UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

|

Filed by the Registrant ☒ |

||

|

Filed by a Party other than the Registrant ☐ |

||

|

Check the appropriate box: |

||

|

☒ |

Preliminary Proxy Statement |

|

|

☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☐ |

Definitive Proxy Statement |

|

|

☐ |

Definitive Additional Materials |

|

|

☐ |

Soliciting Material under §240.14a-12 |

|

___________________________________________________________________________________________________

(Name of Registrant as Specified In Its Charter)

___________________________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply): |

||

|

☒ |

No fee required. |

|

|

☐ |

Fee paid previously with preliminary materials. |

|

|

☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

|

PRELIMINARY PROXY STATEMENT DATED FEBRUARY 26, 2024 – SUBJECT TO COMPLETION

NOTICE OF 2024 ANNUAL MEETING

OF STOCKHOLDERS AND

PROXY STATEMENT

[•], 2024

Dear Fellow Stockholder:

On behalf of your Board of Directors, we are pleased to invite you to attend the 2024 annual meeting of stockholders to be held on [•], 2024 at [•] [a.m./p.m.] Eastern Time. The meeting will be held in person at [•].

In 2023, we delivered strong financial and operational results from the continued execution of our strategic plan. Our performance was driven by our concentration in the select-service economy and midscale segments and sustained demand from our leisure and everyday business travelers. Global RevPAR grew 5% year-over-year in constant currency, or 16% above 2019 pre-Covid levels. System-wide rooms grew organically by 3.5% year-over-year, a record level, and we grew our global development pipeline by 10% year-over-year to a record 240,000 rooms.

We are proud to have achieved a record-high global retention rate of 95.6% with our valued franchisees. We also made meaningful progress across other parts of our business this year, all with a continued focus on our Owner-First™ approach. We opened 500 hotels and introduced 13 of our 24 brands in 24 new countries. We invested in new technology solutions to help owners streamline operations, enhance the guest experience and increase profitability. We did all of this while continuing to prioritize targeted investments in the future growth of our business, including increased key money investments to attract new hotels in key domestic and international markets and to support renovation of existing hotels.

