UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15 (d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 17, 2023

CHOICE HOTELS INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 001-13393 | 52-1209792 | ||

| (State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

| 1 Choice Hotels Circle, Suite 400, Rockville, Maryland 20850 |

20850 | |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (301) 592-5000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading |

Name of each exchange on which registered | ||

| Common Stock, Par Value $0.01 per share | CHH | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01 | Regulation FD Disclosure. |

On October 17, 2023, Choice Hotels International, Inc. (“Choice”) posted on its website (www.choicehotels.com) an investor presentation providing information about its proposal to acquire all the outstanding shares of Wyndham Hotels & Resorts, Inc. (“Wyndham”) for per-share consideration of $90.00 in a mix of cash and stock (the “Proposal”). A copy of the investor presentation is attached hereto as Exhibit 99.1.

The investor presentation is being furnished under Item 7.01 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of such section. The foregoing description is qualified in its entirety by reference to the text of such investor presentation and is incorporated herein by reference and constitutes part of this report.

| Item 8.01 | Other Events. |

On October 17, 2023, Choice issued a press release announcing the Proposal. A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated herein by reference.

Forward-looking Statements

Information set forth herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward-looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions and expectations regarding future events, which, in turn, are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation, difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees may be difficult. Such statements may relate to projections of the company’s revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, RevPAR, the company’s ability to benefit from any rebound in travel demand, and the company’s liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors.

These and other risk factors that may affect Choice’s operations are discussed in detail in the company’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and, as applicable, our Quarterly Reports on Form 10-Q. Choice undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

- 2 -

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham. In furtherance of this proposal and subject to future developments, Choice (and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed transaction.

Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www.investor.choicehotels.com.

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| 99.1 | Investor Presentation, dated October 17, 2023 | |

| 99.2 | Press Release dated October 17, 2023, issued by Choice Hotels International, Inc. | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) | |

- 3 -

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 17, 2023 | /s/ Simone Wu | |||||

| Simone Wu | ||||||

| Senior Vice President, General Counsel, Corporate Secretary & External Affairs | ||||||

- 4 -

Exhibit 99.1 October 17, 2023 A COMPANY BUILT FOR THE VALUE-DRIVEN TRAVELER C h o i c e | W y n d h a m

Forward-looking statements Information set forth herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward-looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management's current beliefs, assumptions and expectations regarding future events, which, in turn, are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation, difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees may be difficult. Such statements may relate to projections of the company's revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, RevPAR, the company's ability to benefit from any rebound in travel demand, and the company's liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors. These and other risk factors that may affect Choice’s operations are discussed in detail in the company's filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and, as applicable, our Quarterly Reports on Form 10-Q. Choice undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. C h o i c e W y n d h a m 2

Non-GAAP financial measurements and other definitions The company evaluates its operations utilizing, among others, the performance metric adjusted EBITDA, which is a non-GAAP financial measurement. This measure should not be considered as an alternative to any measure of performance or liquidity as promulgated under or authorized by GAAP, such as net income. The company's calculation of this measurement may be different from the calculations used by other companies, including Wyndham, and comparability may therefore be limited. We discuss management's reasons for reporting this non-GAAP measure and how it is calculated below. In addition to the specific adjustments noted below with respect to adjusted EBITDA, the non-GAAP measures presented herein also exclude restructuring of the company's operations including employee severance benefit, income taxes and legal costs, acquisition related due diligence, transition and transaction costs, and gains/losses on sale/disposal and impairment of assets primarily related to hotel ownership and development activities to allow for period-over-period comparison of ongoing core operations before the impact of these discrete and infrequent charges. Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization: Adjusted EBITDA reflects net income excluding the impact of interest expense, interest income, provision for income taxes, depreciation and amortization, franchise-agreement acquisition cost amortization, other (gains) and losses, equity in net income (loss) of unconsolidated affiliates, mark to-market adjustments on non-qualified retirement plan investments, share based compensation expense (benefit) and surplus or deficits generated by reimbursable revenue from franchised and managed properties. We consider adjusted EBITDA and adjusted EBITDA margins to be an indicator of operating performance because it measures our ability to service debt, fund capital expenditures, and expand our business. We also use these measures, as do analysts, lenders, investors, and others, to evaluate companies because it excludes certain items that can vary widely across industries or among companies within the same industry. For example, interest expense can be dependent on a company's capital structure, debt levels, and credit ratings, and share based compensation expense (benefit) is dependent on the design of compensation plans in place and the usage of them. Accordingly, the impact of interest expense and share based compensation expense (benefit) on earnings can vary significantly among companies. The tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary considerably among companies. These measures also exclude depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets or amortizing franchise-agreement acquisition costs. These differences can result in considerable variability in the relative asset costs and estimated lives and, therefore, the depreciation and amortization expense among companies. Mark-to-market adjustments on non-qualified retirement-plan investments recorded in SG&A are excluded from EBITDA, as the company accounts for these investments in accordance with accounting for deferred-compensation arrangements when investments are held in a rabbi trust and invested. Changes in the fair value of the investments are recognized as both compensation expense in SG&A and other gains and losses. As a result, the changes in the fair value of the investments do not have a material impact on the company's net income. Surpluses and deficits generated from reimbursable revenues from franchised and managed properties are excluded, as the company's franchise and management agreements require these revenues to be used exclusively for expenses associated with providing franchise and management services, such as central reservation and property-management systems, hotel employee and operating costs, reservation delivery and national marketing and media advertising. Franchised and managed property owners are required to reimburse the company for any deficits generated from these activities and the company is required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess the company's operating performance. RevPAR: RevPAR is calculated by dividing hotel room revenue by the total number of room nights available to guests for a given period. Management considers RevPAR to be a meaningful indicator of hotel performance and therefore company royalty and system revenues as it provides a metric correlated to the two key drivers of operations at a hotel: occupancy and ADR. The company calculates RevPAR based on information as reported by its franchisees. To accurately reflect RevPAR, the company may revise its prior years' operating statistics for the most current information provided. RevPAR is also a useful indicator in measuring performance over comparable periods. Pipeline: Pipeline is defined as hotels awaiting conversion, under construction or approved for development, and master development agreements committing owners to future franchise development. This presentation includes Wall Street consensus projected results for Choice and Wyndham for future periods. Choice is including these consensus estimates for informational purposes only, but is not affirming analyst projections or separately including guidance on these metrics. Other information regarding Wyndham has been taken from, or based upon, publicly available information. Choice does not take any responsibility for the accuracy or completeness of such information. To date, Choice has not had access to any non-public information of Wyndham. C h o i c e W y n d h a m 3

Additional information This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham. In furtherance of this proposal and subject to future developments, Choice(and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed transaction. Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www.investor.choicehotels.com. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com. C h o i c e W y n d h a m 4

C h o i c e & W y n d h a m – Ideally positioned to realize a significant market opportunity and enhance value for all stakeholders Offers Compelling Combines Two Complementary Enhances Opportunity for Creates a Leading Hotel Enhances Competitive Financial Benefits Hotel Franchising Companies, Franchisee Return on Platform Better Positioned Position Against Larger Accelerating Opportunities for Investment to Continue Capturing Industry Players Sustained Long-Term Growth Large and Growing Market Opportunity C C h h o o i i c c e e W W y y n n d d h h a a m m 5

