UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☐ | Soliciting Material under §240.14a-12 |

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials. |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

NOTICE OF 2023 ANNUAL MEETING

OF STOCKHOLDERS AND

PROXY STATEMENT

Wyndham Hotels & Resorts, Inc.

22 Sylvan Way

Parsippany, New Jersey 07054

March 28, 2023

Dear Fellow Stockholder:

On behalf of the entire Board, we are pleased to invite you to attend the 2023 annual meeting of stockholders to be held on Tuesday, May 9, 2023 at 11:30 a.m. Eastern Time. The meeting will be held in person at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

Our concentration in select-service economy and midscale segments, sustained demand from our leisure and everyday business travelers and the investments we made to help our owners grow market share all contributed to what was, by all accounts, a remarkably successful year for Wyndham Hotels & Resorts. Excluding currency effects, global RevPAR increased 20% year-over-year, or 7% above 2019 levels, and domestic RevPAR increased by 12% year-over-year or 9% above 2019 levels. System-wide rooms increased 4% year-over-year, including 80 basis points from the acquisition of the Vienna House brand. We also grew our global development pipeline by 12% year-over-year to a record level of 219,000 rooms, including 170 contracts awarded in nine short months since the launch of our 24th brand in March 2022 - ECHO Suites Extended Stay by Wyndham.

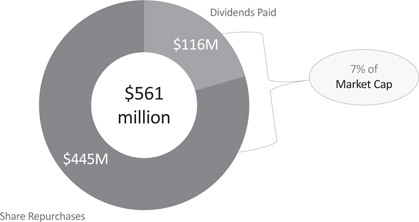

Our management team, led by our executive officers, produced diluted earnings per share of $3.91 and adjusted diluted earnings per share* of $3.96. Net income was $355 million for 2022, adjusted net income* was $360 million, and adjusted EBITDA* was $650 million. Our team also generated $399 million of net cash provided by operating activities and free cash flow* for 2022 was $360 million. Our Board demonstrated its continued confidence in our business and our strategy through its decision to continue paying quarterly dividends throughout 2022 and authorizing a 9% increase to $0.35 per share beginning with the dividend declared in first quarter 2023. In total, we returned a record-high $561 million to our shareholders in 2022, including common stock dividend payments of $116 million and common stock repurchases of $445 million. In addition, our Board increased the Company’s share repurchase authorization by $400 million in October 2022.

In October 2022, we were incredibly proud to be ranked number eleven out of 100 among Newsweek Magazine’s Most Loved Workplaces in America, followed by recognition as one of Newsweek Magazine’s Most Responsible Companies in America, which honors those with superior environmental and social responsibility practices and, in February 2023, Forbes Magazine recognized us, once again, on its 2023 List of America’s Best Large Employers. We were also named a 2022 Diversity Inc. Noteworthy Company, one of The Best Employers for Diversity 2022 by Forbes and one of America’s 2023 Greatest Workplaces for Diversity by Newsweek. In addition, after successfully launching our Women Own the Room initiative to support the advancement of women entrepreneurs and hotel ownership in January 2022, we became the first major hotel company to launch a program in July 2022 focused on engaging with and advancing more Black entrepreneurs on their journey to hotel ownership, named Black Owners and Lodging Developers, or BOLD by Wyndham.

We are extremely proud of our team members who were critical to our accomplishments in yet another unprecedented year.

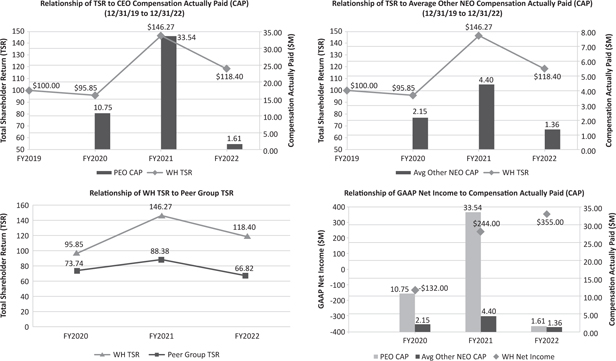

As described in the accompanying proxy statement, our Compensation Committee works to ensure that executive pay and performance are appropriately aligned to incentivize management to increase stockholder value.

We encourage you to read the proxy statement carefully for more information. Your vote is very important. Whether or not you plan to attend the 2023 annual meeting, please cast your vote as soon as possible. We look forward to continuing our dialogue in the future and we, along with our outstanding executive team and team members worldwide, remain committed to creating even greater value for you.

Very truly yours,

|

|

| Stephen P. Holmes | Geoffrey A. Ballotti |

| Chair of the Board | President and Chief Executive Officer |

| * | Please see Appendix A to the proxy statement for information on non-GAAP reconciliations and cautionary language regarding forward-looking statements. |

WYNDHAM HOTELS & RESORTS, INC.

NOTICE OF 2023 ANNUAL MEETING OF STOCKHOLDERS

March 28, 2023

| Date: | Tuesday, May 9, 2023 |

| Time: | 11:30 a.m. Eastern Time |

| Place: | Wyndham Hotels & Resorts, Inc. 22 Sylvan Way Parsippany, New Jersey 07054 |

Purposes of the meeting:

| ● | to elect eight Directors for a term expiring at the 2024 annual meeting, with each Director to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal; |

| ● | to vote on an advisory resolution to approve our executive compensation program; |

| ● | to vote on an amendment to our Second Amended and Restated Certificate of Incorporation to provide for exculpation of certain officers of the Company as permitted by recent amendments to Delaware law; |

| ● | to vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2023; and |

| ● | to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting. |

The matters specified for voting above are more fully described in the attached proxy statement. Only our stockholders of record at the close of business on March 17, 2023 will be entitled to notice of and to vote at the meeting and any adjournments or postponements for which no new record date is set.

Who may attend the meeting:

Only stockholders, persons holding proxies from stockholders, invited representatives of the media and financial community and other guests of Wyndham Hotels & Resorts, Inc. may attend the meeting.

How to attend the meeting:

All persons attending the meeting must bring photo identification such as a valid driver’s license or passport for purposes of personal identification. If you are a stockholder of record, you will also need to bring your Notice, proxy card or proof of your stock ownership as of the record date.

If your shares are held in the name of a broker, trust, bank or other nominee, you will also need to bring a proxy, letter or recent account statement from that broker, trust, bank or nominee that confirms that you are the beneficial owner of those shares.

Record Date:

March 17, 2023 is the record date for the meeting. This means that owners of Wyndham Hotels & Resorts, Inc. common stock at the close of business on that date are entitled to:

| ● | receive notice of the meeting; and |

| ● | vote at the meeting and any adjournments or postponements of the meeting for which no new record date is set. |

Information About the Notice of Internet Availability of Proxy Materials:

Instead of mailing a printed copy of our proxy materials, including our Annual Report, to all of our stockholders, we provide access to these materials in a fast and efficient manner via the Internet. This reduces the amount of paper necessary to produce these materials as well as the costs associated with mailing these materials to all stockholders. Accordingly, on or about March 28, 2023,

we will begin mailing a Notice to all stockholders as of March 17, 2023, and will post our proxy materials on the website referenced in the Notice. As more fully described in the Notice, stockholders may choose to access our proxy materials on the website referred to in the Notice or may request to receive a printed set of our proxy materials. In addition, the Notice and website provide information regarding how you may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis.

Householding Information:

We have adopted a procedure approved by the Securities and Exchange Commission called householding. Under this procedure, stockholders of record who have the same address and last name and have not previously requested electronic delivery of proxy materials will receive a single envelope containing the Notices for all stockholders having that address. The Notice for each stockholder will include that stockholder’s unique control number needed to vote his or her shares. This procedure will reduce our printing costs and postage fees.