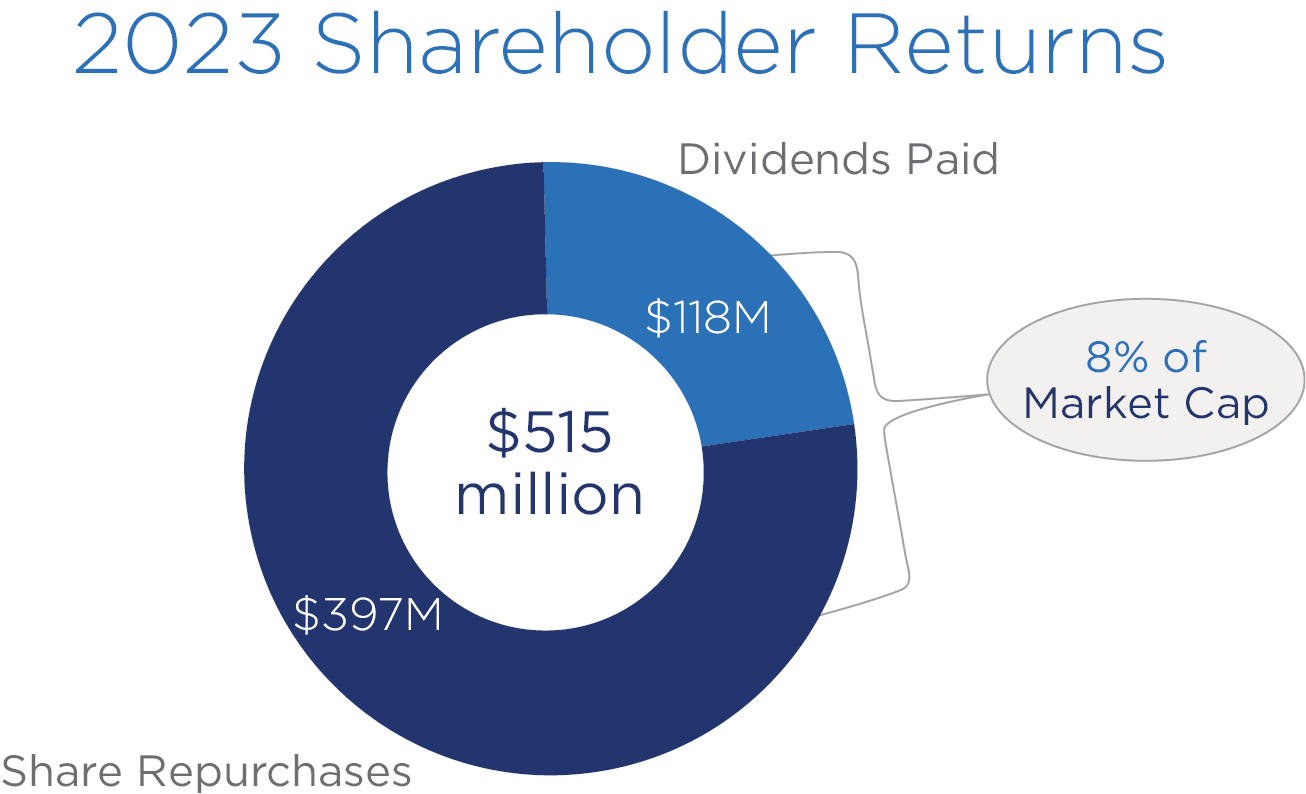

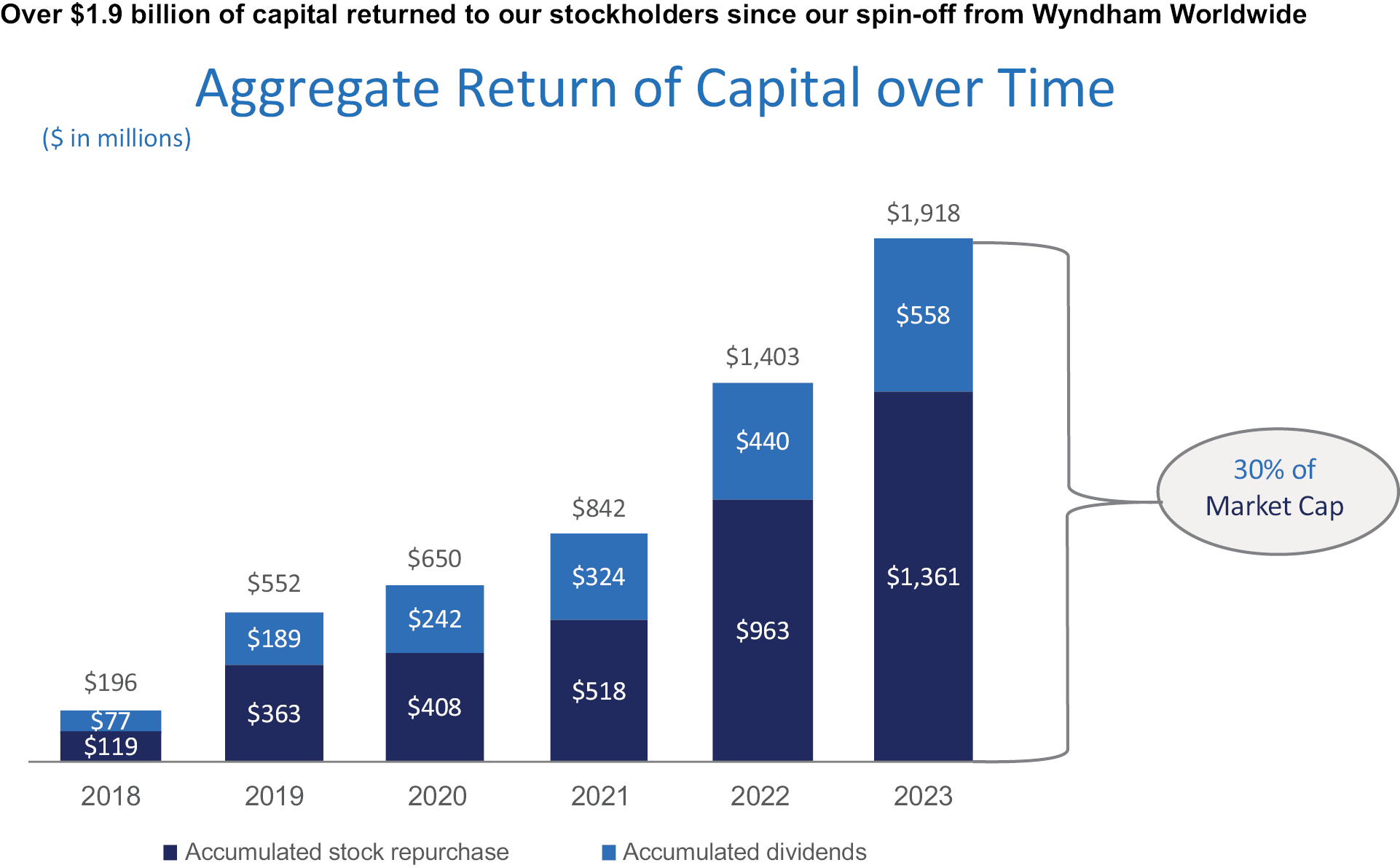

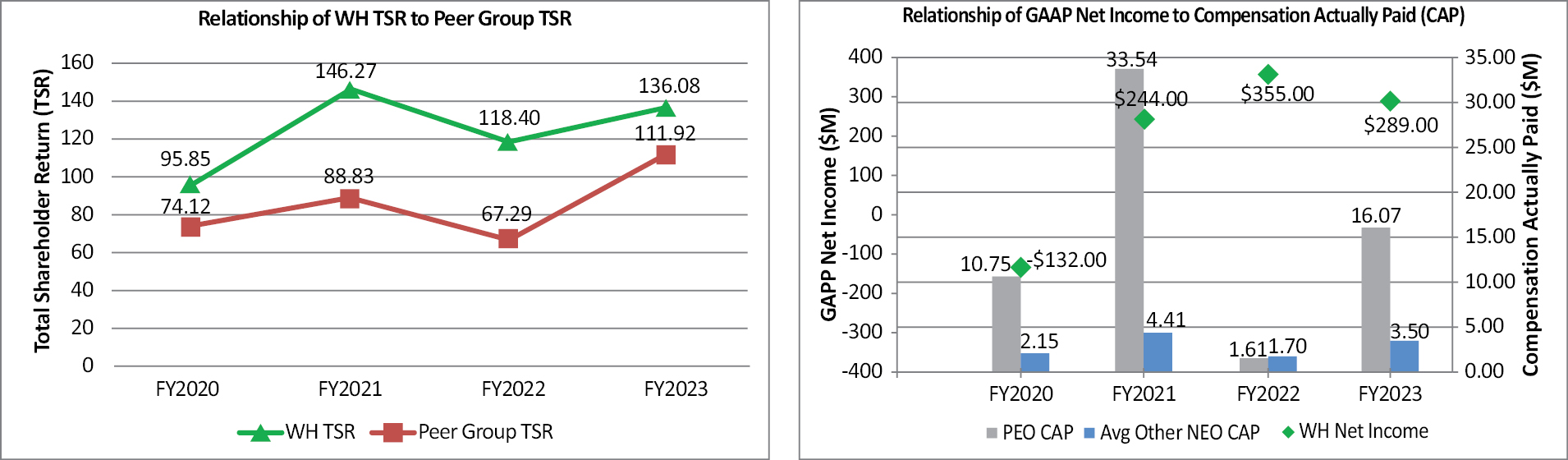

The continued focus and thoughtful execution of our team in 2023 led to the delivery of diluted earnings per share of $3.41 and adjusted diluted earnings per share of $4.01. For 2023, net income was $289 million, adjusted net income was $341 million, and adjusted EBITDA was $659 million. Net cash provided by operating activities was $376 million, and free cash flow was $339 million in 2023. We also returned $515 million to our stockholders in 2023, including dividend payments of $118 million and stock repurchases of $397 million. This highlights your Board’s continued confidence in our business and our strategy.*

We are grateful for our team members who drove our accomplishments this year and for the continued support and loyalty of our franchisees, the backbone of our business. In September 2023, we were ranked number eight out of 100 among Newsweek® Magazine’s Most Loved Workplaces in America. We were named one of the World’s Most Ethical Companies® by Ethisphere for 2023, marking the third time we have been recognized for this award.

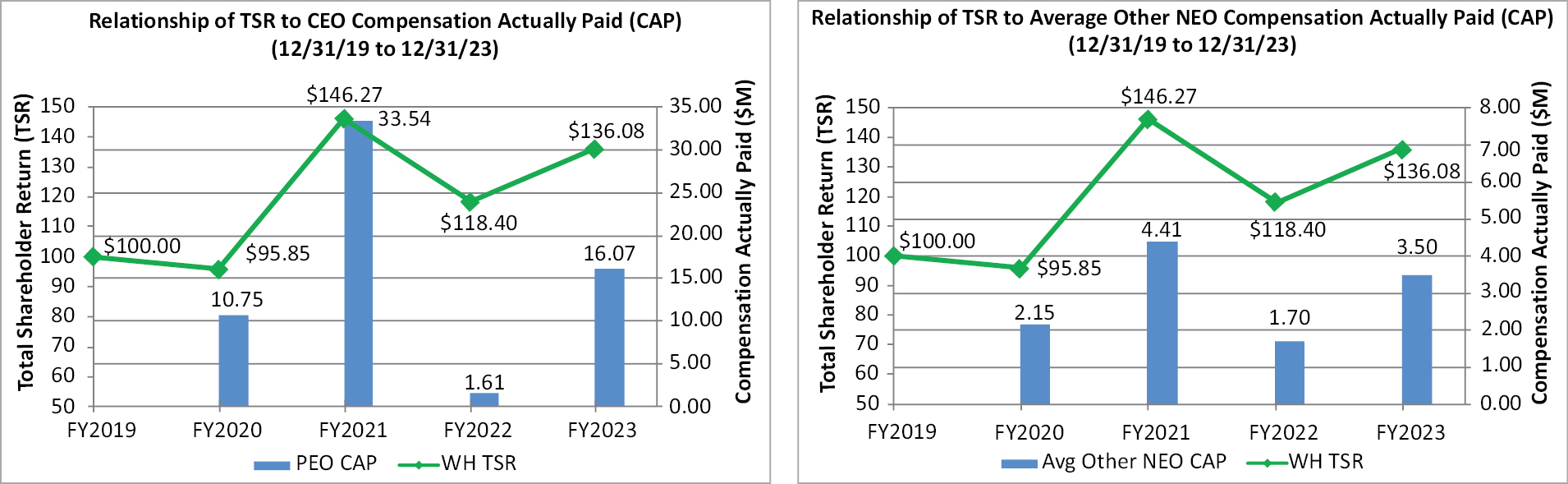

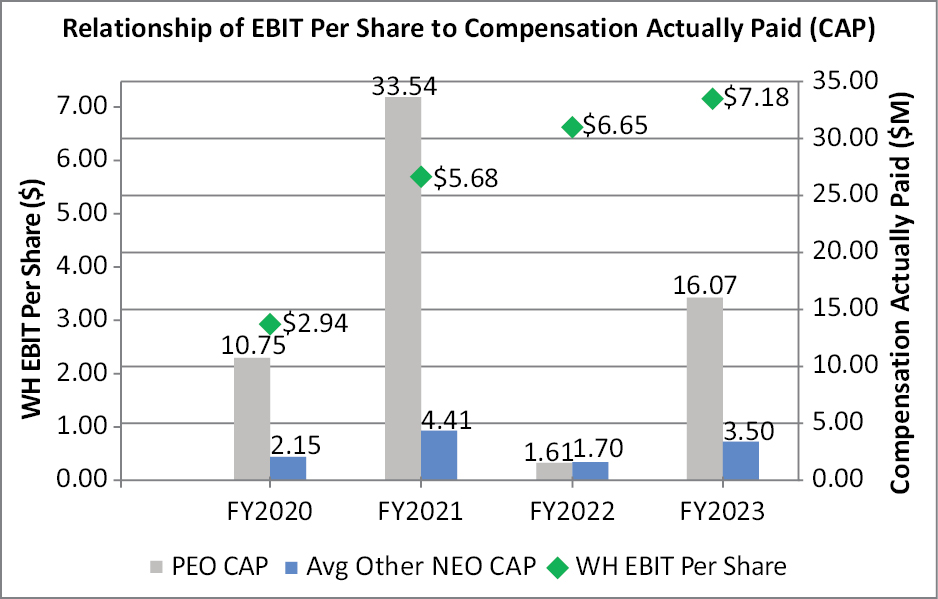

As described in the accompanying proxy statement, your Board’s Compensation Committee works to ensure that executive pay and performance are appropriately aligned to incentivize management to increase stockholder value. We encourage you to read the proxy statement carefully for more information.

Your Board remains committed to providing effective oversight as Wyndham continues to execute our strategy and we’re confident the plan we have in place is the right one – one that is expected to generate significant value over the near and medium term.

|

________________ |

||

|

* |

Please see Appendix A to the accompanying proxy statement for (i) cautionary language regarding forward-looking statements and (ii) a reconciliation of non-GAAP financial measures to the corresponding GAAP results and an explanation of the adjustments that we have made to calculate these adjusted non-GAAP financial measures. |

|

Finally, Choice Hotels International, Inc. has notified the Company that it intends to propose a full slate of Directors for election at this year’s annual meeting, in opposition to the nominees recommended by your Board. As a result, you may receive solicitation materials from Choice seeking your proxy to vote for Choice’s nominees. To reiterate what we have said before, your Board strongly believes that Choice is making these nominations with the sole purpose of advancing its hostile exchange offer, which your Board unanimously determined is inadequate, risk-laden and not in the best interests of Wyndham shareholders. Despite Choice making a series of unsolicited proposals to acquire Wyndham, initiating a hostile exchange offer and now launching a proxy contest, we are proud of how our team has remained focused on executing our strategy and delivered strong 2023 financial results.

Your vote is very important. Whether or not you plan to attend the 2024 annual meeting, please cast your vote as soon as possible. Your Board unanimously recommends that you use the WHITE proxy card to vote “FOR” only the eight nominees proposed by your Board and in accordance with your Board’s recommendations on all other proposals. We look forward to our continued dialogue in the future and we, along with our outstanding team, remain committed to creating even greater value for you.

Very truly yours,

|

|

|

|

|

Stephen P. Holmes |

Geoffrey A. Ballotti |

|

|

Chair of the Board |

President and Chief Executive Officer |

PRELIMINARY PROXY STATEMENT DATED FEBRUARY 26, 2024 – SUBJECT TO COMPLETION

WYNDHAM HOTELS & RESORTS, INC.

NOTICE OF 2024 ANNUAL MEETING OF STOCKHOLDERS

[•], 2024

|

Date: |

[•], 2024 |

|

|

Time: |

[•] [a.m./p.m.] Eastern Time |

|

|

Place: |

[•] |

Purposes of the Annual Meeting:

• to elect eight Directors for a term expiring at the 2025 Annual Meeting of Stockholders, with each Director to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal (“Proposal 1”);

• to vote on an advisory resolution to approve our executive compensation program (“Proposal 2”);

• to vote on a proposal to ratify the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2024 (“Proposal 3”);

• to vote on the Choice Hotels proposal, if properly presented at the meeting, to repeal each provision or amendment of the Company’s By-Laws adopted by the Board subsequent to January 4, 2023 without the approval of Wyndham stockholders (“Proposal 4” or the “Choice Proposal”); and

• to transact any other business that may be properly brought before the meeting or any postponement, adjournment or continuation of the meeting.