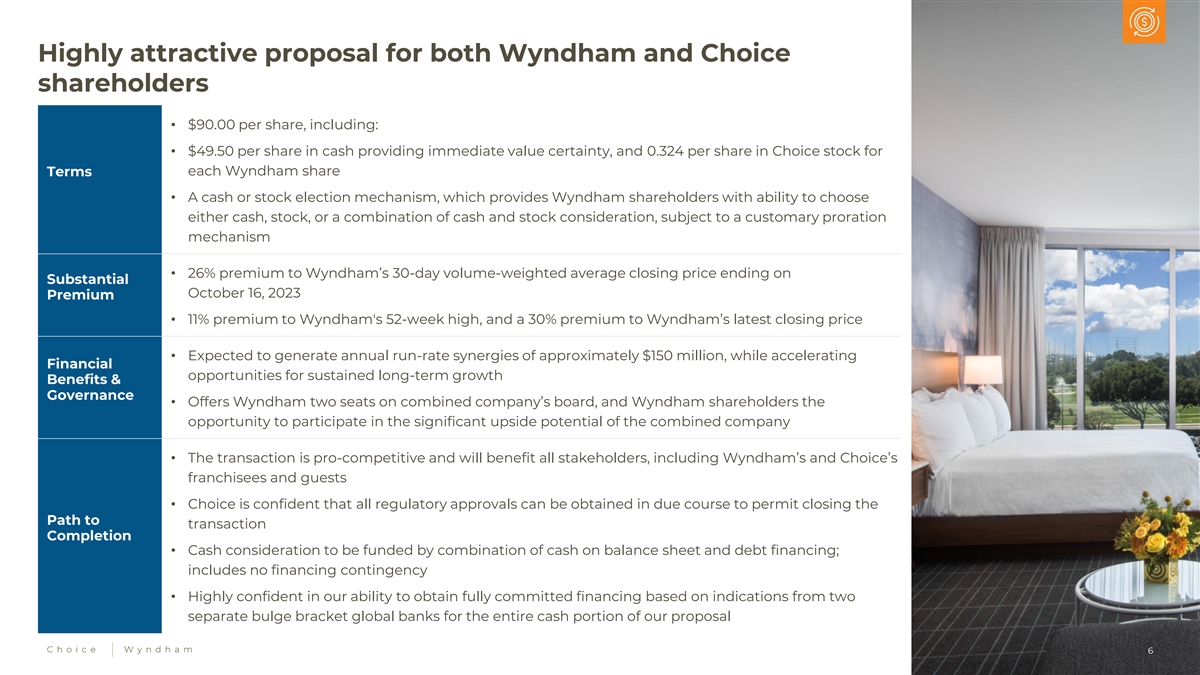

Highly attractive proposal for both Wyndham and Choice shareholders • $90.00 per share, including: • $49.50 per share in cash providing immediate value certainty, and 0.324 per share in Choice stock for Terms each Wyndham share • A cash or stock election mechanism, which provides Wyndham shareholders with ability to choose either cash, stock, or a combination of cash and stock consideration, subject to a customary proration mechanism • 26% premium to Wyndham’s 30-day volume-weighted average closing price ending on Substantial October 16, 2023 Premium • 11% premium to Wyndham's 52-week high, and a 30% premium to Wyndham’s latest closing price • Expected to generate annual run-rate synergies of approximately $150 million, while accelerating Financial opportunities for sustained long-term growth Benefits & Governance • Offers Wyndham two seats on combined company’s board, and Wyndham shareholders the opportunity to participate in the significant upside potential of the combined company • The transaction is pro-competitive and will benefit all stakeholders, including Wyndham’s and Choice’s franchisees and guests • Choice is confident that all regulatory approvals can be obtained in due course to permit closing the Path to transaction Completion • Cash consideration to be funded by combination of cash on balance sheet and debt financing; includes no financing contingency • Highly confident in our ability to obtain fully committed financing based on indications from two separate bulge bracket global banks for the entire cash portion of our proposal C h o i c e W y n d h a m 6

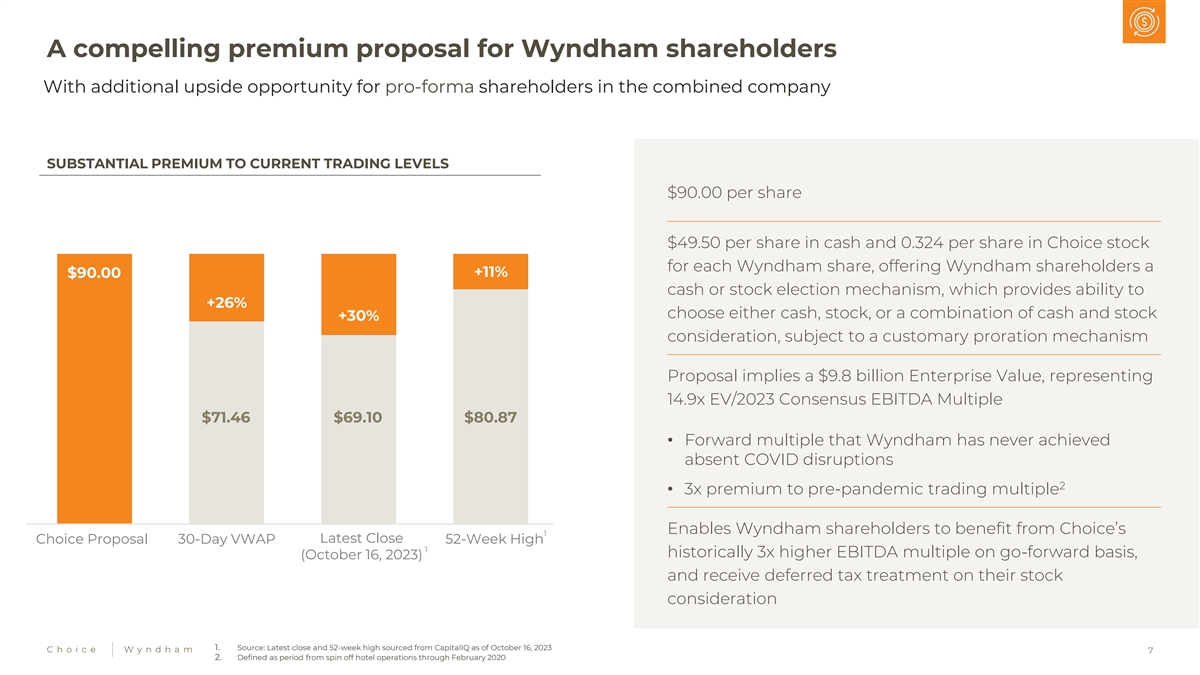

A compelling premium proposal for Wyndham shareholders With additional upside opportunity for pro-forma shareholders in the combined company SUBSTANTIAL PREMIUM TO CURRENT TRADING LEVELS $90.00 per share $49.50 per share in cash and 0.324 per share in Choice stock for each Wyndham share, offering Wyndham shareholders a $90.00 +11% cash or stock election mechanism, which provides ability to +26% choose either cash, stock, or a combination of cash and stock +30% consideration, subject to a customary proration mechanism Proposal implies a $9.8 billion Enterprise Value, representing 14.9x EV/2023 Consensus EBITDA Multiple $71.46 $69.10 $80.87 • Forward multiple that Wyndham has never achieved absent COVID disruptions 2 • 3x premium to pre-pandemic trading multiple Enables Wyndham shareholders to benefit from Choice’s 1 Latest Close Choice Proposal 30-Day VWAP 52-Week High 1 historically 3x higher EBITDA multiple on go-forward basis, (October 16, 2023) and receive deferred tax treatment on their stock consideration 1. Source: Latest close and 52-week high sourced from CapitalIQ as of October 16, 2023 C h o i c e W y n d h a m 7 2. Defined as period from spin off hotel operations through February 2020