If you do not wish to participate in householding and prefer to receive your Notice in a separate envelope, please contact Broadridge Financial Solutions by calling their toll-free number at (866) 540-7095 or through Broadridge Financial Solutions, Attn.: Householding Department, 51 Mercedes Way, Edgewood, New York 11717.

For those stockholders who have the same address and last name and who request to receive a printed copy of the proxy materials by mail, we will send only one copy of such materials to each address unless one or more of those stockholders notifies us, in the same manner described above, that they wish to receive a printed copy for each stockholder at that address.

Beneficial stockholders may request information about householding from their banks, brokers or other holders of record.

Proxy Voting:

Your vote is important. Please vote your proxy promptly so your shares are represented, even if you plan to attend the annual meeting. You may vote by Internet, by telephone or by requesting a printed copy of the proxy materials and using the enclosed proxy card. You may also vote at the annual meeting.

Our proxy tabulator, Broadridge Financial Solutions, must receive any proxy that will not be voted at the annual meeting by 11:59 p.m. Eastern Time on Monday, May 8, 2023. If you have shares of common stock credited to your account under the Wyndham Hotel Group Employee Savings Plan, the trustee must receive your voting instructions by 11:59 p.m. Eastern Time on Thursday, May 4, 2023.

| By order of the Board of Directors, | |

|

|

| Paul F. Cash General Counsel, Chief Compliance Officer and Corporate Secretary |

TABLE OF CONTENTS

i

ii

WYNDHAM HOTELS & RESORTS, INC.

PROXY STATEMENT

The enclosed proxy materials are provided to you at the request of the Board of Directors of Wyndham Hotels & Resorts, Inc. (the “Board”) to encourage you to vote your shares at our 2023 annual meeting of stockholders. This proxy statement contains information on matters that will be presented at the meeting and is provided to assist you in voting your shares. References in this proxy statement to “we,” “us,” “our,” “Wyndham Hotels” and the “Company” refer to Wyndham Hotels & Resorts, Inc. and our consolidated subsidiaries.

References in this proxy statement to “Wyndham Worldwide” refer to Wyndham Worldwide Corporation and its consolidated subsidiaries prior to the consummation of the spin-off. References to “Travel + Leisure” refer to Travel + Leisure Co. (previously known as Wyndham Destinations, Inc.) and its consolidated subsidiaries. References to the “spin-off” refer to the spin-off completed by Wyndham Worldwide effective June 1, 2018 resulting in its principal businesses becoming two separate, publicly traded companies, Wyndham Hotels and Travel + Leisure.

Our Board made these materials available to you over the Internet or, upon your request, mailed you printed versions of these materials in connection with our 2023 annual meeting. We will mail a Notice of Internet Availability of Proxy Materials (“Notice”) to our stockholders beginning on or about March 28, 2023 and will post our proxy materials on our website referenced in the Notice on that same date. We are, on behalf of our Board, soliciting your proxy to vote your shares at our 2023 annual meeting. We solicit proxies to give all stockholders of record an opportunity to vote on matters that will be presented at the annual meeting.

FREQUENTLY ASKED QUESTIONS

When and where will the annual meeting be held?

The annual meeting will be held on Tuesday, May 9, 2023 at 11:30 a.m. Eastern Time at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

What am I being asked to vote on at the meeting?

You are being asked to vote on the following:

| ● | the election of eight Directors for a term expiring at the 2024 annual meeting of stockholders, with each Director to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal; |

| ● | the advisory approval of our executive compensation program; |

| ● | the amendment of our Second Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) to provide for exculpation of certain officers of the Company as permitted by recent amendments to Delaware law; |

| ● | the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2023; and |

| ● | to transact any other business that may be properly brought before the meeting or any adjournment or postponement of the meeting. |

We are not aware of any other matters that will be brought before the stockholders for a vote at the annual meeting. If any other matters are properly presented for a vote, the individuals named as proxies will have discretionary authority to the extent permitted by law to vote on such matters according to their best judgment.

1

Who may vote and how many votes does a stockholder have?

All holders of record of our common stock as of the close of business on March 17, 2023 (the “record date”) are entitled to vote at the meeting. Each stockholder will have one vote for each share of our common stock held as of the close of business on the record date. As of the record date, 86,209,562 shares of our common stock were outstanding. There is no cumulative voting and the holders of our common stock vote together as a single class.

How many votes must be present to hold the meeting?

The holders of a majority of the outstanding shares of our common stock entitled to vote at the meeting, or 43,104,782 shares, also known as a quorum, must be present in-person or by proxy at the meeting in order to constitute a quorum necessary to conduct the meeting. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the meeting.

We urge you to vote by proxy even if you plan to attend the meeting so that we will know as soon as possible that a quorum has been achieved.

What is a broker non-vote?

A broker non-vote occurs when a broker or other nominee submits a proxy that states that the broker does not vote for one or more of the proposals because the broker has not received instructions from the beneficial owner on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions.

How do I vote?

Even if you plan to attend the meeting you are encouraged to vote by proxy.

If you are a stockholder of record, also known as a registered stockholder, you may vote in one of the following ways:

| ● | by telephone by calling the toll-free number 1-800-690-6903 (have your Notice or proxy card in hand when you call); |

| ● | by Internet at http://www.proxyvote.com (have your Notice or proxy card in hand when you access the website); |

| ● | if you received (or requested and received) a printed copy of the annual meeting materials, by returning the enclosed proxy card (signed and dated) in the envelope provided; or |

| ● | at the annual meeting (please see below under “How do I attend the meeting?”). |

If your shares are registered in the name of a bank, broker or other nominee, follow the proxy instructions on the voting instruction form you receive from the bank, broker or other nominee. You may also vote at the annual meeting – please see below under “How do I attend the meeting?”

When you vote by proxy, your shares will be voted according to your instructions. If you sign your proxy card or vote by Internet or by telephone but do not specify how you want your shares to be voted, they will be voted as the Board recommends.

What if I am a participant in the Wyndham Hotel Group Employee Savings Plan?

For participants in the Wyndham Hotel Group Employee Savings Plan with shares of our common stock credited to their accounts, voting instructions for the trustees of the plan are also being solicited through this proxy statement. In accordance with the provisions of the plan, the trustee will vote shares of our common stock in accordance with instructions received from the participants

2

to whose accounts the shares are credited. If you do not instruct the plan trustee on how to vote the shares of our common stock credited to your account, the trustee will vote those shares in proportion to the shares for which instructions are received.

How does the Board recommend that I vote?

The Board recommends the following votes:

| ● | FOR the election of each of the Director nominees, |

| ● | FOR the advisory approval of our executive compensation program, |

| ● | FOR the amendment of our Certificate of Incorporation to provide for exculpation of certain officers of the Company as permitted by recent amendments to Delaware law, and |

| ● | FOR the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2023. |

How many votes are required to approve each proposal?

In the election of Directors, Directors are elected by a majority of the votes cast at the annual meeting, meaning that the number of shares voted “for” a Director must exceed the number of shares voted “against” such Director’s election. Abstentions and broker non-votes will have no effect on the outcome of the vote.

For the proposal to amend the Certificate of Incorporation, the affirmative vote of the holders of a majority of outstanding shares of our common stock entitled to vote at the meeting will be required for approval. Abstentions and broker non-votes will have the effect of a vote against this proposal.

For each of the other proposals, the affirmative vote of the holders of a majority of the shares represented at the meeting in person or by proxy and entitled to vote on the proposal will be required for approval. Abstentions will have the effect of a vote against any of these proposals. Broker non-votes will have no effect on the outcome of these proposals.

If your shares are registered in the name of a bank, broker or other financial institution and you do not give your broker or other nominee specific voting instructions for your shares, under the rules of the New York Stock Exchange (“NYSE”), your record holder has discretion to vote your shares on the ratification of the appointment of the independent registered public accounting firm, but does not have discretion to vote your shares on any of the other proposals. Your broker, bank or other financial institution will not be permitted to vote on your behalf on the election of Director nominees, the advisory vote on executive compensation, or the proposal to amend the Certificate of Incorporation, unless you provide specific instructions before the date of the annual meeting by completing and returning the voting instruction or proxy card or following the instructions provided to you to vote your shares by telephone or the Internet.

