Exhibit 99.2

In this Exhibit 99.2, references to “Wyndham Hotels,” “we,” “us,” “our,” and the “Company” refer to Wyndham Hotels & Resorts, Inc. and its consolidated subsidiaries unless the context requires otherwise.

Except where the context suggests otherwise, we define certain terms in this document as follows:

“guests” means the guests of our franchised, managed and owned hotels;

“occupancy” means the total number of room nights sold divided by the total number of room nights available at a property or group of properties; and

“RevPAR” or “revenue per available room” represents the room rental revenues generated by our franchisees divided by the number of available room-nights in the period.

Non-GAAP Financial Measures

Certain financial measures as presented in this document, including Adjusted EBITDA, are supplemental measures of our performance. These measures are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). Adjusted EBITDA is not a measurement of our financial performance or financial position under GAAP and should not be considered as an alternative to net revenues, net income or any other performance measures derived in accordance with GAAP.

The Securities and Exchange Commission (the “SEC”) has adopted rules to regulate the use in filings with the SEC and public disclosures and press releases of non GAAP financial measures, such as Adjusted EBITDA that are derived on the basis of methodologies other than in accordance with GAAP. The non GAAP financial measures presented in this document may not comply with these rules.

Special Note About Forward-Looking Statements

This document contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These statements include, but are not limited to, statements related to our expectations regarding our strategy and the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate” and similar words or expressions, including the negative version of such words and expressions.

Forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on the forward-looking statements in this document. We undertake no obligation to update forward-looking statements after we distribute this document.

The risk factors discussed in the section “Risk Factors” of our Form 10-K for the year ended December 31, 2019 and our Form 10-Q for the quarterly period ended June 30, 2020, and in subsequent filings with the SEC could cause our results to differ materially from those expressed in forward-looking statements. Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, general economic conditions; the continuation or worsening of the effects from the coronavirus pandemic, (“COVID-19”); its scope and duration and impact on our business operations, financial results, cash flows and liquidity, as well as the impact on our franchisees and property owners, guests and team members, the hospitality industry and overall demand for travel; the success of our mitigation efforts in response to the COVID-19 pandemic; our performance in any recovery from the COVID-19 pandemic, the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising and management businesses; our relationships with franchisees and property owners; the impact of war, terrorist activity or political strife; concerns with or threats of pandemics, contagious diseases or health epidemics, including the effects of the COVID-19 pandemic and any resurgence of the virus and actions governments, businesses and individuals take in response to the pandemic, including stay-in-place directives and other travel restrictions; risks related to restructuring or strategic initiatives; risks related to our relationship with CorePoint Lodging; our spin-off as a newly independent company; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with covenants thereunder; risks related to our ability to obtain financing, including access to liquidity and capital as a result of COVID-19; the restrictions on share repurchases and the Company’s ability or plans to pay dividends and to repurchase shares including the timing and amount of any future share repurchases and dividends, as well as the risks described in our Annual Report on Form 10-K for the year ended December 31, 2019 and subsequent reports filed with the SEC. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, subsequent events or otherwise. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. Any such risks could cause our results to differ materially from those expressed in forward-looking statements.

