Exhibit 1.2 January 10, 2024 CHOICE AND WYNDHAM – A PRO-COMPETITIVE COMBINATION

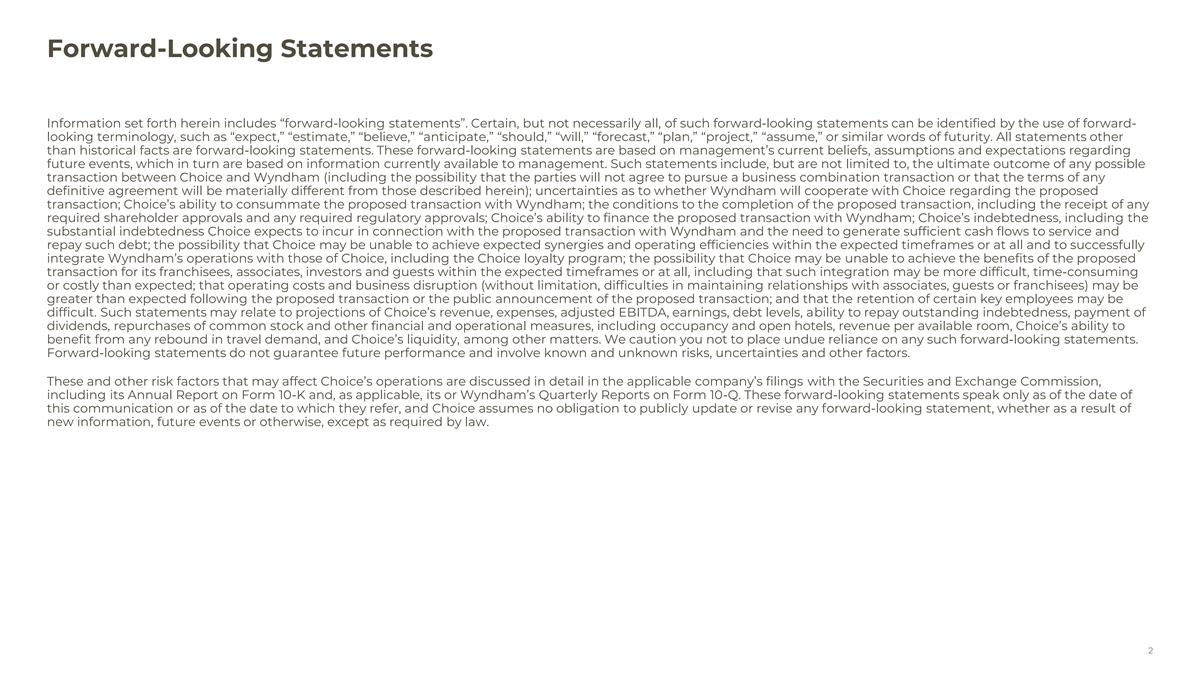

Forward-Looking Statements Information set forth herein includes “forward-looking statements”. Certain, but not necessarily all, of such forward-looking statements can be identified by the use of forward- looking terminology, such as “expect,” “estimate,” “believe,” “anticipate,” “should,” “will,” “forecast,” “plan,” “project,” “assume,” or similar words of futurity. All statements other than historical facts are forward-looking statements. These forward-looking statements are based on management’s current beliefs, assumptions and expectations regarding future events, which in turn are based on information currently available to management. Such statements include, but are not limited to, the ultimate outcome of any possible transaction between Choice and Wyndham (including the possibility that the parties will not agree to pursue a business combination transaction or that the terms of any definitive agreement will be materially different from those described herein); uncertainties as to whether Wyndham will cooperate with Choice regarding the proposed transaction; Choice’s ability to consummate the proposed transaction with Wyndham; the conditions to the completion of the proposed transaction, including the receipt of any required shareholder approvals and any required regulatory approvals; Choice’s ability to finance the proposed transaction with Wyndham; Choice’s indebtedness, including the substantial indebtedness Choice expects to incur in connection with the proposed transaction with Wyndham and the need to generate sufficient cash flows to service and repay such debt; the possibility that Choice may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate Wyndham’s operations with those of Choice, including the Choice loyalty program; the possibility that Choice may be unable to achieve the benefits of the proposed transaction for its franchisees, associates, investors and guests within the expected timeframes or at all, including that such integration may be more difficult, time-consuming or costly than expected; that operating costs and business disruption (without limitation, difficulties in maintaining relationships with associates, guests or franchisees) may be greater than expected following the proposed transaction or the public announcement of the proposed transaction; and that the retention of certain key employees may be difficult. Such statements may relate to projections of Choice’s revenue, expenses, adjusted EBITDA, earnings, debt levels, ability to repay outstanding indebtedness, payment of dividends, repurchases of common stock and other financial and operational measures, including occupancy and open hotels, revenue per available room, Choice’s ability to benefit from any rebound in travel demand, and Choice’s liquidity, among other matters. We caution you not to place undue reliance on any such forward-looking statements. Forward-looking statements do not guarantee future performance and involve known and unknown risks, uncertainties and other factors. These and other risk factors that may affect Choice’s operations are discussed in detail in the applicable company’s filings with the Securities and Exchange Commission, including its Annual Report on Form 10-K and, as applicable, its or Wyndham’s Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date of this communication or as of the date to which they refer, and Choice assumes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. 2