How do I attend the meeting?

The meeting will begin promptly at 11:30 a.m. Eastern Time on Tuesday, May 9, 2023 at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

To attend the meeting you must bring with you a photo identification such as a valid driver’s license or passport for personal identification. If you are a shareholder of record, you will need to bring your Notice, proxy card or proof of your stock ownership as of the record date.

If your shares are held in the name of a broker, trust, bank or other nominee, you will also need to bring a proxy, letter or recent account statement from that broker, trust, bank or nominee that confirms that you are the beneficial owner of those shares.

3

Can I change or revoke my vote?

You may change or revoke your proxy at any time prior to voting at the meeting by submitting a later dated proxy or by entering new instructions by Internet or telephone prior to 11:59 p.m. Eastern Time on Monday, May 8, 2023, or by giving timely written notice of such change or revocation to the Corporate Secretary or by attending the meeting and voting.

How are proxies solicited?

We retained Innisfree M&A Incorporated to advise and assist us in soliciting proxies at a cost of $20,000 plus reasonable expenses. Proxies may also be solicited by our Directors, officers and employees (who we refer to as “team members”) personally, by mail, telephone or electronic means. We will pay all costs relating to the solicitation of proxies. We will also reimburse brokers, custodians, nominees and fiduciaries for reasonable expenses in forwarding proxy materials to beneficial owners of our common stock.

How do I make a stockholder proposal for the 2024 meeting?

Stockholders interested in presenting a proposal for inclusion in our proxy statement and proxy relating to our 2024 annual meeting may do so by following the procedures prescribed in Rule 14a-8 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). To be eligible for inclusion in next year’s proxy statement, stockholder proposals must be received by the Corporate Secretary at our principal executive offices no later than the close of business on November 29, 2023.

In general, any stockholder proposal to be considered at next year’s annual meeting but not included in the proxy statement must be submitted in accordance with the procedures set forth in our Third Amended and Restated By-Laws (“By-Laws”). Notice of any such proposal must be submitted in writing to and received by the Corporate Secretary at our principal executive offices not earlier than the close of business on Wednesday, January 10, 2024 and not later than the close of business on Friday, February 9, 2024. However, if the date of the 2024 annual meeting is not within 30 days before or after May 9, 2024, then a stockholder will be able to submit a proposal for consideration at the annual meeting not later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or such notice of the date of such annual meeting was mailed, whichever occurs first. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. Any notification to bring any proposal before an annual meeting must comply with the requirements of our By-Laws as to proper form. A stockholder may obtain a copy of our By-Laws on our investor website, https://investor.wyndhamhotels.com under the Governance/Governance Documents page, or by writing to our Corporate Secretary.

Stockholders may also nominate Directors for election at an annual meeting. To nominate a Director outside of our proxy access By-Laws, stockholders must comply with provisions of applicable law and Article II, Section 15 of our By-Laws. Pursuant to the proxy access provisions in our By-Laws, a stockholder, or a group of up to 20 stockholders, owning at least 3% of the Company’s outstanding stock continuously for at least three years, may nominate and include in the Company’s proxy materials Director nominees constituting up to the greater of two directors or 20% of the Board, provided that the stockholders and Director nominees satisfy the disclosure and procedural requirements in Article II, Section 16 of our By-Laws. The Corporate Governance Committee will also consider stockholder recommendations for candidates to the Board sent to the Committee c/o the Corporate Secretary. See below under “Director Nomination Process” for information regarding nomination or recommendation of a Director.

4

GOVERNANCE OF THE COMPANY

Strong corporate governance is an integral part of our core values. Our Board is committed to having sound corporate governance principles and practices. Please visit our investor website at https://investor.wyndhamhotels.com under the Governance/Governance Documents page, which can be reached by clicking on the Governance link, followed by the Governance Documents link, for the Board’s Corporate Governance Guidelines and Director Independence Criteria, the Board-approved charters for the Audit, Compensation and Corporate Governance Committees and related information. These guidelines and charters may also be obtained by writing to our Corporate Secretary at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

Corporate Governance Guidelines

Our Board adopted Corporate Governance Guidelines that, along with the charters of the Board committees, Director Independence Criteria and Code of Business Conduct and Ethics for Directors, provide the framework for our governance. The governance rules for companies listed on the NYSE and those contained in the Securities and Exchange Commission (the “SEC”) rules and regulations are reflected in the guidelines. The Board reviews these principles and other aspects of governance periodically. The Corporate Governance Guidelines are available on the Corporate Governance/Governance Documents page of our investor website at https://investor.wyndhamhotels.com.

Director Independence Criteria

The Board adopted the Director Independence Criteria set out below for its evaluation of the materiality of Director relationships with us. The Director Independence Criteria contain independence standards that exceed the independence standards specified in the listing standards of the NYSE. The Director Independence Criteria are available on the Governance/Governance Documents page of our investor website at https://investor.wyndhamhotels.com.

A Director who satisfies all of the following criteria shall be presumed to be independent under our Director Independence Criteria:

| ● | Wyndham Hotels does not currently employ and has not within the last three years employed the Director or any of his or her immediate family members (except in the case of immediate family members, in a non-executive officer capacity). |

| ● | The Director is not currently and has not within the last three years been employed by Wyndham Hotels’ present auditors nor has any of his or her immediate family members been so employed (except in a non-professional capacity not involving Wyndham Hotels’ business). |

| ● | Neither the Director nor any of his or her immediate family members is or has been within the last three years part of an interlocking directorate in which an executive officer of Wyndham Hotels serves on the compensation or equivalent committee of another company that employs the Director or his or her immediate family member as an executive officer. |

| ● | The Director is not a current employee nor is an immediate family member a current executive officer of a company that has made payments to or received payments from Wyndham Hotels for property or services in an amount in any of the last three fiscal years exceeding the greater of $750,000 or 1% of such other company’s consolidated gross revenues. |

| ● | The Director currently does not have and has not had within the past three years a personal services contract with Wyndham Hotels or its executive officers. |

| ● | The Director has not received and the Director’s immediate family member has not received during any twelve-month period within the last three years more than $100,000 in direct compensation from Wyndham Hotels other than Board fees. |

5

| ● | The Director is not currently an officer or director of a foundation or other non-profit organization to which Wyndham Hotels within the last three years gave directly or indirectly through the provision of services more than the greater of 2% of the consolidated gross revenues of such organization during any single fiscal year or $1,000,000. |

Guidelines for Determining Director Independence

Our Corporate Governance Guidelines and Director Independence Criteria provide for director independence standards that meet or exceed those of the NYSE. Our Board is required under NYSE rules to affirmatively determine that each independent Director has no material relationship with Wyndham Hotels other than as a Director.

In accordance with these standards and criteria, the Board undertook its annual review of the independence of its Directors. During this review, the Board considered whether there are any relationships or related party transactions between each Director, any member of his or her immediate family or other affiliated entities and us and our subsidiaries. The purpose of this review was to determine whether any such relationships or transactions existed that were inconsistent with a determination that the Director is independent.

The Board follows a number of procedures to review related party transactions. We maintain a written policy governing related party transactions that requires Audit Committee preapproval of related party transactions exceeding $120,000. Each Board member answers a questionnaire designed to disclose conflicts and related party transactions. We also review our internal records for related party transactions. Based on a review of these standards and materials, none of our independent Directors had or has any relationship with us other than as a Director.

As a result of its review, the Board affirmatively determined that the following Directors are independent of us and our management as required by the NYSE listing standards and the Director Independence Criteria: Myra J. Biblowit, James E. Buckman, Bruce B. Churchill, Mukul V. Deoras, Ronald L. Nelson and Pauline D.E. Richards.