Excerpts from the Preliminary Offering Memorandum dated August 10, 2020

Certain Excerpts Regarding Our Company

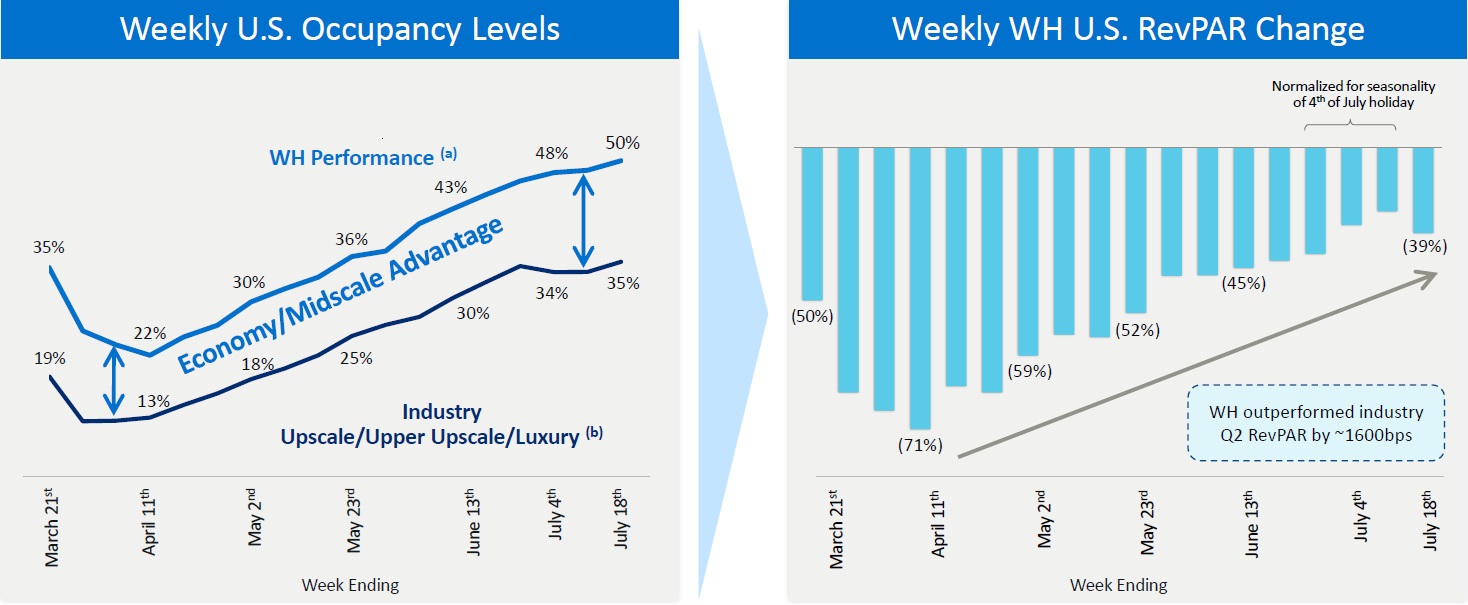

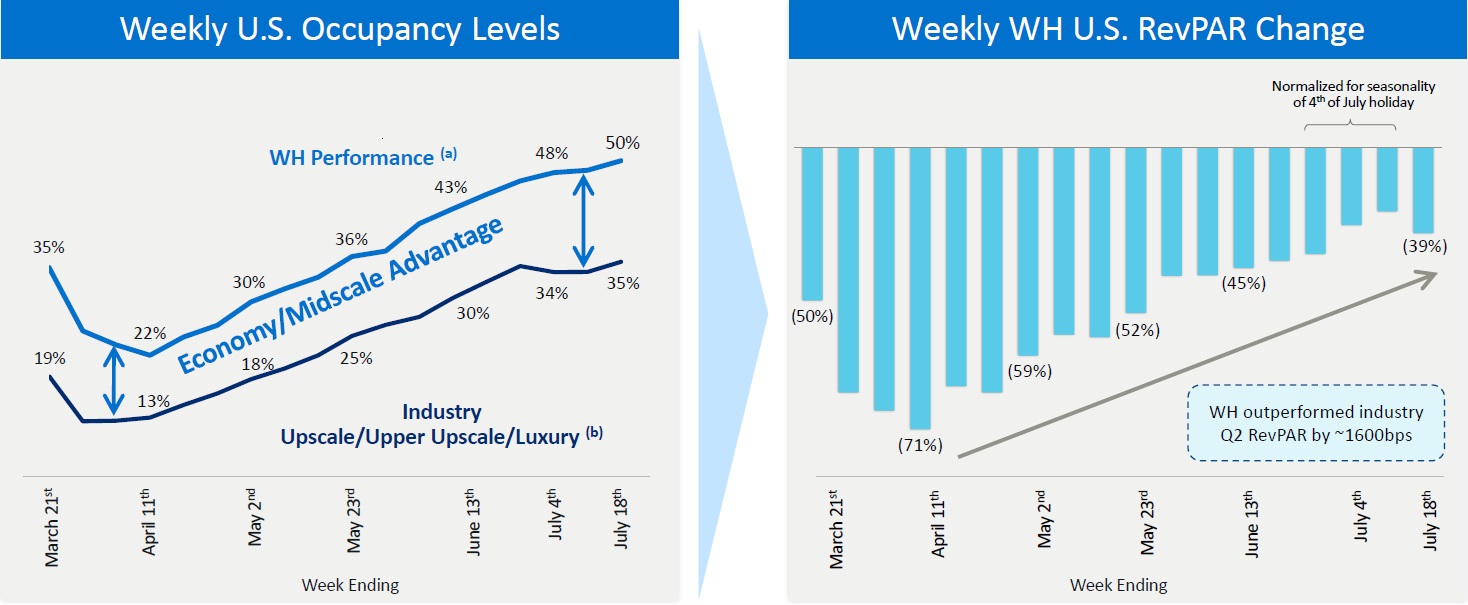

We lead the select-service space - 99% of our U.S. hotels are select-service. These hotels fare much better in turbulent times than the higher-end chainscales, as evidenced by second quarter RevPAR performance in 2020 where RevPAR in our economy and midscale portfolios declined 52% compared to 2019 while the upper upscale and luxury segments across the industry declined 87% compared to 2019.