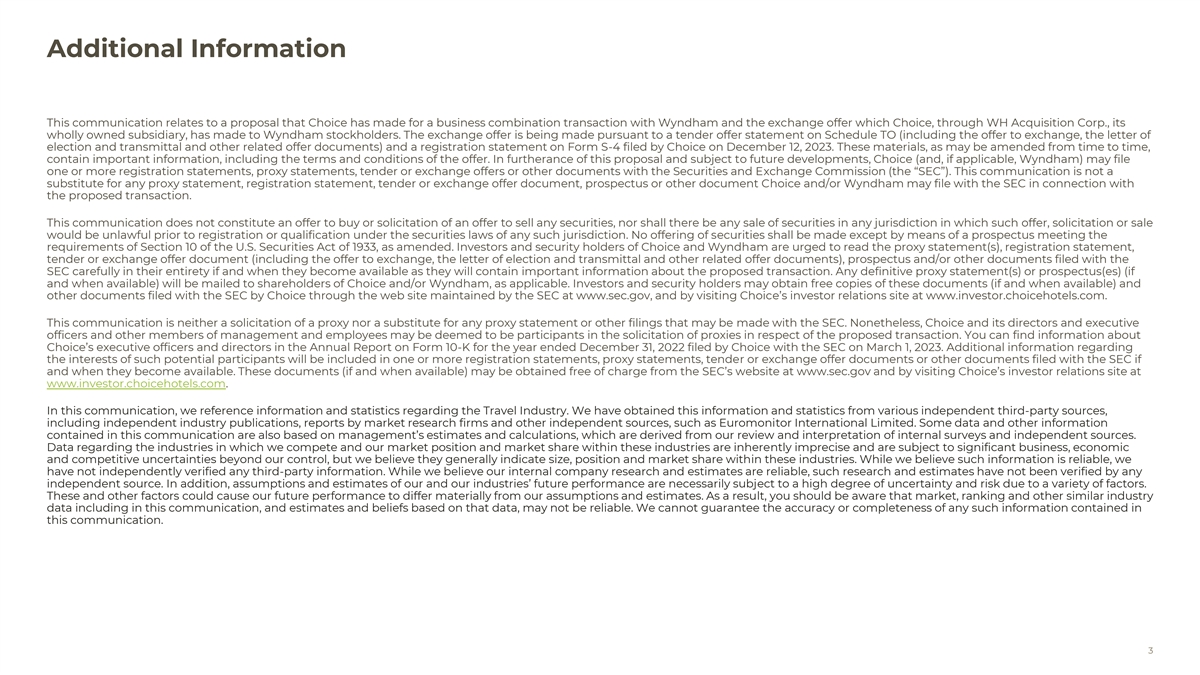

Additional Information This communication relates to a proposal that Choice has made for a business combination transaction with Wyndham and the exchange offer which Choice, through WH Acquisition Corp., its wholly owned subsidiary, has made to Wyndham stockholders. The exchange offer is being made pursuant to a tender offer statement on Schedule TO (including the offer to exchange, the letter of election and transmittal and other related offer documents) and a registration statement on Form S-4 filed by Choice on December 12, 2023. These materials, as may be amended from time to time, contain important information, including the terms and conditions of the offer. In furtherance of this proposal and subject to future developments, Choice (and, if applicable, Wyndham) may file one or more registration statements, proxy statements, tender or exchange offers or other documents with the Securities and Exchange Commission (the “SEC”). This communication is not a substitute for any proxy statement, registration statement, tender or exchange offer document, prospectus or other document Choice and/or Wyndham may file with the SEC in connection with the proposed transaction. This communication does not constitute an offer to buy or solicitation of an offer to sell any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended. Investors and security holders of Choice and Wyndham are urged to read the proxy statement(s), registration statement, tender or exchange offer document (including the offer to exchange, the letter of election and transmittal and other related offer documents), prospectus and/or other documents filed with the SEC carefully in their entirety if and when they become available as they will contain important information about the proposed transaction. Any definitive proxy statement(s) or prospectus(es) (if and when available) will be mailed to shareholders of Choice and/or Wyndham, as applicable. Investors and security holders may obtain free copies of these documents (if and when available) and other documents filed with the SEC by Choice through the web site maintained by the SEC at www.sec.gov, and by visiting Choice’s investor relations site at www.investor.choicehotels.com. This communication is neither a solicitation of a proxy nor a substitute for any proxy statement or other filings that may be made with the SEC. Nonetheless, Choice and its directors and executive officers and other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. You can find information about Choice’s executive officers and directors in the Annual Report on Form 10-K for the year ended December 31, 2022 filed by Choice with the SEC on March 1, 2023. Additional information regarding the interests of such potential participants will be included in one or more registration statements, proxy statements, tender or exchange offer documents or other documents filed with the SEC if and when they become available. These documents (if and when available) may be obtained free of charge from the SEC’s website at www.sec.gov and by visiting Choice’s investor relations site at www.investor.choicehotels.com. In this communication, we reference information and statistics regarding the Travel Industry. We have obtained this information and statistics from various independent third-party sources, including independent industry publications, reports by market research firms and other independent sources, such as Euromonitor International Limited. Some data and other information contained in this communication are also based on management’s estimates and calculations, which are derived from our review and interpretation of internal surveys and independent sources. Data regarding the industries in which we compete and our market position and market share within these industries are inherently imprecise and are subject to significant business, economic and competitive uncertainties beyond our control, but we believe they generally indicate size, position and market share within these industries. While we believe such information is reliable, we have not independently verified any third-party information. While we believe our internal company research and estimates are reliable, such research and estimates have not been verified by any independent source. In addition, assumptions and estimates of our and our industries’ future performance are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. These and other factors could cause our future performance to differ materially from our assumptions and estimates. As a result, you should be aware that market, ranking and other similar industry data including in this communication, and estimates and beliefs based on that data, may not be reliable. We cannot guarantee the accuracy or completeness of any such information contained in this communication. 3

A Choice-Wyndham Combination is Well Positioned for Regulatory Approval Wyndham’s market definition is wrong. It supposes an overly narrow, manipulated market that 1 is inconsistent with antitrust law, as it focuses on price segmentation and excludes independent hotels Choice and Wyndham combined are only 10% of the relevant market. Franchisors compete for 2 1 hotels across STR chain scales and independent hotels actively compete with franchised brands Important new players are entering already competitive market. Key new competitive brands 3 are backed by well capitalized players with active competition among existing brands Deal would create a better competitor against Marriott, Hilton and OTAs. Choice-Wyndham 4 franchisees could better compete against dominant players and fight the immense power of the OTAs like Expedia and Booking Franchisees benefit. The combination would lower guest acquisition and operating costs and 5 drive top-line growth through increased brand marketing Guests benefit. The combined company would create an enhanced rewards program and 6 provide a fulsome suite of participating properties across hotel types and locations Choice has proactively commenced the antitrust review and expects it to take less than 12 months; the real risk of delay is Wyndham’s intransigence and attempts to manipulate the regulatory process 4 1. STR, a division of CoStar Group, Inc., provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry.

