UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement

|

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

| ☐ |

Definitive Proxy Statement

|

| ☐ |

Definitive Additional Materials

|

| ☒ |

Soliciting Material under §240.14a-12

|

Wyndham Hotels & Resorts, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required.

|

| ☐ |

Fee paid previously with preliminary materials.

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

On December 18, 2023, Wyndham Hotels & Resorts, Inc. issued the following press release.

Wyndham Board Urges Shareholders to Reject

Inadequate and Highly Conditional Choice Exchange Offer

Board Unanimously Recommends Wyndham Shareholders NOT Tender Shares

Choice Ignores Significant Regulatory and Business Risks and Misleads Wyndham Shareholders and Other Stakeholders with Continued Inconsistent and Inaccurate Statements

Wyndham Board Believes the Company Can Deliver Long-Term Shareholder Value in Excess of the Current $85 Per Share in Cash and Stock Offered by Choice

Visit StayWyndham.com, Where Shareholders and Franchisees Can Get the Facts

PARSIPPANY, N.J., December 18, 2023 – Wyndham Hotels & Resorts (NYSE: WH) (“Wyndham” or the “Company”), today announced that its Board of Directors, following a

comprehensive review with its outside financial and legal advisors, has unanimously determined the unsolicited exchange offer (the “Offer”) from Choice Hotels International, Inc. (NYSE: CHH) (“Choice”) to acquire all outstanding shares of

Wyndham is NOT in the best interests of Wyndham and its shareholders. The Wyndham Board of Directors unanimously recommends that shareholders NOT tender any of their shares into the Offer.

“Choice has, once again, failed to address the major value gap and risks of their offer – which remains virtually unchanged from the terms outlined in their previous unsolicited proposal,” said Stephen P. Holmes,

Chairman of the Board. “The core issues we have articulated remain the same: a likely prolonged regulatory review period of up to 24 months with an uncertain outcome; the pure inadequacy of the Offer from a valuation standpoint, including the

significant equity component of Choice stock; and the lack of consideration for Wyndham’s superior, standalone growth prospects.”

Holmes continued, “Our Board has made itself consistently clear on these risks, but Choice continues to ignore what is in the best interests of Wyndham shareholders by repeatedly proposing illusory and unrealistic

offers while making inconsistent and misleading public statements. We are confident Wyndham can deliver long-term shareholder value well in excess of the $85 per share offered by Choice by continuing to execute on our existing business plan.

The Board is steadfast in our recommendation that shareholders not tender their shares into this offer, and we remain fully committed to acting in the best interests of all Wyndham shareholders.”

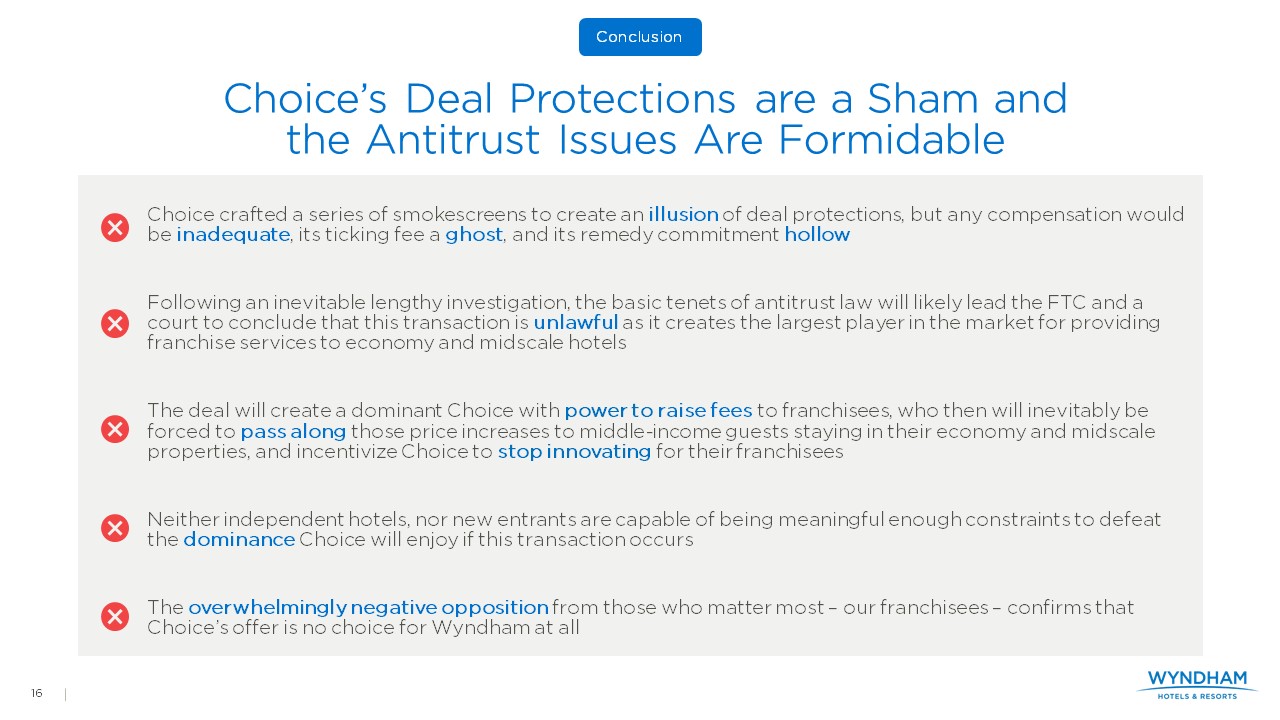

The Company unveiled a presentation detailing the unprecedented antitrust risks this offer presents. The presentation is available on StayWyndham.com.

Wyndham’s Board of Directors conducted a comprehensive review of the Offer and recommends shareholders reject the Offer for the following reasons:

|

•

|

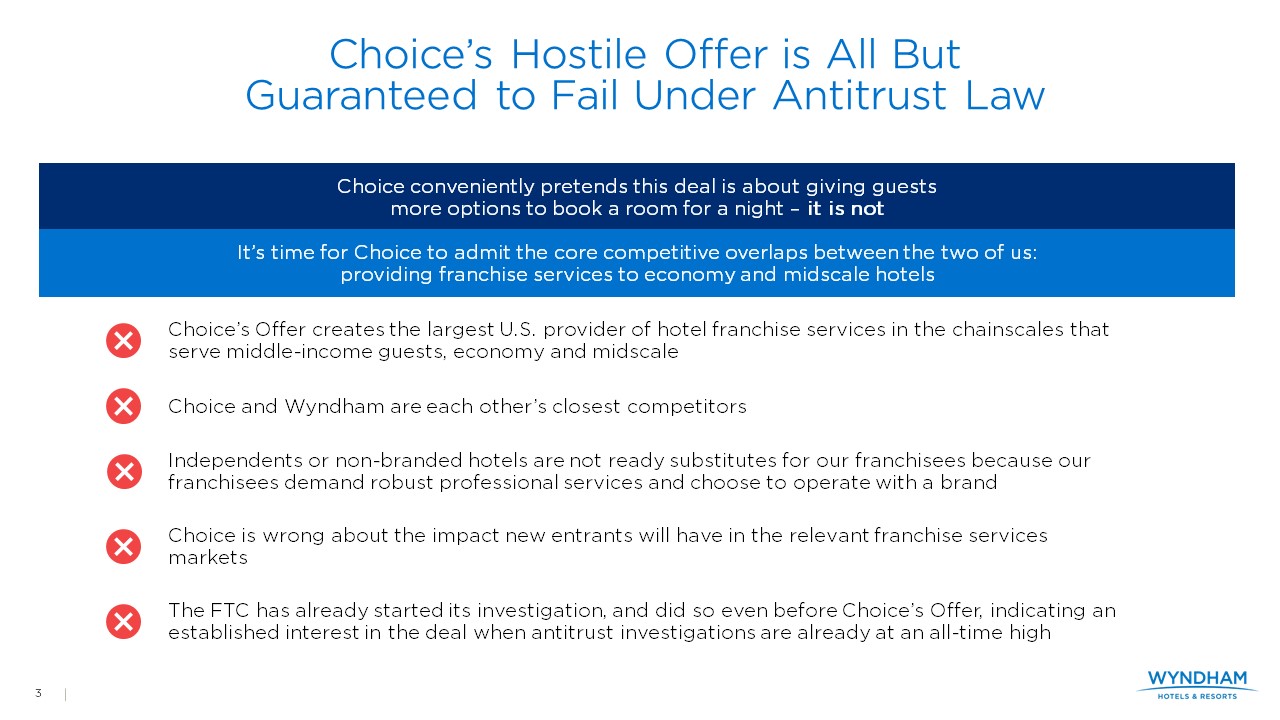

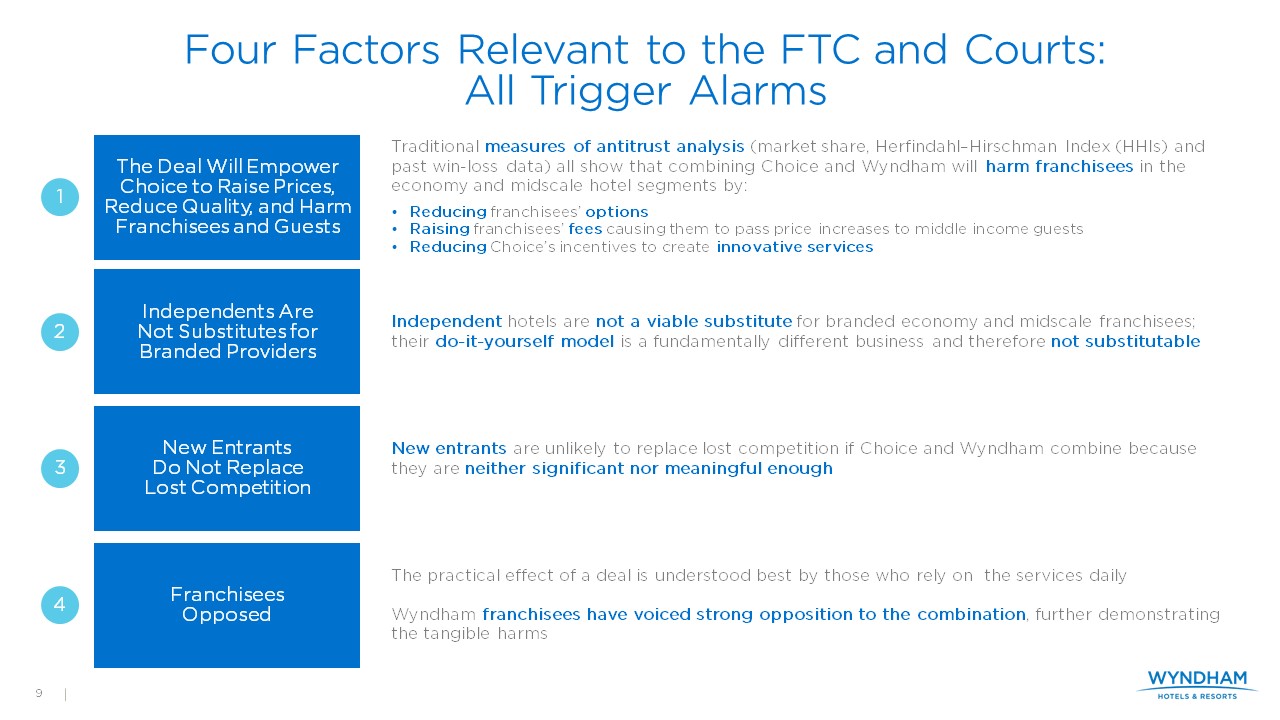

The Offer involves an uncertain regulatory timeline and outcome and does not provide sufficient protections and compensation for the asymmetrical risks Wyndham shareholders would face.

