Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy

Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| Filed by the Registrant ý | ||

Filed by a Party other than the Registrant o |

||

Check the appropriate box: |

||

o |

Preliminary Proxy Statement |

|

o |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

ý |

Definitive Proxy Statement |

|

o |

Definitive Additional Materials |

|

o |

Soliciting Material under §240.14a-12 |

|

| Wyndham Hotels & Resorts, Inc. | ||||

|

(Name of Registrant as Specified In Its Charter) |

||||

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

||||

Payment of Filing Fee (Check the appropriate box): |

||||

ý |

No fee required. |

|||

o |

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

|||

| (1) | Title of each class of securities to which transaction applies: |

|||

| (2) | Aggregate number of securities to which transaction applies: |

|||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

|||

| (4) | Proposed maximum aggregate value of transaction: |

|||

| (5) | Total fee paid: |

|||

o |

Fee paid previously with preliminary materials. |

|||

o |

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|||

(1) |

Amount Previously Paid: |

|||

| (2) | Form, Schedule or Registration Statement No.: |

|||

| (3) | Filing Party: |

|||

| (4) | Date Filed: |

|||

NOTICE OF 2021 ANNUAL MEETING

OF STOCKHOLDERS AND

PROXY STATEMENT

Wyndham Hotels & Resorts, Inc.

22 Sylvan Way

Parsippany, New Jersey 07054

March 31,

2021

Dear Fellow Stockholder:

On behalf of the entire Board, we are pleased to invite you to attend the 2021 annual meeting of stockholders to be held on Wednesday, May 12, 2021 at 11:30 a.m. Eastern Time.

In light of the ongoing coronavirus (COVID-19) pandemic and to assist in protecting the health and well-being of our stockholders and team members, we have decided to once again hold the meeting in a virtual-only meeting format. We will provide a live audio webcast of the meeting at www.virtualshareholdermeeting.com/WH2021. For further information on how to attend the meeting, please see "How do I attend the meeting?" on page 3 in the accompanying proxy statement.

In 2020, our operations, along with those of our peers and other businesses worldwide, were significantly impacted by the unprecedented circumstances created by the COVID-19 pandemic. During this extraordinary time, our priority remained the health and safety of our team members, owners and guests, while we also recognized the necessity of taking steps to mitigate the impact of the pandemic on our business. We rapidly and successfully transferred our corporate team members to a remote working environment. To mitigate the impact on our revenues, we took immediate steps to reduce cash outflows, including workforce reductions and furloughs for team members, substantially reducing all non-essential spending and dividend payments and suspending share repurchase activity. With the approval of our Board and CEO, we also suspended our CEO's salary and our Board's cash-based compensation for part of 2020.

Our 2020 performance in the face of COVID-19 was driven by the drive-to nature of our hotel portfolio of brands, the demand of our everyday business travelers and our ability to manage costs. Against this backdrop, our management team led by our named executive officers produced diluted loss per share of $1.42 and adjusted diluted earnings per share of $1.03. Net loss was $132 million for 2020, adjusted net income was $96 million, and adjusted EBITDA was $327 million. Our Board demonstrated its continued confidence in our business and our strategy through its decision to continue a quarterly dividend throughout 2020. We could not be prouder of all of our team members who were critical to our accomplishments in this unprecedented year.

We also continued to take steps in furtherance of our commitment to fostering a values-driven culture and to being a socially responsible partner in the communities where we live, work and serve, and we have continued to be recognized for our efforts. We developed the Wyndham Green Program, which is a five-level certification program that helps hotels reduce their environmental footprint, and have maintained LEED® Gold certification at our corporate headquarters. We strengthened our partnerships with organizations like Polaris, BEST and ECPAT-USA and are working with our industry to combat human trafficking. We earned our third consecutive perfect score of 100 in the 2021 Human Rights Campaign's Corporate Equality Index — a national benchmarking survey on practices related to LGBTQ equality — and we supported the pledge for CEO Action for Diversity & Inclusion™ and equal representation of men and women in leadership positions. None of this could have been achieved without the support and dedication of our team members worldwide.

As described in the accompanying proxy statement, our Compensation Committee works to ensure that executive pay and performance are appropriately aligned to incentivize management to increase stockholder value.

We encourage you to read the proxy statement carefully for more information. Your vote is very important. Whether or not you plan to attend the 2021 annual meeting, please cast your vote as soon as possible. We look forward to continuing our dialogue in the future and we, along with our outstanding executive team and team members worldwide, remain committed to creating even greater value for you.

Very truly yours,

|

||

| Stephen P. Holmes Chairman of the Board |

Geoffrey A. Ballotti President and Chief Executive Officer |

WYNDHAM HOTELS & RESORTS, INC.

NOTICE OF 2021 ANNUAL MEETING OF STOCKHOLDERS

March 31, 2021

| Date: | Wednesday, May 12, 2021 | |

| Time: | 11:30 a.m. Eastern Time | |

| Virtual Meeting Link: | www.virtualshareholdermeeting.com/WH2021 |

Purposes of the meeting:

The matters specified for voting above are more fully described in the attached proxy statement. Only our stockholders of record at the close of business on March 18, 2021 will be entitled to notice of and to vote at the meeting and any adjournments or postponements for which no new record date is set.

How to attend the meeting:

The meeting will begin promptly at 11:30 a.m. Eastern Time on May 12, 2021 at www.virtualshareholdermeeting.com/WH2021. Stockholders will need their 16-digit control number to log in to attend the meeting and vote or ask questions during the meeting. The control number can be found on the Notice (please see below under "Information About the Notice of Internet Availability of Proxy Materials"), proxy card or voting instruction form distributed to stockholders.

Online access to the meeting will open 15 minutes prior to the start of the meeting to allow time for participants to log in and testing of device audio systems. We encourage participants to access the meeting in advance of the designated start time.

Beneficial stockholders whose shares are registered in the name of a bank, broker or other nominee may need to obtain the information required to be able to participate in, and vote at, the meeting, including their control number, from their bank, broker or other nominee. If a beneficial holder has any questions regarding attendance at the meeting, they should contact their broker, bank or other nominee who holds their shares.

Support will be available 15 minutes prior to, and during, the meeting to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If participants encounter any difficulty, they should call the support team at the numbers listed on the login screen.

Record Date:

March 18, 2021 is the record date for the meeting. This means that owners of Wyndham Hotels & Resorts, Inc. common stock at the close of business on that date are entitled to:

Information About the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to all of our stockholders, we provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all stockholders. Accordingly, on or about March 31, 2021, we will begin mailing a Notice to all stockholders as of March 18, 2021, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Householding Information:

We have adopted a procedure approved by the Securities and Exchange Commission called householding. Under this procedure, stockholders of record who have the same address and last name and have not previously requested electronic delivery of proxy materials will receive a single envelope containing the Notices for all stockholders having that address. The Notice for each stockholder will include that stockholder's unique control number needed to vote his or her shares. This procedure will reduce our printing costs and postage fees.

If you do not wish to participate in householding and prefer to receive your Notice in a separate envelope, please contact Broadridge Financial Solutions by calling their toll-free number at (866) 540-7095 or through Broadridge Financial Solutions, Attn.: Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

For those stockholders who have the same address and last name and who request to receive a printed copy of the proxy materials by mail, we will send only one copy of such materials to each address unless one or more of those stockholders notifies us, in the same manner described above, that they wish to receive a printed copy for each stockholder at that address.

Beneficial stockholders may request information about householding from their banks, brokers or other holders of record.

Proxy Voting:

Your vote is important. Please vote your proxy promptly so your shares are represented, even if you plan to attend the annual meeting. You may vote by Internet, by telephone or by requesting a printed copy of the proxy materials and using the enclosed proxy card. You may also vote at the annual meeting.