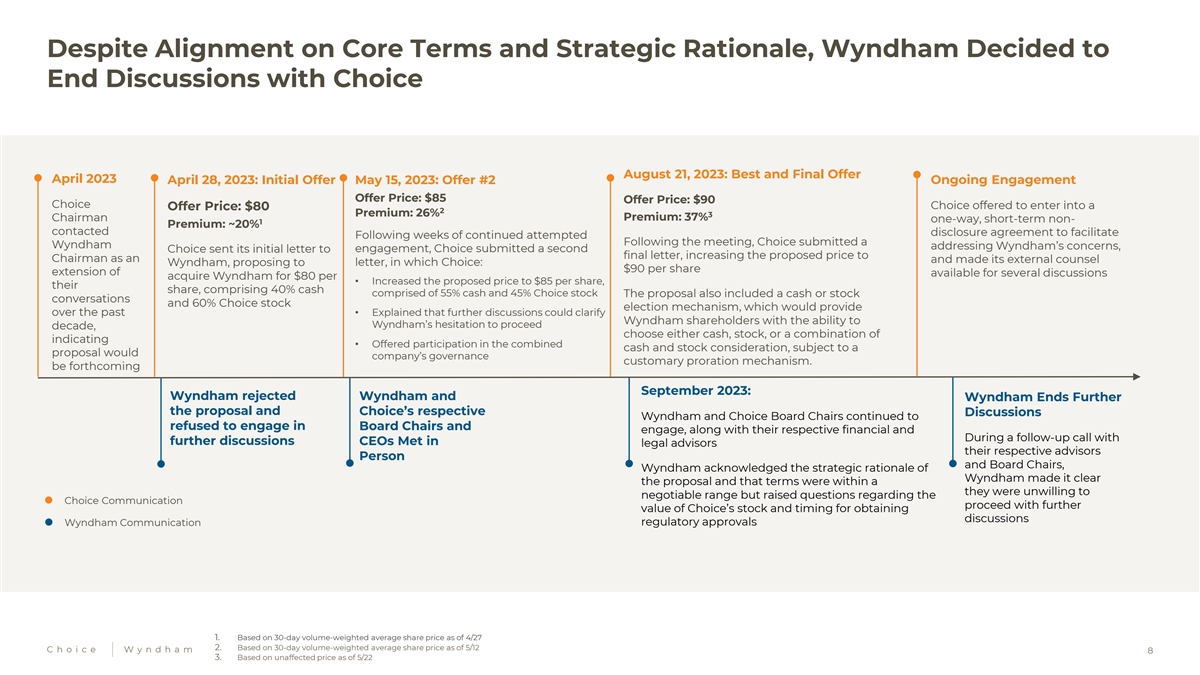

Despite Alignment on Core Terms and Strategic Rationale, Wyndham Decided to End Discussions with Choice August 21, 2023: Best and Final Offer April 2023 April 28, 2023: Initial Offer Ongoing Engagement May 15, 2023: Offer #2 Offer Price: $85 Offer Price: $90 Choice Choice offered to enter into a Offer Price: $80 2 Premium: 26% 3 Chairman Premium: 37% one-way, short-term non- 1 Premium: ~20% contacted disclosure agreement to facilitate Following weeks of continued attempted Following the meeting, Choice submitted a Wyndham addressing Wyndham’s concerns, Choice sent its initial letter to engagement, Choice submitted a second final letter, increasing the proposed price to Chairman as an and made its external counsel Wyndham, proposing to letter, in which Choice: $90 per share extension of available for several discussions acquire Wyndham for $80 per • Increased the proposed price to $85 per share, their share, comprising 40% cash comprised of 55% cash and 45% Choice stock The proposal also included a cash or stock conversations and 60% Choice stock election mechanism, which would provide over the past • Explained that further discussions could clarify Wyndham shareholders with the ability to Wyndham’s hesitation to proceed decade, choose either cash, stock, or a combination of indicating • Offered participation in the combined cash and stock consideration, subject to a proposal would company’s governance customary proration mechanism. be forthcoming September 2023: Wyndham rejected Wyndham and Wyndham Ends Further the proposal and Choice’s respective Discussions Wyndham and Choice Board Chairs continued to refused to engage in Board Chairs and engage, along with their respective financial and During a follow-up call with further discussions CEOs Met in legal advisors their respective advisors Person and Board Chairs, Wyndham acknowledged the strategic rationale of Wyndham made it clear the proposal and that terms were within a they were unwilling to negotiable range but raised questions regarding the Choice Communication proceed with further value of Choice’s stock and timing for obtaining discussions Wyndham Communication regulatory approvals 1. Based on 30-day volume-weighted average share price as of 4/27 2. Based on 30-day volume-weighted average share price as of 5/12 C h o i c e W y n d h a m 8 3. Based on unaffected price as of 5/22

Creates an asset-light franchise business with a shared history of C h o i c e & W y n d h a m value creation for franchisees, guests, and shareholders… ~16,360 >2,700 60 Million Open Hotels Hotels in Choice Privileges Globally Global Pipeline Rewards Members ~97% 112 99 Million Of U.S. Hotels Are Countries & Territories Wyndham Rewards Select Service Worldwide Members Only lodging company ~100% 1 Franchised All figures as of December 31, 2022 1 Choice Hotels and Wyndham owned and/or managed 19 hotels and 72 hotels respectively as of December 31, 2022 C C h h o o i i c c e e W W y y n n d d h h a a m m Note: Wyndham property counts exclude properties under affiliation arrangements with Wyndham Destinations or other 3rd parties (186 properties as of 12/31/2022). 9

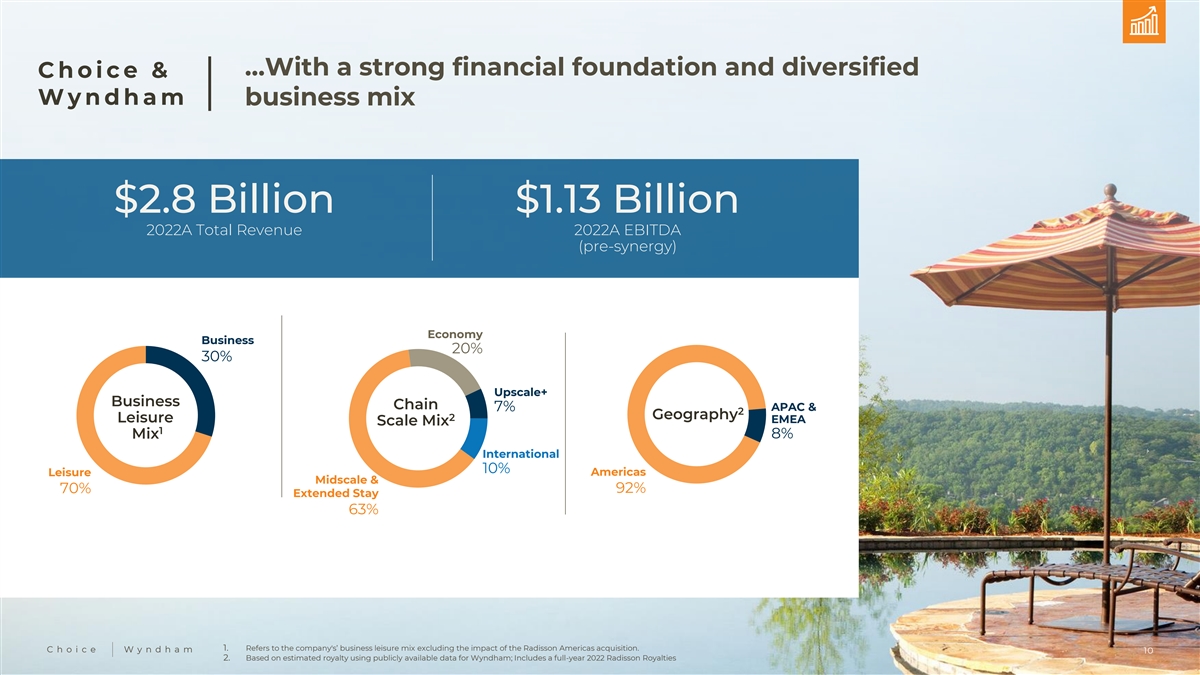

…With a strong financial foundation and diversified C h o i c e & W y n d h a m business mix $2.8 Billion $1.13 Billion 2022A Total Revenue 2022A EBITDA (pre-synergy) Economy Business 20% 30% Upscale+ Business Chain 7% APAC & 2 Geography 2 Leisure EMEA Scale Mix 1 Mix 8% International 10% Leisure Americas Midscale & 92% 70% Extended Stay 63% 1. Refers to the company's’ business leisure mix excluding the impact of the Radisson Americas acquisition. C C h h o o i i c c e e W W y y n n d d h h a a m m 10 2. Based on estimated royalty using publicly available data for Wyndham; Includes a full-year 2022 Radisson Royalties