|

|

o

|

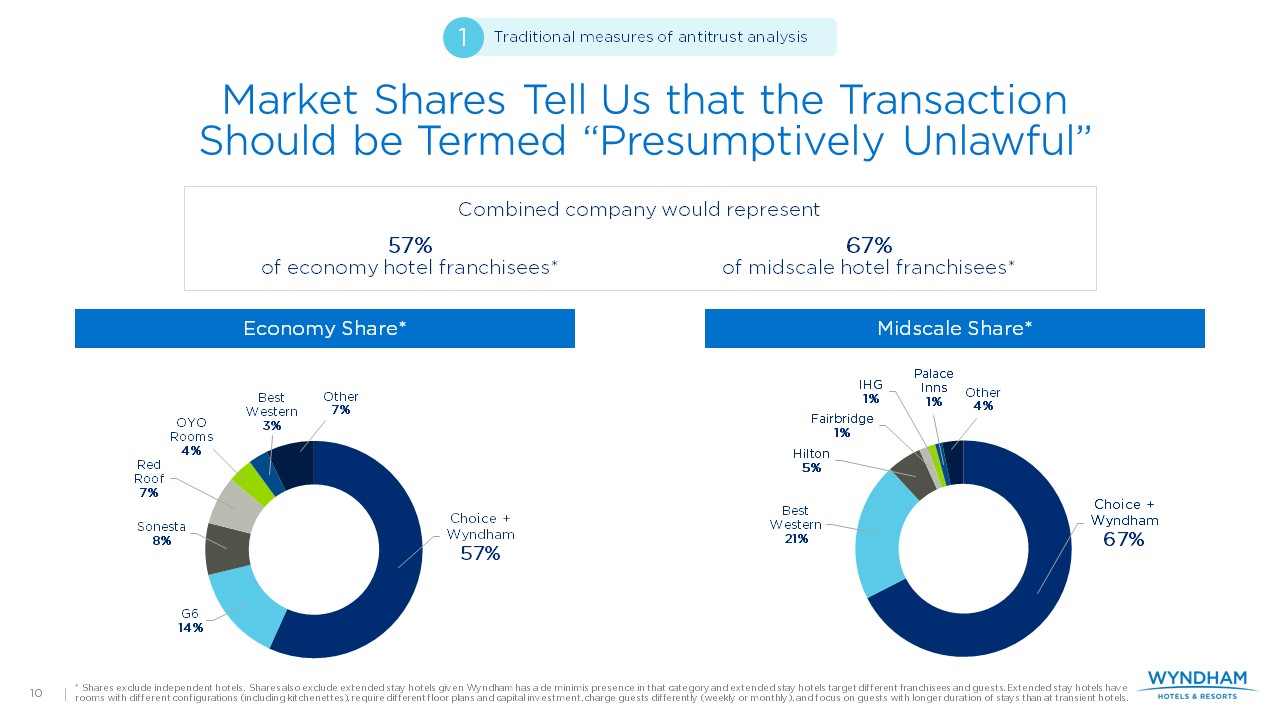

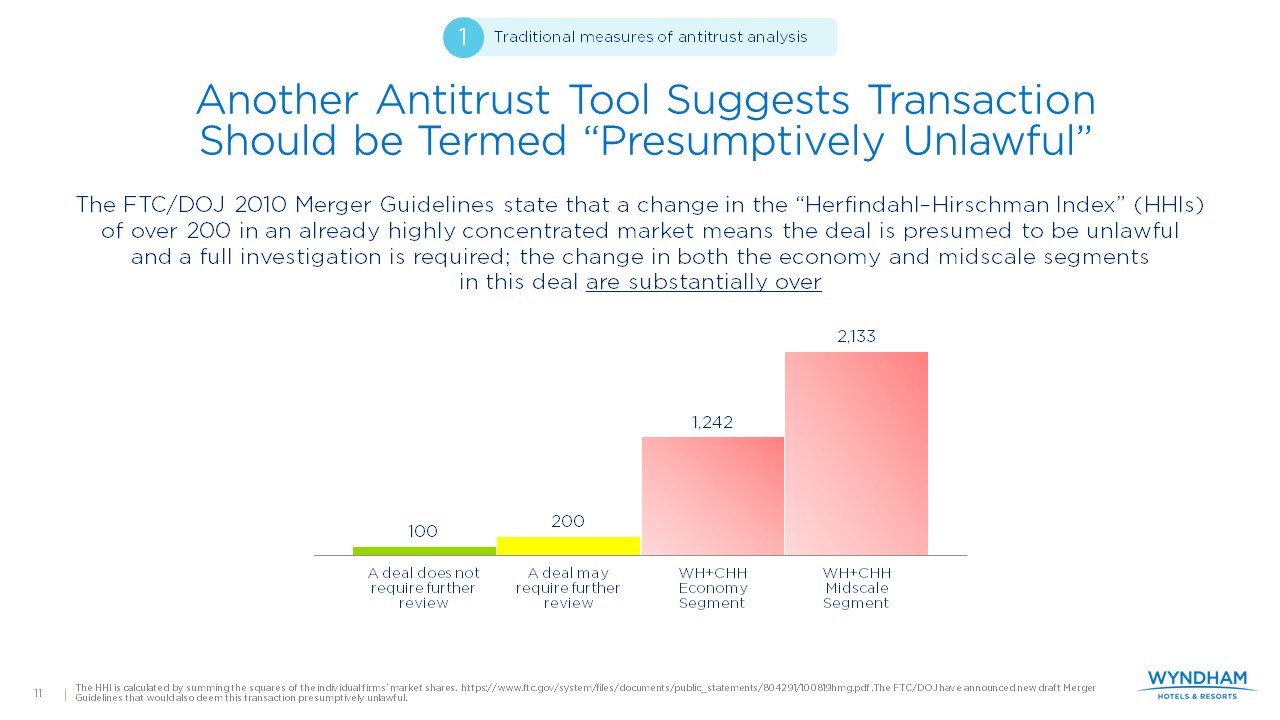

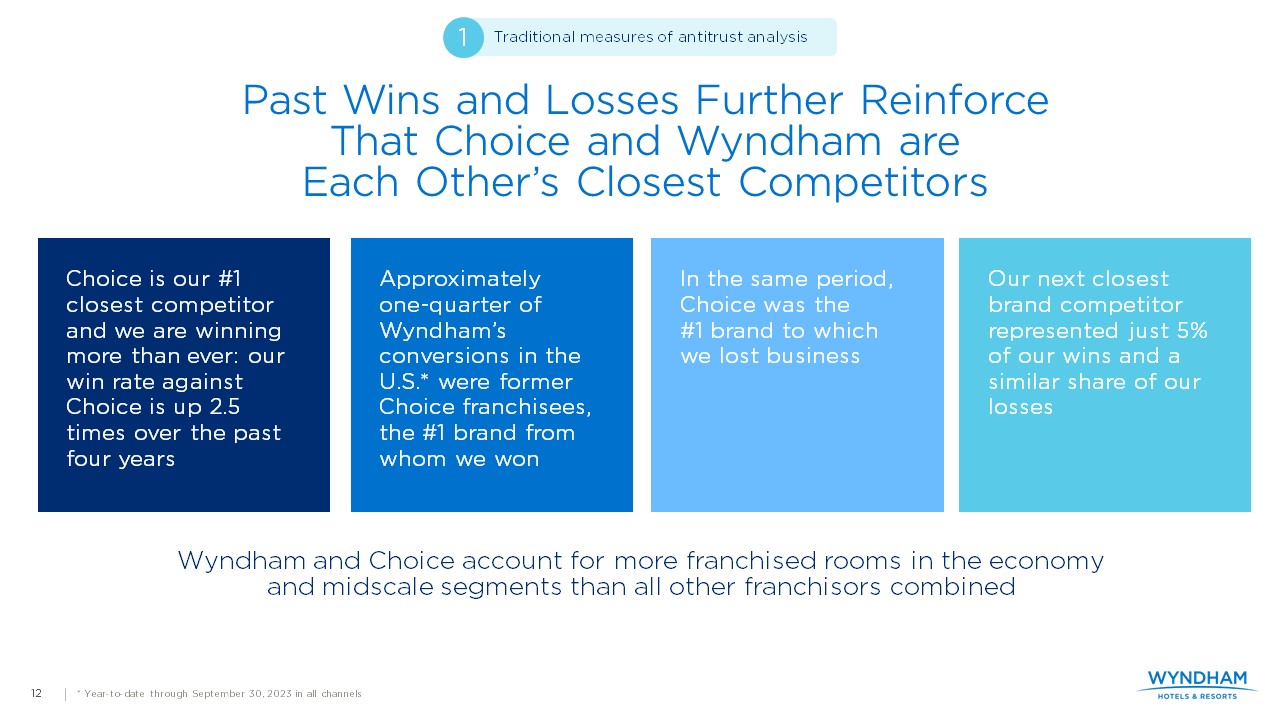

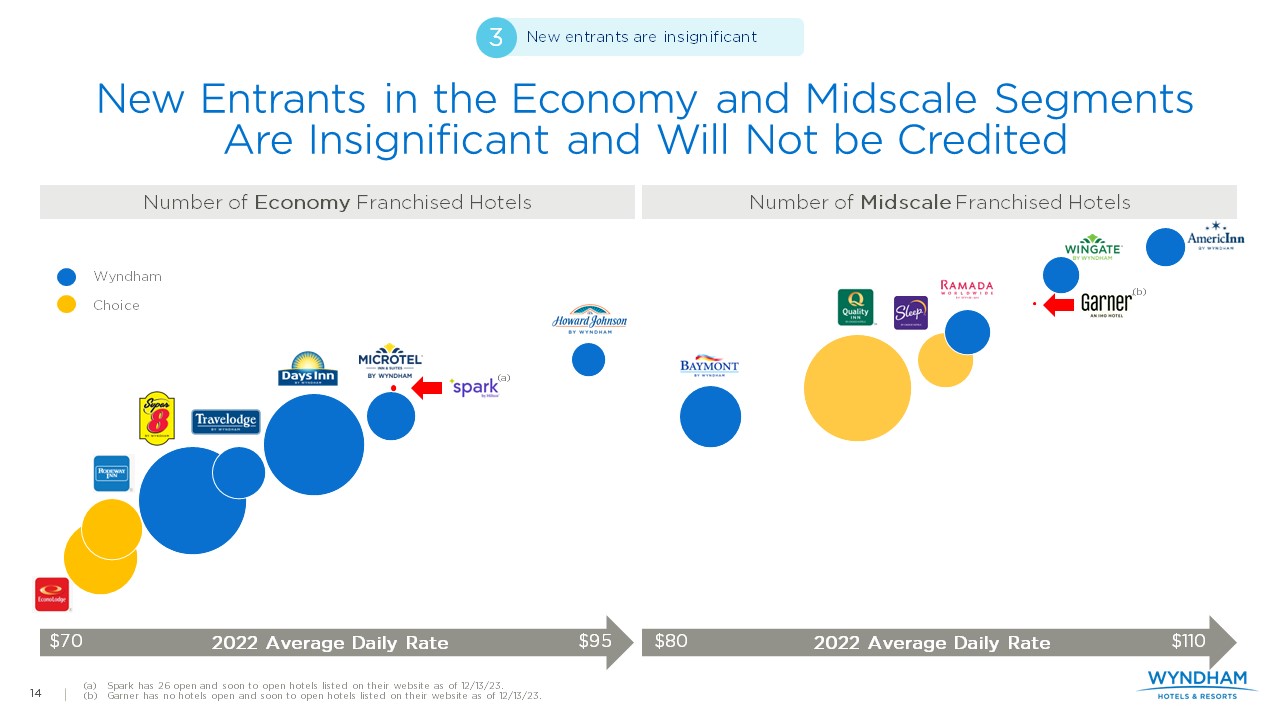

Choice's Offer would create the largest U.S. provider of hotel franchise services in the chainscales that serve middle-income guests - economy and midscale - with over 55% market share in each, resulting in significant uncertainty

as to whether the FTC or courts would ever clear the transaction.

