Exhibit 1

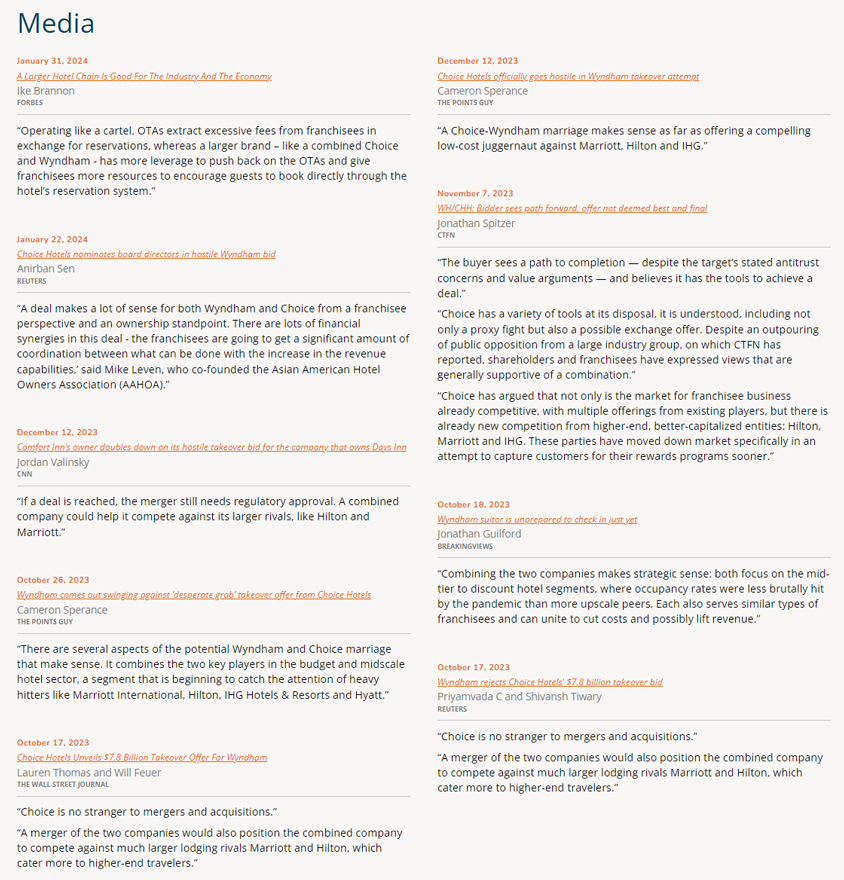

Media January 31. 2024 A Larger Hotel Chain Is Good For The Industry And The Economv. Ike Brannon FORBES “Operating like a cartel, OTAs extract excessive fees from franchisees in exchange for reservations. whereas a larger brand—like a combined Choice and Wyndham—has more leverage to push back on the OTAs and give franchisees more resources to encourage guests to book directly through the hot el’s reservation system.” January 22. 2024 Choice Hotels nominates board directors in hostile Wvndham bid Anirban Sen REUTERS “A deal makes a lot of sense for both Wyndham and Choice from a franchisee perspective and an ownership st andpoint. There are lots of financial synergies in this deal—the franchisees are going to get a significant amount of coordination between what can be done with the increase in the revenue capabilities: said Mike Leven. w1o co-founded the Asian American Hotel Owners Association (AAHOA).” Oecomber 12, 2023 (Qmtort Inn’s oNner doubles down on irs hostile takeover bid for the com!2Q!1Y_ thor owns Da’~ jordan Valinsky CNN “If a deal is reached, the merger still needs regulatory approval. A combined company could help it compet e against its larger rivals. like Hilton and Marriott.” October 26, 2023 Wvndham comes out swingiJ1g.2goinst ‘des12erate grab’ tokeo’ter of/;Ljrom Choice Hotels Cameron Sperance THE POINTS GUY “There are several aspects of the potential Wyndham and Choice marriage that make sense. It combines the two key players in the budget and midscale hot el sector, a segment that is beginning to catch the attention of heavy hitters like Marriott International. Hilton, IHG Hotels & Resorts and Hyatt.” October 17. 2023 Choice Hotels Unveils $7.8 Billion Takeo“er Off_er For V/yndhom Lauren Thomas and Will Feuer THE WAll STREET JOURNAL “Choice is no stranger to merge-s and acquisitions.” “A merger of the two companies would also position the combined company to compete against much larger lodging rivals Marriott and Hilton. which cater more to higher-end travelers.” December 12, 2023 ~goeshostile in Wvndham tokeoverattemP-I. Cameron Sperance THE POINTS GUY “A Choice-Wynd ham marriage makes sense as far as offering a compelling low-cost juggernaut against Marriott, Hilton and IHG.” November 7. 2023 WHICHH: Bidder sees P-ath forward offer not deemed best and final jonathan Spitzer CTFN “The buyer sees a path to completion—despite the target’s stated antitrust concerns and value arguments—and believes it has the tools to achieve a deal.” “Choice has a variety of tools at its disposal. it is understood, including not only a proxy fight but also a possible exchange offer. Despite an outpouring of public opposition from a large industry group, on w hich CTFN has reported, shareholders and franchisees have expressed views that are generally supportive o f a combination.” “Choice has argued that not only is the market for franchisee business already competitive. with m ultiple offerings from existing players, but there is already new competition from higher-end. better-capitalized entities: Hilton, Marriott and IHG. These parties have moved down market specifically in an attempt to capture customers for their rewar:l s programs sooner.” October 18, 2023 Wvndham suitor is unp_reP-ared to check in i!:!.H ,y,.fi jonathan Guilford BREAkiNGVIEWS “Combining the two companies makes strategic sense: both focus on the m id-tier to discount hotel segments, w here occupancy rates were less brutally hit by the pandemic than more upscale peers. Each also serves similar types of franchisees and can unite to cut costs and possibly lift revenue.” October 17. 2023 Wvndham re{ects Choice Hotels’ $7.8 billion takeover bid Priyamvada c and Shivansh Tiwary REUTERS “Choice is no stranger to mergers and acquisitions.” “A merger of the two companies would also position the combined company to compete against much larger lodging rivals Marriott and Hilton. which cater more to higher-end travelers.”