Committees of the Board

The following describes our Board committees and related matters. The composition of the committees is provided immediately after.

Audit Committee

Responsibilities include:

| ● | appoints our independent registered public accounting firm to perform an integrated audit of our consolidated financial statements and internal control over financial reporting; |

| ● | pre-approves all services performed by our independent registered public accounting firm; |

| ● | provides oversight on the external reporting process and the adequacy of our internal controls; |

| ● | reviews the scope, planning, staffing and budgets of the audit activities of the independent registered public accounting firm and our internal auditors; |

| ● | reviews services provided by our independent registered public accounting firm and other disclosed relationships as they bear on the independence of our independent registered public accounting firm and provides oversight on hiring policies with respect to employees or former employees of the independent auditor; |

| ● | maintains procedures for the receipt, retention and resolution of complaints regarding accounting, internal controls and auditing matters; and |

6

| ● | reviews and provides oversight with respect to the Company’s related person transaction policy and reviews and preapproves related person transactions under such policy. |

All members of the Audit Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards. The Board in its business judgment determined that each member of the Audit Committee is financially literate, knowledgeable and qualified to review financial statements in accordance with applicable listing standards. The Board also determined that Bruce B. Churchill, Ronald L. Nelson and Pauline D.E. Richards are audit committee financial experts within the meaning of applicable SEC rules.

The Audit Committee Charter is available on the Governance/Governance Documents page of our investor website at https://investor.wyndhamhotels.com.

Audit Committee Report

The Audit Committee of the Board of Directors assists the Board in fulfilling its oversight responsibilities for the external financial reporting process and the adequacy of Wyndham Hotels’ internal control over financial reporting. Specific responsibilities of the Audit Committee are set forth in the Audit Committee Charter adopted by the Board. The Charter is available on the Governance/Governance Documents page of our investor website at https://investor.wyndhamhotels.com.

The Audit Committee is comprised of five Directors, all of whom meet the standards of independence adopted by the NYSE and the SEC. The Audit Committee appoints, compensates and oversees the services performed by Wyndham Hotels’ independent registered public accounting firm. The Audit Committee approves in advance all services to be performed by Wyndham Hotels’ independent registered public accounting firm in accordance with SEC rules and the Audit Committee’s established policy for pre-approval of all audit services and permissible non-audit services, subject to the de minimis exceptions for non-audit services.

Management is responsible for Wyndham Hotels’ financial reporting process including our system of internal controls and for the preparation of consolidated financial statements in compliance with generally accepted accounting principles, applicable laws and regulations. In addition, management is responsible for establishing, maintaining and assessing the effectiveness of Wyndham Hotels’ internal control over financial reporting. Deloitte & Touche LLP (“Deloitte”), Wyndham Hotels’ independent registered public accounting firm, is responsible for expressing an opinion on Wyndham Hotels’ consolidated financial statements and the effectiveness of Wyndham Hotels’ internal control over financial reporting. The Audit Committee reviewed and discussed Wyndham Hotels’ 2022 Annual Report on Form 10-K, including the audited consolidated financial statements of Wyndham Hotels for the year ended December 31, 2022, with management and Deloitte. It is not the Audit Committee’s duty or responsibility to conduct auditing or accounting reviews or procedures.

The Audit Committee also discussed with Deloitte matters required to be discussed by applicable standards and rules of the Public Company Accounting Oversight Board (the “PCAOB”) and the SEC. The Audit Committee also received the written disclosures and the letter from Deloitte required by applicable standards and rules of the PCAOB, including those required by Auditing Standard No. 1301, Communications with Audit Committees, and the SEC regarding Deloitte’s communications with the Audit Committee concerning independence, and discussed with Deloitte its independence.

The Audit Committee also considered whether the permissible non-audit services provided by Deloitte to Wyndham Hotels are compatible with Deloitte maintaining its independence. The Audit Committee satisfied itself as to the independence of Deloitte.

Based on the Audit Committee’s review and discussions described above, the Audit Committee recommended to the Board of Directors that the audited consolidated financial statements be included in Wyndham Hotels’ Annual Report on Form 10-K for the year ended December 31, 2022.

7

AUDIT COMMITTEE

Pauline D.E. Richards (Chair)

James E. Buckman

Bruce B. Churchill

Mukul V. Deoras

Ronald L. Nelson

Compensation Committee

Responsibilities include:

| ● | provides oversight with respect to our executive compensation program consistent with corporate objectives and stockholder interests; |

| ● | reviews and approves Chief Executive Officer (“CEO”) and other senior management compensation; |

| ● | approves grants of long-term incentive awards and our senior executives’ annual incentive compensation under our compensation plans; and |

| ● | reviews and considers the independence of advisers to the Committee. |

For additional information regarding the Compensation Committee’s processes and procedures see below under “Executive Compensation – Compensation Discussion and Analysis – Compensation Committee Matters.”

All members of the Compensation Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards.

The Compensation Committee Report is provided below under Executive Compensation. The Compensation Committee Charter is available on the Governance/Governance Documents page on our investor website at https://investor.wyndhamhotels.com.

Compensation Committee Interlocks and Insider Participation

During 2022, Ms. Biblowit, Mr. Buckman and Mr. Churchill served on our Compensation Committee. There are no compensation committee interlocks between Wyndham Hotels and other entities involving our executive officers and Directors.

Corporate Governance Committee

Responsibilities include:

| ● | recommends to the Board nominees for election to the Board; |

| ● | reviews principles, policies and procedures affecting Directors and the Board’s operation and effectiveness; |

| ● | provides oversight on the evaluation of the Board and its effectiveness; |

| ● | provides oversight with respect to our social responsibility program, including environmental, social and governance matters; and |

| ● | reviews and makes recommendations to the Board on Director compensation. |

All members of the Corporate Governance Committee are independent Directors under the Board’s Director Independence Criteria and applicable regulatory and listing standards.

8

The Corporate Governance Committee Charter is available on the Governance/Governance Documents page on our investor website at https://investor.wyndhamhotels.com.

Executive Committee

The Executive Committee may exercise all of the authority of the Board when the Board is not in session, except that the Executive Committee does not have the authority to take any action which legally or under our internal governance policies may be taken only by the Board.

Committee Membership

The following chart provides the current committee membership and the number of meetings that each committee held during 2022.

| Director | Audit Committee |

Compensation Committee |

Governance Committee |

Executive Committee |

| Geoffrey A. Ballotti | M | |||

| Myra J. Biblowit | M | C | ||

| James E. Buckman | M | M | M | |

| Bruce B. Churchill | M | C | ||

| Mukul V. Deoras | M | M | ||

| Stephen P. Holmes | C | |||

| Ronald L. Nelson | M | M | ||

| Pauline D.E. Richards | C | M | ||

| Number of Meetings in 2022 | 8 | 5 | 4 | 5 |

C = Chair

M = Member

The Board held four meetings during 2022. Each Director attended at least 75% of the meetings of the Board and the committees of the Board on which the Director served while in office.

Directors fulfill their responsibilities not only by attending Board and committee meetings but also through communication with the Non-Executive Chair, Lead Director, CEO and other members of management relative to matters of interest and concern to Wyndham Hotels.

Board Leadership Structure

Under our current Board leadership structure, the roles of Chair and CEO are held by two different individuals. Mr. Holmes, the former Chairman and CEO of Wyndham Worldwide, serves as our Non-Executive Chair, while Mr. Ballotti serves as our President and CEO. The Board believes that Mr. Holmes is highly effective in serving as our Non-Executive Chair due to his strong leadership skills and his extensive knowledge of our operations and the markets in which we compete. We also appointed an independent Lead Director so that Wyndham Hotels benefits from further effective oversight as described below under Lead Director.