Our proxy tabulator, Broadridge Financial Solutions, must receive any proxy that will not be voted at the annual meeting by 11:59 p.m. Eastern Time on Tuesday, May 11, 2021. If you have shares of common stock credited to your account under the Wyndham Hotel Group Employee Savings Plan, the trustee must receive your voting instructions by 11:59 p.m. Eastern Time on Friday, May 7, 2021.

| By order of the Board of Directors, | ||

|

||

| Paul F. Cash Corporate Secretary |

i

ii

WYNDHAM HOTELS & RESORTS, INC.

The enclosed proxy materials are provided to you at the request of the Board of Directors of Wyndham Hotels & Resorts, Inc. (the "Board") to encourage you to vote your shares at our 2021 annual meeting of stockholders. This proxy statement contains information on matters that will be presented at the meeting and is provided to assist you in voting your shares. References in this proxy statement to "we," "us," "our," "Wyndham Hotels" and the "Company" refer to Wyndham Hotels & Resorts, Inc. and our consolidated subsidiaries.

References in this proxy statement to "Wyndham Worldwide" refer to Wyndham Worldwide Corporation and its consolidated subsidiaries prior to the consummation of the spin-off. References to "Travel + Leisure" refer to Travel + Leisure Co. (previously known as Wyndham Destinations, Inc.) and its consolidated subsidiaries. References to the "spin-off" refer to the spin-off completed by Wyndham Worldwide effective June 1, 2018 resulting in its principal businesses becoming two separate, publicly traded companies, Wyndham Hotels and Travel + Leisure.

Our Board made these materials available to you over the Internet or, upon your request, mailed you printed versions of these materials in connection with our 2021 annual meeting. We will mail a Notice of Internet Availability of Proxy Materials ("Notice") to our stockholders beginning on or about March 31, 2021 and will post our proxy materials on our website referenced in the Notice on that same date. We are, on behalf of our Board, soliciting your proxy to vote your shares at our 2021 annual meeting. We solicit proxies to give all stockholders of record an opportunity to vote on matters that will be presented at the annual meeting.

When and where will the annual meeting be held?

The annual meeting will be held on Wednesday, May 12, 2021 at 11:30 a.m. Eastern Time. Stockholders of record at the close of business on March 18, 2021 may attend the meeting and vote their shares during the meeting at www.virtualshareholdermeeting.com/WH2021. Stockholders will have the same opportunity to participate as they would at an in person meeting, with the ability to vote and submit questions during the meeting in accordance with the rules of conduct posted on the meeting website. For further information on how to attend the meeting, please see below under "How do I attend the meeting?"

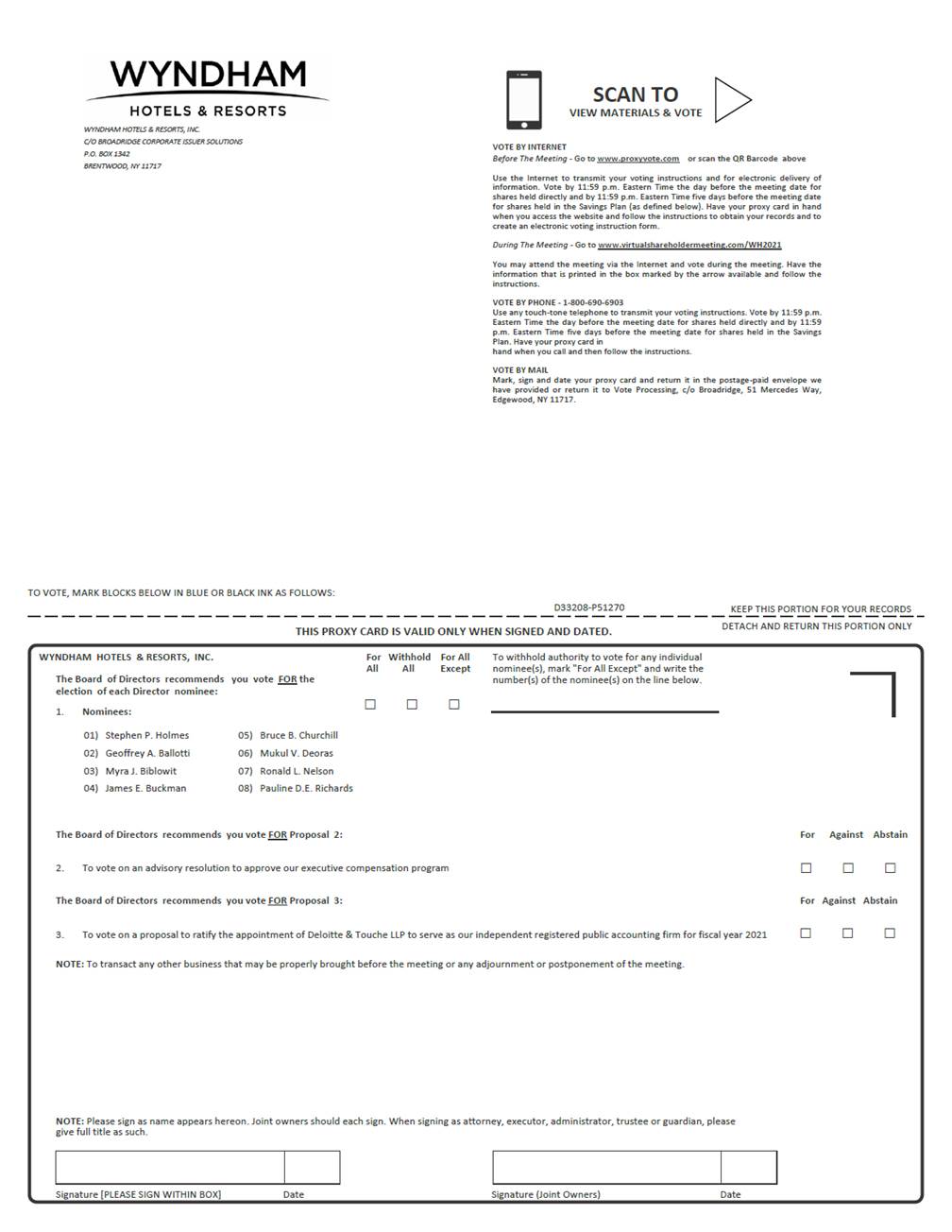

What am I being asked to vote on at the meeting?

You are being asked to vote on the following:

1

We are not aware of any other matters that will be brought before the stockholders for a vote at the annual meeting. If any other matters are properly presented for a vote, the individuals named as proxies will have discretionary authority to the extent permitted by law to vote on such matters according to their best judgment.

Who may vote and how many votes does a stockholder have?

All holders of record of our common stock as of the close of business on March 18, 2021 (the "record date") are entitled to vote at the meeting. Each stockholder will have one vote for each share of our common stock held as of the close of business on the record date. As of the record date, 93,368,910 shares of our common stock were outstanding. There is no cumulative voting and the holders of our common stock vote together as a single class.

How many votes must be present to hold the meeting?

The holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting, or 46,684,456 shares, also known as a quorum, must be present virtually or by proxy at the meeting in order to constitute a quorum necessary to conduct the meeting. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

A broker non-vote occurs when a broker or other nominee submits a proxy that states that the broker does not vote for some of the proposals because the broker has not received instructions from the beneficial owner on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions.

Even if you plan to attend the meeting you are encouraged to vote by proxy.

If you are a stockholder of record, also known as a registered stockholder, you may vote in one of the following ways:

If your shares are registered in the name of a bank, broker or other nominee, follow the proxy instructions on the form you receive from the bank, broker or other nominee. You may also vote at the annual meeting — please see below under "How do I attend the meeting?"

2

When you vote by proxy, your shares will be voted according to your instructions. If you sign your proxy card or vote by Internet or by telephone but do not specify how you want your shares to be voted, they will be voted as the Board recommends.