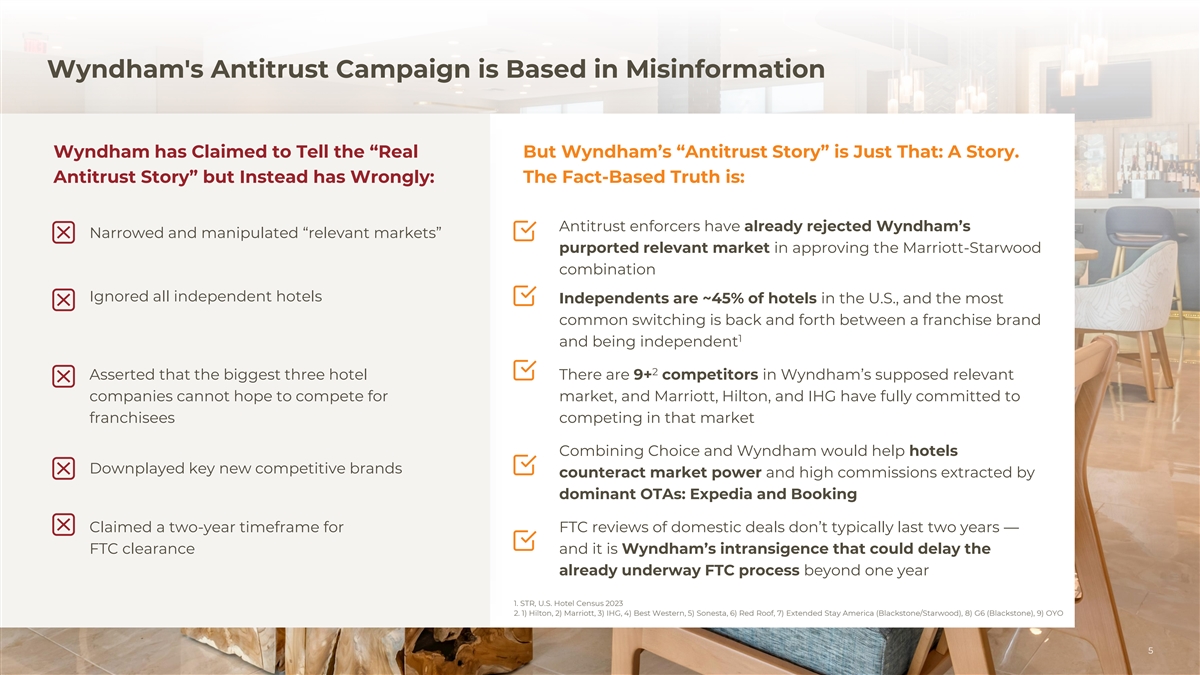

Wyndham's Antitrust Campaign is Based in Misinformation Wyndham has Claimed to Tell the “Real But Wyndham’s “Antitrust Story” is Just That: A Story. Antitrust Story” but Instead has Wrongly: The Fact-Based Truth is: Antitrust enforcers have already rejected Wyndham’s Narrowed and manipulated “relevant markets” purported relevant market in approving the Marriott-Starwood combination Ignored all independent hotels Independents are ~45% of hotels in the U.S., and the most common switching is back and forth between a franchise brand 1 and being independent 2 Asserted that the biggest three hotel There are 9+ competitors in Wyndham’s supposed relevant companies cannot hope to compete for market, and Marriott, Hilton, and IHG have fully committed to franchisees competing in that market Combining Choice and Wyndham would help hotels Downplayed key new competitive brands counteract market power and high commissions extracted by dominant OTAs: Expedia and Booking Claimed a two-year timeframe for FTC reviews of domestic deals don’t typically last two years — FTC clearance and it is Wyndham’s intransigence that could delay the already underway FTC process beyond one year 1. STR, U.S. Hotel Census 2023 2. 1) Hilton, 2) Marriott, 3) IHG, 4) Best Western, 5) Sonesta, 6) Red Roof, 7) Extended Stay America (Blackstone/Starwood), 8) G6 (Blackstone), 9) OYO 5

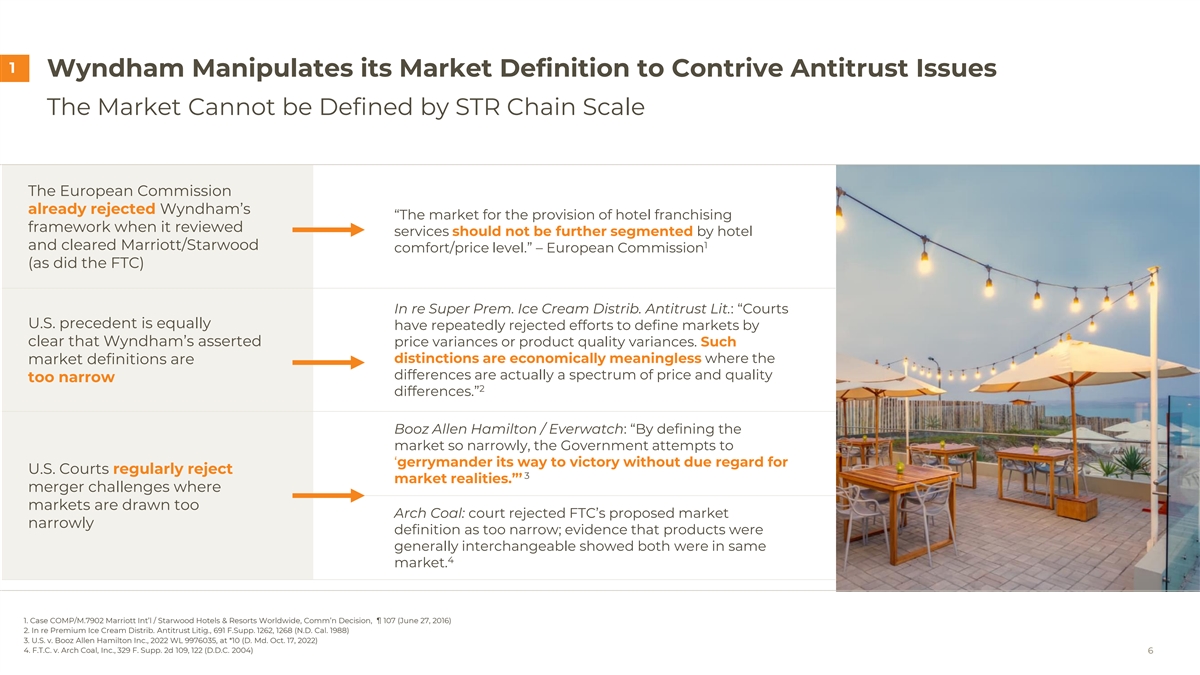

1 Wyndham Manipulates its Market Definition to Contrive Antitrust Issues The Market Cannot be Defined by STR Chain Scale The European Commission already rejected Wyndham’s “The market for the provision of hotel franchising framework when it reviewed services should not be further segmented by hotel 1 and cleared Marriott/Starwood comfort/price level.” – European Commission (as did the FTC) In re Super Prem. Ice Cream Distrib. Antitrust Lit.: “Courts U.S. precedent is equally have repeatedly rejected efforts to define markets by clear that Wyndham’s asserted price variances or product quality variances. Such distinctions are economically meaningless where the market definitions are differences are actually a spectrum of price and quality too narrow 2 differences.” Booz Allen Hamilton / Everwatch: “By defining the market so narrowly, the Government attempts to ‘gerrymander its way to victory without due regard for U.S. Courts regularly reject 3 market realities.”’ merger challenges where markets are drawn too Arch Coal: court rejected FTC’s proposed market narrowly definition as too narrow; evidence that products were generally interchangeable showed both were in same 4 market. 1. Case COMP/M.7902 Marriott Int’l / Starwood Hotels & Resorts Worldwide, Comm’n Decision, ¶ 107 (June 27, 2016) 2. In re Premium Ice Cream Distrib. Antitrust Litig., 691 F.Supp. 1262, 1268 (N.D. Cal. 1988) 3. U.S. v. Booz Allen Hamilton Inc., 2022 WL 9976035, at *10 (D. Md. Oct. 17, 2022) 4. F.T.C. v. Arch Coal, Inc., 329 F. Supp. 2d 109, 122 (D.D.C. 2004) 6