One of the key responsibilities of the Board is to review our strategic direction and hold management accountable for the execution of strategy once it is developed. The Board believes that the separation of the roles of the Chair and the CEO is objective and in the best interests of stockholders at this time because it allows our CEO to focus on the execution of our business strategy, growth and development, while our Non-Executive Chair oversees our Board. In addition, our independent Lead Director provides us with further oversight as further described below.

9

Lead Director

Mr. Buckman, an independent Director, has served as the Board’s Lead Director since August 2019. The Lead Director acts as a liaison with the Non-Executive Chair in consultation with the other Directors; chairs executive sessions of the non-executive Directors and independent Directors and provides feedback to the Non-Executive Chair; chairs meetings of the Board in the absence of the Non-Executive Chair; and reviews in advance and consults with the Non-Executive Chair regarding the schedule and agenda for all Board meetings as well as the materials distributed to Directors in connection with such meetings. With his deep knowledge of our business and industry, our Board believes Mr. Buckman as Lead Director adds significant value to our Board in assisting in the leadership of our Board in its oversight, strategy and execution.

Oversight of Risk Management

The Board has an active role, as a whole and at the committee level, in providing oversight with respect to management of our risks. The Board focuses on the most significant risks facing us and our general risk management strategy and seeks to ensure that risks undertaken by us are consistent with a level of risk that is appropriate for our Company and aligned with the achievement of our business objectives and strategies.

The Board regularly reviews information regarding risks associated with our finances, credit and liquidity; our business, operations and strategy; legal, regulatory and compliance matters; and reputational exposure. The Audit Committee provides oversight on our programs for risk assessment and risk management, including with respect to financial accounting and reporting, internal audit services, information technology, cybersecurity and compliance. The Compensation Committee provides oversight on our assessment and management of risks relating to our executive compensation. The Corporate Governance Committee provides oversight on our management of risks associated with the independence of the Board, potential conflicts of interest and environmental, social and governance matters. While each committee is responsible for providing oversight with respect to the management of risks, the entire Board is regularly informed about our risks through committee reports and management presentations.

While the Board and the committees provide oversight with respect to our risk management, our CEO and other senior management are primarily responsible for day-to-day risk management analysis and mitigation and report to the full Board or the relevant committee regarding risk management. Our General Counsel, who also serves as our Chief Compliance Officer, is a direct report to our CEO, is in attendance at all meetings of the Board and committees of the Board and provides regular reports to the Board. Our General Counsel and Chief Compliance Officer also has a direct reporting relationship to the Audit Committee and the Board under our compliance program. Our leadership structure, with Mr. Holmes serving as our Non-Executive Chair and with Mr. Ballotti serving as a Director, enhances the Board’s effectiveness in risk oversight due to their extensive knowledge of our industry, business and operations and facilitates the Board’s oversight of key risks. We believe this division of responsibility and leadership structure is the most effective approach for addressing our risk management.

Succession Planning

The Board believes in providing strong and effective continuity in leadership of our Company. A principal responsibility and strategic priority of our Board is the selection, retention and succession planning for our CEO and other senior leaders. The Board works with the CEO and with our Chief Human Resource Officer to plan for succession, and the non-management members of the Board discuss CEO and other senior leader succession planning at executive sessions. The Board also discusses with our CEO the appropriate continuing development of our senior leaders, as well as criteria the Board considers important as part of succession planning. The Board also actively interacts with and evaluates and discusses potential internal candidates as part of its succession planning.

10

Executive Sessions of Non-Management and Independent Directors

The Board meets regularly without any members of management present. Our Lead Director presides at these sessions. Our independent Directors also meet in executive session at least twice per year. The Lead Director chairs these sessions of independent directors.

Communications with the Board and Directors

Stockholders and other parties interested in communicating directly with the Board, our non-management Directors as a group, our independent Directors as a group or any individual Director may do so by writing our Corporate Secretary at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054. Prior to forwarding any correspondence, the Corporate Secretary will review it and in his discretion will not forward correspondence deemed to be of a commercial nature or otherwise not appropriate for review by the Directors.

Director Attendance at Annual Meeting of Stockholders

As provided in the Board’s Corporate Governance Guidelines, Directors are expected to attend our annual meeting absent exceptional cause. All of our current Directors attended our 2022 annual meeting of stockholders and are expected to attend our 2023 annual meeting.

Code of Business Conduct and Ethics

The Board maintains a Code of Business Conduct and Ethics for Directors with ethics guidelines specifically applicable to Directors. In addition, we maintain Business Principles applicable to all our team members, including our CEO, Chief Financial Officer (“CFO”) and Chief Accounting Officer.

We will disclose on our website any amendment to or waiver from a provision of our Business Principles or Code of Business Conduct and Ethics for Directors as may be required and within the time period specified under applicable SEC and NYSE rules. The Code of Business Conduct and Ethics for Directors and our Business Principles are available on the Governance/Governance Documents page of our investor website at https://investor.wyndhamhotels.com. Copies of these documents may also be obtained free of charge by writing to our Corporate Secretary.

Director Nomination Process

Role of Corporate Governance Committee. The Corporate Governance Committee is responsible for recommending the Director nominees for election to the Board. The Corporate Governance Committee considers the appropriate balance of experience, skills and characteristics required of the Board when considering potential candidates to serve on the Board. Nominees for Director are selected on the basis of their depth and breadth of experience, skills, wisdom, integrity, ability to make independent analytical inquiries, understanding of our business environment and willingness to devote adequate time to Board duties.

The Corporate Governance Committee also focuses on issues of diversity, such as diversity of gender, race and national origin, education, professional experience and differences in viewpoints and skills. The Corporate Governance Committee does not have a formal policy with respect to diversity; however, the Board and the Corporate Governance Committee believe that it is essential that the Board members represent diverse experience and viewpoints. The Board values diversity of all types, and the Corporate Governance Committee will seek to include diverse candidates in any pool of potential directors from which new Director candidates are selected.

In considering candidates for the Board, the Corporate Governance Committee considers the entirety of each candidate’s credentials in the context of these standards. For the nomination of continuing Directors for re-election, the Corporate Governance Committee also considers the individual’s contributions to the Board.

11

All of our Directors bring to our Board a wealth of executive leadership experience derived from their service as senior executives of large organizations as well as extensive board experience. Certain individual qualifications, experience and skills of our Directors that led the Board to conclude that each nominee for Director should serve as our Director are described below under “Proposal No. 1: Election of Directors.”

Identification and Evaluation Process. The process for identifying and evaluating nominees to the Board is initiated by identifying candidates who meet the criteria for selection as a nominee and have the specific qualities or skills being sought based on input from members of the Board and, if the Corporate Governance Committee deems appropriate, a third-party search firm. These candidates will be evaluated by the Corporate Governance Committee by reviewing the candidates’ biographical information and qualifications and checking the candidates’ references. Qualified nominees will be interviewed by at least one member of the Corporate Governance Committee. Using the input from the interview and other information it obtains, the Corporate Governance Committee evaluates whether the prospective candidate is qualified to serve as a Director and whether the Corporate Governance Committee should recommend to the Board that the Board nominate the prospective candidate for election by the stockholders or to fill a vacancy on the Board.

Stockholder Recommendations of Nominees. The Corporate Governance Committee will consider written recommendations from stockholders for nominees for Director. Recommendations should be submitted to the Corporate Governance Committee, c/o the Corporate Secretary, and include at least the following: name of the stockholder and evidence of the person’s ownership of our common stock, number of shares owned and the length of time of ownership, name of the candidate, the candidate’s resume or a listing of his or her qualifications to be a Director and the person’s consent to be named as a Director if selected by the Corporate Governance Committee and nominated by the Board. To evaluate nominees for Directors recommended by stockholders, the Corporate Governance Committee intends to use a substantially similar evaluation process as described above.