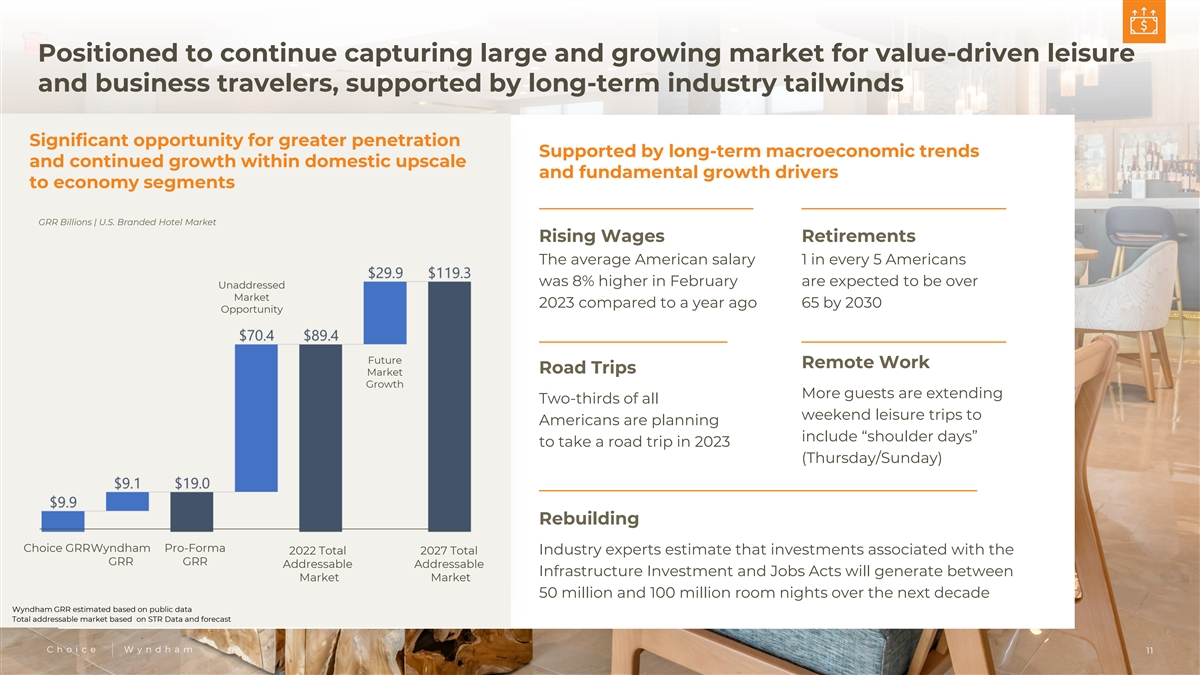

Positioned to continue capturing large and growing market for value-driven leisure and business travelers, supported by long-term industry tailwinds Significant opportunity for greater penetration Supported by long-term macroeconomic trends and continued growth within domestic upscale and fundamental growth drivers to economy segments GRR Billions | U.S. Branded Hotel Market Rising Wages Retirements The average American salary 1 in every 5 Americans was 8% higher in February are expected to be over Unaddressed Market 2023 compared to a year ago 65 by 2030 Opportunity Future Remote Work Road Trips Market Growth More guests are extending Two-thirds of all weekend leisure trips to Americans are planning include “shoulder days” to take a road trip in 2023 (Thursday/Sunday) Rebuilding Choice GRRWyndham Pro-Forma 2022 Total 2027 Total Industry experts estimate that investments associated with the GRR GRR Addressable Addressable Infrastructure Investment and Jobs Acts will generate between Market Market 50 million and 100 million room nights over the next decade Wyndham GRR estimated based on public data Total addressable market based on STR Data and forecast C C h h o o i i c c e e W W y y n n d d h h a a m m 11

Transaction additive to revenue intense strategy… • Choice’s proven franchisee success system is dedicated to Enhanced platform to attract driving incremental topline reservation delivery to hotel and retain higher revenue- owners and lowering total cost of operations, while still allowing franchisees to continue determining their own generating hotels, building on commercial and pricing strategy Choice’s existing revenue intense capabilities • Creates additional capacity to further support the company’s revenue intense strategy, ultimately helping drive growth across its organic revenue levers … by driving growth through all revenue levers C C h h o o i i c c e e W W y y n n d d h h a a m m 12

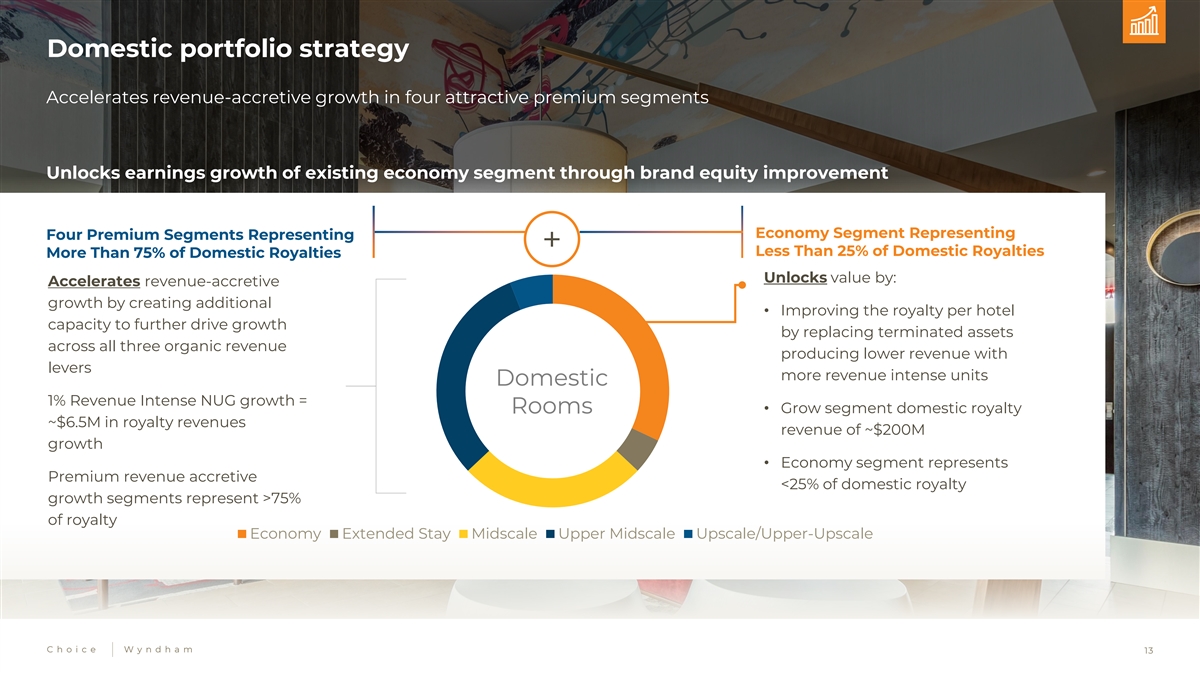

Domestic portfolio strategy Accelerates revenue-accretive growth in four attractive premium segments Unlocks earnings growth of existing economy segment through brand equity improvement Economy Segment Representing Four Premium Segments Representing + Less Than 25% of Domestic Royalties More Than 75% of Domestic Royalties Unlocks value by: Accelerates revenue-accretive growth by creating additional • Improving the royalty per hotel capacity to further drive growth by replacing terminated assets across all three organic revenue producing lower revenue with levers more revenue intense units Domestic 1% Revenue Intense NUG growth = Rooms• Grow segment domestic royalty ~$6.5M in royalty revenues revenue of ~$200M growth • Economy segment represents Premium revenue accretive <25% of domestic royalty growth segments represent >75% of royalty Economy Extended Stay Midscale Upper Midscale Upscale/Upper-Upscale C h o i c e W y n d h a m 13