What if I am a participant in the Wyndham Hotel Group Employee Savings Plan?

For participants in the Wyndham Hotel Group Employee Savings Plan with shares of our common stock credited to their accounts, voting instructions for the trustees of the plan are also being solicited through this proxy statement. In accordance with the provisions of the plan, the trustee will vote shares of our common stock in accordance with instructions received from the participants to whose accounts the shares are credited. If you do not instruct the plan trustee on how to vote the shares of our common stock credited to your account, the trustee will vote those shares in proportion to the shares for which instructions are received.

How does the Board recommend that I vote?

The Board recommends the following votes:

How many votes are required to approve each proposal?

In the election of Directors, Directors are elected by a majority of the votes cast at the annual meeting, meaning that the number of shares voted "for" a Director must exceed the number of shares withheld from such Director's election. Abstentions and broker non-votes will have no effect on the outcome of the vote.

For each of the other proposals, the affirmative vote of the holders of a majority of the shares represented at the meeting virtually or by proxy and entitled to vote on the proposal will be required for approval. Abstentions will have the effect of a vote against any of these proposals. Broker non-votes will have no effect on the outcome of these proposals.

If your shares are registered in the name of a bank, broker or other financial institution and you do not give your broker or other nominee specific voting instructions for your shares, under the rules of the New York Stock Exchange ("NYSE"), your record holder has discretion to vote your shares on the ratification of auditor proposal but does not have discretion to vote your shares on any of the other proposals. Your broker, bank or other financial institution will not be permitted to vote on your behalf on the election of Director nominees or the advisory vote on executive compensation unless you provide specific instructions before the date of the annual meeting by completing and returning the voting instruction or proxy card or following the instructions provided to you to vote your shares by telephone or the Internet.

The meeting will begin promptly at 11:30 a.m. Eastern Time on May 12, 2021 at www.virtualshareholdermeeting.com/WH2021. Stockholders will need their 16-digit control number to log in to attend the meeting and vote or ask questions during the meeting. The control number can be found on the Notice, proxy card or voting instruction form distributed to stockholders.

3

Online access to the meeting will open 15 minutes prior to the start of the meeting to allow time for participants to log in and testing of device audio systems. We encourage participants to access the meeting in advance of the designated start time.

Beneficial stockholders whose shares are registered in the name of a bank, broker or other nominee may need to obtain the information required to be able to participate in, and vote at, the meeting, including their control number, from their bank, broker or other nominee. If a beneficial holder has any questions regarding attendance at the meeting, they should contact their broker, bank or other nominee who holds their shares.

Support will be available 15 minutes prior to, and during, the meeting to assist stockholders with any technical difficulties they may have accessing or hearing the virtual meeting. If participants encounter any difficulty, they should call the support team at the numbers listed on the login screen.

How do I ask questions during the meeting?

Stockholders are encouraged to submit questions during the meeting at www.virtualshareholdermeeting.com/WH2021. You will need the 16-digit control number found on the Notice, proxy card or voting instruction form to log in to the meeting and submit questions. Subject to time constraints, we will answer appropriate stockholder questions during the meeting.

Can I change or revoke my vote?

You may change or revoke your proxy at any time prior to voting at the meeting by submitting a later dated proxy or by entering new instructions by Internet or telephone prior to 11:59 p.m. Eastern Time on Tuesday, May 11, 2021, or by giving timely written notice of such change or revocation to the Corporate Secretary or by attending the meeting and voting.

We retained Innisfree M&A Incorporated to advise and assist us in soliciting proxies at a cost of $20,000 plus reasonable expenses. Proxies may also be solicited by our Directors, officers and employees personally, by mail, telephone or electronic means. We will pay all costs relating to the solicitation of proxies. We will also reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses in forwarding proxy materials to beneficial owners of our common stock.

How do I make a stockholder proposal for the 2022 meeting?

Stockholders interested in presenting a proposal for inclusion in our proxy statement and proxy relating to our 2022 annual meeting may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). To be eligible for inclusion in next year's proxy statement, stockholder proposals must be received by the Corporate Secretary at our principal executive offices no later than the close of business on December 1, 2021.

In general, any stockholder proposal to be considered at next year's annual meeting but not included in the proxy statement must be submitted in accordance with the procedures set forth in our Second Amended and Restated By-Laws ("By-Laws"). Notice of any such proposal must be submitted in writing to and received by the Corporate Secretary at our principal executive offices not earlier than January 12, 2022 and not later than February 11, 2022. However, if the date of the 2022 annual meeting is not within 30 days before or after May 12, 2022, then a stockholder will be able to submit a proposal for consideration at the annual meeting not later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or such notice of the date of such annual meeting was mailed whichever occurs first. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. Any notification to

4

bring any proposal before an annual meeting must comply with the requirements of our By-Laws as to proper form. A stockholder may obtain a copy of our By-Laws on our investor website, www.investor.wyndhamhotels.com under the Corporate Governance/Governance Documents page, or by writing to our Corporate Secretary.

Stockholders may also nominate Directors for election at an annual meeting. To nominate a Director stockholders must comply with provisions of applicable law and our By-Laws. The Corporate Governance Committee will also consider stockholder recommendations for candidates to the Board sent to the Committee c/o the Corporate Secretary. See below under Director Nomination Process for information regarding nomination or recommendation of a Director.

5

Strong corporate governance is an integral part of our core values. Our Board is committed to having sound corporate governance principles and practices. Please visit our investor website at www.investor.wyndhamhotels.com under the Corporate Governance/Governance Documents page, which can be reached by clicking on the Corporate Governance link, followed by the Governance Documents link, for the Board's Corporate Governance Guidelines and Director Independence Criteria, the Board-approved charters for the Audit, Compensation and Corporate Governance Committees and related information. These guidelines and charters may also be obtained by writing to our Corporate Secretary at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

Corporate Governance Guidelines

Our Board adopted Corporate Governance Guidelines that, along with the charters of the Board Committees, Director Independence Criteria and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. The governance rules for companies listed on the NYSE and those contained in the Securities and Exchange Commission (the "SEC") rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically. The Corporate Governance Guidelines are available on the Corporate Governance/Governance Documents page of our investor website at www.investor.wyndhamhotels.com.

Director Independence Criteria

The Board adopted the Director Independence Criteria set out below for its evaluation of the materiality of Director relationships with us. The Director Independence Criteria contain independence standards that exceed the independence standards specified in the listing standards of the NYSE. The Director Independence Criteria are available on the Corporate Governance/Governance Documents page of our investor website at www.investor.wyndhamhotels.com.

A Director who satisfies all of the following criteria shall be presumed to be independent under our Director Independence Criteria:

6

Guidelines for Determining Director Independence

Our Corporate Governance Guidelines and Director Independence Criteria provide for director independence standards that meet or exceed those of the NYSE. Our Board is required under NYSE rules to affirmatively determine that each independent Director has no material relationship with Wyndham Hotels other than as a Director.

In accordance with these standards and criteria, the Board undertook its annual review of the independence of its Directors. During this review, the Board considered whether there are any relationships or related party transactions between each Director, any member of his or her immediate family or other affiliated entities and us and our subsidiaries. The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the Director is independent.

The Board follows a number of procedures to review related party transactions. We maintain a written policy governing related party transactions that requires Board approval of related party transactions exceeding $120,000. Each Board member answers a questionnaire designed to disclose conflicts and related party transactions. We also review our internal records for related party transactions. Based on a review of these standards and materials, none of our independent Directors had or has any relationship with us other than as a Director.

As a result of its review, the Board affirmatively determined that the following Directors are independent of us and our management as required by the NYSE listing standards and the Director Independence Criteria: Myra J. Biblowit, James E. Buckman, Bruce B. Churchill, Mukul V. Deoras, Ronald L. Nelson and Pauline D.E. Richards.