|

|

o

|

This complex merger would require an extended period of time to review relative to businesses that are smaller in scope, scale, or competitive intensity.

|

|

◾

|

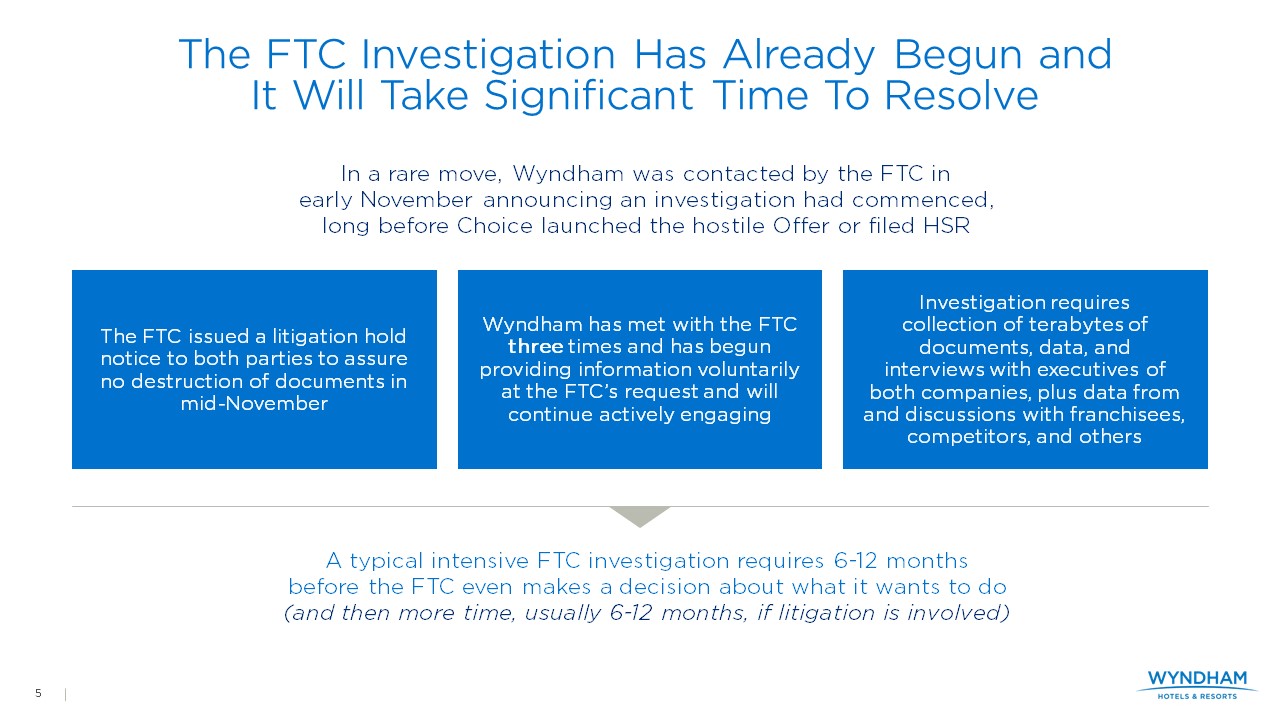

The FTC opened a preliminary investigation into the transaction – even before there was an exchange offer or transaction – additional evidence of antitrust concerns and a potential prolonged review process.