1 In Wyndham's World, These Hotels Don't Compete for Guests Economy Midscale Upper Midscale Upscale 7

1 Wyndham Manipulates its Market Definition to Contrive Antitrust Issues Franchising Services Cannot Be Subdivided By STR Chain Scale Wyndham arbitrarily Wyndham’s market definitions ignore that entry, expansion segments hotel competition and repositioning are rampant within & across STR chain scales based on STR chain scales, but 1 When franchisors successfully convert a hotel, ~47% of the STR chain scales are not time, the hotel moves up or down STR chain scales — often meaningful under antitrust law two or more at a time What (Midscale) (Economy) doesn’t compete for franchisees with Wyndham These arguments is arguing (Economy) (Midscale) doesn’t compete for franchisees with make no practical sense (Midscale) (Upper Midscale) doesn’t compete for franchisees with (Upper Midscale) doesn’t compete for franchisees with (Upscale) (Upscale) doesn’t compete for franchisees with (Upper Upscale) (Midscale) (Upper Midscale) doesn’t compete for franchisees with 8 1. STR, U.S. Hotel Census, 2019-2023

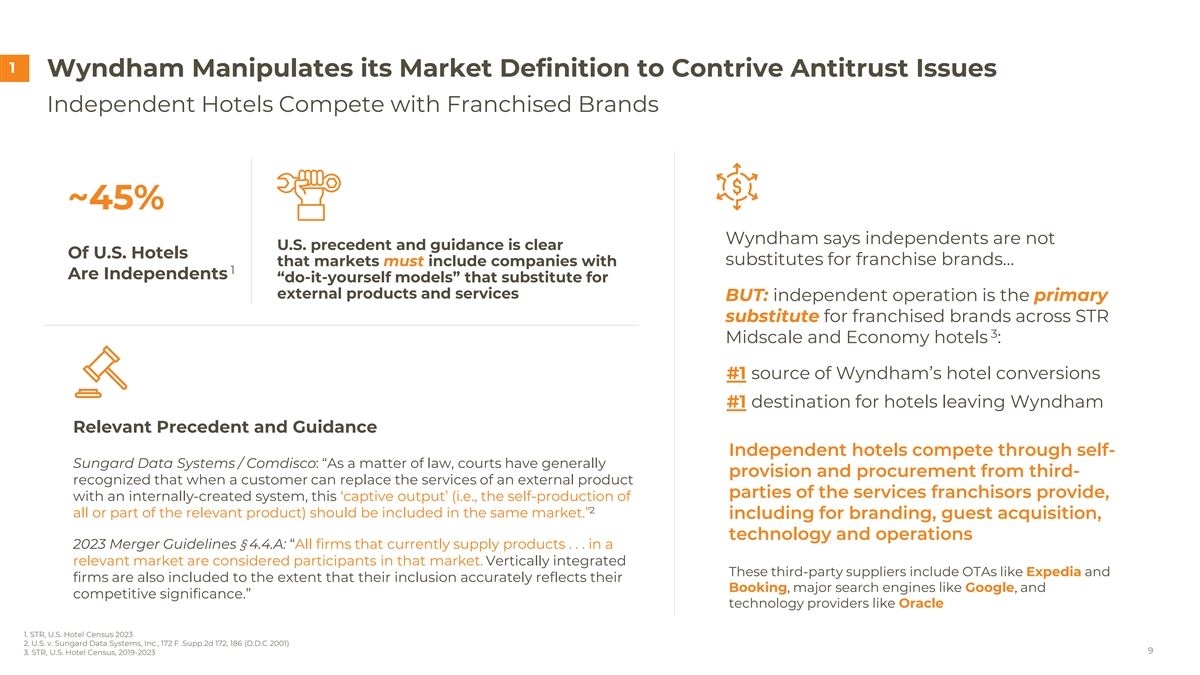

1 Wyndham Manipulates its Market Definition to Contrive Antitrust Issues Independent Hotels Compete with Franchised Brands ~45% Wyndham says independents are not U.S. precedent and guidance is clear Of U.S. Hotels substitutes for franchise brands… that markets must include companies with 1 Are Independents “do-it-yourself models” that substitute for external products and services BUT: independent operation is the primary substitute for franchised brands across STR 3 Midscale and Economy hotels : #1 source of Wyndham’s hotel conversions #1 destination for hotels leaving Wyndham Relevant Precedent and Guidance Independent hotels compete through self- Sungard Data Systems / Comdisco: “As a matter of law, courts have generally provision and procurement from third- recognized that when a customer can replace the services of an external product parties of the services franchisors provide, with an internally-created system, this ‘captive output’ (i.e., the self-production of 2 all or part of the relevant product) should be included in the same market.” including for branding, guest acquisition, technology and operations 2023 Merger Guidelines § 4.4.A: “All firms that currently supply products . . . in a relevant market are considered participants in that market. Vertically integrated These third-party suppliers include OTAs like Expedia and firms are also included to the extent that their inclusion accurately reflects their Booking, major search engines like Google, and competitive significance.” technology providers like Oracle 1. STR, U.S. Hotel Census 2023 2. U.S. v. Sungard Data Systems, Inc., 172 F .Supp.2d 172, 186 (D.D.C 2001) 9 3. STR, U.S. Hotel Census, 2019-2023

