Forward-looking Statements Information set forth herein includes “forward-looking statements”. Certain, but not necessarily

all, of such forward-looking statements can be identified by the use of forward-looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,”

“forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s

current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction

between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties

as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of

any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in

connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the

expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its

franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation,

difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees

may be difficult. Such statements may relate to projections of Choice’s revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial

and operational measures, including occupancy and open hotels, revenue per available room, Choice’s ability to benefit from any rebound in travel demand, and Choice’s liquidity, among other matters. We caution you not to place undue

reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors. These and other risk factors that may affect Choice’s

operations are discussed in detail in the applicable company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and, as applicable, its or Wyndham’s

Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this communication or as of the date to which they refer, and Choice assumes no obligation to publicly update or

revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Non-GAAP Financial Measurements and Other Definitions Choice evaluates its

operations utilizing, among others, the performance metric adjusted EBITDA, which is a non-GAAP financial measurement. This measure should not be considered as an alternative to any measure of performance or

liquidity as promulgated under or authorized by GAAP, such as net income. Choice’s calculation of this measurement may be different from the calculations used by other companies, including Wyndham, and comparability may therefore be limited. We

discuss management’s reasons for reporting this non-GAAP measure and how it is calculated below. In addition to the specific adjustments noted below with respect to adjusted EBITDA, the non-GAAP measures presented herein also exclude restructuring of Choice’s operations including employee severance benefit, income taxes and legal costs, acquisition related due diligence, transition and

transaction costs, and gains/losses on sale/disposal and impairment of assets primarily related to hotel ownership and development activities to allow for period-over-period comparison of ongoing core operations before the impact of these discrete

and infrequent charges. Adjusted Earnings Before Interest, Taxes, Depreciation, and Amortization: Adjusted EBITDA reflects net income excluding the impact of interest expense, interest income, provision for income taxes, depreciation and

amortization, franchise-agreement acquisition cost amortization, other (gains) and losses, equity in net income (loss) of unconsolidated affiliates, markto-market adjustments on non-qualified retirement plan

investments, share based compensation expense (benefit) and surplus or deficits generated by reimbursable revenue from franchised and managed properties. We consider adjusted EBITDA and adjusted EBITDA margins to be an indicator of operating

performance because it measures our ability to service debt, fund capital expenditures, and expand our business. We also use these measures, as do analysts, lenders, investors, and others, to evaluate companies because it excludes certain items that

can vary widely across industries or among companies within the same industry. For example, interest expense can be dependent on a company’s capital structure, debt levels, and credit ratings, and share based compensation expense (benefit) is

dependent on the design of compensation plans in place and the usage of them. Accordingly, the impact of interest expense and share based compensation expense (benefit) on earnings can vary significantly among companies. The tax positions of

companies can also vary because of their differing abilities to take advantage of tax benefits and because of the tax policies of the jurisdictions in which they operate. As a result, effective tax rates and provision for income taxes can vary

considerably among companies. These measures also exclude depreciation and amortization because companies utilize productive assets of different ages and use different methods of both acquiring and depreciating productive assets or amortizing

franchise-agreement acquisition costs. These differences can result in considerable variability in the relative asset costs and estimated lives and, therefore, the depreciation and amortization expense among companies.

Mark-to-market adjustments on non-qualified retirement-plan investments recorded in SG&A are excluded from EBITDA, as Choice

accounts for these investments in accordance with accounting for deferred-compensation arrangements when investments are held in a rabbi trust and invested. Changes in the fair value of the investments are recognized as both compensation expense in

SG&A and other gains and losses. As a result, the changes in the fair value of the investments do not have a material impact on Choice’s net income. Surpluses and deficits generated from reimbursable revenues from franchised and managed

properties are excluded, as Choice’s franchise and management agreements require these revenues to be used exclusively for expenses associated with providing franchise and management services, such as central reservation and property-management

systems, hotel employee and operating costs, reservation delivery and national marketing and media advertising. Franchised and managed property owners are required to reimburse Choice for any deficits generated from these activities and Choice is

required to spend any surpluses generated in future periods. Since these activities will be managed to break-even over time, quarterly or annual surpluses and deficits have been excluded from the measurements utilized to assess Choice’s

operating performance. RevPAR: RevPAR is calculated by dividing hotel room revenue by the total number of room nights available to guests for a given period. Management considers RevPAR to be a meaningful indicator of hotel performance and therefore

company royalty and system revenues as it provides a metric correlated to the two key drivers of operations at a hotel: occupancy and ADR. Choice calculates RevPAR based on information as reported by its franchisees. To accurately reflect RevPAR,

Choice may revise its prior years’ operating statistics for the most current information provided. RevPAR is also a useful indicator in measuring performance over comparable periods. Pipeline: Pipeline is defined as hotels awaiting conversion,

under construction or approved for development, and master development agreements committing owners to future franchise development. This communication includes Wall Street consensus projected results for Choice and Wyndham for future periods.