The following describes our Board committees and related matters. The composition of the committees is provided immediately after.

Audit Committee

Responsibilities include:

7

All members of the Audit Committee are independent Directors under the Board's Director Independence Criteria and applicable regulatory and listing standards. The Board in its business judgment determined that each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements in accordance with applicable listing standards. The Board also determined that Bruce B. Churchill, Ronald L. Nelson and Pauline D.E. Richards are audit committee financial experts within the meaning of applicable SEC rules.

The Audit Committee Charter is available on the Corporate Governance/Governance Documents page of our investor website at www.investor.wyndhamhotels.com.

Audit Committee Report

The Audit Committee of the Board of Directors assists the Board in fulfilling its oversight responsibilities for the external financial reporting process and the adequacy of Wyndham Hotels' internal controls. Specific responsibilities of the Audit Committee are set forth in the Audit Committee Charter adopted by the Board. The Charter is available on the Corporate Governance/Governance Documents page of our investor website at www.investor.wyndhamhotels.com.

The Audit Committee is comprised of five Directors, all of whom meet the standards of independence adopted by the NYSE and the SEC. The Audit Committee appoints, compensates and oversees the services performed by Wyndham Hotels' independent registered public accounting firm. The Audit Committee approves in advance all services to be performed by Wyndham Hotels' independent registered public accounting firm in accordance with SEC rules and the Audit Committee's established policy for pre-approval of all audit services and permissible non-audit services, subject to the de minimis exceptions for non-audit services.

Management is responsible for Wyndham Hotels' financial reporting process including our system of internal controls and for the preparation of consolidated financial statements in compliance with generally accepted accounting principles, applicable laws and regulations. In addition, management is responsible for establishing, maintaining and assessing the effectiveness of Wyndham Hotels' internal control over financial reporting. Deloitte & Touche LLP ("Deloitte"), Wyndham Hotels' independent registered public accounting firm, is responsible for expressing an opinion on Wyndham Hotels' consolidated financial statements and the effectiveness of Wyndham Hotels' internal control over financial reporting. The Audit Committee reviewed and discussed Wyndham Hotels' 2020 Annual Report on Form 10-K, including the audited consolidated financial statements of Wyndham Hotels for the year ended December 31, 2020, with management and Deloitte. It is not the Audit Committee's duty or responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee also discussed with Deloitte matters required to be discussed by applicable standards and rules of the Public Company Accounting Oversight Board (the "PCAOB") and the SEC. The Audit Committee also received the written disclosures and the letter from Deloitte required by applicable standards and rules of the PCAOB, including those required by Auditing Standard No. 1301, Communications with Audit Committees, and the SEC regarding Deloitte's communications with the Audit Committee concerning independence, and discussed with Deloitte its independence.

8

The Audit Committee also considered whether the permissible non-audit services provided by Deloitte to Wyndham Hotels are compatible with Deloitte maintaining its independence. The Audit Committee satisfied itself as to the independence of Deloitte.

Based on the Audit Committee's review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Wyndham Hotels' Annual Report on Form 10-K for the year ended December 31, 2020.

AUDIT COMMITTEE

Pauline

D.E. Richards (Chair)

James E. Buckman

Bruce B. Churchill

Mukul V. Deoras

Ronald L. Nelson

Compensation Committee

Responsibilities include:

For additional information regarding the Compensation Committee's processes and procedures see below under "Executive Compensation — Compensation Discussion and Analysis — Compensation Committee Matters."

All members of the Compensation Committee are independent Directors under the Board's Director Independence Criteria and applicable regulatory and listing standards.

The Compensation Committee Report is provided below under Executive Compensation. The Compensation Committee Charter is available on the Corporate Governance/Governance Documents page on our investor website at www.investor.wyndhamhotels.com.

Compensation Committee Interlocks and Insider Participation

During 2020, Ms. Biblowit, Mr. Buckman and Mr. Churchill served on our Compensation Committee. There are no compensation committee interlocks between Wyndham Hotels and other entities involving our executive officers and Directors.

Corporate Governance Committee

Responsibilities include:

9

All members of the Corporate Governance Committee are independent Directors under the Board's Director Independence Criteria and applicable regulatory and listing standards.

The Corporate Governance Committee Charter is available on the Corporate Governance/Governance Documents page on our investor website at www.investor.wyndhamhotels.com.

Executive Committee

The Executive Committee may exercise all of the authority of the Board when the Board is not in session, except that the Executive Committee does not have the authority to take any action which legally or under our internal governance policies may be taken only by the full Board.

The following chart provides the current committee membership and the number of meetings that each committee held during 2020.

| |

|

|

|

|

|

|

|

|

|

|

||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | | | | | | | | | | | | | | | | | | | | |

|

Director |

|

Audit Committee |

|

Compensation Committee |

|

Governance Committee |

|

Executive Committee |

| ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Geoffrey A. Ballotti |

M | ||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Myra J. Biblowit |

| | | M | | C | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

James E. Buckman |

M | M | M | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Bruce B. Churchill |

| M | | C | | | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Mukul V. Deoras |

M | M | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Stephen P. Holmes |

| | | | | | | C | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Ronald L. Nelson |

M | M | |||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Pauline D.E. Richards |

| C | | | | M | | | | ||||||||||

| | | | | | | | | | | | | | | | | | | | | |

|

Number of Meetings in 2020 |

8 | 6 | 4 | 4 | |||||||||||||||

| | | | | | | | | | | | | | | | | | | | | |

C =

Chair

M = Member

The Board held six meetings during 2020, including the four regularly scheduled meetings and two special meetings which were primarily held to facilitate the Board's oversight of the Company's response to the COVID-19 pandemic. Each Director attended at least 75% of the meetings of the Board and the committees of the Board on which the Director served while in office.

Directors fulfill their responsibilities not only by attending Board and committee meetings but also through communication with the Non-Executive Chairman, Lead Director, CEO and other members of management relative to matters of interest and concern to Wyndham Hotels.

10

Under our current Board leadership structure, the roles of Chairman and CEO are held by two different individuals. Mr. Holmes, the former CEO of Wyndham Worldwide, serves as our Non-Executive Chairman, while Mr. Ballotti serves as our President and CEO. The Board believes that Mr. Holmes is able to serve as a highly effective Non-Executive Chairman due to his strong leadership skills and his extensive knowledge of our operations and the markets in which we compete. As the former CEO of Wyndham Worldwide, Mr. Holmes is not independent under NYSE rules. Therefore, we also appointed an independent Lead Director to ensure that Wyndham Hotels benefits from effective independent oversight as described below under Lead Director.

One of the key responsibilities of the Board is to review our strategic direction and hold management accountable for the execution of strategy once it is developed. The Board believes that the separation of the roles of the Chairman and the CEO is in the best interests of stockholders at this time because it allows our CEO to focus on the execution of our business strategy, growth and development, while our Non-Executive Chairman oversees our Board. In addition, our independent Lead Director provides us with independent oversight as further described below.

Mr. Buckman, an independent Director, has served as the Board's Lead Director since August 2019. The Lead Director acts as a liaison with the Non-Executive Chairman in consultation with the other Directors; chairs executive sessions of the non-executive Directors and independent Directors and provides feedback to the Non-Executive Chairman; chairs meetings of the Board in the absence of the Non-Executive Chairman; and reviews in advance and consults with the Non-Executive Chairman regarding the schedule and agenda for all Board meetings as well as the materials distributed to Directors in connection with such meetings.

The Board has an active role, as a whole and at the committee level, in providing oversight with respect to management of our risks. The Board focuses on the most significant risks facing us and our general risk management strategy and seeks to ensure that risks undertaken by us are consistent with a level of risk that is appropriate for our Company and aligned with the achievement of our business objectives and strategies.