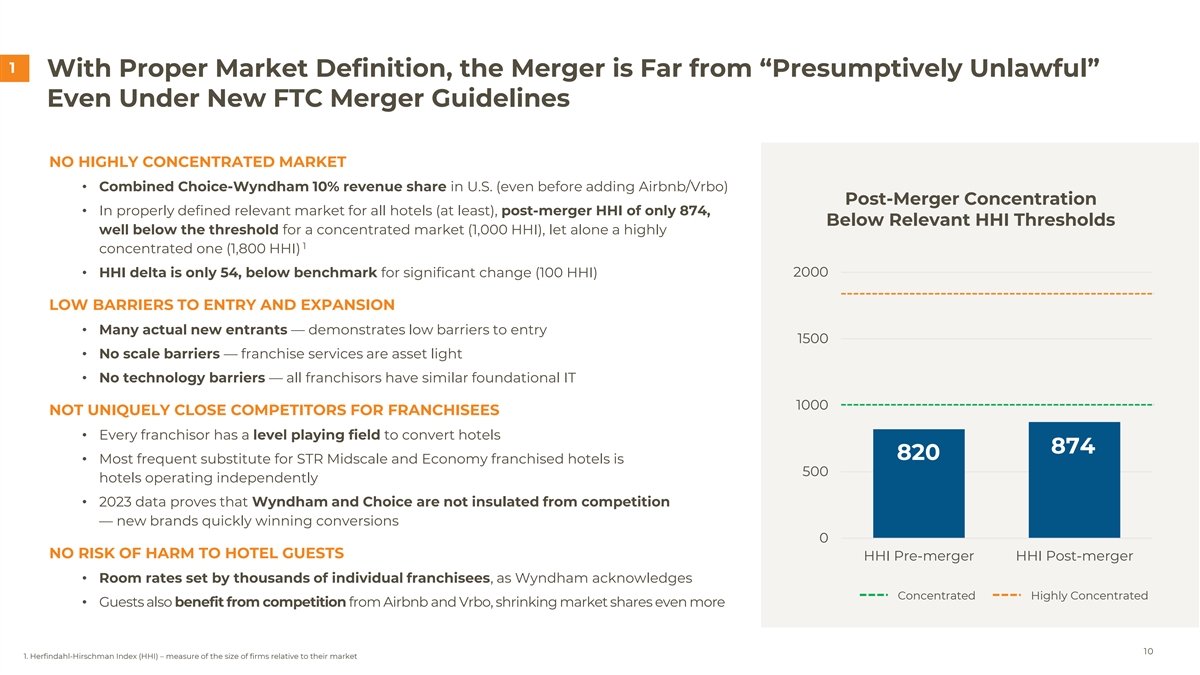

1 With Proper Market Definition, the Merger is Far from “Presumptively Unlawful” Even Under New FTC Merger Guidelines NO HIGHLY CONCENTRATED MARKET • Combined Choice-Wyndham 10% revenue share in U.S. (even before adding Airbnb/Vrbo) Post-Merger Concentration • In properly defined relevant market for all hotels (at least), post-merger HHI of only 874, Below Relevant HHI Thresholds well below the threshold for a concentrated market (1,000 HHI), let alone a highly 1 concentrated one (1,800 HHI) • HHI delta is only 54, below benchmark for significant change (100 HHI) 2000 LOW BARRIERS TO ENTRY AND EXPANSION • Many actual new entrants — demonstrates low barriers to entry 1500 • No scale barriers — franchise services are asset light • No technology barriers — all franchisors have similar foundational IT 1000 NOT UNIQUELY CLOSE COMPETITORS FOR FRANCHISEES • Every franchisor has a level playing field to convert hotels 874 820 • Most frequent substitute for STR Midscale and Economy franchised hotels is 500 hotels operating independently • 2023 data proves that Wyndham and Choice are not insulated from competition — new brands quickly winning conversions 0 NO RISK OF HARM TO HOTEL GUESTS HHI Pre-merger HHI Post-merger • Room rates set by thousands of individual franchisees, as Wyndham acknowledges Concentrated Highly Concentrated • Guests also benefit from competition from Airbnb and Vrbo, shrinking market shares even more 10 1. Herfindahl-Hirschman Index (HHI) – measure of the size of firms relative to their market

2 No Antitrust Problem Even if You Accept Wyndham’s Incorrect Market Definition Many Brands Compete for STR Midscale and Economy Hotels 9 other franchisors competing for STR midscale and economy franchisee conversions today From Wyndham’s December 18, 2023, presentation Wyndham itself references this competition in claiming to be worried about the merger review timing Competition from these brands is — and will remain — intense post-merger 11

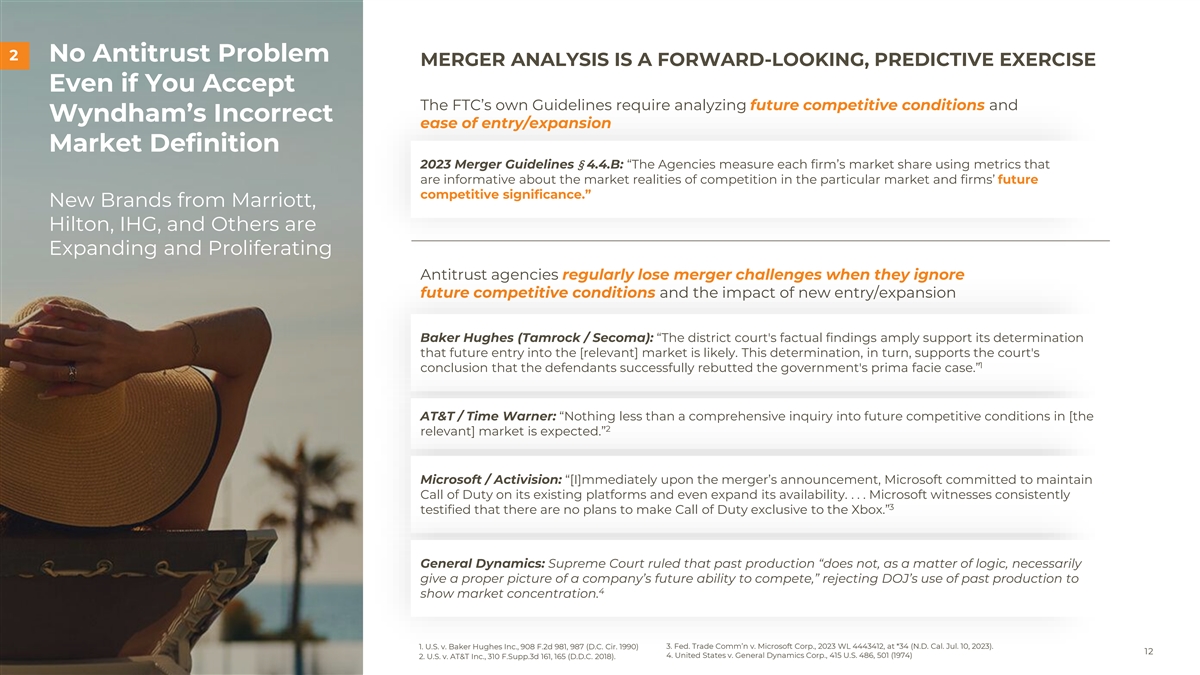

2 No Antitrust Problem MERGER ANALYSIS IS A FORWARD-LOOKING, PREDICTIVE EXERCISE Even if You Accept The FTC’s own Guidelines require analyzing future competitive conditions and Wyndham’s Incorrect ease of entry/expansion Market Definition 2023 Merger Guidelines § 4.4.B: “The Agencies measure each firm’s market share using metrics that are informative about the market realities of competition in the particular market and firms’ future competitive significance.” New Brands from Marriott, Hilton, IHG, and Others are Expanding and Proliferating Antitrust agencies regularly lose merger challenges when they ignore future competitive conditions and the impact of new entry/expansion Baker Hughes (Tamrock / Secoma): “The district court's factual findings amply support its determination that future entry into the [relevant] market is likely. This determination, in turn, supports the court's 1 conclusion that the defendants successfully rebutted the government's prima facie case.” AT&T / Time Warner: “Nothing less than a comprehensive inquiry into future competitive conditions in [the 2 relevant] market is expected.” Microsoft / Activision: “[I]mmediately upon the merger’s announcement, Microsoft committed to maintain Call of Duty on its existing platforms and even expand its availability. . . . Microsoft witnesses consistently 3 testified that there are no plans to make Call of Duty exclusive to the Xbox.” General Dynamics: Supreme Court ruled that past production “does not, as a matter of logic, necessarily give a proper picture of a company’s future ability to compete,” rejecting DOJ’s use of past production to 4 show market concentration. 3. Fed. Trade Comm’n v. Microsoft Corp., 2023 WL 4443412, at *34 (N.D. Cal. Jul. 10, 2023). 1. U.S. v. Baker Hughes Inc., 908 F.2d 981, 987 (D.C. Cir. 1990) 12 2. U.S. v. AT&T Inc., 310 F.Supp.3d 161, 165 (D.D.C. 2018). 4. United States v. General Dynamics Corp., 415 U.S. 486, 501 (1974)