Stockholder Nominations and By-Law Procedures. Our By-Laws establish procedures pursuant to which a stockholder may nominate a person for election to the Board. Our By-Laws are posted on our investor website under Governance/Governance Documents at https://investor.wyndhamhotels.com. To nominate a person for election to the Board outside of our proxy access by-laws, a stockholder must submit a notice under Article II, Section 15 containing all information required by our By-Laws regarding the Director nominee and the stockholder and any associated persons making the nomination, including but not limited to name and address, number of shares owned, a description of any additional interests of such nominee or stockholder and certain representations regarding such nomination. Our By-Laws require that such notice be updated as necessary as of specified dates prior to the annual meeting. We may require any proposed nominee to furnish such other information as we may require to determine his or her eligibility to serve as a Director. Such notice must be accompanied by the proposed nominee’s consent to being named as a nominee and to serve as a Director if elected.

To nominate a person for election to the Board at our annual meeting, written notice of a stockholder nomination must be delivered to our Corporate Secretary not later than the close of business on the 90th day (February 9, 2024) nor earlier than the close of business on the 120th day (January 10, 2024) prior to the anniversary date of the prior year’s annual meeting. However, if our annual meeting is advanced or delayed by more than 30 days from the anniversary date of the previous year’s meeting, a stockholder’s written notice will be timely if it is delivered by no later than the close of business on the 10th day following the day on which public disclosure of the date of the annual meeting is made or the notice of the date of the annual meeting was mailed, whichever occurs first. Our By-Laws require that any such notice be updated as necessary as of specified dates prior to the annual meeting. A stockholder may make nominations of persons for election to the Board at a special meeting if the stockholder delivers written notice to our Corporate Secretary not later than the close of business on the 10th day following the day on which public disclosure of the date such special meeting was made or notice of such special meeting was mailed, whichever occurs first; provided that, at a special meeting of stockholders, only such business may be conducted as shall have been brought before the meeting (including election of directors) under our notice of meeting. Under the universal proxy rules, stockholders who intend to solicit proxies in support of director nominees other than the Company’s nominees, in addition

12

to complying with the requirements in our By-Laws for nominations of directors, must also provide timely notice that complies with any additional requirements of Rule 14a-19 under the Exchange Act by no later than March 11, 2024.

To nominate a person for election to the Board pursuant to the proxy access provisions in our By-Laws, a stockholder, or a group of up to 20 stockholders, owning at least 3% of the Company’s outstanding stock continuously for at least three years, may nominate and include in the Company’s proxy materials Director nominees constituting up to the greater of two directors or 20% of the Board, provided that the stockholders and Director nominees satisfy the disclosure and procedural requirements in Article II, Section 16 of our By-Laws. To be timely, any notice of proxy access nomination must be delivered to the Corporate Secretary no earlier than the close of business on the 150th day (October 30, 2023) and no later than the close of business on the 120th day before the anniversary (November 29, 2023) of the date that the Company issued its proxy statement for the previous year’s annual meeting, or, if the date of the annual meeting is more than 30 days earlier or more than 60 days later than the anniversary date of the most recent annual meeting, then not later than the close of business on the 10th day after public announcement of the meeting date.

Compensation of Directors

Non-management Directors receive compensation for Board service designed to compensate them for their Board responsibilities and align their interests with the interests of stockholders. A management Director receives no additional compensation for Board service. The following are certain highlights of our Director compensation program:

| ● | Heavy weighting on equity pay to align Director compensation with our stockholders’ long-term interests |

| ● | Annual time-based restricted stock unit (“RSU”) grants subject to 4-year vesting |

| ● | Opportunity to defer all cash and equity compensation in the form of deferred stock units (“DSUs”) under our deferred compensation plan which are not paid out until the Director’s retirement or other cessation of service from the Board |

| ● | For 2022, 100% of our non-management Directors elected to receive a portion of their total compensation in DSUs to further align their interests with our stockholders for the long term. |

| ● | Limit on annual equity grants under our stockholder-approved equity incentive plan |

| ● | No fees paid per meeting |

| ● | No retirement benefits |

| ● | Robust stock ownership guidelines |

Overview. Our Directors play a critical and active role in overseeing the management of our Company and guiding our strategic direction. Ongoing developments in corporate governance, executive compensation and financial reporting have resulted in increased demand for highly qualified and productive public company directors. The time commitment and the many responsibilities and risks of being a director of a public company of our size and profile require that we provide reasonable compensation that is competitive among our peers and commensurate with our Directors’ qualifications, responsibilities and workload. Our non-management directors are compensated based on their specific Board responsibilities, including service as Board Chair, Lead Director, or chair or member of key Board committees. Our Board is made up of 8 members total, with 6 independent Directors. All of our independent Directors serve on more than one committee. Our director compensation program is designed to reasonably compensate our non-employee directors for their significant responsibilities, expected time commitment and qualifications.

13

Peer Review. In October 2021, the Rewards Solutions practice at Aon plc (“Aon”) was engaged to conduct an independent review of our non-management Director compensation program. For this review, Aon used the following peer group, which was the Company’s peer group in effect at that time (prior to the Compensation Committee’s adoption of a new peer group in November 2021 as described below in the Compensation Discussion and Analysis under “Compensation Review and Benchmarking – Peer Review”) less Dunkin’ Brands Group, Inc. and Extended Stay America, Inc. which had been acquired:

| Boyd Gaming Corp. | Marriott International | |

| Brinker International, Inc. | Penn National Gaming, Inc. | |

| Chipotle Mexican Grill, Inc. | Ryman Hospitality Properties, Inc. | |

| Choice Hotels International, Inc. | TripAdvisor, Inc. | |

| Hilton Worldwide Holdings Inc. | Wynn Resorts, Limited | |

| Hyatt Hotels Corporation | YUM! Brands, Inc. |

The following elements were examined as part of this review: annual board retainers in the form of cash and equity, retainers for chair and committee service, prevalence of program features such as non-executive chair and lead director pay, other compensation in the form of perquisites and benefits, and governance policies such as stock ownership guidelines and stock hedging/pledging. The Committee reviewed the peer group data prepared by our compensation consultant that presented annual retainer fees, average committee pay, and annual equity award value at the 25th, 50th, 75th and 90th percentiles and determined that the average total direct compensation of our Directors was aligned with the philosophy of targeting the top quartile of the peer group. Based on peer group data regarding our overall Director compensation program, it was also determined that the value provided from the Company’s current Director compensation program is aligned competitively with our peer group and that our program features are consistent with the structure of programs offered by our peers. Upon the recommendation of Aon, the Committee determined not to make any changes to our non-management Director compensation program for 2022.

Annual Retainer Fees. The table below describes 2022 annual retainer and committee chair and membership fees for non-management Directors. Our Directors do not receive additional fees for attending Board or committee meetings.

| Cash-Based | Stock-Based | Total | ||||||

| Non-Executive Chair | $ | 160,000 | $ | 160,000 | $ | 320,000 | ||

| Lead Director | $ | 132,500 | $ | 132,500 | $ | 265,000 | ||

| Director | $ | 105,000 | $ | 105,000 | $ | 210,000 | ||

| Audit Committee chair | $ | 22,500 | $ | 22,500 | $ | 45,000 | ||

| Audit Committee member | $ | 12,500 | $ | 12,500 | $ | 25,000 | ||

| Compensation Committee chair | $ | 17,500 | $ | 17,500 | $ | 35,000 | ||

| Compensation Committee member | $ | 10,000 | $ | 10,000 | $ | 20,000 | ||

| Corporate Governance Committee chair | $ | 15,000 | $ | 15,000 | $ | 30,000 | ||

| Corporate Governance Committee member | $ | 8,750 | $ | 8,750 | $ | 17,500 | ||

| Executive Committee member | $ | 10,000 | $ | 10,000 | $ | 20,000 | ||

The annual Director retainer and committee chair and membership fees are paid on a quarterly basis, 50% in cash and 50% in Wyndham Hotels stock. The requirement for Directors to receive at least 50% of their fees in our equity further aligns their interests with those of our stockholders. The number of shares of stock issued is based on our stock price on the quarterly determination date. Directors may elect to receive the stock-based portion of their fees in the form of common stock or DSUs.