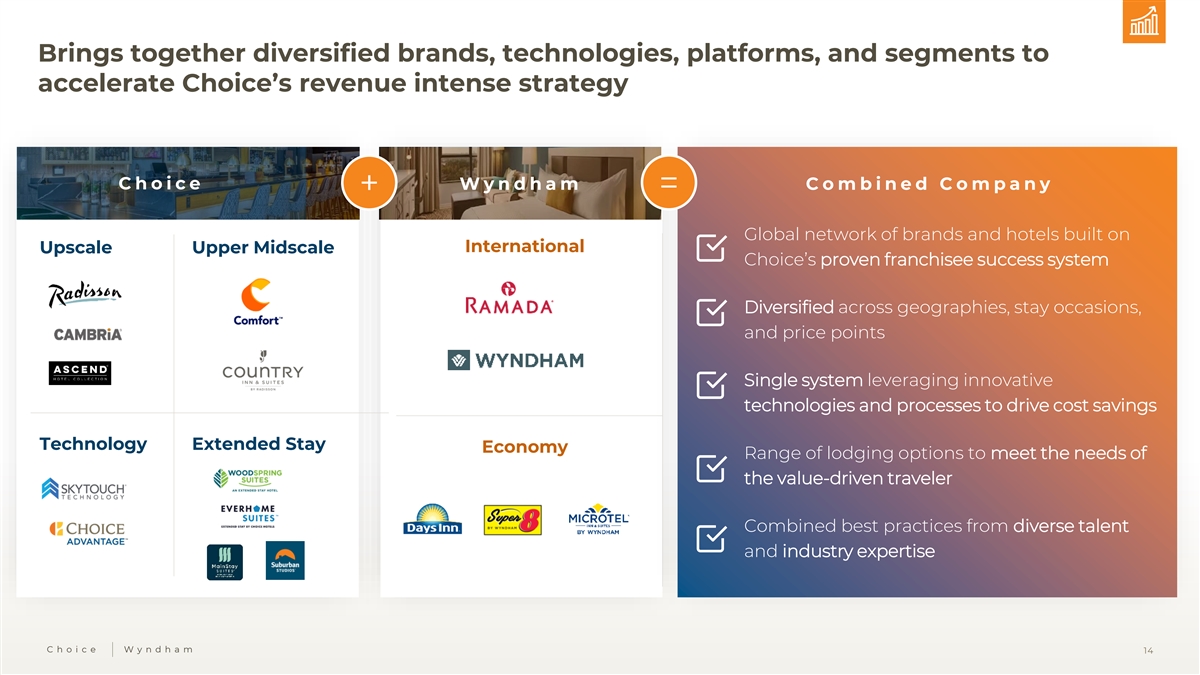

Brings together diversified brands, technologies, platforms, and segments to accelerate Choice’s revenue intense strategy C h o i c e W y n d h a m C o m b i n e d C o m p a n y + = Global network of brands and hotels built on International Upscale Upper Midscale Choice’s proven franchisee success system Diversified across geographies, stay occasions, and price points Single system leveraging innovative technologies and processes to drive cost savings Technology Extended Stay Economy Range of lodging options to meet the needs of the value-driven traveler Combined best practices from diverse talent and industry expertise C C h h o o i i c c e e W W y y n n d d h h a a m m 14

• Increased Proprietary Channel Contribution, driving more Enhances customers through the lowest cost direct booking channels franchisee return on • Optimized third-party distribution and vendor relationships investment will reduce costs Improved and Efficient 1 • Customer Acquisition Rewards membership base comprising up to 160M Including improvements in and Revenue Delivery• Members who are more likely to stay and book direct owner profitability and best-in-class resources • Higher umbrella brand marketing spend allows for greater customer reach • Combined segment expertise to improve training, systems, and processes to support franchisee management of labor costs • Purpose built, lower cost proprietary technology and direct Reduce Total Cost of booking channel offerings designed to maximize efficiency and Ownership Focused on minimize cost, while still determining own commercial and Franchisee Bottom Line pricing strategy • Combined resources to invest in tools to help franchisees address rising costs − Supply Chain Nearly Doubled − Labor Cost Resources to Invest − Inflationary Pressures and Evolve With • Improves the value of franchisees’ real estate assets by Franchisee Needs enhancing applicable cap rates and cash flows as a result of affiliation with the pro-forma company C C h h o o i i c c e e W W y y n n d d h h a a m m 15 1. As of December 31, 2022

Economies of scale in marketing and reservation spend drive additional value creation for franchisees In Business For $1.2 Billion Nearly 2x Yourself But Not By Combined Marketing & Combined Marketing & Yourself Reservation Spend Reservation Spend Used in 2022 Rewards Program Technology Investment National Media Campaigns Franchisee Tools Search Engine Innovation Optimization C h o i c e W y n d h a m 16 16

Builds on Choice’s proven franchisee success system Premier customer Proprietary technology Best-in-class franchisee delivery engine built by hotel experts for resources & support hotel owners Lower-cost customer acquisition Low cost-to-build hotel prototypes improve through high-performing franchisees' investment returns, operating Automation tools reduce proprietary channels profitability, and resiliency housekeeping and front desk costs Award-winning rewards program Dedicated revenue Award-winning, mobile- (60 million members) drives repeat management consultants supporting enabled pricing optimization business owners with best-in class cloud-based and merchandising tools allows revenue management tool owners to manage their business Negotiated lower third-party from anywhere reservations delivery rates and other Award-winning proprietary training suite benefits for franchisee owners and other services Leading-edge, low-cost cloud- based Property Management Suite of best practices and benchmarking System tools coupled with dedicated area director team to help franchisees reduce costs Industry's only proprietary reservations delivery system built on the Amazon cloud – reliable, innovative, scalable, and extensible 17 C h o i c e W y n d h a m 17

Guest Access • Access to a greater set of hotels, locations, and price points for a growing value-driven market • Unparalleled selection of accommodations with a Creates a leading hotel platform better carefully curated collection of properties positioned to capture a • Added redemption options for guests in upscale and sought-after leisure markets large and growing • Expanded opportunity for partnership across the travel ecosystem aimed at driving value for guests market opportunity Guest Experience • Two global hospitality technology initiatives and platforms are combined to enhance the guest experience, improve service delivery, and provide guests with a more effective and efficient booking and shopping system • Elevated customer service with increased assistance, convenience, personalization, and an enhanced rewards program C C h h o o i i c c e e W W y y n n d d h h a a m m 18

Leverages demonstrated history of In less than a year since acquisition, Choice: success • Drove a turnaround of Radisson Hotel Group Americas Americas' results with expected revenue contribution and cost savings ahead of Proven Playbook original expectations. Recent integration of nearly 600 Enabling Quick and Radisson Hotel Group Americas • Transitioned Radisson Hotel Group Americas properties to the Choice Efficient Integration hotels offers an integration franchisee success system, including distribution channels such as playbook with a proven history of Choice.com, by leveraging our proprietary technology offerings creating value for all • Fully integrated Radisson Hotel Group Americas Rewards Americas stakeholders program to our award-winning Choice Privileges program Franchisees: • Since joining, Radisson Hotel Group Americas franchisees have seen an improvement in look-to-book conversions, lowered distribution With Measurable costs, and improved guest traffic on proprietary channels Results for Franchisees, Shareholders: Shareholders, and • Realized revenue and cost synergies resulting in the Radisson Hotel Guests Group Americas business growing from ($12M) of EBITDA in 2021 to an expected $80M+ in 2024 • Drove synergy realization resulting in the acquisition of Radisson Hotel Group Americas for an effective multiple of less than 8x run-rate 1 EBITDA Guests: • Offers travelers of both systems greater access to hotels across the Americas, including additional properties in the Upscale, Midscale, and Extended Stay segments C C h h o o i i c c e e W W y y n n d d h h a a m m 19 1. Adjusted for Tax Structuring Benefits