|

|

o

|

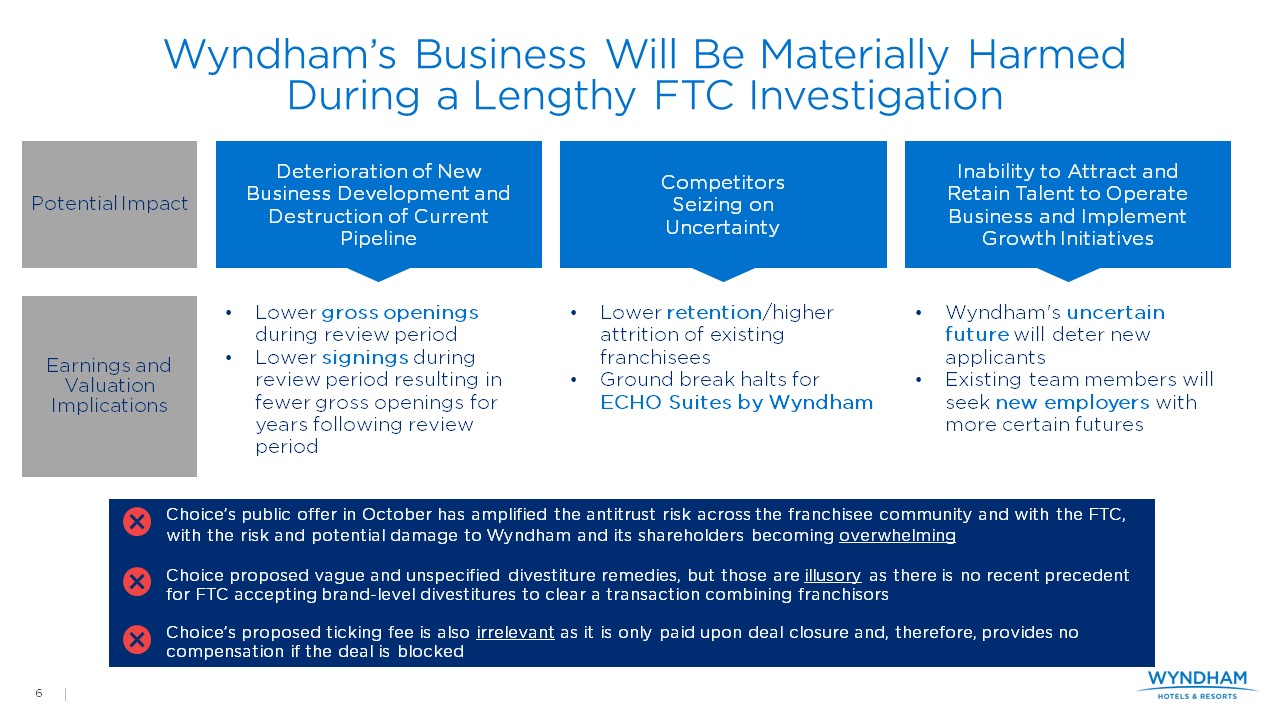

Any extended period between the announcement and closing (or termination) of the transaction exposes Wyndham and its shareholders to meaningful risks, including:

|

|

◾

|

New business development disruption and deterioration in segment-leading retention rates resulting in impaired earnings growth;

|

|

◾

|

Competitors (including Choice) capitalizing on franchisee uncertainty;

|

|

◾

|

Stagnated development of Wyndham’s fast-growing ECHO Suites brand; and

|

|

◾

|

Increased employee turnover and reduced ability to attract and retain team members.

|

|

o

|

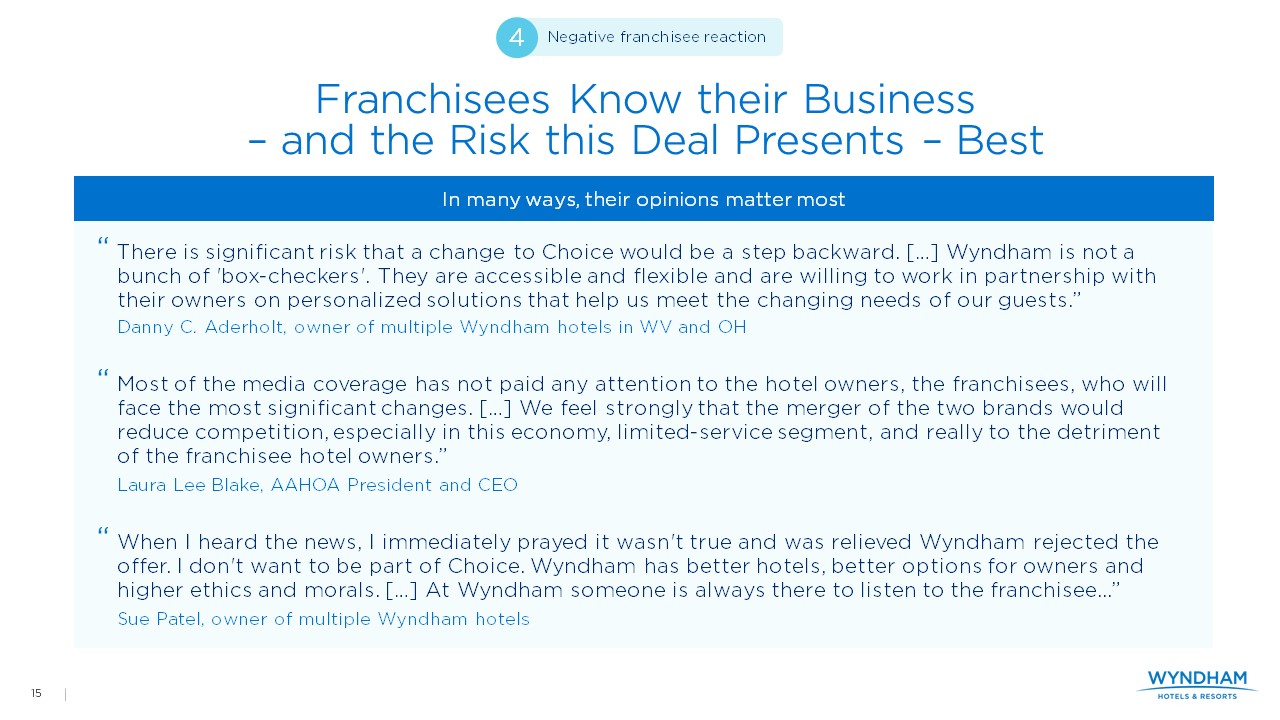

Franchisees have vehemently expressed their opposition to a proposed transaction, which heightens the level of business risk and FTC scrutiny.

|

|

◾

|

The reception from franchisees has been extremely negative.

|

|

◾

|

AAHOA, which represents roughly two-thirds of Wyndham and Choice franchisees, has been strongly opposed to a potential combination, noting that having one franchisor control so many economy and midscale hotels would be “highly

disruptive.”

|

|

◾

|

The Wyndham Board is concerned that the announcement of a transaction could result in increased franchisee churn and reduced new development activity.

|

|

o

|

Choice’s public offer in October has amplified the antitrust risk across the franchisee community and with the FTC. As a result, it has become apparent that the risk and the potential damage to Wyndham and its shareholders would

be overwhelming.

|

|

•

|

The Offer is inadequate and undervalues Wyndham’s superior, standalone growth prospects.

|

|

o

|

The Wyndham Board believes the Company can deliver long-term shareholder value in excess of the $85 per share offered by Choice by continuing to execute on its existing business plan.

|

|

◾

|

Wyndham has significant embedded upside from its ongoing retention strategy.

|

|

◾

|

The attractive mix of Wyndham’s record pipeline provides additional opportunity for accelerated net room growth, above-market RevPAR growth and royalty rate expansion.

|

|

◾

|

Wyndham’s geographic domestic footprint is best positioned to capture unprecedented hotel demand in markets receiving the largest allocation of the Federal Government’s $1.5 trillion Infrastructure Bill.

|

|

◾

|

Wyndham has launched the fastest-growing brand in the industry, ECHO Suites Extended Stay by Wyndham, appealing to this infrastructure demand.