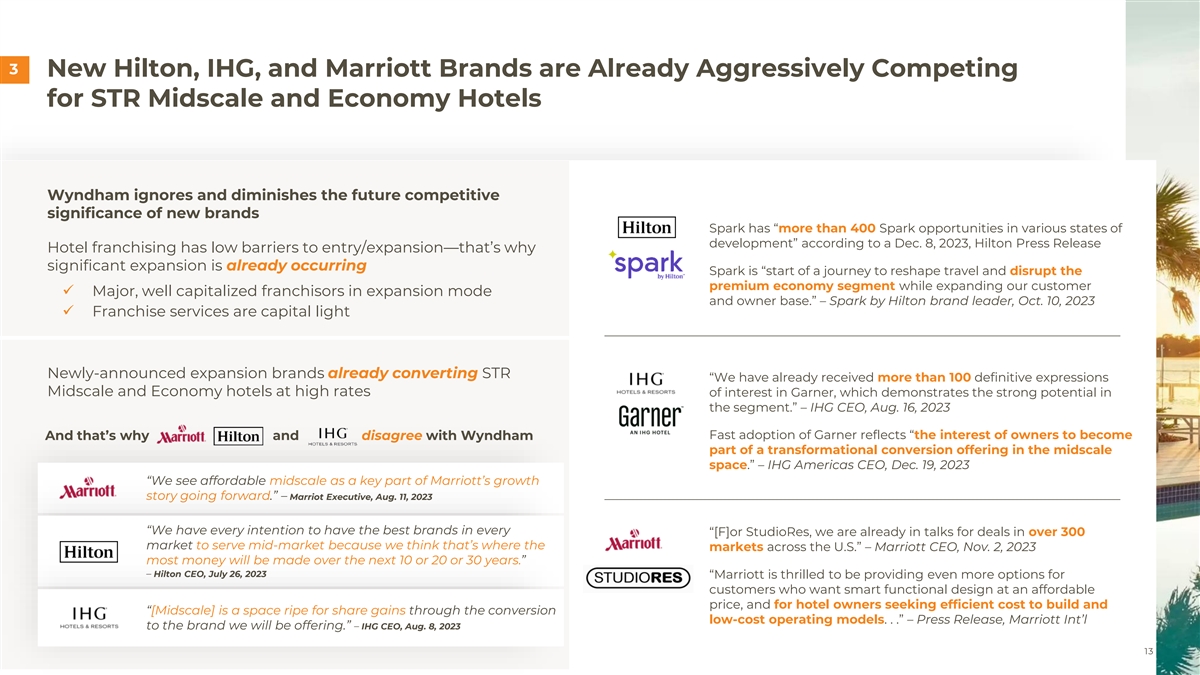

3 New Hilton, IHG, and Marriott Brands are Already Aggressively Competing for STR Midscale and Economy Hotels Wyndham ignores and diminishes the future competitive significance of new brands Spark has “more than 400 Spark opportunities in various states of development” according to a Dec. 8, 2023, Hilton Press Release Hotel franchising has low barriers to entry/expansion—that’s why significant expansion is already occurring Spark is “start of a journey to reshape travel and disrupt the premium economy segment while expanding our customer ✓ Major, well capitalized franchisors in expansion mode and owner base.” – Spark by Hilton brand leader, Oct. 10, 2023 ✓ Franchise services are capital light Newly-announced expansion brands already converting STR “We have already received more than 100 definitive expressions Midscale and Economy hotels at high rates of interest in Garner, which demonstrates the strong potential in the segment.” – IHG CEO, Aug. 16, 2023 Fast adoption of Garner reflects “the interest of owners to become And that’s why and disagree with Wyndham part of a transformational conversion offering in the midscale space.” – IHG Americas CEO, Dec. 19, 2023 “We see affordable midscale as a key part of Marriott’s growth story going forward.” – Marriot Executive, Aug. 11, 2023 “We have every intention to have the best brands in every “[F]or StudioRes, we are already in talks for deals in over 300 market to serve mid-market because we think that’s where the markets across the U.S.” – Marriott CEO, Nov. 2, 2023 most money will be made over the next 10 or 20 or 30 years.” – Hilton CEO, July 26, 2023 “Marriott is thrilled to be providing even more options for customers who want smart functional design at an affordable price, and for hotel owners seeking efficient cost to build and “[Midscale] is a space ripe for share gains through the conversion low-cost operating models. . .” – Press Release, Marriott Int’l to the brand we will be offering.” – IHG CEO, Aug. 8, 2023 13 13