The matters specified for voting above are more fully described in the attached Proxy Statement. Only our stockholders of record at the close of business on [•], 2024 (the “Record Date”) will be entitled to notice of and to vote at the 2024 Annual Meeting of Stockholders (including any postponements, adjournments or continuations thereof, the “Annual Meeting”). This Notice of 2024 Annual Meeting of Stockholders, the Annual Report on Form 10-K for the year ended December 31, 2023 and the attached Proxy Statement and form of WHITE proxy card are first being sent to stockholders of record as of the Record Date on or about [•], 2024.

Please note that Choice Hotels International, Inc. (“Choice” or “Choice Hotels”) has stated its intention to propose eight of its own Director nominees for election at the Annual Meeting. Your Board strongly believes that Choice is making these nominations with the sole purpose of advancing its hostile exchange offer, which your Board unanimously determined is inadequate, risk-laden and not in the best interests of Wyndham shareholders. Accordingly, you may also receive solicitation materials from Choice, including proxy statements and blue proxy cards. The Company is not responsible for the accuracy or completeness of any information provided by Choice or its nominees or relating to the Choice Proposal contained in solicitation materials filed or disseminated by or on behalf of Choice or any other statements that Choice may make.

Your Board does NOT endorse Choice’s nominees and strongly recommends that you NOT sign or return any blue proxy card sent to you by Choice. Your Board unanimously recommends that you use the WHITE proxy card to vote “FOR” only the eight nominees

proposed by your Board and in accordance with your Board’s recommendations on all other proposals. Your Board strongly urges you to discard and NOT to vote using any blue proxy card sent to you by Choice.

Please note that this year, your WHITE proxy card looks different. Recently adopted proxy rules applicable to a contested meeting like the Annual Meeting require the Company’s WHITE proxy card to list Choice’s nominees in addition to your Board’s nominees. Please mark your WHITE proxy card carefully and vote “FOR” only the eight nominees recommended by your Board and in accordance with your Board’s recommendations on all other proposals.

|

YOUR BOARD RECOMMENDS VOTING ON THE WHITE PROXY CARD “FOR” ONLY YOUR BOARD’S EIGHT NOMINEES ON PROPOSAL 1, “FOR” PROPOSALS 2 AND 3, AND “AGAINST” PROPOSAL 4. YOUR BOARD ALSO URGES YOU NOT TO SIGN, RETURN OR VOTE ANY BLUE PROXY CARD SENT TO YOU BY CHOICE. |

If you vote, or have already voted, using a blue proxy card sent to you by Choice, you can subsequently revoke that proxy by following the instructions on your WHITE proxy card or WHITE voting instruction form to vote over the Internet or by telephone or by marking, signing and dating the enclosed WHITE proxy card and returning it in the postage pre-paid envelope provided. Only your latest validly executed proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the Proxy Statement.

Who may attend the Annual Meeting:

Attendance at the Annual Meeting will be limited to stockholders as of the close of business on the Record Date, their authorized representatives and guests of the Company. Access to the Annual Meeting may be granted to others at the discretion of the Company and the chair of the Annual Meeting. Cameras and recording devices will not be permitted at the Annual Meeting.

How to attend the Annual Meeting:

All persons attending the Annual Meeting must bring photo identification such as a valid driver’s license or passport for purposes of personal identification along with proof of stock ownership. If you are a stockholder of record, please be prepared to provide the top portion of your proxy card.

If your shares are held in the name of a bank, broker or other nominee, you will need to bring a proxy, letter or recent account statement from that bank, broker or nominee that confirms that you are the beneficial owner of those shares.

Record Date:

[•], 2024 is the record date for the Annual Meeting. This means that owners of Wyndham Hotels & Resorts, Inc. common stock at the close of business on that date are entitled to:

• receive notice of the Annual Meeting; and

• vote at the Annual Meeting.

Householding Information:

We have adopted a procedure approved by the Securities and Exchange Commission called householding. Under this procedure, stockholders who have the same address and last name and have not previously requested electronic delivery of proxy materials or otherwise provided instructions to the contrary will receive a single set of proxy materials (including our annual report) for all stockholders having that address, with each stockholder continuing to receive separate proxy cards. This procedure will reduce our printing costs and postage fees.

If you do not wish to participate in householding, please contact Broadridge Financial Solutions by calling their toll-free number at (866) 540-7095 or through Broadridge Financial Solutions, Attn.: Householding Department, 51 Mercedes Way, Edgewood, New York 11717, and a separate copy of the proxy materials will be promptly delivered to your address. If you are currently receiving multiple sets of the proxy materials and wish to receive only one, you may use the same contact information to opt into householding.

Beneficial stockholders may request information about householding from their banks, brokers or other holders of record.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Stockholders: The Proxy Statement and the Annual Report on Form 10-K for the year ended December 31, 2023 and the means to vote by Internet are available at [•].

Proxy Voting:

Your vote is very important, and we encourage you to vote and submit your WHITE proxy card as promptly as possible, even if you plan to attend the Annual Meeting. You may vote by Internet, by telephone or by using the enclosed WHITE proxy card. If you are a stockholder of record, you may also vote at the Annual Meeting. If you hold your shares in “street name,” you may only vote in person at the Annual Meeting if you obtain a legal proxy from your bank, broker or other nominee.

Please carefully note any voting deadline indicated on your WHITE proxy card, as voting deadlines may vary depending on how you hold your shares.

|

By order of the Board of Directors, |

||

|

|

||

|

Paul F. Cash |

YOUR VOTE IS VERY IMPORTANT!

If you have any questions about the Annual Meeting or how to vote your shares,

please contact the firm assisting us with the solicitation of proxies:

INNISFREE M&A INCORPORATED:

[•] (toll-free from the U.S. and Canada) or

+[•] from other countries

TABLE OF CONTENTS

|

Page |

||

|

1 |

||

|

3 |

||

|

3 |

||

|

3 |

||

|

4 |

||

|

4 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

5 |

||

|

6 |

||

|

What if I am a participant in the Wyndham Hotel Group Employee Savings Plan? |

6 |

|

|

7 |

||

|

7 |

||

|

8 |

||

|

8 |

||

|

8 |

||

|

9 |

||

|

How do I make a stockholder proposal for the 2025 Annual Meeting? |

9 |

|

|

Who should I call if I have questions about the Annual Meeting? |

10 |

|

|

11 |

||

|

22 |

||

|

22 |

||

|

22 |

||

|

22 |

||

|

23 |

||

|

23 |

||

|

26 |

||

|

26 |

||

|

27 |

||

|

27 |

||

|

27 |

||

|

Executive Sessions of Non-Management and Independent Directors |

28 |

|

|

28 |

||

|

28 |

||

|

28 |

||

|

28 |

||

|

30 |

||

|

32 |

i

|

Page |

||

|

33 |

||

|

34 |

||

|

35 |

||

|

36 |

||

|

37 |

||

|

38 |

||

|

40 |

||

|

48 |

||

|

48 |

||

|

66 |

||

|

67 |

||

|

68 |

||

|

69 |

||

|

70 |

||

|

72 |

||

|

73 |

||

|

74 |

||

|

78 |

||

|

80 |

||

|

81 |

||

|

84 |

||

|

86 |

||

|

86 |

||

|

87 |

||

|

PROPOSAL NO. 3: RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

88 |

|

|

88 |

||

|

89 |

||

|

90 |

||

|

92 |

||

|

92 |

||

|

92 |

||

|

92 |

||

|

92 |

||

|

APPENDIX A: Non-GAAP Financial Information and Forward-Looking Statements |

A-1 |

|

|

APPENDIX B: Additional Information Regarding Participants In The Solicitation |

B-1 |

ii

PRELIMINARY PROXY STATEMENT DATED FEBRUARY 26, 2024 – SUBJECT TO COMPLETION

WYNDHAM HOTELS & RESORTS, INC.

PROXY STATEMENT

This Proxy Statement is being provided to you at the request of the Board of Directors of Wyndham Hotels & Resorts, Inc. (the “Board”) in connection with the solicitation of proxies by the Board and to encourage you to vote your shares at our 2024 Annual Meeting of Stockholders (including any postponements, adjournments or continuations thereof, the “Annual Meeting”). This Proxy Statement contains information on matters that will be presented at the Annual Meeting and is provided to assist you in voting your shares. References in this Proxy Statement to “we,” “us,” “our,” “Wyndham Hotels,” “Wyndham” and the “Company” refer to Wyndham Hotels & Resorts, Inc. and our consolidated subsidiaries.

The 2023 Annual Report on Form 10-K for the year ended December 31, 2023 (“2023 Form 10-K”), the Notice of Annual Meeting, this Proxy Statement and the accompanying form of WHITE proxy card are first being sent to stockholders of record as of [•], 2024, on or about [•], 2024.

Annual Meeting Details

|

Date and Time |

Place: |

|

[•] [a.m./p.m.] Eastern Time on [•], 2024 |

[•] |

Meeting Agenda and Voting Recommendations

|

Proposal |

Board Recommendation |

|

|

1. |

Election of eight Director nominees for a term expiring at the 2025 Annual Meeting of Stockholders |

FOR only the eight nominees recommended by the Board |

|

2. |

Advisory vote to approve named executive officer compensation |

FOR |

|

3. |

Ratification of appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the year ending December 31, 2024 |

FOR |

|

4. |

The Choice proposal, if properly presented at the Annual Meeting, to repeal each provision or amendment of the Company’s By-Laws adopted by the Board subsequent to January 4, 2023 without the approval of Wyndham stockholders |

AGAINST |

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy on such matters to the extent authorized by Rule 14a-4(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The Board knows of no matters, other than those previously described, to be presented for consideration at the Annual Meeting.