The Board regularly reviews information regarding risks associated with our finances, credit and liquidity; our business, operations and strategy; legal, regulatory and compliance matters; and reputational exposure. The Audit Committee provides oversight on our programs for risk assessment and risk management, including with respect to financial accounting and reporting, internal audit services, information technology, cybersecurity and compliance. The Compensation Committee provides oversight on our assessment and management of risks relating to our executive compensation. The Corporate Governance Committee provides oversight on our management of risks associated with the independence of the Board and potential conflicts of interest. While each committee is responsible for providing oversight with respect to the management of risks, the entire Board is regularly informed about our risks through committee reports and management presentations.

While the Board and the committees provide oversight with respect to our risk management, our CEO and other senior management are primarily responsible for day-to-day risk management analysis and mitigation and report to the full Board or the relevant committee regarding risk management. Our leadership structure, with Mr. Holmes serving as our Non-Executive Chairman and with Mr. Ballotti serving as a Director, enhances the Board's effectiveness in risk oversight due to their extensive

11

knowledge of our industry, business and operations and facilitates the Board's oversight of key risks. We believe this division of responsibility and leadership structure is the most effective approach for addressing our risk management.

Executive Sessions of Non-Management and Independent Directors

The Board meets regularly without any members of management present. Our Lead Director presides at these sessions. Our independent Directors also meet in executive session at least twice per year. The Lead Director chairs these sessions of independent directors.

Communications with the Board and Directors

Stockholders and other parties interested in communicating directly with the Board, our non-management Directors as a group, our independent Directors as a group or any individual Director may do so by writing our Corporate Secretary at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054. Prior to forwarding any correspondence, the Corporate Secretary will review it and in his discretion will not forward correspondence deemed to be of a commercial nature or otherwise not appropriate for review by the Directors.

Director Attendance at Annual Meeting of Stockholders

As provided in the Board's Corporate Governance Guidelines, Directors are expected to attend our annual meeting absent exceptional cause. All of our current Directors attended our 2020 annual meeting of stockholders and are expected to attend our 2021 annual meeting.

Code of Business Conduct and Ethics

The Board maintains a Code of Business Conduct and Ethics for Directors with ethics guidelines specifically applicable to Directors. In addition, we maintain Business Principles applicable to all our associates, including our CEO, Chief Financial Officer ("CFO") and Chief Accounting Officer.

We will disclose on our website any amendment to or waiver from a provision of our Business Principles or Code of Business Conduct and Ethics for Directors as may be required and within the time period specified under applicable SEC and NYSE rules. The Code of Business Conduct and Ethics for Directors and our Business Principles are available on the Corporate Governance/Governance Documents page of our investor website at www.investor.wyndhamhotels.com. Copies of these documents may also be obtained free of charge by writing to our Corporate Secretary.

Role of Corporate Governance Committee. The Corporate Governance Committee is responsible for recommending the Director nominees for election to the Board. The Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board when considering potential candidates to serve on the Board. Nominees for Director are selected on the basis of their depth and breadth of experience, skills, wisdom, integrity, ability to make independent analytical inquiries, understanding of our business environment and willingness to devote adequate time to Board duties.

The Corporate Governance Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The Corporate Governance Committee does not have a formal policy with respect to diversity; however, the Board and the Corporate Governance Committee believe that it is essential that the

12

Board members represent diverse viewpoints. In considering candidates for the Board, the Corporate Governance Committee considers the entirety of each candidate's credentials in the context of these standards. For the nomination of continuing Directors for re-election, the Corporate Governance Committee also considers the individual's contributions to the Board.

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as senior executives of large organizations as well as extensive board experience. Certain individual qualifications, experience and skills of our Directors that led the Board to conclude that each nominee or Director should serve as our Director are described below under "Proposal No. 1: Election of Directors."

Identification and Evaluation Process. The process for identifying and evaluating nominees to the Board is initiated by identifying a candidate who meets the criteria for selection as a nominee and has the specific qualities or skills being sought based on input from members of the Board and, if the Corporate Governance Committee deems appropriate, a third-party search firm. These candidates will be evaluated by the Corporate Governance Committee by reviewing the candidates' biographical information and qualifications and checking the candidates' references. Qualified nominees will be interviewed by at least one member of the Corporate Governance Committee. Using the input from the interview and other information it obtains, the Corporate Governance Committee evaluates whether the prospective candidate is qualified to serve as a Director and whether the Corporate Governance Committee should recommend to the Board that the Board nominate the prospective candidate for election by the stockholders or to fill a vacancy on the Board.

Stockholder Recommendations of Nominees. The Corporate Governance Committee will consider written recommendations from stockholders for nominees for Director. Recommendations should be submitted to the Corporate Governance Committee, c/o the Corporate Secretary, and include at least the following: name of the stockholder and evidence of the person's ownership of our common stock, number of shares owned and the length of time of ownership, name of the candidate, the candidate's resume or a listing of his or her qualifications to be a Director and the person's consent to be named as a Director if selected by the Corporate Governance Committee and nominated by the Board. To evaluate nominees for Directors recommended by stockholders, the Corporate Governance Committee intends to use a substantially similar evaluation process as described above.

Stockholder Nominations and By-Law Procedures. Our By-Laws establish procedures pursuant to which a stockholder may nominate a person for election to the Board. Our By-Laws are posted on our investor website under Corporate Governance/Governance Documents at www.investor.wyndhamhotels.com. To nominate a person for election to the Board, a stockholder must submit a notice containing all information required by our By-Laws regarding the Director nominee and the stockholder and any associated persons making the nomination, including name and address, number of shares owned, a description of any additional interests of such nominee or stockholder and certain representations regarding such nomination. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. We may require any proposed nominee to furnish such other information as we may require to determine his or her eligibility to serve as a Director. Such notice must be accompanied by the proposed nominee's consent to being named as a nominee and to serve as a Director if elected.

To nominate a person for election to the Board at our annual meeting, written notice of a stockholder nomination must be delivered to our Corporate Secretary not less than 90 nor more than 120 days prior to the anniversary date of the prior year's annual meeting. However, if our annual meeting is advanced or delayed by more than 30 days from the anniversary date of the previous year's meeting, a stockholder's written notice will be timely if it is delivered by no later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or the notice of the date of the annual meeting was mailed, whichever occurs first. Our By-Laws require that any such notice be updated as necessary as of specified dates prior to the annual meeting. A

13

stockholder may make nominations of persons for election to the Board at a special meeting if the stockholder delivers written notice to our Corporate Secretary not later than the close of business on the 10th day following the day on which public disclosure of the date such special meeting was made or notice of such special meeting was mailed, whichever occurs first; provided, that, at a special meeting of stockholders, only such business may be conducted as shall have been brought before the meeting under our notice of meeting.

Non-management Directors receive compensation for Board service designed to compensate them for their Board responsibilities and align their interests with the interests of stockholders. A management Director receives no additional compensation for Board service. The following are certain highlights of our Director compensation program:

2020 Program Change Due to COVID-19. In March 2020, in recognition of the negative financial and operational impacts and uncertainty resulting from the rapidly evolving COVID-19 situation, the Board determined to forgo the cash-based portion of their annual retainer and committee chair and membership fees. The cash-based portion of the fees was reinstated effective August 3, 2020.

Overview. Our Directors play a critical and active role in overseeing the management of our Company and guiding our strategic direction. Ongoing developments in corporate governance, executive compensation and financial reporting have resulted in increased demand for highly qualified and productive public company directors. The time commitment and the many responsibilities and risks of being a director of a public company of our size and profile require that we provide reasonable compensation that is competitive among our peers and commensurate with our Directors' qualifications, responsibilities and workload. Our non-management directors are compensated based on their specific Board responsibilities, including service as Board Chairman, Lead Director, or Chair or member of key Board committees. Our Board is made up of 8 members total, with 6 independent Directors. All of our independent Directors serve on more than one committee. Our director compensation program is designed to reasonably compensate our non-employee directors for their significant responsibilities, expected time commitment and qualifications.