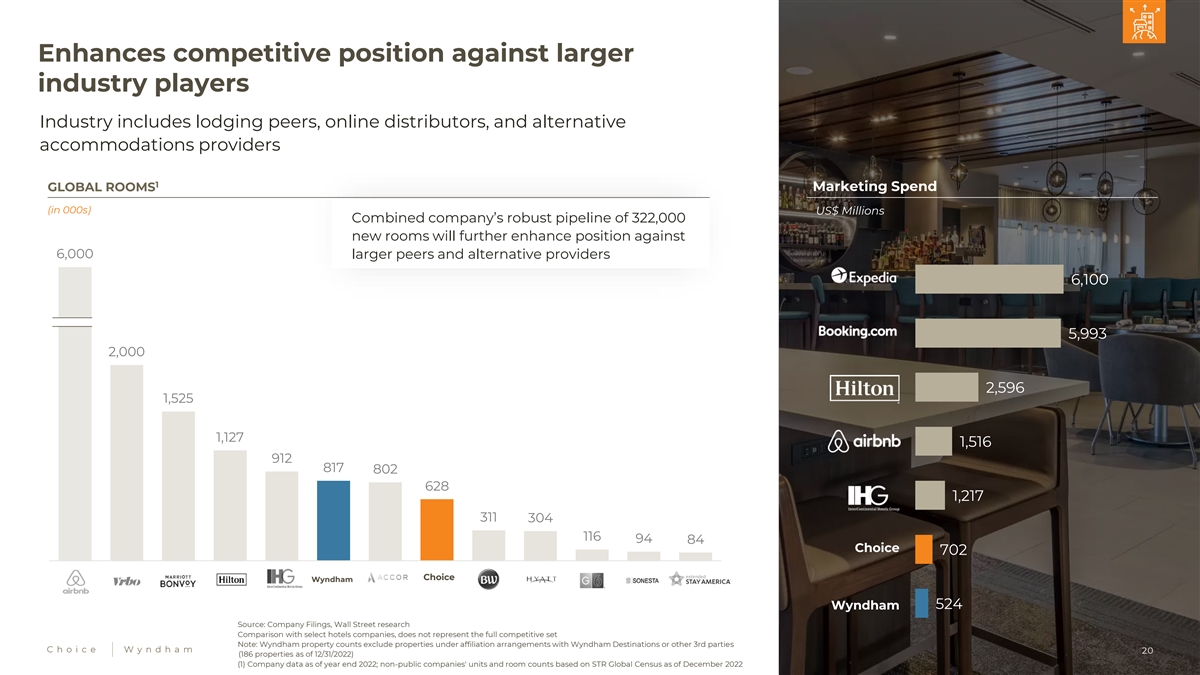

Enhances competitive position against larger industry players Industry includes lodging peers, online distributors, and alternative accommodations providers 1 GLOBAL ROOMS Marketing Spend (in 000s) US$ Millions Combined company’s robust pipeline of 322,000 new rooms will further enhance position against 6,000 larger peers and alternative providers 6,100 5,993 2,000 2,596 1,525 1,127 1,516 912 817 802 628 1,217 311 304 116 94 84 Choice 702 AirBnB VRBO Marriott Hilton IHG Alpine Accor Ch Ce hoi et ca eh Best Hyatt G6 Sonesta ESA Wyndham Western 524 Wyndham Source: Company Filings, Wall Street research Comparison with select hotels companies, does not represent the full competitive set Note: Wyndham property counts exclude properties under affiliation arrangements with Wyndham Destinations or other 3rd parties C h o i c e W y n d h a m 20 (186 properties as of 12/31/2022) (1) Company data as of year end 2022; non-public companies' units and room counts based on STR Global Census as of December 2022

Path to completion Choice strongly believes that the transaction is pro-competitive and will benefit all stakeholders, including Wyndham’s and Choice’s franchisees, shareholders, associates, and guests To be funded by Engaged Moelis & Company Choice is confident that combination of cash on LLC, Wells Fargo, and Willkie all regulatory approvals balance sheet and debt Farr & Gallagher LLP to assist can be obtained in due financing, confident in in expedited due diligence course to permit closing - ability to obtain the latter process the transaction Choice has demonstrated track record of completing and integrating acquisitions seamlessly, as evidenced by: • The Radisson Hotel Group Americas integration, which delivered increased financial benefits, exceeding expectations and ahead of schedule • Successful integration and growth of WoodSpring Suites brand C C h h o o i i c c e e W W y y n n d d h h a a m m 21

A Value Creating, Premium Proposal Offers Compelling Financial Benefits for Creates a Leading Hotel Platform Better both Choice and Wyndham Shareholders Positioned to Capture a Large and Growing Market Opportunity Combines Two Complementary Hotel Franchising Companies, Accelerating Opportunities for Sustained Long-Term Growth Enhances Competitive Position Against Larger Industry Players Enhances Opportunity for Franchisee Return on Investment 22 C C h h o o i i c c e e W W y y n n d d h h a a m m

Exhibit 99.2

FOR IMMEDIATE RELEASE

Choice Hotels Proposes to Acquire Wyndham Hotels & Resorts for $90.00 per Share in

Cash-and-Stock Transaction

Represents 26% Premium to 30-Day VWAP ending on October 16, 2023, 11% Premium to 52-Week

High, and 30% Premium to Latest Closing Price

Significantly Enhances the Return on Investment for Choice and Wyndham Franchisees

Provides a Compelling Range of Lodging Options and Price Points Well-Positioned to Serve Evolving

Needs of the Value-Driven Traveler

Annual Run-Rate Synergies of Approximately $150 Million Anticipated While Accelerating Opportunities

for Sustained Long-Term Growth

ROCKVILLE, Md., Oct. 17, 2023 – Choice Hotels International, Inc. (NYSE: CHH) (the “Company” or “Choice”), today announced a proposal to acquire all the outstanding shares of Wyndham Hotels & Resorts, Inc. (NYSE: WH) (“Wyndham”) at a price of $90.00 per share, payable in a mix of cash and stock.

Under Choice’s proposal, the $90.00 per share to be received by Wyndham shareholders would consist of $49.50 in cash and 0.324 shares of Choice common stock for each Wyndham share they own. Choice’s proposal represents a 26% premium to Wyndham’s 30-day volume-weighted average closing price ending on October 16, 2023, an 11% premium to Wyndham’s 52-week high, and a 30% premium to Wyndham’s latest closing price. In addition, Choice’s proposal includes a cash or stock election mechanism, which would provide Wyndham shareholders with the ability to choose either cash, stock, or a combination of cash and stock consideration, subject to a customary proration mechanism. The proposal implies a total equity value for Wyndham of approximately $7.8 billion on a fully diluted basis. With the assumption of Wyndham’s net debt, the proposed transaction is valued at approximately $9.8 billion.

Choice is making its latest proposal public following Wyndham’s decision to disengage from further discussions with Choice, following nearly six months of dialogue.

Patrick Pacious, President and Chief Executive Officer of Choice Hotels, said, “We have long respected Wyndham’s business and are confident that this combination would significantly accelerate both Choice’s and Wyndham’s long-term organic growth strategy for the benefit of all stakeholders. For franchisees, the transaction would bring Choice’s proven franchisee success system to a broader set of owners, enabling them to benefit from Choice’s world-class reservation platform and proprietary technology to drive cost savings and greater investment returns. Additionally, the value-driven leisure and business traveler would benefit from the combined company’s rewards program, which would be on par with the top two global hotel rewards programs, enabling them to receive greater value and access to a broader selection of options across stay occasions and price points.”

“A few weeks ago, Choice and Wyndham were in a negotiable range on price and consideration, and both parties have a shared recognition of the value opportunity this potential transaction represents. We were therefore surprised and disappointed that Wyndham decided to disengage. While we would have preferred to continue discussions with Wyndham in private, following their unwillingness to proceed, we feel there is too much value for both companies’ franchisees, shareholders, associates, and guests to not continue pursuing this transaction. Importantly, we remain convinced of both the many benefits of the combination and our ability to complete it,” concluded Pacious.