|

|

◾

|

Wyndham expects to benefit from ancillary revenue growth including new credit card products, new strategic marketing partnerships and other monetization opportunities.

|

|

•

|

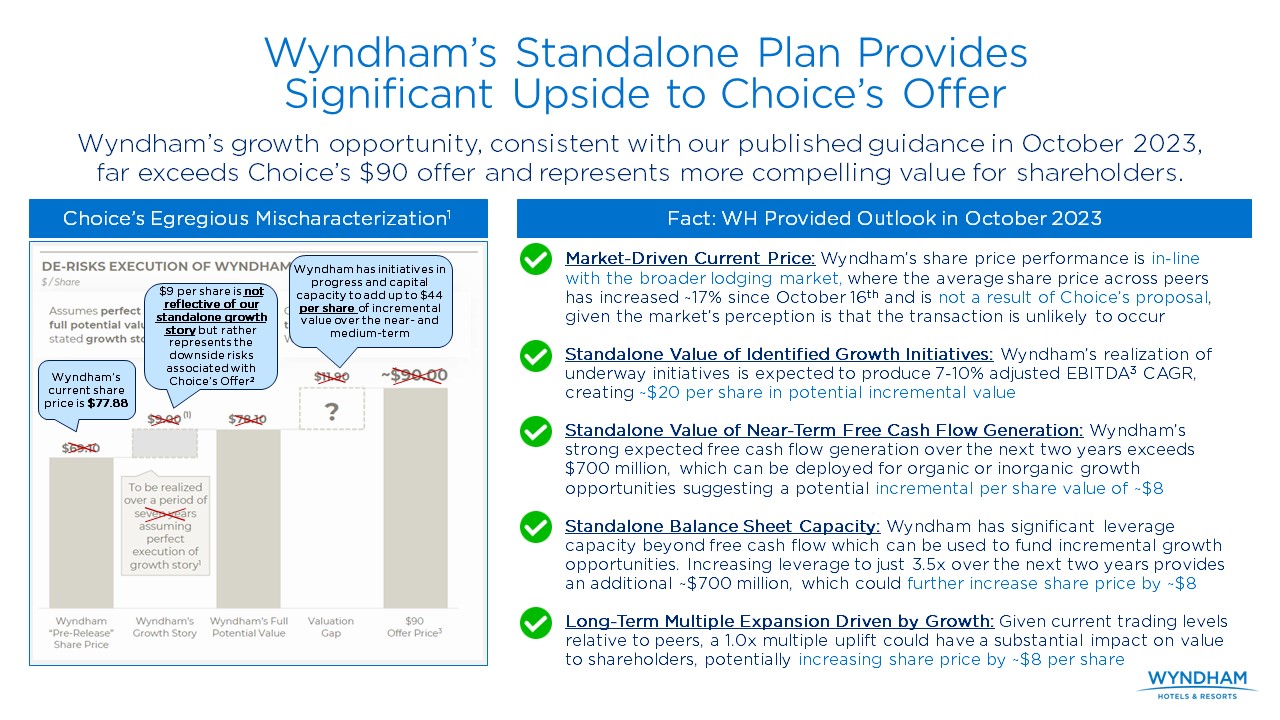

Choice’s Offer mischaracterizes Wyndham's growth potential.

|

|

◾

|

Choice portrays Wyndham’s growth potential as $9 per share, which is an egregious mischaracterization and fails to reflect the outlook Wyndham provided in its October investor presentation, which provides the roadmap for an

incremental $20 per share from EBITDA growth potential over the next two years with an additional $16 per share from the deployment of available capital during that period.

|

|

◾

|

Importantly this standalone plan does not rely on overleveraging Wyndham’s balance sheet. Rather, Wyndham’s plan can be achieved with leverage remaining in the lower half of Wyndham’s stated target range at 3.5x.

|

|

◾

|

Additionally, there is further upside from continued multiple expansion. Since completing its spin-off in 2018, Wyndham’s multiple has expanded and continues to close the gap to its peer set average, which currently stands at 15.7

times. Every 1.0x multiple increase could translate into as much as $8 per share of additional value.

|

|

o

|

The Offer represents a mere 4% premium to Wyndham’s 52-week high and a 10% premium to Wyndham’s current stock price (as of December 15, 2023).

|

|

◾

|

Importantly, since the announcement of Choice’s proposal on October 17, 2023, Wyndham’s share price has recovered to 95% of its 52-week high, which is generally consistent with the broader lodging sector performance of 99%.

|

|

o

|

Choice’s proposed “ticking fee” is illusory as crafted.

|

|

•

|

Choice’s stock is at significant risk for further price degradation, with a slower-growing business. Post-transaction, Choice’s leverage level would surpass all other lodging peers’ average leverage

ratios – negatively affecting not only the value of the equity consideration in the Offer, but also limiting Choice’s ability to invest in future growth.

|

|

o

|

The Wyndham Board sees the Offer as an attempt by Choice to mask its anemic organic growth by acquiring Wyndham’s global system and capabilities without paying adequate consideration for it to Wyndham shareholders.

|

|

o

|

The 45% stock component is subject to volatility and exposes Wyndham shareholders to excessive risks with respect to the value of the consideration received. Choice stock has already dropped by 12% since its initial public offer.

|

|

o

|

Choice’s stock appears to be fully valued with significant risk for further degradation. Approximately 70% of covering research analysts rate Choice as a “sell” or “hold” stock. Over 90% of covering analysts rate Wyndham as a

“buy.”

|

|

•

|

The Offer is subject to a litany of conditions, which make the consummation of the Offer highly uncertain.

|

|

o

|

Choice has not arranged committed financing, despite “numerous calls with potential financing sources” (according to its own statements) for more than four months.

|

|

o

|

The Offer includes a non-customary “Diligence Condition,” which the Wyndham Board believes is designed solely to serve as a one-way exit option to the Offer in favor of Choice.

|

The basis for the Board's decision is set forth in the Solicitation/Recommendation Statement on Schedule 14D-9 (the "Schedule 14D-9") filed today with the U.S. Securities and Exchange Commission.

The filing and additional materials are available at https://www.staywyndham.com/.

Advisors

Deutsche Bank Securities Inc. and PJT Partners are serving as financial advisors and Kirkland & Ellis LLP and Arnold & Porter Kaye Scholer LLP are legal advisors to Wyndham.

About Wyndham Hotels & Resorts

Wyndham Hotels & Resorts (NYSE: WH) is the world's largest hotel franchising company by the number of properties, with approximately 9,100 hotels across over 95 countries on six continents. Through its

network of approximately 858,000 rooms appealing to the everyday traveler, Wyndham commands a leading presence in the economy and midscale segments of the lodging industry. The Company operates a portfolio of 24 hotel brands, including

Super 8®, Days Inn®, Ramada®, Microtel®, La Quinta®, Baymont®, Wingate®, AmericInn®, Hawthorn Suites®, Trademark Collection® and Wyndham®. The Company's award-winning Wyndham Rewards loyalty program offers approximately 105 million enrolled

members the opportunity to redeem points at thousands of hotels, vacation club resorts and vacation rentals globally. The Company may use its website as a means of disclosing material non-public information and for complying with its

disclosure obligations under Regulation FD. Disclosures of this nature will be included on the Company's website in the Investors section, which can currently be accessed at https://investor.wyndhamhotels.com. Accordingly, investors should

monitor this section of the Company's website in addition to following the Company's press releases, filings submitted with the Securities and Exchange Commission and any public conference calls or webcasts.

