts, Inc.

Investor Relations

22 Sylvan Way

Parsippany, New Jersey 07054

Phone: (973) 753-6000

Email: ir@wyndham.com

www.wyndhamhotels.com

18

| Distributing Company | Wyndham Worldwide Corporation, a Delaware corporation. After the distribution, Wyndham Worldwide, which will then be known as Wyndham Destinations, will not own any shares of Wyndham Hotels common stock. | |

Distributed Company |

Wyndham Hotels & Resorts, Inc., a Delaware corporation and, prior to the spin-off, a wholly owned subsidiary of Wyndham Worldwide Corporation. After the spin-off, Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company. |

|

Distributed Securities |

All of the outstanding shares of Wyndham Hotels common stock owned by Wyndham Worldwide Corporation, which will be 100 percent of the Wyndham Hotels common stock issued and outstanding immediately prior to the distribution. |

|

Record Date |

The record date for the distribution is May 18, 2018. |

|

Distribution Date |

The distribution date is May 31, 2018. |

|

Internal Reorganization |

As part of the spin-off, Wyndham Worldwide, which will be known as Wyndham Destinations after the completion of the spin-off, will undergo an internal reorganization, pursuant to which, among other things: (i) all of the assets and liabilities (whether accrued, contingent or otherwise) associated with the hotel business, subject to certain exceptions, will be retained by or transferred to Wyndham Hotels; and (ii) all other assets and liabilities (whether accrued, contingent or otherwise) of Wyndham Worldwide, subject to certain exceptions (including the shared contingent assets and the shared contingent liabilities), will be retained by or transferred to Wyndham Destinations. See "The Spin-Off—Manner of Effecting the Spin-Off—Internal Reorganization." |

|

After completion of the spin-off: |

||

|

• Wyndham Hotels & Resorts, Inc. will be an independent, publicly traded company (listed on the New York Stock Exchange under the ticker symbol "WH"), and will own and operate Wyndham Worldwide's hotel business; and |

|

|

• Wyndham Worldwide Corporation, which will then be known as Wyndham Destinations, Inc., will continue to be an independent company, is expected to continue to be listed on the New York Stock Exchange under its new symbol, "WYND," and will continue to own and operate its timeshare, vacation exchange and vacation rentals businesses. |

|

Distribution Ratio |

Each holder of Wyndham Worldwide common stock will receive one share of Wyndham Hotels common stock for each share of Wyndham Worldwide common stock held at 5:00 p.m., Eastern time, on May 18, 2018. |

19

| Immediately following the spin-off, Wyndham Hotels & Resorts, Inc. expects to have approximately 5,100 record holders of shares of its common stock and approximately 100 million shares of common stock outstanding, based on the number of stockholders and outstanding shares of Wyndham Worldwide common stock on March 31, 2018 and the distribution ratio. The actual number of shares to be distributed will be determined as of the record date and will reflect any repurchases of shares of Wyndham Worldwide common stock and issuances of shares of Wyndham Worldwide common stock in respect of awards under Wyndham Worldwide Corporation equity-based incentive plans between the date the Wyndham Worldwide board of directors declares the dividend for the distribution and the record date for the distribution. | ||

The Distribution |

On the distribution date, Wyndham Worldwide Corporation will release the shares of Wyndham Hotels common stock to the distribution agent to distribute to Wyndham Worldwide stockholders. The distribution of shares will be made in book-entry form only, meaning that no physical share certificates will be issued. It is expected that it will take the distribution agent up to two weeks to issue shares of Wyndham Hotels common stock to you or to your bank or brokerage firm electronically on your behalf by way of direct registration in book-entry form. Trading of our shares will not be affected during that time. You will not be required to make any payment, surrender or exchange your shares of Wyndham Worldwide common stock or take any other action to receive your shares of Wyndham Hotels common stock. |

|

Fractional Shares |

The distribution agent will not distribute any fractional shares of Wyndham Hotels common stock to Wyndham Worldwide stockholders. Fractional shares of Wyndham Hotels common stock to which Wyndham Worldwide stockholders of record would otherwise be entitled will be aggregated and sold in the public market by the distribution agent. The aggregate net cash proceeds of the sales will be distributed ratably to those stockholders who would otherwise have received fractional shares of Wyndham Hotels common stock. Receipt of the proceeds from these sales generally will result in a taxable gain or loss to those stockholders for U.S. federal income tax purposes. Each stockholder entitled to receive cash proceeds from these shares should consult his, her or its own tax advisor as to such stockholder's particular circumstances. The material U.S. federal income tax consequences of the distribution are described in more detail under "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution." |

|

Conditions to the Distribution |

The distribution is subject to the satisfaction, or waiver by Wyndham Worldwide Corporation, of the following conditions: |

|

|

• the final approval of the distribution by the Wyndham Worldwide board of directors, which approval may be given or withheld in its absolute and sole discretion; |

