Exhibit 1.5

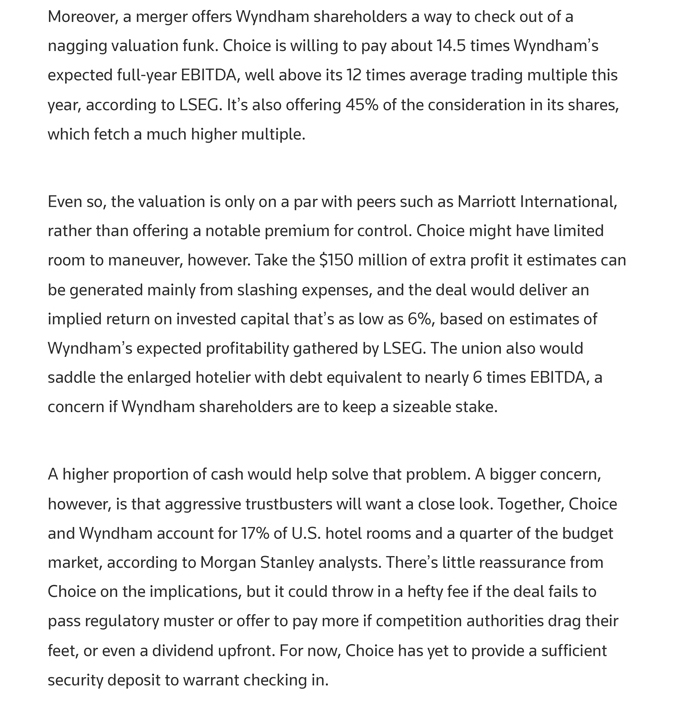

Wyndham suitor is unprepared to check in just yet No vacancy. Wyndham Hotels and Resorts is understandably demanding some room service. The budget lodging chain rejected a takeover bid from Choice Hotels International, a $10 billion entreaty its rival made public on Tuesday after months of private negotiations. Despite a 38% premium to Wyndham’s stock price back before talks surfaced in media reports, the valuation lacks comparative oomph and the offer also glosses over competition risks. The two sides have been at loggerheads since Choice first made its unsolicited proposal in April. Combining the two companies makes strategic sense: both focus on the mid-tier to discount hotel segments, where occupancy rates were less brutally hit by the pandemic than more upscale peers. Each also serves similar types of franchisees and can unite to cut costs and possibly lift revenue.