14

Peer Review. In October 2019, the Rewards Solutions practice at Aon plc ("Aon") was engaged to conduct an independent review of our non-management Director compensation program. For this review, Aon used the peer group described below in the Compensation Discussion and Analysis under "Compensation Review and Benchmarking — 2020 Peer Review." The following elements were examined as part of this review: annual board retainers in the form of cash and equity, retainers for chairman and committee service, and prevalence of program features such as non-executive chairman and lead director pay (but did not include supplemental pay for these features), other compensation in the form of perquisites and benefits, and governance policies such as stock ownership guidelines and stock hedging/pledging. The Committee reviewed the peer group data prepared by our compensation consultant that presented annual retainer fees, average committee pay, and annual equity award value at the 25th, 50th and 75th percentiles and determined that the average total direct compensation of our Directors was aligned with the philosophy of targeting the top quartile of the peer group. Based on peer group data regarding our overall Director compensation program, it was also determined that the value provided from the Company's current Director compensation program is aligned competitively with our peer group and that our program features are consistent with the structure of programs offered by our peers. Upon the recommendation of Aon, the Committee determined not to make any changes to our non-management Director compensation program for 2020.

Annual Retainer Fees. The table below describes 2020 annual retainer and committee chair and membership fees for non-management Directors. Our Directors do not receive additional fees for attending Board or committee meetings.

| |

Cash-Based | Stock-Based | Total | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

Non-Executive Chairman |

$ | 160,000 | $ | 160,000 | $ | 320,000 | ||||

Lead Director |

$ | 132,500 | $ | 132,500 | $ | 265,000 | ||||

Director |

$ | 105,000 | $ | 105,000 | $ | 210,000 | ||||

Audit Committee chair |

$ | 22,500 | $ | 22,500 | $ | 45,000 | ||||

Audit Committee member |

$ | 12,500 | $ | 12,500 | $ | 25,000 | ||||

Compensation Committee chair |

$ | 17,500 | $ | 17,500 | $ | 35,000 | ||||

Compensation Committee member |

$ | 10,000 | $ | 10,000 | $ | 20,000 | ||||

Corporate Governance Committee chair |

$ | 15,000 | $ | 15,000 | $ | 30,000 | ||||

Corporate Governance Committee member |

$ | 8,750 | $ | 8,750 | $ | 17,500 | ||||

Executive Committee member |

$ | 10,000 | $ | 10,000 | $ | 20,000 | ||||

The annual Director retainer and committee chair and membership fees are paid on a quarterly basis, 50% in cash and 50% in Wyndham Hotels stock. The requirement for Directors to receive at least 50% of their fees in our equity further aligns their interests with those of our stockholders. The number of shares of stock issued is based on our stock price on the quarterly determination date. Directors may elect to receive the stock-based portion of their fees in the form of common stock or DSUs.

A DSU entitles the Director to receive one share of common stock following the Director's retirement or termination of service from the Board for any reason and is credited with dividend equivalents during the deferral period in the form of additional DSUs. The Director may not sell or receive value from any DSU prior to termination of service. Directors may also elect to defer any cash-based compensation or vested RSUs in the form of DSUs under our Non-Employee Director Deferred Compensation Plan.

As described above, in March 2020, the Directors determined to forgo their cash-based fees in light of the negative financial and operational impact of the COVID-19 pandemic, including any cash-based fees that any Director had elected to defer in the form of DSUs. These cash payments were reinstated effective August 3, 2020.

Annual Equity Grant. In February 2020, each non-management Director of Wyndham Hotels was awarded a grant of time-vesting RSUs with a grant date fair value of $100,000 which vests in equal

15

annual increments over a four-year period. RSUs are credited with dividend equivalents subject to the same vesting restrictions as the underlying units.

Benefits and Other Compensation. Consistent with the Company's commitment to philanthropic giving, we provide up to a three-for-one Company match of a non-management Director's qualifying charitable contributions. We match each Director's personal contribution on a three-for-one basis up to a Company contribution of $75,000 per year, with such contributions paid by Wyndham Hotels directly to the charitable organization. This match program supports our core value of caring for our communities.

We maintain a policy to provide our non-management Directors annually with 500,000 Wyndham Rewards Points. These Wyndham Rewards Points have an approximate value of $6,500 and may be redeemed for numerous rewards options including stays at Wyndham properties. This benefit provides our Directors with ongoing, first-hand exposure to our properties and operations, furthering their understanding and evaluation of our business. Directors are permitted to hold up to a maximum of 1,000,000 Wyndham Rewards Points under this policy and for this reason may be granted fewer than 500,000 points in a given year.

Letter Agreement with Mr. Holmes. In connection with his appointment as Non-Executive Chairman of the Board in June 2018, we entered into a letter agreement with Mr. Holmes, which provides him with an annual retainer of $320,000 payable 50% in cash and 50% in our equity as described above, $18,750 per year for his costs incurred in connection with retaining an administrative assistant, $12,500 per year for the cost of his office space, 50% of the cost of the lease associated with his vehicle through the earlier of the conclusion of the lease term and the conclusion of his service on the Board, and reimbursement for 50% of the cost of his annual health and wellness physical.

2020 Director Compensation Table

The following table describes compensation we paid our non-management Directors for 2020.

|

Name |

|

|

Fees Paid in Cash ($) |

|

Stock Awards ($) |

|

|

All Other Compensation ($)(a) |

|

|

Total ($)(a) |

| ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Myra J. Biblowit |

86,667(b | ) | 230,000(c) | 43,488(d | ) | 360,155 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

James E. Buckman |

| | 110,000(b | ) | | 265,000(c) | | | 1,170(d | ) | | | 376,170 | | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Bruce B. Churchill |

90,000(b | ) | 235,000(c) | 81,500(d | ) | 406,500 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Mukul V. Deoras |

| | 84,167(b | ) | | 226,250(c) | | | 6,500(d | ) | | | 316,917 | | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Stephen P. Holmes |

113,333(b | ) | 270,000(c) | 47,320(d | ) | 430,653 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Ronald L. Nelson |

| | 84,167(b | ) | | 226,250(c) | | | 6,500(d | ) | | | 316,917 | | ||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

|

Pauline D.E. Richards |

90,833(b | ) | 236,250(c) | 39,081(d | ) | 366,164 | ||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | |

16

2020 Director Compensation Excluding Charitable Contributions:

|

Name |

|

|

Fees Paid in Cash ($) |

|

|

Stock Awards ($) |

|

|

All Other Compensation, Excluding Charitable Donations(i) ($) |

|

|

Total, Excluding Charitable Donations(i) ($) |

| ||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ms. Biblowit |

86,667 | 230,000 | 6,500 | 323,167 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mr. Buckman |

110,000 | 265,000 | 1,170 | 376,170 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mr. Churchill |

90,000 | 235,000 | 6,500 | 331,500 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mr. Deoras |

84,167 | 226,250 | 6,500 | 316,917 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mr. Holmes |

113,333 | 270,000 | 47,320 | 430,653 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Mr. Nelson |

84,167 | 226,250 | 6,500 | 316,917 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

|

Ms. Richards |

90,833 | 236,250 | 7,581 | 334,664 | |||||||||||||||||||

| | | | | | | | | | | | | | | | | | | | | | | | | |

Total shares of our common stock issuable for unvested Wyndham Hotels RSUs at December 31, 2020 were as follows: Ms. Biblowit, 4,523; Mr. Buckman, 4,523; Mr. Churchill, 4,523; Mr. Deoras, 4,523; Mr. Holmes, 4,523; Mr. Nelson, 1,872; and Ms. Richards, 4,523. Total shares of our common stock issuable for Wyndham Hotels DSUs at December 31, 2020 were as follows: Ms. Biblowit, 73,736; Mr. Buckman, 68,110; Mr. Churchill, 8,540; Mr. Deoras, 5,609; Mr. Holmes, 3,680; Mr. Nelson, 2,733; and Ms. Richards, 48,634. Mr. Holmes also held 160,028 stock-settled stock appreciation rights ("SSARs") at December 31, 2020.