We have 362 hotels under management contracts and two owned hotels - the Wyndham Grand Rio Mar Beach Resort and Spa in Puerto Rico and the Wyndham Grand Orlando Bonnet Creek.

Recent Developments

Impact of COVID-19 on Our Business

Our industry is experiencing a sharp decline in travel demand due to COVID-19 and the related government preventative and protective actions intended to slow the spread of the virus. While RevPAR has been steadily improving since April 2020, we and the entire industry are experiencing significant revenue losses as a result of steep RevPAR declines, which may continue for some time. We are committed to protecting the health of our communities and have been responding to the evolving COVID-19 situation by implementing a recovery plan focused on the health and safety of guests and employees and the implementation of cost saving and mitigating measures.

Prevention Measures

As a result of the financial impact of COVID-19, we have taken the following preventative measures to conserve our liquidity, strengthen our balance sheet and support our franchisees through these unprecedented times:

| · | Suspended our share repurchase program as of March 17, 2020; |

| · | Workforce reductions, including the elimination of 442 team members across the globe; |

| · | Advertising reductions; |

| · | Reduced our quarterly cash dividend per share to $0.08 per share from $0.32 per share in the first quarter of 2020; |

| · | Capital expenditures reductions to focus on only the highest priority projects; |

| 2 |

| · | Elimination of all discretionary spend; |

| · | Temporary closure of our two owned hotels for April and May 2020; |

| · | Our Chief Executive Officer elected to forgo his base salary and our Board of Directors ("Board") elected to forgo the cash portion of their fees for a portion of the year; and |

| · | Drew substantially all of our outstanding availability under our revolving credit facility in March 2020 to further increase our liquidity position. Additionally, in April 2020, we completed an amendment to our revolving credit facility agreement to provide for more flexibility. |

Our franchisees’ financial health and long-term success is a top priority for us, and we have taken the following proactive steps to help them preserve cash during this period:

| · | Suspended non-room revenue related fees, such as Wyndham Rewards retraining fees; |

| · | Deferred property improvement plans and certain non-essential brand standards requiring cash outlays, such as hot breakfast requirements; |

| · | Partnered with industry associations to advocate for government relief for our franchisees and their employees; |

| · | Guided owners through the Coronavirus Aid, Relief, and Economic Security Act ("CARES") and its evolving guidance and urged the government to expand and clarify these loan programs, for which the majority of our owners qualify; |

| · | Provided payment relief by deferring March, April and May receivables and suspending interest charges and late fees until September 1, 2020; and |

| · | Revised cleaning protocols and secured critical cleaning and disinfection supplies pursuant to new U.S. Centers for Disease Control and Prevention ("CDC") guidelines through our procurement network at reduced costs for our franchisees as well as funding and deferring repayment of these costs to help our franchisees conserve cash during this pandemic. |

| · | For our guests whose travel plans have changed, we have modified cancellation policies, paused Wyndham Rewards point expirations until September 30, 2020 and are maintaining loyalty member level status through the end of 2021. |

As a result of the above mentioned mitigation steps, we have reduced our expected cash outflows in 2020 by approximately $255 million, of which $155 million is expected to be volume-related reductions with the remaining $100 million representing expected savings from our restructuring actions that are permanent changes to our cost infrastructure. Of this $100 million, approximately $40 million is expected to drive incremental EBITDA on a continual basis in the future while approximately $60 million relates to our marketing, reservation and loyalty funds and will eventually be redeployed to variable, high-ROI marketing activities on an opportunistic basis as marketing, reservation and loyalty revenues recover in the future. For the three months ended June 30, 2020, we generated Adjusted EBITDA of $63 million.(1) In addition, we used $85 million of cash during the three months ended June 30, 2020, including the effects of $67 million of deferred franchise fees in connection with our franchise relief measures and $28 million of transaction-related, separation-related and restructuring cash payments, all of which are currently expected to be one-time in nature. Excluding these one-time items, we generated $10 million in positive cash flow in the second quarter of 2020.