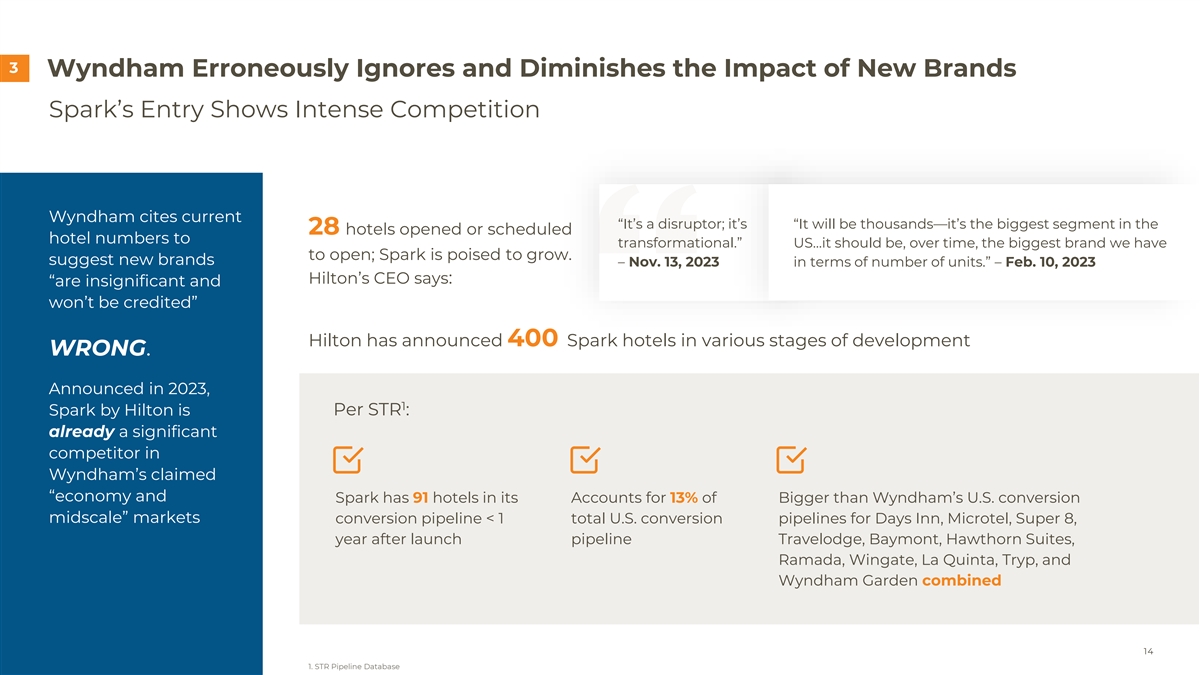

3 Wyndham Erroneously Ignores and Diminishes the Impact of New Brands Spark’s Entry Shows Intense Competition Wyndham cites current “It’s a disruptor; it’s “It will be thousands—it’s the biggest segment in the 28 hotels opened or scheduled hotel numbers to transformational.” US…it should be, over time, the biggest brand we have to open; Spark is poised to grow. suggest new brands – Nov. 13, 2023 in terms of number of units.” – Feb. 10, 2023 Hilton’s CEO says: “are insignificant and won’t be credited” Hilton has announced 400 Spark hotels in various stages of development WRONG. Announced in 2023, 1 Per STR : Spark by Hilton is already a significant competitor in Wyndham’s claimed “economy and Spark has 91 hotels in its Accounts for 13% of Bigger than Wyndham’s U.S. conversion midscale” markets conversion pipeline < 1 total U.S. conversion pipelines for Days Inn, Microtel, Super 8, year after launch pipeline Travelodge, Baymont, Hawthorn Suites, Ramada, Wingate, La Quinta, Tryp, and Wyndham Garden combined 14 1. STR Pipeline Database

Improved Scale 4 The Pro-Competitive and Financial Resources Combination Benefits Franchisees and Guests Gives Franchisees Better Tools to Compete with OTAs More Attractive Rewards Program 15

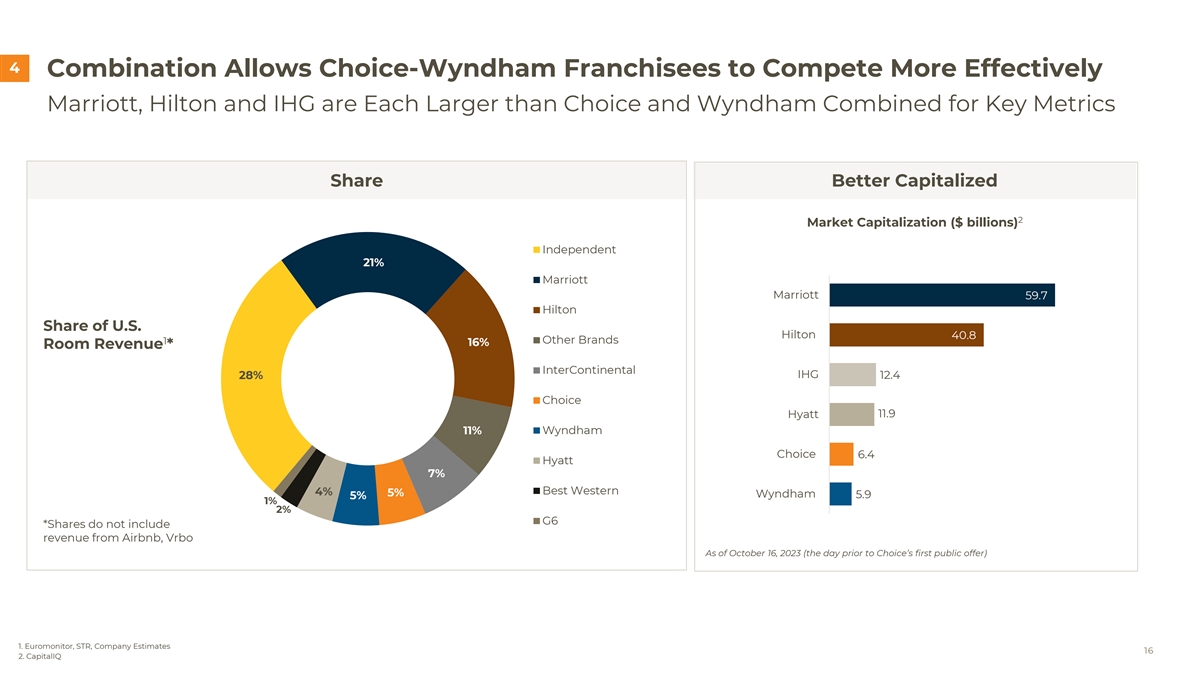

4 Combination Allows Choice-Wyndham Franchisees to Compete More Effectively Marriott, Hilton and IHG are Each Larger than Choice and Wyndham Combined for Key Metrics Share Better Capitalized 2 Market Capitalization ($ billions) Independent 21% Marriott Marriott 59.7 Hilton Share of U.S. Hilton 40.8 Other Brands 1 16% Room Revenue * InterContinental 28% IHG 12.4 Choice 11.9 Hyatt Wyndham 11% Choice 6.4 Hyatt 7% 4% Best Western 5% Wyndham 5.9 5% 1% 2% G6 *Shares do not include revenue from Airbnb, Vrbo As of October 16, 2023 (the day prior to Choice’s first public offer) 1. Euromonitor, STR, Company Estimates 16 2. CapitalIQ