It is especially important this year that you use this opportunity to take part in the affairs of our Company by voting on the business to come before the stockholders at the Annual Meeting. Choice Hotels International, Inc. (“Choice” or “Choice Hotels”) has notified us that it intends to nominate eight candidates for election as Directors at the Annual Meeting. Your Board of Directors does not recommend Choice’s nominees and recommends that you vote FOR only the eight nominees proposed by the Board using the WHITE proxy card.

We strongly urge you to read this Proxy Statement carefully and vote FOR only the eight nominees recommended by your Board, and, in accordance with your Board’s recommendations on all other proposals, by using the enclosed WHITE proxy card.

1

You may receive solicitation materials from Choice Hotels. We are not responsible for the accuracy of any information provided by Choice Hotels or its nominees contained in solicitation materials filed or disseminated by or on behalf of Choice Hotels or any other statements that Choice Hotels may make.

YOUR BOARD DOES NOT ENDORSE CHOICE’S NOMINEES AND STRONGLY RECOMMENDS THAT YOU NOT SIGN OR RETURN ANY BLUE PROXY CARD SENT TO YOU BY CHOICE. IF YOU VOTE, OR HAVE ALREADY VOTED, USING A BLUE PROXY CARD SENT TO YOU BY CHOICE, YOU CAN SUBSEQUENTLY REVOKE THAT PROXY BY FOLLOWING THE INSTRUCTIONS ON YOUR WHITE PROXY CARD OR WHITE VOTING INSTRUCTION FORM TO VOTE OVER THE INTERNET OR BY TELEPHONE OR BY COMPLETING, SIGNING AND DATING THE WHITE PROXY CARD AND RETURNING IT IN THE POSTAGE PRE-PAID ENVELOPE PROVIDED. ONLY YOUR LATEST DATED PROXY WILL COUNT, AND ANY PROXY MAY BE REVOKED AT ANY TIME PRIOR TO ITS EXERCISE AT THE ANNUAL MEETING AS DESCRIBED IN THIS PROXY STATEMENT.

Importantly, voting on a blue proxy card to “withhold” with respect to any of the Choice’s nominees is NOT the same as voting “FOR” your Board’s nominees. This is because a vote on a blue proxy card to “withhold” with respect to any of Choice’s nominees will revoke any WHITE proxy card or WHITE voting instruction form you may have previously submitted. To support your Board’s nominees, you should use the WHITE proxy card or WHITE voting instruction form to vote “FOR” only your Board’s eight nominees.

If you have any questions or require assistance with voting your WHITE proxy card, please contact our proxy solicitation firm, Innisfree M&A Incorporated:

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

[•] (toll-free from the U.S. and Canada) or

+[•] from other countries

Board’s Director Nominees (Proposal 1)

The following table provides summary information about each of the Board’s Director nominees. We ask you to vote “FOR” only your Board’s eight Director nominees using the enclosed WHITE proxy card.

|

Nominee |

Director |

Principal Occupation |

Committees |

|

Stephen P. Homes |

2018 |

Non-Executive Chair of the Board of Wyndham Hotels & Resorts |

Executive (Chair) |

|

Geoffrey A. Ballotti |

2018 |

President and Chief Executive Officer of Wyndham Hotels & Resorts (our “CEO”) |

Executive |

|

Myra J. Biblowit |

2018 |

President Emeritus of The Breast Cancer Research Foundation |

Compensation |

|

James E. Buckman |

2018 |

Former Vice Chairman of York Capital Management |

Audit |

|

Bruce B. Churchill |

2018 |

Former President of DIRECTV Latin America LLC |

Audit |

|

Mukul V. Deoras |

2018 |

President, Asia Pacific Division of Colgate-Palmolive Company & Chairman of Colgate-Palmolive (India) Ltd. |

Audit |

|

Ronald L. Nelson |

2019 |

Former Chairman of Hanesbrands Inc. |

Audit |

|

Pauline D.E. Richards |

2018 |

Former Chief Operating Officer of Trebuchet Group Holdings Limited |

Audit (Chair) |

2

FREQUENTLY ASKED QUESTIONS

When and where will the Annual Meeting be held?

The Annual Meeting will be held on [•], 2024 at [•] [a.m./p.m.] Eastern Time at [•].

Attendance at the Annual Meeting will be limited to stockholders as of the close of business on [•], 2024 (the “Record Date”), their authorized representatives and guests of the Company. Access to the Annual Meeting may be granted to others at the discretion of the Company and the chair of the Annual Meeting. In accordance with security procedures, all persons attending the Annual Meeting must present picture identification along with proof of ownership. If you are a stockholder of record, please be prepared to provide the top portion of your proxy card. If you hold your shares in “street name,” you will need to provide proof of ownership, such as a recent account statement or letter from your broker. Cameras and recording devices will not be permitted at the Annual Meeting.

Even if you plan to attend the Annual Meeting, we strongly urge you to vote in advance by voting via the Internet or by telephone or by completing, signing, and dating the enclosed WHITE voting instruction form or WHITE proxy card and returning it in the postage pre-paid envelope provided, as soon as possible.

What am I being asked to vote on at the Annual Meeting?

You are being asked to vote on the following:

• the election of eight Directors for a term expiring at the 2025 Annual Meeting of Stockholders, with each Director to serve until such Director’s successor is elected and qualified or until such Director’s earlier resignation, retirement, disqualification or removal (“Proposal 1”);

• the advisory approval of our executive compensation program (“Proposal 2”);

• the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2024 (“Proposal 3”);

• Choice’s proposal, if properly presented at the Annual Meeting, to repeal each provision or amendment of the Company’s By-Laws adopted by the Board subsequent to January 4, 2023 without the approval of Wyndham stockholders (“Proposal 4”); and

• to transact any other business that may be properly brought before the Annual Meeting.

If any other business properly comes before the stockholders for a vote at the Annual Meeting, your shares will be voted at the discretion of the holders of the proxy on such matters to the extent authorized by Rule 14a-4(c) under the Exchange Act. The Board knows of no matters, other than those previously described, to be presented for consideration at the Annual Meeting.

The Board recommends voting “FOR” only the eight nominees recommended by the Board on Proposal 1, “FOR” Proposals 2 and 3, and “AGAINST” Proposal 4 using the enclosed WHITE proxy card.

3

Who is Choice Hotels?

Choice is the primary competitor of Wyndham in the economy and midscale hotel franchising business domestically. Since April 2023, Choice has submitted a series of unsolicited offers to acquire Wyndham, which your Board determined were inadequate and risk-laden. Choice subsequently escalated its pursuit of Wyndham by commencing a hostile exchange offer to acquire Wyndham, followed by this proxy contest where it seeks to replace your entire Board with its hand-picked slate of eight nominees. We believe Choice assembled and paid its slate of nominees with a sole goal in mind: to push through Choice’s offer to acquire Wyndham. Wyndham rejected Choice’s offers and recommended that Wyndham stockholders not tender into Choice’s hostile exchange offer because the Board believes that the proposed transaction (1) would not adequately compensate Wyndham stockholders for Wyndham’s superior standalone growth prospects, (2) provides inadequate consideration from a valuation standpoint (including the significant equity component of Choice stock that may already be fully valued) and (3) would likely be subject to a prolonged regulatory review period with an uncertain outcome.

Importantly, the eight Director nominees that stockholders elect to your Board at the Annual Meeting will be responsible for overseeing Wyndham’s strategy and its execution against its strategic growth plan for (1) a meaningful period of time until any transaction with Choice clears regulatory approvals and closes (to the extent that ever happens) or (2) an indefinite period of time if a transaction with Choice never occurs or closes. Therefore, we believe it is critical that you vote only on the WHITE proxy card for the re-election of your Board’s eight Directors as recommended herein and NOT in favor of any of Choice nominees, who we have determined both individually and collectively lack the necessary experience, including in hospitality and global franchising, to sit on the board of directors of a large, international hotel franchising company like Wyndham and oversee your investment in Wyndham.

Accordingly, your Board does NOT endorse any of Choice’s nominees and strongly recommends that you NOT sign or return any blue proxy card sent to you by Choice. The Board unanimously recommends that you use the WHITE proxy card to vote “FOR” only the eight nominees proposed by your Board and in accordance with your Board’s recommendations on all other proposals. Your Board strongly urges you to discard and NOT to vote using any blue proxy card sent to you by Choice.

If you vote, or have already voted, using a blue proxy card sent to you by Choice, you can subsequently revoke that proxy by following the instructions on your WHITE proxy card or WHITE voting instruction form to vote over the Internet or by telephone or by marking, signing and dating the enclosed WHITE proxy card and returning it in the postage pre-paid envelope provided. Only your latest validly executed proxy will count, and any proxy may be revoked at any time prior to its exercise at the Annual Meeting as described in the Proxy Statement.

Why have I received different color proxy cards?

As discussed in the prior question, Choice has notified us that it intends to nominate candidates for election as Directors at the Annual Meeting. Your Board has provided you with the enclosed WHITE proxy card. Choice may send you a blue proxy card. The Board recommends using the enclosed WHITE proxy card to vote “FOR” only the eight nominees proposed by the Board for election as Directors. The Board also recommends that you DISREGARD and DISCARD blue proxy cards.

Your shares may be owned through more than one brokerage or other share ownership account. In order to vote all of the shares that you own, you must use each WHITE proxy card you receive in order to vote with respect to each account by Internet, by telephone or by marking, signing, dating and returning the WHITE proxy card in the postage pre-paid envelope provided.