Choice is including these consensus estimates for informational purposes only, but is not affirming analyst projections or separately including guidance on these metrics. Other information regarding Wyndham has been taken from, or based upon,

publicly available information. Choice does not take any responsibility for the accuracy or completeness of such information. To date, Choice has not had access to any non-public information of Wyndham.

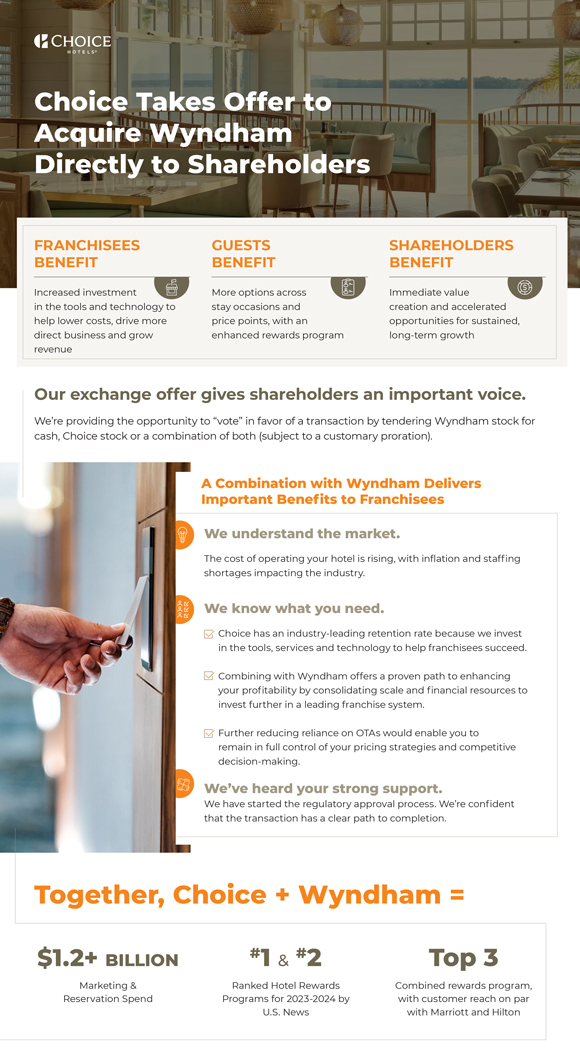

Additional Information This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham and the exchange offer which Choice, through WH Acquisition Corp., its wholly owned subsidiary, has made to

Wyndham stockholders. The exchange offer is being made pursuant to a tender offer statement on Schedule TO (including the offer to exchange, the letter of election and transmittal and other related offer documents) and a registration statement on

Form S-4 filed by Choice on December 12, 2023. These materials, as may be amended from time to time, contain important information, including the terms and conditions of the offer. In furtherance of this

proposal and subject to future developments, Choice (and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the

“SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed

transaction. This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document (including the offer to exchange, the letter of election and transmittal and other related offer

documents), prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or

prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders may obtain free copies of these documents (if and when available) and other documents filed with the SEC by

Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www. investor.choicehotels.com. This communication is neither a solicitation of a proxy nor a substitute for any proxy

statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the

proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on

March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if

and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com. In this

communication, we reference information and statistics regarding the Travel Industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market

research firms and other independent sources, such as Euromonitor International Limited. Some data and other information contained in this communication are also based on management’s estimates and calculations, which are derived from our

review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant

business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within these industries. While we believe such information is reliable, we have not independently verified

any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our

industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As

a result, you should be aware that market, ranking and other similar industry data including in this communication, and estimates and beliefs based on that data, may not be reliable. We cannot guarantee the accuracy or completeness of any such

information contained in this communication.