STAKEHOLDER BENEFITS

The proposed transaction is expected to provide important benefits for both companies’ stakeholders – franchisees, shareholders, associates, and guests – that will be particularly significant in the current uncertain economic climate:

| • | Franchisees Win with Lower Total Cost of Ownership and Increased Hotel Profitability. |

| • | Capitalizes on Choice’s proven franchisee success system, dedicated to driving incremental topline reservation delivery to hotel owners’ properties, while lowering the total cost of hotel operations. |

| • | Nearly doubles the resources available to spend on marketing and driving direct bookings to franchisees’ hotels, lowering the cost of customer acquisition. |

| • | Establishes an even larger rewards member base on par with the top two global programs in hospitality. |

| • | Drives more business to franchisees through lower cost direct booking channels, lower customer acquisition commissions and fees, and lower hotel operating costs and technology-driven labor efficiencies, while continuing to determine their own commercial and pricing strategy. |

| • | Improves the value of franchisees’ real estate assets by enhancing applicable cap rates and cash flows resulting from affiliation with the proforma company. |

| • | Reduces friction by offering guests a broad portfolio of brands across segments, no matter their stay occasions, within a single system. |

| • | Promotes increased investment and innovation in proprietary technology systems, processes, and training at the hotel and corporate level, which drives returns for Choice franchisees. |

| • | Creates an opportunity to replicate the tremendous success of Choice’s recent acquisition of Radisson Hotel Group Americas. During the integration of the nearly 600 Radisson Americas hotels into the Choice platform, Radisson’s franchisees have already meaningfully benefited from increased guest traffic to direct and digital channels, improvement in conversion rates, and access to more corporate accounts, among other benefits. |

| • | Shareholders Win with Superior Value Creation. |

| • | Represents a 26% premium to Wyndham’s 30-day volume-weighted average closing price ending on October 16, 2023, an 11% premium to the 52-week high, and a 30% premium to the latest closing price. |

| • | Anticipates meaningful annual run-rate synergies, estimated at approximately $150 million, through the rationalization of operational redundancies, duplicate public company costs, and topline growth potential. |

| • | Enables Wyndham shareholders to benefit from Choice’s historically 3x higher EBITDA multiple on a go-forward basis and receive deferred tax treatment on their stock consideration. |

| • | Creates additional capacity to further support Choice’s revenue intense strategy, ultimately helping drive growth across its organic revenue levers. |

| • | Generates predictable high free cash flow through an asset-light, fee-for-service model, providing resiliency through all economic cycles and enabling additional investments for future growth. |

| • | Offers Wyndham two seats on the combined company’s board and Wyndham shareholders the opportunity to participate in the significant upside potential of the combined company. |

| • | Cash/stock consideration mechanism enables Wyndham shareholders to choose between immediate upfront proceeds or long-term value creation, subject to a customary proration mechanism. |

| • | Guests Win with More Lodging Options and Value. |

| • | Creates a combined rewards program on par with the top two global programs in hospitality and will offer best-in-class program benefits through partnerships and compelling hotel redemption options. |

| • | Builds a global network of brands and hotels that meets the needs of the value-driven traveler across geographies, stay occasions and price points, supported by a seamless reservation system that provides guests with a more effective and efficient booking and shopping experience. |

| • | Improves data analytics, enabling the combined company to personalize communications and tailor recommendations to best meet the needs of the up to 160 million combined rewards program members. |

| • | Associates Win with Expanded Opportunities and Increased Stability. |

| • | Offers the ability to retain and attract “best-in-class” talent to one of the world’s premier hotel companies focused on employee well-being, bringing together a wide range of experience and deep industry expertise. |

| • | Provides more opportunities for advancement and career growth as part of a larger, more diversified organization. |

| • | Combines two performance-driven cultures with a continued emphasis on associate development and growth. |

RECENT ENGAGEMENT OVERTURES

Choice has been engaging with Wyndham for nearly six months.

In April 2023, Choice sent its initial letter to Wyndham regarding a potential transaction, proposing to acquire Wyndham for $80.00 per share, comprising 40% cash and 60% Choice stock. The proposal represented a 20% premium to the closing price of Wyndham common stock on April 27, 2023, and a 19% premium over Wyndham’s 30-day volume-weighted average share price as of such date. Wyndham rejected the proposal and refused to engage in further discussions.

In the days and weeks thereafter, Choice continued to attempt engagement with Wyndham, increasing its proposal to $85.00 per share, comprising 55% cash and 45% Choice stock, explaining that further discussions could clarify Wyndham’s hesitation to proceed with negotiations. The companies’ respective Board Chairs and CEOs then met in person, and following that meeting, Choice improved its proposal yet again. Choice made its best and final offer which represented an increase of the per-share consideration to $90.00, comprising 55% cash and 45% Choice stock.

In September 2023, the Choice and Wyndham Board Chairs continued engagement, along with each of their respective financial and legal advisors. Wyndham acknowledged the strategic rationale of the proposal and that terms were within a negotiable range but raised questions regarding the value of Choice stock and timing for obtaining regulatory approvals. In response, Choice proposed to enter into a one-way, short-term non-disclosure agreement to facilitate Choice providing information that would address Wyndham’s concerns (a draft of which was subsequently sent to Wyndham) and made its external counsel available for several discussions. However, during a follow-up call between the Chair of each company’s Board and their respective advisors, Wyndham made clear their unwillingness to proceed with further discussions.

The full text of each letter that Choice has sent to Wyndham, as well as additional materials regarding Choice’s proposal, is available at CreateValueWithChoice.com.

FINANCING, CONDITIONS AND APPROVALS

Closing of the contemplated transaction would be subject to satisfaction of customary closing conditions, including receipt of required shareholder and regulatory approvals. Choice would not make this offer if it were not confident that its franchisees and guests would embrace the proposed combination and that the transaction would receive applicable regulatory approvals in due course.

The cash portion of the purchase price is expected to be funded with a combination of cash on hand, as well as proceeds from the issuance of debt securities. Choice is highly confident in its ability to obtain fully committed financing based on indications from two separate bulge bracket global banks for the entire cash portion of our proposal. Strong free cash flows will allow for continued investments in the proforma business and rapid deleveraging of the balance sheet.

RECENT LETTER TO WYNDHAM BOARD

Below is the most recent letter sent to Wyndham’s Board of Directors:

August 21, 2023

Via Electronic Mail

Board of Directors

Wyndham Hotels & Resorts, Inc.

c/o Stephen P. Holmes, Chairman of the Board

22 Sylvan Way

Parsippany, NJ, 07054

Dear Directors:

On behalf of Choice Hotels International, Inc. (“Choice” or “we”), I am writing this letter to reiterate our strong interest in pursuing a business combination (the “Transaction”) with Wyndham Hotels & Resorts, Inc. (“Wyndham” or “you”). This fourth letter takes into consideration the feedback we received from you following our conversations and our last letter, dated May 31, 2023, and materially increases our offer.

We are now offering to acquire 100% of the fully diluted equity of Wyndham for $90.00 per share, a $5.00 per share increase from our offer on May 15, 2023 of $85.00 per share, and a $10.00 per share increase from our initial proposal on April 28, 2023. The aggregate Transaction consideration would be comprised of 55% cash and 45% shares of Choice stock. In addition, we propose to include a cash or stock election mechanism, which would provide your shareholders with the ability to choose either cash, stock or a combination of cash and stock consideration, allowing them to choose between realizing a substantial immediate cash premium or benefiting from the opportunity to participate in the material value creation of the combined platform, that we detail hereafter. Non-electing shareholders would receive all stock, and there would be a pro-ration mechanism should either cash or stock consideration be oversubscribed. Additionally, we are highly confident in our ability to obtain fully committed financing based on indications from two separate bulge bracket global banks for the entire cash portion of our proposal, removing any financing risk from our proposed transaction.

The proposed consideration of $90.00 per share represents a compelling valuation for your shareholders. It reflects a 37% premium to your unaffected stock price as of the May 22, 2023, the day before the WSJ article disclosing a possible transaction, an 11% premium to your 52-week high and a 24% premium to your most recent closing price on August 21, 2023. The implied valuation also reflects a 14.9x multiple of your consensus 2023 EBITDA estimates, a forward multiple that Wyndham has never achieved absent COVID disruptions, and comes at the high end of your equity research analyst price targets.