For Mr. Holmes, the amount reported in the All Other Compensation column of the 2020 Director Compensation table also includes $31,250 reflecting reimbursement for his office space and administrative support and $9,570 for his vehicle lease under the terms of his letter agreement. In addition, on limited occasions, Directors' spouses may accompany Directors on the Company-chartered aircraft when traveling for business purposes, for which there is generally no incremental cost to the Company.

In accordance with SEC rules, the value of dividends paid to our Directors on vesting of RSUs and DSUs credited as dividend equivalents with respect to outstanding DSUs is not reported above because dividends were factored into the grant date fair value of these awards.

17

Non-Management Director Stock Ownership Guidelines

The Corporate Governance Guidelines require each non-management Director to comply with Wyndham Hotels' Non-Management Director Stock Ownership Guidelines. These guidelines require each non-management Director to beneficially own an amount of our stock equal to the greater of a multiple of at least five times the cash portion of the annual retainer or two and one-half times the total retainer value without regard to Board committee fees. Directors have a period of five years after joining the Board to achieve compliance with this ownership requirement. DSUs and RSUs credited to a Director count towards satisfaction of the guidelines. As of December 31, 2020, all of our non-management Directors were in compliance with the stock ownership guidelines.

The following table describes the beneficial ownership of our common stock for the following persons as of December 31, 2020: each executive officer named in the Summary Compensation Table below, each Director, each person who to our knowledge beneficially owns in excess of 5% of our common stock and all of our Directors and executive officers as a group. The percentage values for each Director and executive officer are based on 93,169,085 shares of our common stock outstanding as of December 31, 2020. The principal address for each Director and executive officer of Wyndham Hotels is 22 Sylvan Way, Parsippany, New Jersey 07054.

|

Name |

Number of Shares |

% of Class | |||

|

Capital Research Global Investors |

11,023,302 | (a) | 11.83% | ||

|

The Vanguard Group |

8,170,933 | (b) | 8.77% | ||

|

BlackRock, Inc. |

8,104,430 | (c) | 8.70% | ||

|

Boston Partners |

4,734,766 | (d) | 5.08% | ||

|

Michele Allen |

32,592 | (e)(f) | * | ||

|

Geoffrey A. Ballotti |

500,642 | (e)(f) | * | ||

|

Tom H. Barber |

29,890 | (f) | * | ||

|

Myra J. Biblowit |

82,605 | (e)(g) | * | ||

|

James E. Buckman |

76,053 | (e)(g) | * | ||

|

Paul F. Cash |

46,219 | (e)(f) | * | ||

|

Lisa Checchio |

27,612 | (e)(f) | * | ||

|

Bruce B. Churchill |

9,485 | (e)(g) | * | ||

|

Mukul V. Deoras |

9,124 | (e)(g) | * | ||

|

Mary R. Falvey |

149,368 | (e)(f) | * | ||

|

Stephen P. Holmes |

758,373 | (e)(g)(h) | * | ||

|

Robert D. Loewen |

62,537 | (f) | * | ||

|

Ronald L. Nelson |

34,141 | (e)(g) | * | ||

|

Pauline D.E. Richards |

58,237 | (e)(g) | * | ||

|

All Directors and executive officers as a group (17 persons) |

1,937,388 | (i) | 2.06% |

18

stock with sole voting power over 7,657,303 shares, shared voting power over no shares, sole dispositive power over 8,104,430 shares and shared dispositive power over no shares. The principal business address for BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055.

Excludes shares of our common stock issuable upon vesting of time-vesting RSUs after 60 days from December 31, 2020 as follows: Ms. Allen, 22,609; Mr. Ballotti, 71,028; Ms. Biblowit, 3,578; Mr. Buckman, 3,578; Mr. Cash, 26,425; Ms. Checchio, 18,339; Mr. Churchill, 3,578; Mr. Deoras, 3,578; Ms. Falvey, 38,743; Mr. Holmes, 3,578; Mr. Nelson, 1,404; and Ms. Richards, 3,578.

Excludes shares of our common stock underlying stock options which are not currently exercisable and will not become exercisable within 60 days of December 31, 2020 as follows: Ms. Allen, 44,349; Mr. Ballotti, 398,706; Mr. Barber, 0; Mr. Cash, 49,901; Ms. Checchio, 30,791; Ms. Falvey, 71,998; and Mr. Loewen, 0.

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership of our common stock with the SEC. Based on the information available to us during 2020, we believe that all applicable Section 16(a) filing requirements were met on a timely basis.

19

PROPOSAL NO. 1: ELECTION OF DIRECTORS

At the date of this proxy statement, the Board consists of eight members, six of whom are independent Directors under applicable listing standards and our corporate governance documents.

At this year's meeting, all eight of our Directors are to be elected for terms expiring at the 2022 annual meeting, with each Director to serve until such Director's successor is elected and qualified or until such Director's earlier resignation, retirement, disqualification death or removal.

On the recommendation of the Corporate Governance Committee, the Board has nominated Stephen P. Holmes, Geoffrey A. Ballotti, Myra J. Biblowit, James E. Buckman, Bruce B. Churchill, Mukul V. Deoras, Ronald L. Nelson and Pauline D.E. Richards for election, each of whom is presently a Director, to serve until the 2022 annual meeting. The eight nominees are listed below with brief biographies.

We do not know of any reason why any nominee would be unable to serve as a Director. If any nominee is unable to serve, the shares represented by all valid proxies will be voted for the election of such other person as the Board may nominate.

Majority Voting Standard in Uncontested Director Elections

Under our By-Laws, Directors are elected by a majority of the votes cast at the annual meeting, meaning that, for a Director to be elected, the number of shares voted "for" the Director must exceed the number of shares withheld from such Director's election. In the event that the number of candidates nominated for election as Directors exceeds the number of directors to be elected, a plurality of the votes cast will instead be the vote standard for that election.

If a Director is not elected under this majority vote standard, he or she is required to promptly offer to resign from the Board. The Corporate Governance Committee will recommend to the Board whether to accept or reject the resignation or to take some other action, such as rejecting the tendered resignation and addressing the apparent underlying causes of the withheld votes. In making this recommendation, the Corporate Governance Committee will consider all factors deemed relevant by its members.

The Board will act on the Corporate Governance Committee's recommendation no later than 120 days following the certification of the stockholder vote. In considering the Corporate Governance Committee's recommendation, the Board will review the factors considered by the Corporate Governance Committee and such additional information and factors the Board believes to be relevant. The Board will promptly publicly disclose its decision in a periodic or current report filed with the SEC. Any Director who offers his or her resignation under this process will not participate in the Corporate Governance Committee recommendation or Board decision regarding whether or not to accept the resignation. However, such Director shall remain active and engaged in all other Board and committee activities, deliberations and decisions during this Corporate Governance Committee and Board process.

20

Nominees for Election to the Board

Stephen P. Holmes, 64, has served as Non-Executive Chairman of our Board since June 2018. From August 2006 to May 2018, Mr. Holmes served as Wyndham Worldwide's Chairman of the Board and Chief Executive Officer. From December 1997 to July 2006, Mr. Holmes served as Vice Chairman and director of Cendant Corporation and Chairman and Chief Executive Officer of Cendant's Travel Content Division. Mr. Holmes served as Vice Chairman of HFS Incorporated from September 1996 to December 1997, a director of HFS from June 1994 to December 1997 and Executive Vice President, Treasurer and Chief Financial Officer of HFS from July 1990 to September 1996. Since May 2018, Mr. Holmes has served as Non-Executive Chairman of the Board of Travel + Leisure (previously known as Wyndham Destinations, Inc. and, prior thereto, Wyndham Worldwide).

