Exhibit 1.1

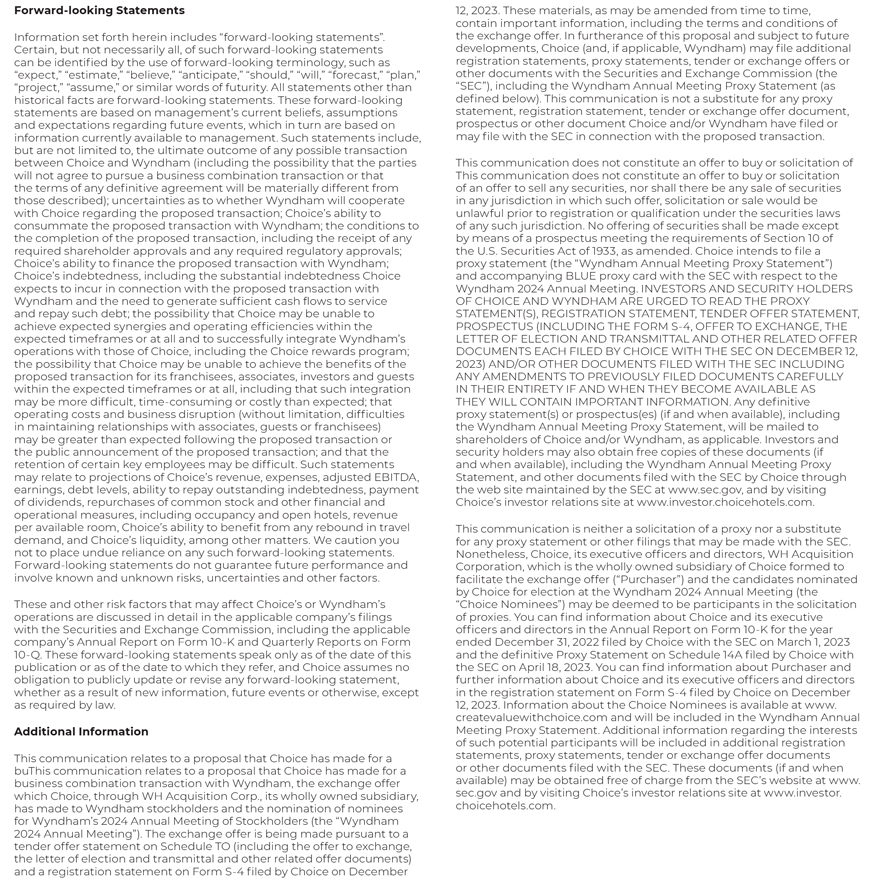

Choice Proposes a Full Slate of Independent, Highly Qualified Candidates for Wyndham’s Board These strong, independent leaders with significant experience and expertise will drive value for Wyndham stakeholders if elected to the Board of Directors. Barbara Bennett Founder and Principal Executive, Bennett West LLC • Spent majority of career at Discovery Communications, serving 17+ years in senior financial leadership roles • Served as President and COO of Vulcan, CFO of Digital First Media, and senate- confirmed CFO of U.S. Environmental Protection Agency • Deep executive leadership, government, corporate finance and corporate governance experience Emanuel Pearlman Founder, Chair and CEO, Liberation Investment Group • Founder, Chair and CEO of Liberation Investment Group, an investment management and consulting firm • Serves on boards of Diebold Nixdorf, Network-1 Technologies and MidCap Financial Investment Corporation • 20+ years of experience in mergers and acquisitions, corporate finance and corporate governance Fiona Dias Former Chief Strategy Officer, ShopRunner • Held senior executive positions at ShopRunner, GSI Commerce and Circuit City Stores • Serves on boards of Anywhere Real Estate and Qurate Retail • Seasoned digital commerce consultant with hospitality, travel, leadership and corporate governance experience Jay Shah Executive Chair, Hersha Hospitality Trust • Executive Chair (formerly CEO) of Hersha Hospitality Trust • Serves on board of HHM Hotels and Cornell University’s Dean’s Advisory Board for the School of Hotel Administration • Member of American Hotel & Lodging Association’s Board of Directors and American Hotel & Lodging Association’s Hospitality Investment Roundtable • Experienced hospitality executive with expertise in franchising, hotel management, executive leadership and corporate finance James Nelson CEO, Global Net Lease, Inc. (NYSE: GNL) • Serves as CEO of publicly traded real estate investment trust, Global Net Lease • Oversaw merger of Necessity Retail REIT and Global Net Lease in September 2023 • Serves on boards of Global Net Lease and Chewy • Previously served on board of Caesars Entertainment Corporation and was Chair of Xerox Holdings Corporation • Nearly four decades of professional experience in mergers and acquisitions, executive leadership, corporate finance and corporate governance Nana Mensah Founder, Chair and CEO, ‘XPORTS Inc. • Founder, Chair and CEO of ‘XPORTS, a privately held food packaging and processing exporter • Previously held senior positions at Long John Silver’s, PepsiCo and KFC. • Serves on board of Darden Restaurants • Decades of experience across franchising, hospitality, mergers and acquisitions and corporate governance Susan Schnabel Co-Managing Partner, aPriori Capital Partners • Serves as Co-Managing Partner of aPriori Capital Partners • Serves on boards of Altice USA, Kayne Anderson BDC and KKR Private Equity Conglomerate • Substantial experience in mergers and acquisitions, executive leadership and corporate finance William Grounds Principal, Burraneer Capital Advisors • Principal of Burraneer Capital Advisors, an investment advisory firm • Formerly served as COO of Infinity World Development Corp. • Led private equity real estate funds management business for Investa Property Group • Serves on boards of PointsBet Holdings and Consumer Portfolio Services and formerly served on the board of MGM Resorts International • Experienced leader in hospitality, travel, executive leadership and corporate finance SKILLS & EXPERIENCE NUMBER OF NOMINEES Public Co. Director Public Co. Senior Leadership Operations Governance M&A Finance/Accounting Hospitality/Franchising Real Estate “These nominees are proven leaders with wide-ranging expertise across relevant industries, including deep proficiency in the hospitality and franchising sectors. We are confident the nominees’ industry, finance, governance and board experience will greatly benefit Wyndham shareholders. Most importantly, if elected, the nominees will exercise their independent judgement to serve Wyndham shareholders’ best interests, which Choice believes is to move with urgency to maximize the value that could be created for them through a combination with Choice.” Stewart W. Bainum CHAIR OF CHOICE’S BOARD OF DIRECTORS