4

If Choice proceeds with its previously announced nominations, the Company will likely conduct multiple mailings prior to the Annual Meeting date to ensure stockholders have the Company’s latest proxy information and materials to vote. The Company will send you a new WHITE proxy card with each mailing, regardless of whether you have previously voted. We encourage you to vote every WHITE proxy card you receive. The latest dated proxy you submit will be counted, and, if you wish to vote as recommended by the Board, then you should only submit WHITE proxy cards.

What is a proxy and a proxy statement?

A proxy is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document also is called a proxy or a proxy card. Geoffrey A. Ballotti, our President and CEO, and Paul F. Cash, our General Counsel, Chief Compliance Officer and Corporate Secretary, will serve as proxies for the Annual Meeting pursuant to the WHITE proxy cards solicited by our Board.

A proxy statement is a document that the regulations of the U.S. Securities and Exchange Commission (“SEC”) require us to give you when we ask that you designate Geoffrey A. Ballotti and Paul F. Cash as proxies to vote on your behalf. This Proxy Statement includes information about the proposals to be considered at the Annual Meeting and other required disclosures, including information about the Board and our named executive officers, for the purpose of informing your vote.

How can I access the proxy materials over the Internet?

Our proxy materials can be found online at [•].

Who may vote and how many votes does a stockholder have?

All holders of record of Wyndham common stock as of the close of business on the Record Date ([•], 2024) are entitled to vote at the Annual Meeting. Each stockholder will have one vote for each share of Wyndham common stock held as of the Record Date. As of the Record Date, [•] shares of Wyndham common stock were outstanding. There is no cumulative voting, and the holders of Wyndham common stock vote together as a single class. Stockholders do not have appraisal rights under Delaware law in connection with this proxy solicitation.

How many votes must be present to hold the Annual Meeting?

The holders of a majority of the outstanding shares of Wyndham common stock entitled to vote at the Annual Meeting must be present in-person or by proxy at the Annual Meeting in order to constitute a quorum necessary to conduct the Annual Meeting. Abstentions and broker non-votes will be counted for purposes of establishing a quorum at the Annual Meeting.

We urge you to vote by proxy using the WHITE proxy card even if you plan to attend the Annual Meeting so that we will know as soon as possible that a quorum has been achieved.

What is the difference between a stockholder of record and a stockholder who holds stock in street name?

Most stockholders hold their shares through a broker, bank or other nominee (i.e., in “street name”) rather than directly in their own name. As summarized below, there are some distinctions between shares held of record and those held in street name.

• Stockholders of Record. If your shares are registered directly in your name with our transfer agent, you are considered, with respect to those shares, the “stockholder of record” (also sometimes referred to as a “registered stockholder” or “registered holder”).

5

• Street Name Stockholders. If your shares are held in a stock brokerage account or by a bank or other nominee, you are considered, with respect to those shares, the beneficial owner of shares held in “street name.” If you are a street name stockholder, you will be forwarded proxy materials by your broker, bank or other nominee, which is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to instruct your broker, bank or other nominee how to vote. Your broker, bank or other nominee has provided a WHITE voting instruction form for you to use in directing the broker, bank or other nominee how to vote your shares. If you fail to provide sufficient instructions to your broker, bank or other nominee, they may be prohibited from voting your shares. See the below question “Will my shares be voted if I do nothing?” for additional information.

How do I vote?

Even if you plan to attend the Annual Meeting you are encouraged to vote by proxy.

If you are a stockholder of record, you may vote at the Annual Meeting or in one of the following ways:

• By Internet. You may submit a proxy electronically on the Internet by following the instructions provided on the enclosed WHITE proxy card. Please have your WHITE proxy card in hand when you log onto the website. Internet voting facilities will be available 24 hours a day.

• By Telephone. You may submit a proxy by telephone using the toll-free number listed on the enclosed WHITE proxy card. Please have your WHITE proxy card in hand when you call. Telephone voting facilities will be available 24 hours a day.

• By Mail. You may indicate your vote by marking, signing and dating your WHITE proxy card and returning it in the enclosed postage pre-paid reply envelope.

If your shares are registered in the name of a bank, broker or other nominee (i.e., in “street name”), you may generally vote your shares or submit a proxy to have your shares voted by one of the following methods:

• By the Methods Listed on the Voting Instruction Form. Please refer to the WHITE voting instruction form or other information forwarded to you by your bank, broker or other nominee to determine whether you may submit a proxy by telephone or on the Internet and follow the instructions provided by your bank, broker or other nominee.

• In Person with a Proxy from the Record Holder. You may vote in person at the Annual Meeting if you obtain a legal proxy from your bank, broker or other nominee. Please consult the WHITE voting instruction form or other information forwarded to you by your bank, broker or other nominee to determine how to obtain a legal proxy in order to vote in person at the Annual Meeting.

If you hold shares in BOTH street name and as a stockholder of record, YOU MUST VOTE SEPARATELY for each set of shares.

When you vote by proxy, your shares will be voted according to your instructions. If you sign your WHITE proxy card but do not specify how you want your shares to be voted, they will be voted as the Board recommends.

What if I am a participant in the Wyndham Hotel Group Employee Savings Plan?

For participants in the Wyndham Hotel Group Employee Savings Plan with shares of Wyndham common stock credited to their accounts, voting instructions for the trustees of the plan are also being solicited through this Proxy Statement. In accordance with the provisions of the plan, the trustee will vote shares of Wyndham common stock in accordance with instructions received from

6

the participants to whose accounts the shares are credited. If you do not instruct the plan trustee on how to vote the shares of Wyndham common stock credited to your account, the trustee will vote those shares in proportion to the shares for which instructions are received.

How does the Board recommend that I vote?

The Board recommends the following votes on the WHITE proxy card or WHITE voting instruction form:

• FOR only the eight Director nominees proposed by your Board for election,

• FOR the advisory approval of our executive compensation program,

• FOR the ratification of the appointment of Deloitte & Touche LLP to serve as our independent registered public accounting firm for 2024, and

• AGAINST Choice’s proposal to repeal each provision or amendment of the Company’s By-Laws adopted by the Board subsequent to January 4, 2023 without the approval of Wyndham stockholders.

Will my shares be voted if I do nothing?

If your shares of Wyndham common stock are registered in your name, you must sign and return a proxy card or submit a proxy by telephone or by Internet in order for your shares to be voted.

If your shares of Wyndham common stock are held in “street name,” that is, held for your account by a bank, broker or other nominee, and you do not instruct your bank, broker or other nominee how to vote your shares, then, to the extent your bank, broker or other nominee has forwarded you proxy materials from or on behalf of Choice, your bank, broker or other nominee would not have discretionary authority to vote your shares on the proposals to be considered at the Annual Meeting (see below question “How many votes are required to approve each proposal?”). If your shares of Wyndham common stock are held in “street name,” your bank, broker or nominee has enclosed a WHITE voting instruction form with this Proxy Statement. We strongly encourage you to authorize your bank, broker or other nominee to vote your shares by following the instructions provided on the WHITE voting instruction form.

To instruct your bank, broker or other nominee how to vote your shares, simply sign, date and return the enclosed WHITE voting instruction form in the accompanying postage-paid envelope, or vote by proxy by telephone or via the internet in accordance with the instructions in the WHITE voting instruction form. Please contact the person responsible for your account to ensure that a WHITE proxy card or WHITE voting instruction form is voted on your behalf.

We strongly urge you to vote by proxy “FOR” only the eight of the nominees listed in Proposal 1, “FOR” Proposals 2 and 3, and “AGAINST” Proposal 4 by using the enclosed WHITE proxy card to vote TODAY by internet, by telephone or by signing, dating and returning the enclosed WHITE proxy card in the envelope provided. If your shares are held in “street name,” you should follow the instructions on the WHITE voting instruction form provided by your bank, broker or other nominee and provide specific instructions to your bank, broker or other nominee to vote as described above.

EVEN IF YOU PLAN TO ATTEND THE ANNUAL MEETING, WE RECOMMEND YOU ALSO SUBMIT YOUR PROXY SO THAT YOUR VOTE WILL COUNT IF YOU ARE UNABLE TO ATTEND THE MEETING. SUBMITTING YOUR PROXY VIA INTERNET, TELEPHONE OR MAIL DOES NOT AFFECT YOUR ABILITY TO VOTE IN PERSON AT THE ANNUAL MEETING.

7

How many votes are required to approve each proposal?

Under the Company’s Third Amended and Restated By-Laws (“By-Laws”), in a non-contested election, Directors are elected by a majority of the votes cast at any meeting of stockholders for the election of directors, meaning that the number of shares voted “FOR” a Director must exceed the number of shares voted “against” such Director’s election. However, this year’s election is contested by Choice, which nominated eight Director nominees. As a result, there are 16 Director nominees which exceeds the number of Directors to be elected, which is eight. In such a case, our By-Laws provide for a plurality voting standard, which means that the eight nominees who receive the greatest number of affirmative “FOR” votes are elected to the Board. Any shares not voted “FOR” a particular director nominee as a result of a “WITHHOLD” vote or a broker non-vote will count for purposes of determining if there is a quorum at the Annual Meeting but will not count in that director nominee’s favor and will not otherwise affect the outcome of the election (except to the extent they otherwise reduce the number of shares voted “FOR” such director nominee).

For each of Proposals 2 and 3, the affirmative vote of the holders of a majority of the shares represented at the Annual Meeting in person or by proxy and entitled to vote on the proposal will be required for approval. Abstentions will have the effect of a vote against any of these proposals. Broker non-votes will have no effect on the outcome of these proposals.

For Proposal 4, the affirmative vote of the holders of a majority of the voting power of the outstanding shares entitled to vote generally in the election of directors will be required for approval. Abstentions and broker non-votes will have the effect of a vote against this proposal.