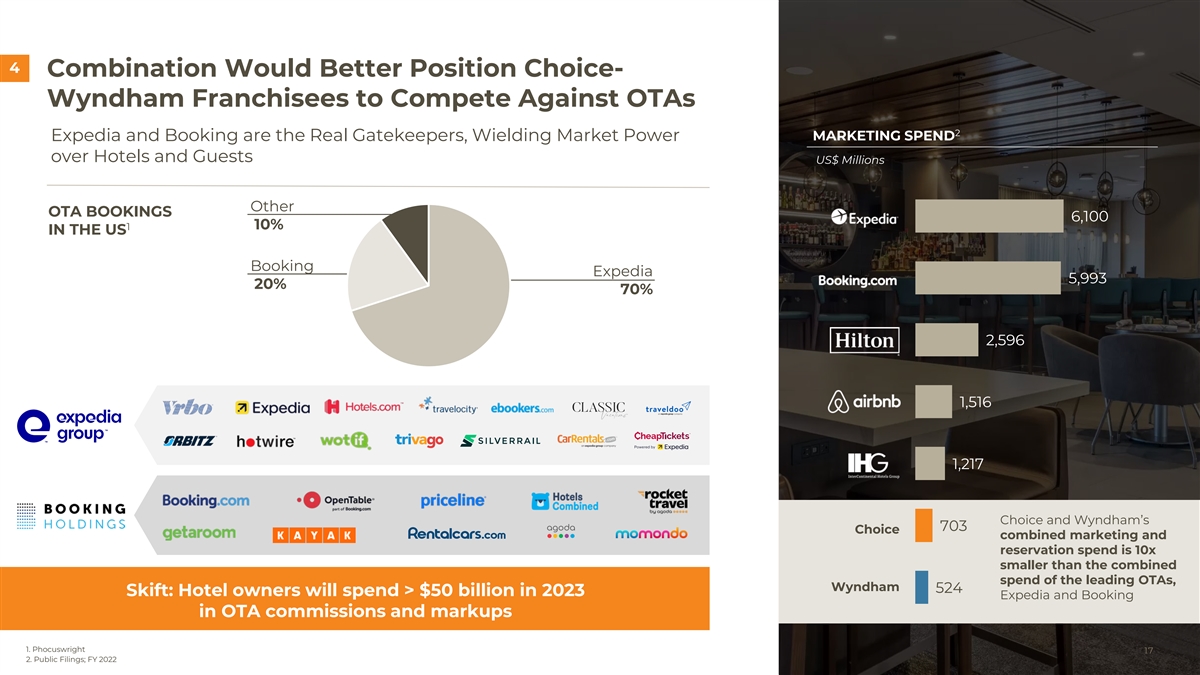

4 Combination Would Better Position Choice- Wyndham Franchisees to Compete Against OTAs 2 Expedia and Booking are the Real Gatekeepers, Wielding Market Power MARKETING SPEND over Hotels and Guests US$ Millions Other OTA BOOKINGS 6,100 1 10% IN THE US Booking Expedia 5,993 20% 70% 2,596 1,516 1,217 Choice and Wyndham’s 703 Choice combined marketing and reservation spend is 10x smaller than the combined spend of the leading OTAs, Wyndham 524 Skift: Hotel owners will spend > $50 billion in 2023 Expedia and Booking in OTA commissions and markups 1. Phocuswright 17 2. Public Filings; FY 2022

5 Combination Would Reduce Franchisee Costs and Drive Revenue to Compete with Bigger Brands and Dominant OTAs – Increased brand marketing spend and more robust rewards program would expand customer reach and draw direct bookings comparable to Marriott & Hilton – Expanded customer reach → increased occupancy Improved and Efficient Reduce Total Cost of Nearly Doubled – Drive more guests through lower-cost direct Customer Acquisition Ownership Focused Resources to Invest channels → less dependence on higher-cost and Revenue Delivery on Franchisee and Evolve with OTAs that charge commissions of 15-30% Bottom Line Franchisee Needs – Lower OTA commissions → lower operating costs + direct savings for franchisees 18

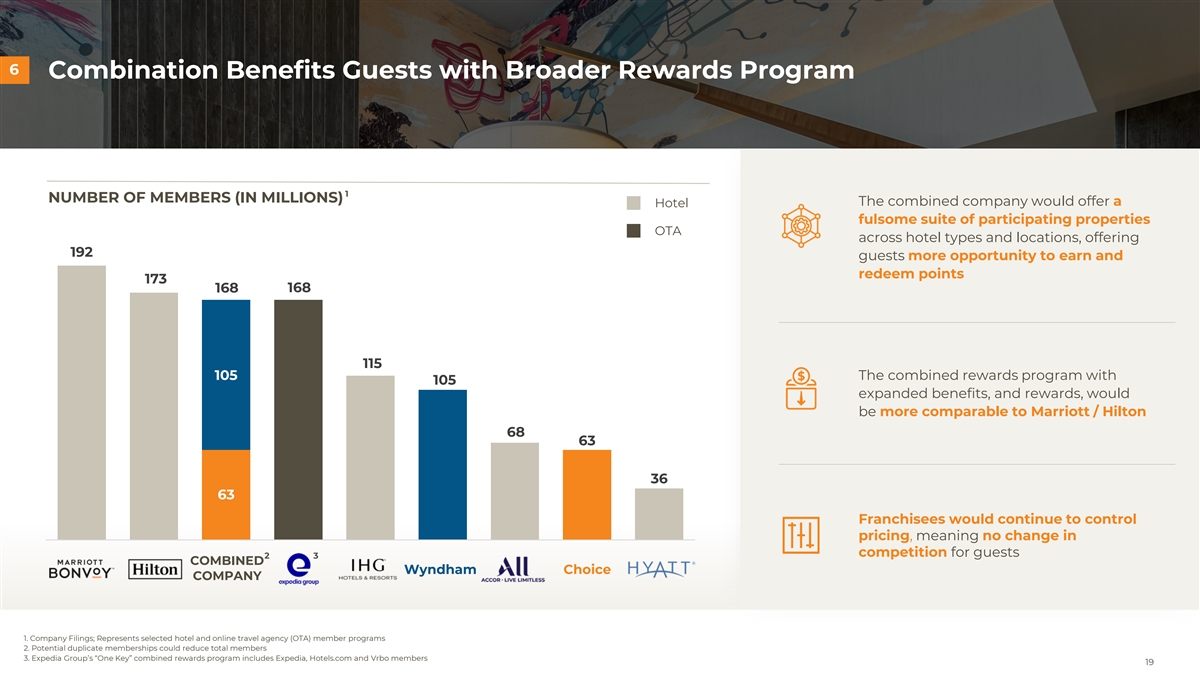

6 Combination Benefits Guests with Broader Rewards Program 1 NUMBER OF MEMBERS (IN MILLIONS) The combined company would offer a Hotel fulsome suite of participating properties OTA across hotel types and locations, offering 192 guests more opportunity to earn and redeem points 173 168 168 115 105 The combined rewards program with 105 expanded benefits, and rewards, would be more comparable to Marriott / Hilton 68 63 36 63 Franchisees would continue to control pricing, meaning no change in competition for guests 2 3 COMBINED Wyndham Choice COMPANY 1. Company Filings; Represents selected hotel and online travel agency (OTA) member programs 2. Potential duplicate memberships could reduce total members 3. Expedia Group’s “One Key” combined rewards program includes Expedia, Hotels.com and Vrbo members 19

Choice is Proactively Proceeding Along Expected Path of FTC Review Choice proactively filed HSR and started clock on December 12; Second Request anticipated on January 11, as expected The Antitrust Agencies issue Second Requests for 45-65 deals per year - The average merger investigation takes less than 12 months to complete, and the vast majority are cleared and close It is the Wyndham board’s continued entrenchment that could create a delay 20