Mr. Holmes was selected to serve on our Board because of his extensive public company experience, his exceptional leadership skills and his knowledge of our business and industry.

Geoffrey A. Ballotti, 59, has served as a Director and as our President and Chief Executive Officer since June 2018. From March 2014 to May 2018, Mr. Ballotti served as President and Chief Executive Officer of Wyndham Hotel Group. From March 2008 to March 2014, Mr. Ballotti served as Chief Executive Officer of Wyndham Destination Network. From October 2003 to March 2008, Mr. Ballotti was President of the North America Division of Starwood Hotels and Resorts Worldwide. From 1989 to 2003, Mr. Ballotti held leadership positions of increasing responsibility at Starwood Hotels and Resorts Worldwide including President of Starwood North America, Executive Vice President, Operations, Senior Vice President, Southern Europe and Managing Director, Ciga Spa, Italy. Prior to joining Starwood Hotels and Resorts Worldwide, Mr. Ballotti was a Banking Officer in the Commercial Real Estate Group at the Bank of New England.

Mr. Ballotti was selected to serve on our Board because of his exceptional and visionary leadership abilities and extensive knowledge of the hotel industry and our business.

21

Myra J. Biblowit, 72, has served as a Director since June 2018. Since April 2001, Ms. Biblowit has served as President of The Breast Cancer Research Foundation. From July 1997 to March 2001, she served as Vice Dean for External Affairs for the New York University School of Medicine and Senior Vice President of the Mount Sinai-NYU Health System. From June 1991 to June 1997, Ms. Biblowit was Senior Vice President and Executive Director of the Capital Campaign for the American Museum of Natural History. Ms. Biblowit served as a director of Cendant Corporation from April 2000 to August 2006 and Wyndham Worldwide from August 2006 to May 2018.

Ms. Biblowit's exceptional leadership experience with iconic research, educational and cultural institutions provides a unique perspective to the Board. As President of The Breast Cancer Research Foundation, a leading funder of research around the world, Ms. Biblowit brings to the Board a global perspective, marketing skills and a commitment to supporting our communities that add significant value to the Board's contribution to our success. Ms. Biblowit was selected to serve on our Board because of her specific experience, qualifications, attributes and skills described above.

James E. Buckman, 76, has served as a Director since May 2018 and our Lead Director since August 2019. Mr. Buckman has also served as a director of Travel + Leisure (previously known as Wyndham Destinations, Inc. and, prior thereto, Wyndham Worldwide) since July 2006 and its lead director since March 2010. From May 2007 to January 2012, Mr. Buckman served as Vice Chairman of York Capital Management, a hedge fund management company. From May 2010 to January 2012, Mr. Buckman also served as General Counsel of York Capital Management and from January 2007 to May 2007 he served as a Senior Consultant to York Capital Management. Mr. Buckman was General Counsel and a director of Cendant Corporation from December 1997 to August 2006, a Vice Chairman of Cendant from November 1998 to August 2006 and a Senior Executive Vice President of Cendant from December 1997 to November 1998. Mr. Buckman was Senior Executive Vice President, General Counsel and Assistant Secretary of HFS Incorporated from May 1997 to December 1997, a director of HFS from June 1994 to December 1997 and Executive Vice President, General Counsel and Assistant Secretary of HFS from February 1992 to May 1997.

Mr. Buckman brings to the Board exceptional leadership, experience and perspective. His service as lead director of Travel + Leisure affords Mr. Buckman extensive experience with Wyndham Hotels' business and operations, and his experience as an executive and general counsel of leading businesses adds valuable executive and legal experience to the Board. Mr. Buckman was selected to serve on our Board because of the specific experience, qualifications, attributes and skills described above.

22

Bruce B. Churchill, 63, has served as a Director since June 2018. From August 2014 to April 2017, Mr. Churchill served on the board of directors of Computer Sciences Corporation (now DXC Technology Company). From January 2004 to August 2015, Mr. Churchill served as President of DIRECTV Latin America and from January 2004 to March 2005, Mr. Churchill served as Chief Financial Officer of DIRECTV. From January 1996 to July 2003, Mr. Churchill served as President and Chief Operating Officer for STAR TV. Prior to joining STAR TV, Mr. Churchill served in senior positions for Fox Television and Paramount Pictures.

Mr. Churchill brings to the Board exceptional and extensive experience in domestic and international management, operations, finance, accounting and oversight of leading media and technology-driven corporations that provides valuable insight to the Board and aligns closely with our focus as an organization. Having served as a director and senior executive for other public companies, Mr. Churchill offers valuable perspectives on board operations as well. Mr. Churchill was selected to serve on our Board because of his specific experience, qualifications, attributes and skills described above.

Mukul V. Deoras, 57, has served as a Director since June 2018. Since September 2018, Mr. Deoras has served as President, Asia Pacific Division of Colgate-Palmolive Company and as Chairman of Colgate-Palmolive (India) Ltd. From August 2015 to September 2018, Mr. Deoras served as Chief Marketing Officer of Colgate-Palmolive Company. From February 2012 to July 2015, Mr. Deoras served as President, Asia Division of Colgate-Palmolive. From January 2010 to January 2012, Mr. Deoras served as Managing Director for Colgate-Palmolive (India) Ltd. From September 2004 to January 2010, Mr. Deoras served in positions of increasing responsibility in marketing and sales for Colgate-Palmolive. Prior to joining Colgate-Palmolive, Mr. Deoras held positions of increasing responsibility in marketing and sales at Hindustan Unilever Limited.

Mr. Deoras' exceptional career provides the Board with valuable experience and knowledge in domestic and international strategy, marketing and sales operations that are an integral part of our organizational focus. His wealth of experience in marketing and sales execution across multiple geographic regions provides insight into areas that are critical to our growth and success. Mr. Deoras was selected to serve on our Board because of his specific experience, qualifications, attributes and skills described above.

23

Ronald L. Nelson, 68, has served as a Director since August 2019. Since July 2008, he has also served as a director of Hanesbrands, Inc. and held the roles of Lead Director since January 2015 and Non-Executive Chairman since April 2019. Mr. Nelson has also served as a director of ViacomCBS Inc. since December 2019. He previously served as a director of Viacom, Inc. from August 2016 to December 2019. Previously, Mr. Nelson served as Executive Chairman of the Board of Avis Budget Group from December 2015 to May 2018 and as its Chairman and Chief Executive Officer from August 2006 to December 2015. He also served as Avis' Chief Operating Officer from June 2010 to October 2015. From April 2003 to August 2006, Mr. Nelson served as Chief Financial Officer and President of Cendant Corporation and served as a member of its board during that same period. From November 1994 to March 2003, Mr. Nelson served as Co-Chief Operating Officer of DreamWorks SKG. Prior to that, he was Executive Vice President, Chief Financial Officer at Paramount Communications, Inc. from November 1987 to March 1994 and served as a director from June 1991 to March 1994. He also previously served as a director of Convergys Corporation from August 2008 to October 2016, serving in the role of Lead Director from April 2013 to October 2016.

Mr. Nelson brings to the Board exceptional and extensive senior leadership experience in management, finance and oversight of leading public companies that contributes significant value and insight to the Board. Having served as a director for other public companies, Mr. Nelson provides valuable experience with board operations and practices as well. Mr. Nelson was selected to serve on our Board because of his specific experience, qualifications, attributes and skills described above.