Our proposal to acquire Wyndham at a premium valuation reflects our conviction that a combined company will deliver significant value to shareholders - value creation, including over $100 million of target cost synergies, in which your shareholders will have the opportunity to participate. As 35% owners of the proforma company, Wyndham legacy shareholders stand to benefit from over

$500 million of value creation1 from the realization of cost synergies, in addition to the compelling premium offered and participation in the multiple expansion of the Wyndham business. We believe our track record of success has been and will continue to be recognized by the equity markets, as evidenced by our stock price. Additionally, we recently reaffirmed our commitment to growth in our press release dated July 11, 2023 and Q2 earnings release, in which we indicated our expectation to grow Choice EBITDA by 10% in 2024. We are committed to growing the combined business for the benefit of the combined company’s shareholders, customers, employees and franchisees. In addition, we continue to propose that two mutually acceptable independent members of the Wyndham board of directors join the Choice board upon the closing of the Transaction.

As previously stated, we would not require a financing contingency in connection with the Transaction. We believe our proposal will result in a combined company that has the financial flexibility to continue to invest in long-term growth initiatives to drive significant value creation for its shareholders and other constituents and will be well positioned to weather any unforeseen macro-economic challenges. Additionally, we do not anticipate this Transaction to have a significant impact on the combined company’s credit rating and that any rating action will be short-term given our ability to efficiently repay debt due to our high margin, high free cash flow generating business plan and would result in a rating that is equal to or better than Wyndham’s existing credit rating.

We are prepared to move expeditiously through any remaining due diligence, and we are confident we could execute definitive documents for the Transaction within 20 days of your agreement to engage with us on the basis of the terms of this letter. We anticipate requiring only limited time of your management to confirm our key assumptions around our business plan and potential synergies.

As you know, and as we have stated multiple times in the past, we respect what you, your management team and your board have accomplished. We have made extraordinary efforts to initiate a direct dialogue with you regarding the key economic terms of a Transaction, and while we recognize the interactions to date, we view them as limited, cursory and dismissive. We are perplexed by your obvious resistance to a frank and open commercial dialogue in light of the compelling value we are offering your shareholders, including the opportunity to participate in the future value creation of the combined company. This enhanced proposal, which is based on public information, represents our best and final offer. We believe the substantial and improved value it provides, with additional flexibility via the election mechanism, would be incredibly attractive to your shareholders.

We urge you to accept our offer and engage with us and our advisors openly and without delay so that we can advance a dialogue for the mutual benefit of our respective shareholders.

Best regards,

ADVISORS

Moelis & Company LLC and Wells Fargo are serving as financial advisors to Choice and Willkie Farr & Gallagher LLP is serving as legal advisor.

| 1 | $100 million of synergies x current Choice consensus 2023 EBITDA trading multiple of 15.0x = $1.50B x 35% pro forma Wyndham ownership |

About Choice Hotels®

Choice Hotels International, Inc. (NYSE: CHH) is one of the leading lodging franchisors in the world. Choice® has nearly 7,500 hotels, representing almost 630,000 rooms, in 46 countries and territories. A diverse portfolio of 22 brands that range from full-service upper upscale properties to midscale, extended stay and economy enables Choice® to meet travelers’ needs in more places and for more occasions while driving more value for franchise owners and shareholders. The award-winning Choice Privileges® loyalty program and co-brand credit card options provide members with a fast and easy way to earn reward nights and personalized perks. For more information, visit www.Choicehotels.com.

Forward-looking Statements

Information set forth herein includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward-looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions and expectations regarding future events, which, in turn, are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation, difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees may be difficult. Such statements may relate to projections of the company’s revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, RevPAR, the company’s ability to benefit from any rebound in travel demand, and the company’s liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors.

These and other risk factors that may affect Choice’s operations are discussed in detail in the company’s filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K and, as applicable, our Quarterly Reports on Form 10-Q. Choice undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measurements and Other Definitions

The company evaluates its operations utilizing, among others, the performance metric adjusted EBITDA, which is a non-GAAP financial measurement. This measure should not be considered as an alternative to any measure of performance or liquidity as promulgated under or authorized by GAAP, such as net income. The company’s calculation of this measurement may be different from the calculations used by

other companies, including Wyndham, and comparability may therefore be limited. We discuss management’s reasons for reporting this non-GAAP measure and how it is calculated below. In addition to the specific adjustments noted below with respect to adjusted EBITDA, the non-GAAP measures presented herein also exclude restructuring of the company’s operations including employee severance benefit, income taxes and legal costs, acquisition related due diligence, transition and transaction costs, and gains/losses on sale/disposal and impairment of assets primarily related to hotel ownership and development activities to allow for period-over-period comparison of ongoing core operations before the impact of these discrete and infrequent charges.

Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization: Adjusted EBITDA reflects net income excluding the impact of interest expense, interest income, provision for income taxes, depreciation and amortization, franchise-agreement acquisition cost amortization, other (gains) and losses, equity in net income (loss) of unconsolidated affiliates, mark -to-market adjustments on non-qualified retirement plan investments, share based compensation expense (benefit) and surplus or deficits generated by reimbursable revenue from franchised and managed properties. We consider adjusted EBITDA and adjusted EBITDA margins to be an indicator of operating performance because it measures our ability to service debt, fund capital expenditures, and expand our business. We also use these measures, as do analysts, lenders, investors, and others, to evaluate companies because it excludes certain items that can vary widely across industries or among companies within the same industry. For example, interest expense can be dependent on a company’s capital structure, debt levels, and credit ratings, and share based compensation expense (benefit) is dependent on the design of compensation plans in place and the usage of them. Accordingly, the impact of interest expense and share based compensation expense (benefit) on earnings can vary significantly among companies. The tax positions of companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary considerably among companies. These measures also exclude depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets or amortizing franchise-agreement acquisition costs. These differences can result in considerable variability in the relative asset costs and estimated lives and, therefore, the depreciation and amortization expense among companies. Mark-to-market adjustments on non-qualified retirement-plan investments recorded in SG&A are excluded from EBITDA, as the company accounts for these investments in accordance with accounting for deferred-compensation arrangements when investments are held in a rabbi trust and invested. Changes in the fair value of the investments are recognized as both compensation expense in SG&A and other gains and losses. As a result, the changes in the fair value of the investments do not have a material impact on the company’s net income. Surpluses and deficits generated from reimbursable revenues from franchised and managed properties are excluded, as the company’s franchise and management agreements require these revenues to be used exclusively for expenses associated with providing franchise and management services, such as central reservation and property-management systems, hotel employee and operating costs, reservation delivery and national marketing and media advertising. Franchised and managed property owners are required to reimburse the company for any deficits generated from these activities and the company is required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess the company’s operating performance.

RevPAR: RevPAR is calculated by dividing hotel room revenue by the total number of room nights available to guests for a given period. Management considers RevPAR to be a meaningful indicator of hotel performance and therefore company royalty and system revenues as it provides a metric correlated to the two key drivers of operations at a hotel: occupancy and ADR. The company calculates RevPAR based on information as reported by its franchisees. To accurately reflect RevPAR, the company may revise its prior years’ operating statistics for the most current information provided. RevPAR is also a useful indicator in measuring performance over comparable periods.

Pipeline: Pipeline is defined as hotels awaiting conversion, under construction or approved for development, and master development agreements committing owners to future franchise development.

Additional Information

This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham. In furtherance of this proposal and subject to future developments, Choice (and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed transaction.

Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document, prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders will be able to obtain free copies of these documents (if and when available) and other documents filed with the SEC by Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www.investor.choicehotels.com.

This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com.

Contacts

Andy Brimmer / Kelly Sullivan / Allison Sobel

Joele Frank, Wilkinson Brimmer Katcher

(212) 355-4449