Important Additional Information

This press release is not an offer to purchase or a solicitation of an offer to sell any securities or the solicitation of any vote or approval. Wyndham Hotels & Resorts, Inc. (“Wyndham” or the “Company”)

has filed with the U.S. Securities and Exchange Commission (the “SEC”) a solicitation/recommendation statement on Schedule 14D-9. Any solicitation/recommendation statement filed by the Company that is required to be mailed to stockholders

will be mailed to Company stockholders. COMPANY STOCKHOLDERS ARE ADVISED TO READ THE COMPANY’S SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE

MAKING ANY DECISION WITH RESPECT TO ANY EXCHANGE OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Company stockholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents

filed by the Company in connection with any exchange offer by Choice Hotels International, Inc. or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders will be able to obtain

free copies of these documents from the Company by directing a request to Matt Capuzzi, Senior Vice President, Investor Relations at matthew.capuzzi@wyndham.com or by calling 973.753.6453.

The Company intends to file a proxy statement and accompanying WHITE proxy card with the SEC with respect to the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”). The Company’s

stockholders are strongly encouraged to read such proxy statement, the accompanying WHITE proxy card and other documents filed with the SEC carefully in their entirety when they become available because they will contain important

information. The Company’s stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC free of charge at the SEC’s website at

www.sec.gov. Copies will also be available free of charge at the Company’s website at https://investor.wyndhamhotels.com.

Certain Information Concerning Participants

Wyndham and certain of its directors and executive officers may be deemed to be participants in the solicitation of proxies under the rules of the SEC. Information regarding the Company’s directors and

officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC on February 16, 2023 and its most recent definitive Proxy Statement on

Schedule 14A filed with the SEC on March 28, 2023. To the extent holdings of the Company’s securities have changed since the filing of the Company’s most recent Annual Report on Form 10-K or the Company’s most recent definitive Proxy

Statement on Schedule 14A, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Updated information relating to the foregoing will also be set forth in the Company’s proxy statement and other

materials to be filed with the SEC for its 2024 Annual Meeting. These documents can be obtained free of charge from the sources indicated above.

Cautionary Statement on Forward-Looking Statements

This press release contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including statements related to the offer. Wyndham claims the

protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. Forward-looking statements include those that convey management’s expectations as to the future based on plans,

estimates and projections at the time Wyndham makes the statements and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,”

“estimate,” “projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the

actual results, performance or achievements of Wyndham to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on

these forward-looking statements, which speak only as of the date of hereof.

Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation: factors relating to the offer; general economic conditions, including

inflation, higher interest rates and potential recessionary pressures; the effects from the coronavirus pandemic, including the impact on Wyndham’s business, as well as the impact on its franchisees, guests and team members, the hospitality

industry and overall demand for and restrictions on travel; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising business;

Wyndham’s relationships with franchisees; the impact of war, terrorist activity, political instability or political strife, including the ongoing conflicts between Russia and Ukraine and between Israel and Hamas; Wyndham’s ability to

satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to Wyndham’s ability to obtain financing and the terms of

such financing, including access to liquidity and capital; and Wyndham’s ability to make or pay, plans for and the timing and amount of any future share repurchases and/or dividends, as well as the risks described in Wyndham’s most recent

Annual Report on Form 10-K filed with the SEC and subsequent reports filed with the SEC. Wyndham undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, subsequent events or

otherwise, except as required by law.

Contacts

For investor inquiries, contact:

Matt Capuzzi

Senior Vice President, Investor Relations

T: 973.449.1537

ir@wyndham.com

Jonathan Salzberger/Scott Winter

Innisfree M&A Incorporated

(212) 750-5833

For media inquiries, contact:

Máire Griffin

Senior Vice President, Global Communications

T: 862.246.9918

Maire.Griffin@wyndham.com

Danya Al-Qattan/Stephen Pettibone/Paul Scarpetta

FGS Global

Wyndham@fgsglobal.com

On December 18, 2023, Wyndham Hotels & Resorts, Inc. sent the following letter to its employees.

To: All Team Members

Dear Team,

Today we announced that our Board unanimously determined Choice’s unsolicited exchange offer (which as we communicated to you last Monday was virtually unchanged from their previous offer) is NOT in the

best interests of our Company or our shareholders. The Board is recommending that our shareholders NOT tender their shares into the offer.

Why did our Board make this recommendation?

Our Board continues to believe that Choice underestimates and undervalues us. Their offer continues to downplay the strength of our business and does not take into consideration our significant growth

prospects as a standalone company.

In addition, we believe that the offer misjudges just how long and hard a potential antitrust review will be. In fact, in a very unusual move, the Federal Trade Commission (the FTC) already opened a

preliminary investigation into the transaction – even before any exchange offer or transaction has occurred. The Board and our leadership team remain committed to doing what’s best for our company, our shareholders, our franchisees and

all of you.

What comes next?

As a reminder, nothing can happen with respect to Choice’s offer until regulatory approvals are obtained, a process which could take up to 24 months. While we can’t speculate on what Choice may say or

choose to do next, we expect they will continue to try to disrupt our business while making noise like announcing they are planning to nominate directors to our Board for election at our next annual meeting. Choice, however, cannot put

director nominees on our Board until a vote occurs in mid-2024.

Whatever course of action Choice may take, we are ready. Our Board will continue acting in the best interests of our Company and shareholders. We will not let Choice distract us from growing our business

or delivering on our goals. And we’ll continue to stay focused on increasing the support we provide to our franchisees and to one another.

Our Board could not be more proud of what you’ve all achieved this year. We’ll continue sharing important updates with you when we can. And you can visit https://StayWyndham.com/

to get the facts and more information on the Board’s recommendation.

As a reminder, if someone outside of the Company reaches out to you, please direct them to Maire Griffin at Maire.Griffin@wyndham.com.

Have a very happy and safe holiday season and new year ahead.

And as always, thank you for all it is that you do.

Geoff

Important Additional Information

This communication is not an offer to purchase or a solicitation of an offer to sell any securities or the solicitation of any vote or approval. Wyndham Hotels

& Resorts, Inc. (“Wyndham” or the “Company”) has filed with the U.S. Securities and Exchange Commission (the “SEC”) a solicitation/recommendation statement on Schedule 14D-9. Any solicitation/recommendation statement filed by the

Company that is required to be mailed to stockholders will be mailed to Company stockholders. COMPANY STOCKHOLDERS ARE ADVISED TO READ THE COMPANY’S SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AND ANY OTHER RELEVANT DOCUMENTS

FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY EXCHANGE OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Company stockholders may obtain a copy of the Solicitation/Recommendation

Statement on Schedule 14D-9, as well as any other documents filed by the Company in connection with any exchange offer by Choice Hotels International, Inc. or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In

addition, investors and security holders will be able to obtain free copies of these documents from the Company by directing a request to Matt Capuzzi, Senior Vice President, Investor Relations at matthew.capuzzi@wyndham.com or by

calling 973.753.6453.