20

|

• our Registration Statement on Form 10, of which this information statement forms a part, shall have been declared effective by the SEC, with no stop order in effect with respect thereto, and a notice of internet availability of this information statement shall have been mailed to Wyndham Worldwide stockholders; |

|

|

• Wyndham Hotels common stock shall have been approved for listing on the New York Stock Exchange, subject to official notice of distribution; |

|

|

• Wyndham Worldwide shall have obtained opinions from its spin-off tax advisors, in form and substance satisfactory to Wyndham Worldwide, to the effect that, subject to the assumptions and limitations described therein, the distribution of Wyndham Hotels common stock and certain related transactions will qualify as a reorganization under Sections 368(a)(1)(D) and 355 of the Code, in which no gain or loss is recognized by Wyndham Worldwide Corporation or its stockholders, except, in case of Wyndham Worldwide stockholders, for cash received in lieu of fractional shares; |

|

|

• Wyndham Worldwide shall have obtained opinions from a nationally recognized valuation firm, in form and substance satisfactory to Wyndham Worldwide, with respect to (i) the capital adequacy and solvency of both Wyndham Worldwide and Wyndham Hotels after giving effect to the spin-off and (ii) the adequate surplus of Wyndham Worldwide to declare the applicable dividend; |

|

|

• all material governmental approvals and other consents necessary to consummate the distribution or any portion thereof shall have been obtained and be in full force and effect; |

|

|

• no order, injunction or decree issued by any governmental entity of competent jurisdiction or other legal restraint or prohibition preventing the consummation of all or any portion of the distribution shall be in effect, and no other event shall have occurred or failed to occur that prevents the consummation of all or any portion of the distribution; and |

|

|

• the financing transactions described herein shall have been completed on the date of or prior to the consummation of the La Quinta acquisition. |

|

We are not aware of any material U.S. federal, non-U.S. or state regulatory requirements that must be complied with or any material approvals that must be obtained, other than compliance with the rules and regulations of the SEC, approval for listing on the New York Stock Exchange and the declaration of effectiveness of the Registration Statement on Form 10, of which this information statement forms a part, by the SEC, in connection with the distribution. Wyndham Worldwide and Wyndham Hotels cannot assure you that any or all of these conditions will be met and Wyndham Worldwide Corporation may waive any of the conditions |

21

| to the distribution. In addition, until the distribution has occurred, the Wyndham Worldwide board of directors has the right to not proceed with the distribution, even if all of the conditions are satisfied. For more information, see "The Spin-Off—Conditions to the Distribution." | ||

Trading Market and Symbol |

We intend to list Wyndham Hotels common stock on the New York Stock Exchange under the ticker symbol "WH." We anticipate that, at least one trading day prior to the record date, trading of shares of Wyndham Hotels common stock will begin on a "when-issued" basis and will continue up to and including the distribution date, and we expect "regular-way" trading of Wyndham Hotels common stock will begin on the first trading day following the distribution date. We also anticipate that, at least one trading day prior to the record date, there will be two markets in Wyndham Worldwide common stock: (i) a "regular-way" market on which shares of Wyndham Worldwide common stock will trade with an entitlement for the purchaser of Wyndham Worldwide common stock to shares of Wyndham Hotels common stock to be distributed pursuant to the distribution; and (ii) an "ex-distribution" market on which shares of Wyndham Worldwide common stock will trade without an entitlement for the purchaser of Wyndham Worldwide common stock to shares of Wyndham Hotels common stock. For more information, see "Trading Market." |

|

Tax Consequences of the Distribution |

The distribution is conditioned upon, among other things, the receipt of opinions of Wyndham Worldwide's spin-off tax advisors to the effect that, subject to the assumptions and limitations described therein, the distribution and certain related transactions will be treated as a reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Code, in which no gain or loss is recognized by Wyndham Worldwide Corporation or its stockholders, except, in the case of Wyndham Worldwide stockholders, for cash received in lieu of fractional shares. In addition, Wyndham Worldwide has received the IRS Ruling from the IRS regarding certain U.S. federal income tax consequences of aspects of the spin-off. See "The Spin-Off—Material U.S. Federal Income Tax Consequences of the Distribution." |

|