A DSU entitles the Director to receive one share of common stock following the Director’s retirement or termination of service from the Board for any reason and is credited with dividend equivalents during the deferral period in the form of additional DSUs. The Director may not sell or receive value from any DSU prior to termination of service. Directors may also elect to defer any cash-based

14

compensation or vested RSUs in the form of DSUs under our Non-Employee Director Deferred Compensation Plan.

Annual Equity Grant. In March 2022, each non-management Director of Wyndham Hotels was awarded a grant of time-vesting RSUs with a value of $100,000 which vests in equal annual increments over a four-year period. RSUs are credited with dividend equivalents subject to the same vesting restrictions as the underlying units.

Benefits and Other Compensation. Consistent with the Company’s commitment to philanthropic giving, we provide up to a three-for-one Company match of a non-management Director’s qualifying charitable contributions. We match each Director’s personal contribution on a three-for-one basis up to a Company contribution of $75,000 per year, with such contributions paid by Wyndham Hotels directly to the charitable organization. This match program supports our core value of caring for our communities.

We maintain a policy to provide our non-management Directors annually with 500,000 Wyndham Rewards Points. These Wyndham Rewards Points have an approximate value of $4,130 and may be redeemed for numerous rewards options including stays at Wyndham properties. This benefit provides our Directors with ongoing, first-hand exposure to our properties and operations, furthering their understanding and evaluation of our business. Directors are permitted to hold up to a maximum of 1,000,000 Wyndham Rewards Points under this policy and for this reason may be granted fewer than 500,000 points in a given year. Directors also receive an additional 30,000 points annually through their membership in the Wyndham Rewards program valued at $248.

Letter Agreement with Mr. Holmes. In connection with his appointment as Non-Executive Chair of the Board in June 2018, we entered into a letter agreement with Mr. Holmes, which provides him with an annual retainer of $320,000 payable 50% in cash and 50% in our equity as described above, $18,750 per year for his costs incurred in connection with retaining an administrative assistant, $12,500 per year for the cost of his office space, 50% of the cost of the lease associated with his vehicle through the earlier of the conclusion of the lease term and the conclusion of his service on the Board, and reimbursement for 50% of the cost of his annual health and wellness physical. Mr. Holmes’ vehicle lease referenced above concluded in April 2022.

2022 Director Compensation Table

The following table describes compensation we paid our non-management Directors for 2022.

| Name | Fees Paid in Cash ($) |

Stock Awards ($) |

All Other Compensation ($)(a) |

Total ($)(a) |

| Myra J. Biblowit | 130,000(b) | 229,950(c) | 63,713(d) | 423,663 |

| James E. Buckman | 165,000(b) | 264,950(c) | 78,253(d) | 508,203 |

| Bruce B. Churchill | 135,000(b) | 234,950(c) | 77,553(d) | 447,503 |

| Mukul V. Deoras | 126,250(b) | 226,200(c) | 1,735(d) | 354,185 |

| Stephen P. Holmes | 170,000(b) | 269,950(c) | 40,664(d) | 480,614 |

| Ronald L. Nelson | 126,250(b) | 226,200(c) | 75,248(d) | 427,698 |

| Pauline D.E. Richards | 136,250(b) | 236,200(c) | 51,148(d) | 423,598 |

| (a) | SEC rules require the reporting of charitable matching contributions as compensation to Directors. The below supplemental table is provided to show “All Other Compensation” and “Total” Director compensation excluding charitable matching contributions and donations, which are paid directly to the charitable organization as part of our non-employee Director charitable match program. |

15

2022 Director Compensation Excluding Charitable Contributions:

|

Name |

Fees Paid |

Stock |

All Other |

Total, |

|

Ms. Biblowit |

130,000 |

229,950 |

3,563 |

363,513 |

|

Mr. Buckman |

165,000 |

264,950 |

3,253 |

433,203 |

|

Mr. Churchill |

135,000 |

234,950 |

2,553 |

372,503 |

|

Mr. Deoras |

126,250 |

226,200 |

1,735 |

354,185 |

|

Mr. Holmes |

170,000 |

269,950 |

40,664 |

480,614 |

|

Mr. Nelson |

126,250 |

226,200 |

248 |

352,698 |

|

Ms. Richards |

136,250 |

236,200 |

5,248 |

377,698 |

| (i) | Excludes charitable matching donations which are paid by the Company directly to the selected 501(c)(3) organization under our three-for-one Company match program for our non-employee Directors. |

| (b) | Reflects the cash-based fees paid in 2022. |

| (c) | Represents the aggregate grant date fair value of stock awards computed in accordance with Financial Accounting Standards Board Accounting Standards Codification Topic 718. Each non-management Director was granted a time-vesting RSU award with a grant date fair value of $99,950 on March 10, 2022 which vests ratably over four years. The remaining amount in each row represents the aggregate grant date fair value of retainer fees paid on a quarterly basis in the form of common stock and/or DSUs. |

Total shares of our common stock issuable for unvested Wyndham Hotels RSUs at December 31, 2022 were as follows: Ms. Biblowit, 3,771; Mr. Buckman, 3,771; Mr. Churchill, 3,771; Mr. Deoras, 3,771; Mr. Holmes, 3,771; Mr. Nelson, 3,294; and Ms. Richards, 3,771. Total shares of our common stock issuable for Wyndham Hotels DSUs at December 31, 2022 were as follows: Ms. Biblowit, 82,840; Mr. Buckman, 75,652; Mr. Churchill, 16,058; Mr. Deoras, 11,521; Mr. Holmes, 9,723; Mr. Nelson, 7,571; and Ms. Richards, 53,568.

| (d) | The amounts reported in the All Other Compensation column of the 2022 Director Compensation table include the following: The value of Wyndham Rewards Points granted to each Director was as follows: Ms. Biblowit, $3,563; Mr. Buckman, $3,253; Mr. Churchill, $2,553; Mr. Deoras, $1,735; Mr. Holmes, $3,612; Mr. Nelson, $248; and Ms. Richards, $620. The value of charitable matching contributions made by Wyndham Hotels were as follows: Ms. Biblowit, $60,150; Mr. Buckman, $75,000; Mr. Churchill, $75,000; Mr. Nelson, $75,000; and Ms. Richards, $45,900. For Ms. Richards, this amount also includes $4,628 in life insurance premiums paid by us under a legacy Wyndham Worldwide program. |

For Mr. Holmes, the amount reported in the All Other Compensation column of the 2022 Director Compensation table also includes $31,250 reflecting reimbursement for his office space and administrative support, $3,552 for his vehicle lease and $2,250 for an annual physical exam under the terms of his letter agreement.

In addition, on limited occasions, Directors’ spouses may accompany Directors on the Company-chartered aircraft when traveling for business purposes, for which there is generally no incremental cost to the Company.

In accordance with SEC rules, the value of dividends paid to our Directors on vesting of RSUs and DSUs credited as dividend equivalents with respect to outstanding DSUs is not reported above because dividends were factored into the grant date fair value of these awards.

Non-Management Director Stock Ownership Guidelines

The Corporate Governance Guidelines require each non-management Director to comply with Wyndham Hotels’ Non-Management Director Stock Ownership Guidelines. These guidelines require each non-management Director to beneficially own an amount of our stock equal to the greater of a multiple of at least five times the cash portion of the annual retainer or two and one-half times the total retainer value without regard to Board committee fees. Directors have a period of five years after joining the Board to achieve compliance with this ownership requirement. DSUs and RSUs credited to a Director count towards satisfaction of the guidelines. As of December 31, 2022, all of our non-management Directors were in compliance with the stock ownership guidelines.