If your shares are registered in the name of a bank, broker or other nominee and you do not give your bank, broker or other nominee specific voting instructions for your shares, under the rules of the New York Stock Exchange (“NYSE”), they normally have discretion to vote your shares on “routine” matters (including Proposal 3 to ratify the appointment of the independent registered public accounting firm) but not on any other proposals. However, to the extent your bank, broker or other nominee has forwarded you proxy materials from Choice, your bank, broker or other nominee would not have discretionary authority to vote your shares on any of the proposals to be considered at the Annual Meeting (including Proposal 3). Therefore, your bank, broker or other nominee will not be permitted to vote on your behalf on Proposals 1 – 4 unless you provide specific instructions before the date of the Annual Meeting by completing and returning the voting instruction or proxy card or following the instructions provided to you to vote your shares by telephone or the Internet; provided, however, that if your bank, broker or other nominee does not provide you with competing proxy materials from Choice, your bank, broker or other nominee will have discretionary authority to vote on Proposal 3.

What is a broker non-vote?

A broker non-vote occurs when a bank, broker or other nominee submits a proxy that states that the bank, broker or other nominee does not vote for one or more of the proposals because such bank, broker or other nominees has not received instructions from the beneficial owner on how to vote on the proposals and does not have discretionary authority to vote in the absence of instructions. To the extent your bank, broker or other nominee has forwarded you proxy materials from or on behalf of Choice, your bank, broker or other nominee would not have discretionary authority to vote your shares on the proposals to be considered at the Annual Meeting.

How do I attend the Annual Meeting?

The Annual Meeting will begin promptly at [•] [a.m./p.m.] Eastern Time on [•], 2024 at [•].

To attend the Annual Meeting, you must bring with you a photo identification such as a valid driver’s license or passport for purposes of personal identification. If you are a stockholder of record, please be prepared to provide the top portion of your proxy card.

8

If your shares are held in the name of a bank, broker or other nominee (in “street name”), you will need to bring a proxy, letter or recent account statement from that bank, broker or nominee that confirms that you are the beneficial owner of those shares.

Can I change or revoke my vote?

You may change or revoke your proxy at any time prior to voting at the Annual Meeting (1) by submitting a later dated proxy or by entering new instructions by Internet or telephone prior to 11:59 p.m. Eastern Time on [•], 2024; (2) by requesting, marking, signing, dating and mailing in a new paper proxy card; (3) by giving timely written notice of such change or revocation to the Corporate Secretary; or (4) by attending the Annual Meeting and voting.

If you are a street name stockholder, you must follow the instructions to revoke your proxy, if any, provided by your bank, broker or other nominee.

How do I make a stockholder proposal for the 2025 Annual Meeting?

Stockholders interested in presenting a proposal for inclusion in our proxy statement and proxy relating to our 2025 annual meeting may do so by following the procedures prescribed in Rule 14a-8 under the Exchange Act. To be eligible for inclusion in next year’s proxy statement, stockholder proposals must be received by the Corporate Secretary at our principal executive offices no later than the close of business on [•]. The Company’s principal executive offices are located at Wyndham Hotels & Resorts, Inc., 22 Sylvan Way, Parsippany, New Jersey 07054.

In general, any stockholder proposal to be considered at the 2025 annual meeting but not included in the proxy statement must be submitted in accordance with the procedures set forth in our By-Laws. Notice of any such proposal must be submitted in writing to and received by the Corporate Secretary at our principal executive offices not earlier than the close of business on [•] and not later than the close of business on [•]. However, if the date of the 2025 annual meeting is not within 30 days before or after [•], 2025, then a stockholder will be able to submit a proposal for consideration at the 2025 annual meeting not earlier than the close of business on the 120th day prior to the 2025 annual meeting and not later than the close of business on the later of the 90th day prior to the 2025 annual meeting or the 10th day following the day on which public announcement of the date of the 2025 annual meeting is first made. Our By-Laws require that such notice be updated as necessary as of specified dates prior to such annual meeting. Any notification to bring any proposal before an annual meeting must comply with the requirements of our By-Laws as to proper form. A stockholder may obtain a copy of our By-Laws on our investor website, https://investor.wyndhamhotels.com under the Governance/Governance Documents page, or by writing to our Corporate Secretary.

Stockholders may also nominate Directors for election at an annual meeting. To nominate a Director outside of our proxy access By-Laws, stockholders must comply with provisions of applicable law and Article II, Section 15 of our By-Laws. Pursuant to the proxy access provisions in our By-Laws, a stockholder, or a group of up to 20 stockholders, owning at least 3% of the Company’s outstanding stock continuously for at least three years, may nominate and include in the Company’s proxy materials Director nominees constituting up to the greater of two Directors or 20% of the Board, provided that the stockholders and Director nominees satisfy the disclosure and procedural requirements in Article II, Section 16 of our By-Laws. The Corporate Governance Committee will also consider stockholder recommendations for candidates to the Board sent to the Committee c/o the Corporate Secretary. See below under “Director Nomination Process” for information regarding nomination or recommendation of a Director.

9

Who should I call if I have questions about the Annual Meeting?

If you have any questions or require any assistance with voting your shares, or if you need additional copies of the proxy materials, please contact our proxy solicitation firm, Innisfree M&A Incorporated, at

Innisfree M&A Incorporated

501 Madison Avenue, 20th Floor

New York, NY 10022

[•] (toll-free from the U.S. and Canada) or

+[•] from other countries

10

BACKGROUND OF THE SOLICITATION

Wyndham evaluates on an ongoing basis its business strategy, capital allocation, and potential strategic alternatives in an effort to create incremental value for its stockholders. This evaluation is iterative and takes into account the perspectives of Wyndham’s stockholders and other considerations. Approximately two decades ago, Wyndham and Choice discussed an all-cash acquisition of Choice by Wyndham, but those discussions (along with other informal approaches between the parties across the ensuing years) never resulted in an actionable transaction.

The following section summarizes Choice’s proposals, beginning in April 2023, to acquire Wyndham for a mix of cash and stock consideration. A more comprehensive summary, including the text of the letters sent between Choice and Wyndham, is contained in the “Background of the Offer and Reasons for Recommendation” of Wyndham’s Solicitation/Recommendation Statement on Schedule 14D-9 filed with the SEC on December 18, 2023 (as amended, the “Schedule 14D-9”). The Schedule 14D-9 is not incorporated by reference into this Proxy Statement.

On April 28, 2023, Stewart Bainum, Jr. (Chairman of Choice) telephoned Stephen Holmes (Chair of Wyndham) to express Choice’s interest in a transaction with Wyndham. Mr. Holmes told Mr. Bainum that he would wait to see any proposal, but as a public company, the Board of Directors of Wyndham (for purposes of this background section, the “Wyndham Board”) had a responsibility to evaluate any serious proposal.

Shortly following that call, Moelis & Company LLC (“Moelis”), financial advisor to Choice, sent a letter to the Wyndham Board (the “April Proposal”). The April Proposal detailed Choice’s interest in a cash-and-stock business combination with Wyndham (the “Transaction”). The April Proposal presented Choice’s offer to acquire Wyndham for a mix of cash and Choice stock with a nominal value of $80 per Wyndham share. Cash represented 40% of the offer and Choice stock represented the remaining 60%, with the intent to fund the cash portion through the issuance of debt securities. With the 40:60 cash-to-equity consideration mix, Wyndham stockholders would own 39% of the combined company. Choice expressed confidence they could execute the necessary transaction documents for the Transaction within 20 days of Wyndham accepting their proposal and that doing so would not be a barrier to completing the deal within their anticipated timeline. The April Proposal made no mention at all of regulatory considerations or a strategy for getting the Transaction cleared. As a next step, Choice suggested engaging directly to discuss the April Proposal and signing a bilateral non-disclosure agreement (“NDA”).

On May 1, 2023, the Executive Committee (Messrs. Holmes, Buckman and Ballotti) of the Wyndham Board (the “Executive Committee”) met, with Wyndham’s General Counsel present, to discuss the April Proposal. Wyndham’s General Counsel reviewed with the Executive Committee legal considerations and fiduciary duties relating to the April Proposal. After review and discussion of the April Proposal, the Executive Committee instructed Wyndham’s management to engage legal and financial advisors to assist Wyndham and the Wyndham Board with this matter.

On May 8 and 9, 2023, the Wyndham Board convened in two successive special meetings to discuss the April Proposal (the “May Board Meetings”), with Wyndham’s General Counsel present. Members of Wyndham management and representatives of its outside legal advisor, Kirkland & Ellis LLP (“Kirkland”), and its outside financial advisor, Deutsche Bank Securities Inc. (“Deutsche Bank”), were present at the May 9, 2023 meeting. In addition, on May 9, 2023, the non-management, independent members of the Wyndham Board (Mses. Biblowit and Richards and Messrs. Buckman, Churchill, Deoras and Nelson and collectively, the “Independent Directors”) met in a separate executive session. The Wyndham Board engaged in an extensive discussion about the April Proposal, including the opportunistic timing of the approach given the companies’ relative valuation multiples, concerns about the value of Choice’s stock (including Choice’s lack of organic growth and the significant leverage that would be incurred to complete a transaction), and risks related to a potentially protracted regulatory review process (including potential franchisee churn, stagnated

11

development of the fast-growing ECHO Suites brand, and challenges attracting and retaining team members). Representatives of Deutsche Bank shared preliminary views on the value terms of the April Proposal and representatives of Kirkland reviewed the Wyndham Board’s fiduciary duties relating to responding to the April Proposal. Wyndham management reviewed with the Wyndham Board long-range projections for Wyndham on a standalone basis, including a detailed discussion of the underlying assumptions. After discussion, the view of the Wyndham Board was that the April Proposal appeared substantially inadequate in terms of price, consideration and other material terms, including in light of the upside in Wyndham’s standalone plan. After consideration of all factors and views from Wyndham management and legal and financial advisors, the Wyndham Board unanimously determined that rejecting the April Proposal, which significantly undervalued Wyndham relative to Wyndham’s standalone plan, was in the best interests of Wyndham’s stockholders and instructed Mr. Holmes to convey its rejection to Choice and the reasons therefor, which Mr. Holmes did on May 9, 2023.