The Company intends to file a proxy statement and accompanying WHITE proxy card with the SEC with respect to the Company’s 2024 Annual Meeting of Stockholders (the

“2024 Annual Meeting”). The Company’s stockholders are strongly encouraged to read such proxy statement, the accompanying WHITE proxy card and other documents filed with the SEC carefully in their entirety when they become available

because they will contain important information. The Company’s stockholders will be able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC free of

charge at the SEC’s website at www.sec.gov. Copies will also be available free of charge at the Company’s website at https://investor.wyndhamhotels.com.

Certain Information Concerning Participants

Wyndham and certain of its directors and executive officers

may be deemed to be participants in the solicitation of proxies under the rules of the SEC. Information regarding the Company’s directors and officers and their respective interests in the Company by security holdings or otherwise is

available in its most recent Annual Report on Form 10-K filed with the SEC on February 16, 2023 and its most recent definitive Proxy Statement on Schedule 14A filed with the SEC on March 28, 2023.

To the extent holdings of the Company’s securities have changed since the filing of the Company’s most recent Annual Report on Form 10-K or the Company’s most recent definitive Proxy Statement on Schedule

14A, such changes have been reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Updated information relating to the foregoing will also be set forth in the Company’s proxy statement and other materials to be

filed with the SEC for its 2024 Annual Meeting. These documents can be obtained free of charge from the sources indicated above.

Cautionary Statement on Forward-Looking Statements

This communication contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended, including statements

related to the offer. Wyndham claims the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements. Forward-looking statements include those that convey management’s

expectations as to the future based on plans, estimates and projections at the time Wyndham makes the statements and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,”

“outlook,” “guidance,” “target,” “objective,” “estimate,” “projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks,

uncertainties and other factors, which may cause the actual results, performance or achievements of Wyndham to be materially different from any future results, performance or achievements expressed or implied by such forward-looking

statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of hereof.

Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation: factors relating to the

offer; general economic conditions, including inflation, higher interest rates and potential recessionary pressures; the effects from the coronavirus pandemic, including the impact on Wyndham’s business, as well as the impact on its

franchisees, guests and team members, the hospitality industry and overall demand for and restrictions on travel; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks

associated with the hotel franchising business; Wyndham’s relationships with franchisees; the impact of war, terrorist activity, political instability or political strife, including the ongoing conflicts between Russia and Ukraine and

between Israel and Hamas; Wyndham’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to Wyndham’s

ability to obtain financing and the terms of such financing, including access to liquidity and capital; and Wyndham’s ability to make or pay, plans for and the timing and amount of any future share repurchases and/or dividends, as well as

the risks described in Wyndham’s most recent Annual Report on Form 10-K filed with the SEC and subsequent reports filed with the SEC. Wyndham undertakes no obligation to update or revise any forward-looking statements, whether as a result

of new information, subsequent events or otherwise, except as required by law.

On December 18, 2023, Wyndham Hotels & Resorts, Inc. made the following presentation available to investors.

On December 18, 2023, Wyndham Hotels & Resorts, Inc. made the following presentation available to investors.

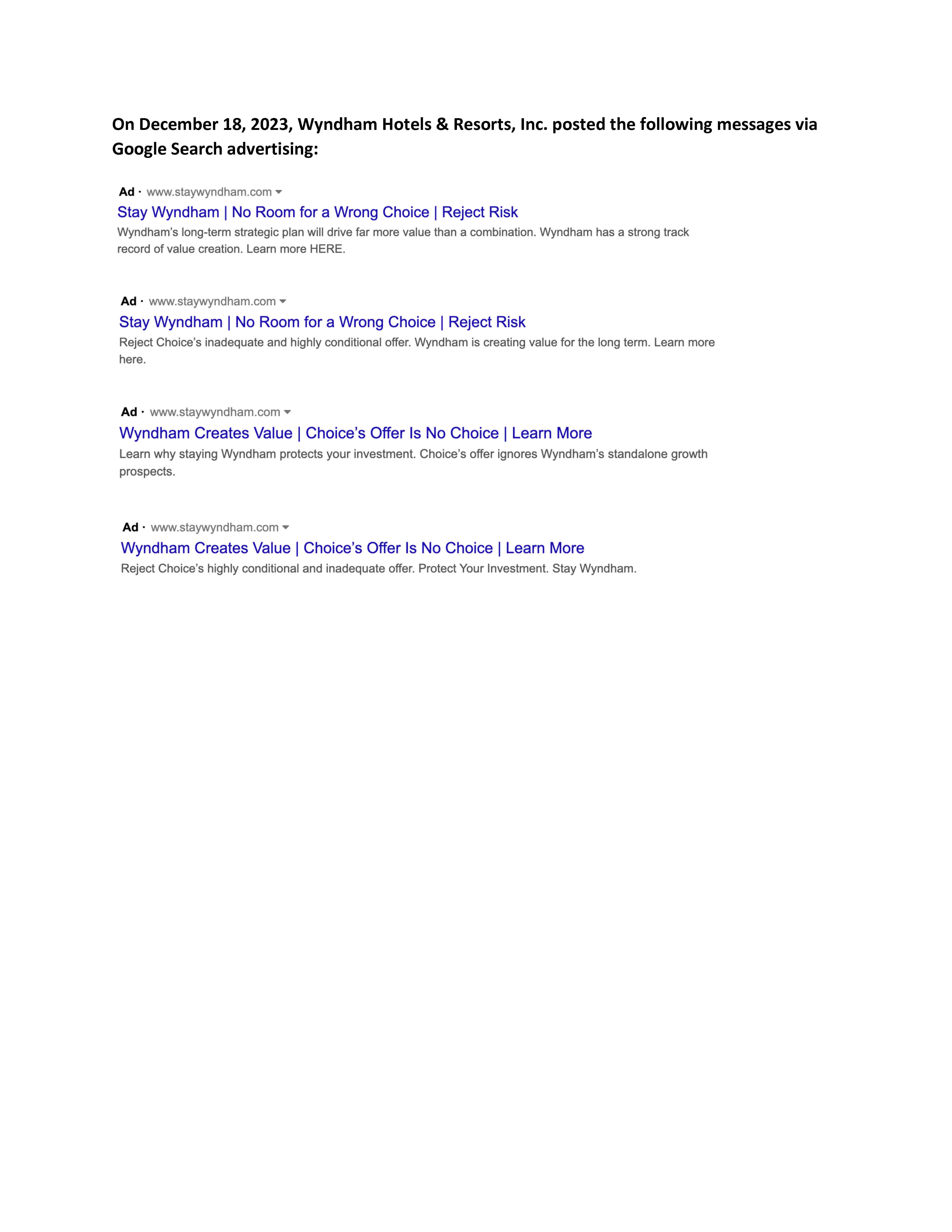

On December 18, 2023, Wyndham Hotels & Resorts, Inc. published the below digital advertisements.

On December 18, 2023, Wyndham Hotels & Resorts, Inc. launched the below website.