16

Ownership of Company Stock

The following table describes the beneficial ownership of our common stock for the following persons as of December 31, 2022: each executive officer named in the Summary Compensation Table below, each Director, each person who to our knowledge beneficially owns in excess of 5% of our common stock and all of our Directors and executive officers as a group. The percentage values for each Director and executive officer are based on 86,417,433 shares of our common stock outstanding as of December 31, 2022. The principal address for each Director and executive officer of Wyndham Hotels is 22 Sylvan Way, Parsippany, New Jersey 07054.

|

Name |

Number of Shares |

% of Class |

||

|

The Vanguard Group |

8,150,815 |

(a) |

9.23% |

|

|

BlackRock, Inc. |

7,948,112 |

(b) |

9.0% |

|

|

Capital Research Global Investors |

7,665,288 |

(c) |

8.7% |

|

|

Michele Allen |

45,971 |

(d)(e) |

* |

|

|

Geoffrey A. Ballotti |

932,237 |

(d)(e) |

1.08% |

|

|

Myra J. Biblowit |

92,092 |

(d)(f) |

* |

|

|

James E. Buckman |

86,287 |

(d)(f) |

* |

|

|

Paul F. Cash |

70,573 |

(d)(e) |

* |

|

|

Lisa Checchio |

63,761 |

(d)(e) |

* |

|

|

Bruce B. Churchill |

17,386 |

(d)(f) |

* |

|

|

Mukul V. Deoras |

16,640 |

(d)(f) |

* |

|

|

Stephen P. Holmes |

456,945 |

(d)(f) |

* |

|

|

Ronald L. Nelson |

39,362 |

(d)(f) |

* |

|

|

Pauline D.E. Richards |

67,174 |

(d)(f) |

* |

|

|

Scott Strickland |

64,974 |

(d)(e) |

* |

|

|

All Directors and executive officers as a group (14 persons) |

2,008,524 |

(g) |

2.29% |

|

| * | Amount represents less than 1% of outstanding common stock. |

| (a) | We have been informed by a Schedule 13G/A filed with the SEC dated February 9, 2023 by The Vanguard Group that The Vanguard Group beneficially owns, as of December 31, 2022, 8,150,815 shares of our common stock with sole voting power over no shares, shared voting power over 39,088 shares, sole dispositive power over 8,023,114 shares and shared dispositive power over 127,701 shares. The principal business address for The Vanguard Group is 100 Vanguard Boulevard, Malvern, Pennsylvania 19355. |

| (b) | We have been informed by a Schedule 13G/A filed with the SEC dated January 25, 2023 by BlackRock, Inc. and affiliates named in such report that BlackRock, Inc. beneficially owns, as of December 31, 2022, 7,948,112 shares of our common stock with sole voting power over 7,695,017 shares, shared voting power over no shares, sole dispositive power over 7,948,112 shares and shared dispositive power over no shares. The principal business address for BlackRock, Inc. is 55 East 52nd Street, New York, New York 10055. |

| (c) | We have been informed by a Schedule 13G/A filed with the SEC dated February 13, 2023 by Capital Research Global Investors that Capital Research Global Investors beneficially owns, as of December 31, 2022, 7,665,288 shares of our common stock with sole voting power over 7,665,288 shares, shared voting power over no shares, sole dispositive power over 7,665,288 shares and shared dispositive power over no shares. The principal business address for Capital Research Global Investors is 333 South Hope Street, 55th Floor, Los Angeles, California 90071. |

| (d) | Includes shares of our common stock issuable upon vesting of time-vesting RSUs within 60 days of December 31, 2022 as follows: Ms. Allen, 15,147; Mr. Ballotti, 38,470; Ms. Biblowit, 1,328; Mr. Buckman, 1,328; Mr. Cash, 14,355; Ms. Checchio, 10,889; Mr. Churchill, 1,328; Mr. Deoras, 1,328; Mr. Holmes, 1,328; Mr. Nelson, 851; Ms. Richards, 1,328; and Mr. Strickland 9,941. |

Excludes shares of our common stock issuable upon vesting of time-vesting RSUs after 60 days from December 31, 2022 as follows: Ms. Allen, 50,305; Mr. Ballotti, 160,271; Ms. Biblowit, 2,443; Mr. Buckman, 2,443; Mr. Cash, 29,631; Ms. Checchio, 22,874; Mr. Churchill, 2,443; Mr. Deoras, 2,443; Mr. Holmes, 2,443; Mr. Nelson, 2,443; Ms. Richards, 2,443; and Mr. Strickland 29,171. Excludes the following performance-vesting restricted stock units (PSUs) granted in 2020, originally scheduled to vest in February 2023, none of which were earned based on the level of performance achieved: Ms. Allen, 7,022; Mr. Ballotti, 42,134; Mr. Cash, 5,852; Ms. Checchio, 4,681; and Mr. Strickland, 4,681. Excludes PSUs granted in 2021 and 2022 which vest, if at all, after 60 days from December 31, 2022 as follows: Ms. Allen, 13,289; Mr. Ballotti, 85,330; Mr. Cash, 10,543; Ms. Checchio, 8,019; and Mr. Strickland 7,875.

17

| (e) | Includes shares of our common stock underlying stock options which are currently exercisable or will become exercisable within 60 days of December 31, 2022 as follows: Ms. Allen, 30,769; Mr. Ballotti, 641,821; Mr. Cash, 51,184; Ms. Checchio, 39,752; and Mr. Strickland, 42,906. |

Excludes shares of our common stock underlying stock options which are not currently exercisable and will not become exercisable within 60 days of December 31, 2022 as follows: Ms. Allen, 10,914; Mr. Ballotti, 106,341; Mr. Cash, 9,095; Ms. Checchio, 7,276; and Mr. Strickland, 7,276.

| (f) | Includes shares of our common stock issuable for DSUs: Ms. Biblowit, 82,840; Mr. Buckman, 75,652; Mr. Churchill, 16,058; Mr. Deoras, 11,521; Mr. Holmes, 9,723; Mr. Nelson, 7,571; and Ms. Richards, 53,568. |

| (g) | Includes or excludes, as the case may be, shares of common stock as indicated in the preceding footnotes. In addition, with respect to our other executive officers who are not named executive officers, this amount includes 12,258 shares of our common stock and 12,565 shares and 4,681 shares of our common stock issuable with respect to unvested RSUs and PSUs, respectively, scheduled to vest within 60 days of December 31, 2022 and 30,299 stock options that are currently exercisable or will become exercisable within 60 days of December 31, 2022. This amount excludes 32,326 shares, 11,603 shares and 7,276 shares of our common stock issuable with respect to unvested RSUs, PSUs and unvested stock options, respectively, after 60 days from December 31, 2022. |

Delinquent Section 16(a) Reports

Section 16(a) of the Exchange Act requires our directors, executive officers, and persons who own more than 10% of our common stock to file reports of ownership and changes in ownership of our common stock with the SEC. Based on the information available to us during 2022, we believe that all applicable Section 16(a) filing requirements were met on a timely basis.

18

PROPOSAL NO. 1: ELECTION OF DIRECTORS

At the date of this proxy statement, the Board consists of eight members, six of whom are independent Directors under applicable listing standards and our corporate governance documents.

At the Annual Meeting, all eight of our Directors are to be elected for terms expiring at the 2024 annual meeting, with each Director to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification, death or removal.

On the recommendation of the Corporate Governance Committee, the Board has nominated Stephen P. Holmes, Geoffrey A. Ballotti, Myra J. Biblowit, James E. Buckman, Bruce B. Churchill, Mukul V. Deoras, Ronald L. Nelson and Pauline D.E. Richards for election, each of whom is presently a Director, to serve until the 2024 annual meeting. The eight nominees are listed below with brief biographies.