| 3 |

| (1) | Adjusted EBITDA is a supplemental measure of our performance and is not required by, or presented in accordance with, GAAP. “Adjusted EBITDA” for us is defined as net income (loss) excluding interest expense, depreciation and amortization, impairment charges, restructuring and related charges, contract termination costs, transaction-related items (acquisition-, disposition- or separation-related), foreign currency impacts of highly inflationary countries, stock-based compensation expense and income taxes. Adjusted EBITDA is not a measurement of our financial performance or financial position under GAAP and should not be considered as an alternative to net revenues, net income or any other performance measures derived in accordance with GAAP. We believe that Adjusted EBITDA is a useful measure of performance for its segments which, when considered with GAAP measures, allows a more complete understanding of its operating performance. We use these measures internally to assess operating performance, both absolutely and in comparison to other companies, and to make day to day operating decisions, including in the evaluation of selected compensation decisions. Adjusted EBITDA is not a recognized term under GAAP and should not be considered as an alternative to net income (loss) or other measures of financial performance or liquidity derived in accordance with GAAP. Our presentation of Adjusted EBITDA may not be comparable to similarly-titled measures used by other companies. |

The reconciliation of Net (loss) to Adjusted EBITDA is as follows:

| ($ in millions) | Three months ended June 30, 2020 | |||

| Net (loss) | $ | (174 | ) | |

| (Benefit) for income taxes | (48 | ) | ||

| Depreciation and amortization | 25 | |||

| Interest expense, net | 28 | |||

| Stock-based compensation expense | 5 | |||

| Impairments, net(a) | 206 | |||

| Restructuring costs(b) | 16 | |||

| Transaction-related expenses, net(c) | 5 | |||

| Adjusted EBITDA | $ | 63 | ||

| (a) | Represents a non-cash charge to reduce the carrying values of certain intangible assets to their fair values principally attributable to higher discount rates primarily resulting from increased share price volatility, partially offset by $3 million of cash proceeds from a previously impaired asset. |

| (b) | Represents charges associated with restructuring initiatives implemented in response to the effects on travel demand as a result of COVID-19. |

| (c) | Primarily relates to integration costs incurred in connection with our acquisition of La Quinta. |

Domestic Trends

As of the date of this offering memorandum, over 99% of our 6,300 domestic hotels are open and our Company experienced as of the week ended August 1st its 16th consecutive week of an increase in occupancy.

Since our recovery is less reliant on air travel or international travel demands and nearly 90% of our domestic hotels are located along highways and in suburban and small metro areas and our brands in the economy and midscale segments are utilized by the truckers, contractors, construction workers, healthcare workers, emergency crews and others who still need overnight accommodations even in this COVID-19 crisis, overall occupancy continues to show sequential improvement in our economy and mid-scale brands in the United States. Our July month-to-date occupancy averaged nearly 50% in the United States and recently reached a high point of 60% on August 1st, reflecting strength in drive-to leisure destinations. As of August 1, 2020, nearly 70% of our US franchisees are operating above 40% occupancy, the level at which we estimate our franchisees to be breakeven after accounting for their operating expenses and debt service requirements. Our weekly U.S. RevPAR has steadily improved from (71%) in mid-April to (39%) in mid-July and the 35% of franchise fees that had been paid as of June 30th has already increased to over 40%.

| 4 |

(a) Includes all WH brands.

(b) Includes Industry averages for Upscale, Upper Upscale and Luxury segments, as defined by STR.

In addition, as of August 1, 2020, direct channel web bookings have increased by approximately 80% since the April-May timeframe. Volume into our call centers is trending near pre-COVID levels, and loyalty member occupancy has increased by over 400 basis points year-to-date compared to 2019.

International Trends

All of our international regions are experiencing occupancy improvement. As of the date of this offering memorandum, 93% of our system is open in Asia-Pacific and occupancy is over 60% in China. In Canada, 98% of our system is open and occupancy has reached over 50%. In the Europe, Middle East and Africa region where 71% of our system is open, occupancy has reached approximately 40%. Latin America remains our most challenged region with over 80 hotels still closed and occupancy levels at less than 30%.

While we believe our hotels will be able to quickly recover once the pandemic abates, the ultimate timing of any recovery remains uncertain. In the meantime, our results of operations may continue to be negatively impacted and certain additional intangible assets, such as our trademarks, and our franchised and managed goodwill may be exposed to additional impairments.

| 5 |