On May 10, 2023, a representative from Moelis telephoned Mr. Holmes to inquire about Wyndham’s response to Choice’s proposal. The representative of Moelis noted that Choice was likely to send another letter to Wyndham and that Choice could likely increase the cash component reflected in the April Proposal.

On May 15, 2023, Choice submitted a second letter to the Wyndham Board, revising its initial proposal (the “May Proposal”). In the May Proposal, Choice reaffirmed its interest in the Transaction and revised its offer to a mix of cash and Choice stock with a nominal value of $85 per Wyndham share. The May Proposal included a consideration mix of 55% cash and 45% stock and stated Choice would welcome having two mutually agreed upon Wyndham-designated independent Board members join the board of directors of the combined company. With the proposed 55:45 cash-to-equity consideration mix, Wyndham stockholders would own approximately 35% of the combined company. The May Proposal made no mention at all of regulatory considerations or strategy for getting the Transaction cleared.

On May 22, 2023, the Executive Committee met, with Wyndham management and representatives of Kirkland and Deutsche Bank present, to discuss the May Proposal. After reviewing the revised terms, which did not address the Wyndham Board’s concerns with the April Proposal, the Executive Committee determined that, consistent with the reasons discussed at the May Board Meetings (including concerns about the value of Choice’s stock, especially in light of the high leverage level of the combined company) and risks to Wyndham’s business relating to a potentially lengthy regulatory review process, and after taking into account the changed terms of the May Proposal relative to the April Proposal, the May Proposal remained substantially inadequate in terms of price, consideration mix and other terms. The Executive Committee instructed Mr. Holmes to convey its rejection of the May Proposal to Choice.

On May 23, 2023, the Wall Street Journal reported that “according to people familiar with the matter” Choice was seeking to acquire Wyndham.

On May 29, 2023, Mr. Holmes emailed Mr. Bainum and Choice’s Chief Executive Officer, Patrick Pacious, rejecting the May Proposal, reiterating the view of the Wyndham Board that the May Proposal still substantially undervalued Wyndham and expressing the additional views of the Wyndham Board that (1) the May Proposal came at a highly opportunistic time for Choice given recent relative trading performance, (2) Choice’s stock was fully valued relative to its growth prospects, and (3) the level of leverage proposed for the combined company could negatively impact the value of the combined company and the stock consideration received by Wyndham’s stockholders.

On June 1, 2023, Choice sent a third letter to the Wyndham Board (the “June Letter”). The June Letter did not propose any increase in value or other changes to the offer set forth in the May Proposal. Instead, Choice reiterated their belief that the Transaction would benefit Wyndham stockholders and purported to address Wyndham’s stated concerns.

12

Following the delivery of the June Letter, at the request of Mr. Bainum, Mr. Holmes and Mr. Bainum agreed to speak to discuss a potential in-person meeting concerning Choice’s proposal. During the first week of June, Mr. Holmes had a telephone call with Mr. Bainum’s assistant to discuss setting up a time for Mr. Holmes and Mr. Bainum to meet. Mr. Holmes and Mr. Bainum exchanged several emails between the delivery of the June Letter and their phone call on June 14, 2023.

On June 2, 2023, representatives of Deutsche Bank and Moelis held a telephonic discussion, in which a representative of Deutsche Bank noted that Kirkland would provide a draft of a customary mutual NDA to facilitate substantive discussions between the parties.

On June 14, 2023, the Wyndham Board held a meeting with Wyndham’s General Counsel present to discuss the recent interactions between Wyndham and Choice. Mr. Holmes updated the Wyndham Board on the proposed meeting with Mr. Bainum, and the Wyndham Board discussed the proposed meeting and messaging.

Later on June 14, 2023, Mr. Holmes held a telephonic discussion with Mr. Bainum to discuss agenda items for the in-person meeting between Mr. Holmes and Mr. Bainum. Mr. Holmes proposed that the parties execute a customary mutual NDA to facilitate substantive discussions between the parties. Mr. Bainum pushed back on the request to sign an NDA, stating that he did not want to spend a lot on legal fees before having an in-person meeting. Mr. Holmes told Mr. Bainum that, without an NDA, substantive and meaningful discussions would necessarily be limited. Mr. Holmes reiterated to Mr. Bainum that the May Proposal (repeated in the June Letter) substantially undervalued Wyndham and also expressed the additional views of the Wyndham Board on Choice’s offer. Mr. Bainum ended the meeting by asking Mr. Holmes to meet without an NDA in place.

Following that conversation, Kirkland delivered a draft customary mutual NDA, including a customary standstill, to Willkie Farr & Gallagher LLP (“Willkie Farr”), legal advisor to Choice. Subsequent to the delivery of the draft NDA, Moelis communicated to a representative of Deutsche Bank that Choice was unwilling to sign an NDA with a customary standstill.

On June 15, 2023, representatives of Kirkland and Willkie Farr discussed the terms of the proposed NDA. In response to an inquiry from Willkie Farr, a representative of Kirkland reiterated the Wyndham Board’s view that the May Proposal still substantially undervalued Wyndham.

On June 22, 2023, despite Choice’s refusal to sign a customary NDA, Messrs. Holmes and Ballotti held an in-person meeting with Mr. Bainum and Mr. Pacious covering a broad range of topics. In light of Choice’s refusal to sign an NDA, the representatives of Wyndham were unable to share any non-public information with Choice. Messrs. Holmes and Ballotti shared the concerns of the Wyndham Board with the valuation and total value of the consideration being proposed, the composition of the consideration (including in light of the significant leverage levels at the combined company), and the regulatory outlook and risks relating to the proposed Transaction.

On June 28, 2023 and June 30, 2023, Messrs. Bainum and Holmes held telephonic discussions regarding Choice’s proposal, including a possible increase in the cash portion of the consideration. Mr. Holmes reiterated to Mr. Bainum that the price was too low, the cash consideration amount was too low and that the regulatory process would be burdensome and the outcome uncertain. In discussing the stock consideration, Mr. Holmes also noted that Wyndham’s stockholders may have concerns about post-transaction liquidity. Mr. Bainum stated that he “heard” and “underst[ood]” Wyndham’s concerns about valuation, that “maybe he got it wrong” with respect to the regulatory analysis and that, although his team was working on lining up financing, Mr. Bainum had President Biden at his house, which was a higher priority.

On July 5, 2023, the Executive Committee met, with Wyndham management and representatives of Kirkland and Deutsche Bank present, to further discuss the June 22 meeting between Choice and Wyndham and subsequent telephone calls between Messrs. Holmes and Bainum. The Executive

13

Committee discussed potential next steps by Choice and regulatory considerations relating to the May Proposal, including concerns about the potential asymmetrical risk borne by Wyndham stockholders in the event of an extended regulatory review period.

On July 11, 2023, the Executive Committee met, with Wyndham management and representatives of Kirkland and Deutsche Bank present, to discuss a press release issued by Choice earlier that day about Choice’s financial outlook.

Later on July 11, 2023, Mr. Bainum telephoned Mr. Holmes to discuss Choice’s proposal, including Choice’s assumptions about Wyndham’s stockholders’ cash and stock election preferences. In addition, consistent with the concerns expressed during the June 22 discussion, Mr. Holmes raised the regulatory risk concerns.

On July 14, 2023, representatives of Deutsche Bank and Moelis held a telephonic discussion to discuss Choice’s expectations about Wyndham’s stockholders’ consideration election preferences and behavior, as well as past transactions involving consideration election mechanisms.

On August 14, 2023, Mr. Bainum telephoned Mr. Holmes to request a further in-person meeting on August 17, 2023, which Mr. Holmes accepted. During their call, Mr. Bainum made a verbal offer that Choice valued at $90 per share with a consideration mix of 55% cash and 45% Choice stock.

On August 16, 2023, the Wyndham Board held a meeting with Wyndham management and representatives of Kirkland and Deutsche Bank present to discuss the revised verbal offer that Mr. Bainum proposed to Mr. Holmes during their August 14 call. In addition, the non-management members of the Wyndham Board (Mses. Biblowit and Richards and Messrs. Buckman, Churchill, Deoras, Holmes and Nelson) met in a separate executive session. Representatives of Deutsche Bank discussed the financial terms of the verbal offer with the Wyndham Board and noted that the increase in the nominal value from the May Proposal of $85 per share was largely attributable to an upward movement in Choice’s share price during the intervening period. Representatives of Kirkland discussed the regulatory environment and specific regulatory considerations relating to a proposed transaction with Choice. The Wyndham Board discussed the likely reaction by franchisees to a possible combination, including the feedback received after the May 23 Wall Street Journal story, and the significant risks posed to Wyndham’s business in the event of an extended regulatory review and the uncertain outcome of such a review. The Wyndham Board also discussed with its advisors potential contractual terms that could mitigate some of the identified risks with respect to value, consideration mix and regulatory considerations. Mr. Holmes discussed his upcoming meeting with Mr. Bainum, and the Wyndham Board instructed Mr. Holmes to communicate the Wyndham Board’s three primary concerns with respect to Choice’s verbal offer.

On August 17, 2023, Mr. Holmes held an in-person meeting with Mr. Bainum to further discuss Choice’s latest verbal proposal and Wyndham’s views on the proposal. Mr. Holmes shared the Wyndham Board’s concerns with the Choice proposal, including that it undervalues Wyndham in relation to its standalone prospects, included a significant stock component as to which the Wyndham Board had concerns including as a result of high post-acquisition leverage, and the asymmetrical risk to Wyndham stockholders as a result of the potential regulatory timeline and uncertain outcome. Mr. Holmes noted that Choice’s offer faced serious regulatory challenges and that if there was not a path to regulatory approvals, even a high price was illusory (if the approvals could not be obtained). Mr. Bainum was dismissive of Mr. Holmes’ concerns about regulatory risk. During that meeting, Mr. Bainum proposed that the parties enter into an NDA and standstill through Wyndham’s filing of its subsequent Form 10-K in February 2024 in order to facilitate discussions between the parties to address the concerns Wyndham had raised. Mr. Holmes subsequently updated the Wyndham Board on the discussions.

On August 18, 2023, representatives of Kirkland and Willkie Farr held a telephonic discussion that addressed Choice’s proposed NDA and the regulatory concerns Wyndham had with Choice’s proposal.

14

On August 21, 2023, Mr. Bainum contacted Mr. Holmes to discuss the impasse that the parties had reached with respect to a potential transaction. Contrary to the statements in Choice’s background section in the Form S-4 filed by Choice with the SEC on December 12, 2023 (as amended, the “Form S-4”), Mr. Holmes did not say on this call that Wyndham would not transact, even at a much higher valuation. Rather, in light of a surprising question from Mr. Bainum on how Mr. Holmes would advise him to proceed, Mr. Holmes told Mr. Bainum that, although it was not his responsibility to solve the issues with Mr. Bainum’s offer, more cash in the offer could solve some of the issues identified. Mr. Bainum stated that as a result of the impasse Choice was going “pencils down” but, for the sake of the record, would send a letter documenting his prior verbal proposal. Following that conversation, on August 21, 2023, Choice sent a fourth letter to the Wyndham Board (the “August Proposal”), which reiterated in writing the verbal proposal discussed during the August 14 telephone call. In the August Proposal, Choice revised its offer to a nominal value of $90 per Wyndham share, which consideration – similar to the previous proposals – would consist of 55% cash and 45% Choice stock. The August Proposal made no mention at all of regulatory considerations or strategy for getting the Transaction cleared by antitrust and competition authorities.

On August 22, 2023, Mr. Holmes and Mr. Bainum exchanged emails relating to the status of the interactions between the parties and to arrange a further telephone call. Those emails included an email from Mr. Holmes to Mr. Bainum noting that the August Proposal did not accurately describe the interactions between the parties and that Mr. Bainum had indicated that Choice was stepping back from its pursuit of Wyndham. Mr. Holmes reiterated the Wyndham Board’s concerns that the August Proposal (1) substantially undervalues Wyndham and its future growth potential, (2) includes a substantial Choice stock component, which Wyndham believes is fully valued relative to Choice’s growth prospects and (3) involves significant business and execution risks for Wyndham’s stockholders. In an email on August 22, 2023, Mr. Bainum rejected the notion that he said he was stepping back from the transaction.

During late August 2023 and September 2023, representatives of Kirkland and Willkie Farr held multiple discussions, including on analysis of the regulatory aspects of the August Proposal. As part of those conversations, Kirkland reiterated the Wyndham Board’s views on Choice’s offers. Representatives of Willkie Farr shared their view that a transaction was likely to be cleared by antitrust regulators within the first 60 days after filing, while representatives of Kirkland shared their view that a transaction was almost certain to face a so-called “Second Request” from U.S. regulatory authorities and that any approval, if it was obtained at all, would come after an extended period of 12 to 18 months or more. Representatives of Kirkland also explained concerns with the asymmetrical risks borne by Wyndham stockholders as a result of an extended review and the resulting need for an appropriate set of terms and protections. Representatives of Willkie Farr rejected any concerns about these risks and instead stated that a “market” reverse termination fee (unquantified) would be adequate compensation and protection. Representatives of Kirkland, consistent with the previously expressed views of the Wyndham Board, communicated that the August Proposal was not in a range of terms of value and regulatory risk in which the Wyndham Board was prepared to transact, so it was premature to share with Choice Wyndham’s view on its own value.

On August 29, 2023, representatives of Kirkland and Willkie Farr held a telephonic discussion regarding regulatory considerations. Willkie Farr told Kirkland that Choice had not yet completed meaningful analysis about regulatory risk (including by having an economist begin work), strategy and data needed, but remained bullish that a transaction could be cleared expeditiously. Kirkland did not agree with Willkie Farr’s assessment of timing or risk and noted that any pro-competitive justifications for the Transaction that Choice might raise would need to be understood in the context of the potential anti-competitive harms.

15

On August 29, 2023, the Executive Committee met, with Wyndham’s General Counsel present, to discuss the recent interactions between Wyndham and Choice. The Executive Committee instructed Mr. Holmes to seek to convene a meeting with Mr. Bainum, along with financial advisors for each party, to discuss Wyndham’s perspective around regulatory considerations and the protections and compensation that would be required to protect Wyndham stockholders against the asymmetrical risk. The Executive Committee noted that, given the critical nature of these concerns, a satisfactory resolution of this issue was a gating item to further discussions about other elements of the August Proposal.

Despite Choice’s assertion to the contrary in the “Background of the Offer” section of the Form S-4, Mr. Holmes, Mr. Bainum, and representatives of Deutsche Bank and Moelis did not meet on August 30, 2023.

On September 5, 2023, Mr. Holmes and Mr. Bainum held a telephonic discussion, in which representatives of Moelis and Deutsche Bank also participated. The parties discussed their respective views on regulatory considerations and the parties’ views with respect to other key concerns raised by Wyndham with respect to the August Proposal, including price and the consideration mix.

On September 6, 2023, representatives of Moelis and Deutsche Bank held a telephonic discussion in which, among other matters, regulatory considerations relating to the August Proposal were discussed. Moelis also proposed that the parties enter into a one-way NDA to allow for limited due diligence by Wyndham on Choice.

On September 8, 2023, Willkie Farr sent to Kirkland a “one-way” NDA pursuant to which Choice would agree to a 21-day standstill and offer to provide certain specified information about Choice to Wyndham. During the next two weeks, representatives of Choice and Wyndham exchanged drafts of (and held discussions on) the specific information that would be provided by Choice. Choice and Wyndham were unable to come to agreement because the information that Choice was willing to provide (most of which was already publicly available) was wholly inadequate for purposes of assessing Choice’s growth prospects and the valuation of the Choice stock consideration. On or around September 9, 2023, when representatives of Willkie Farr asked representatives of Kirkland if Wyndham intended to formally respond to the August Proposal, Kirkland informed them that Wyndham was awaiting a response to the regulatory issues previously raised with Choice and Willkie Farr.

On September 13, 2023, Wyndham engaged PJT Partners LP (“PJT Partners”) as an additional financial advisor to assist Wyndham with respect to a potential transaction with Choice.

On September 26, 2023, the Wyndham Board held a meeting with Wyndham management and representatives of Kirkland and Deutsche Bank present to discuss the status of communications relating to Choice’s August Proposal. Representatives of Kirkland reviewed with the Wyndham Board regulatory considerations relating to the proposed Transaction. The Wyndham Board also discussed information received from the management and sales teams about Choice exploiting rumors regarding the potential Transaction to gain competitive advantages with prospective and existing franchisees and the resulting concerns about the impact of a potential deal on Wyndham’s business and resulting risk to Wyndham stockholders. The Wyndham Board discussed the respective relative benefits and risks of Wyndham’s standalone prospects as compared to the August Proposal and determined that Wyndham should not pursue further discussions with Choice.

On September 26, 2023, representatives of Kirkland and Willkie Farr held a telephonic discussion about regulatory considerations. Kirkland noted that while Choice may believe that there are pro-competitive justifications for the transaction, they did not appear to outweigh the significant antitrust concerns identified through Kirkland and Wyndham’s regulatory analysis.

16

On September 26, 2023, representatives of Deutsche Bank and Moelis held a telephonic discussion. A representative of Deutsche Bank noted Wyndham’s view that Choice appeared to have done minimal work on the regulatory front and had not given Wyndham sufficient comfort on this issue.

On September 27, 2023, Mr. Holmes and Mr. Bainum held a telephonic discussion, in which representatives of Moelis and Deutsche Bank also participated. Mr. Holmes communicated the views of the Wyndham Board that the August Proposal from Choice was not in the best interests of Wyndham and its stockholders given (1) that it undervalued Wyndham’s standalone prospects, (2) the inclusion of a significant portion of Choice stock in the consideration raised concerns about the value of that stock (including in light of Choice’s limited organic growth and the elevated leverage levels that would result from a transaction (which would limit the combined company’s opportunity for growth)), and (3) the asymmetrical risk that Wyndham stockholders were being asked to bear in light of regulatory concerns relating to the Transaction.

On October 17, 2023, Choice publicly announced the terms of the August Proposal along with its version of the history of discussions between the parties and their respective advisors. While the August Proposal had valued synergies from the Transaction at $100 million, Choice’s October announcement valued the synergies at $150 million but did not include any increase to the consideration for those additional synergies. Later that day, the Executive Committee held a meeting, with representatives of Kirkland, Deutsche Bank and PJT Partners present, after which, Wyndham responded with its own press release and supplemental materials, announcing its rejection of the August Proposal and the reasons therefor.

Also on October 17, 2023, the Asian American Hotel Owners Association (“AAHOA”), which represents approximately 2/3 of all Wyndham franchisees and the owners of reportedly 60%+ of all U.S. hotels, issued a statement expressing AAHOA’s “High Concerns Over Possible Merger of Choice Hotels and Wyndham.” In its statement, AAHOA supported the Wyndham Board’s rejection of Choice’s offer, stating that “news of a potential [Choice-Wyndham] merger has sent a shock wave of high concern and even fear through our AAHOA membership” before calling on “the federal agencies, including the [FTC], to do a thorough investigation to fully protect competition in [the economy/limited service segment] of the industry.”

Later on October 17, 2023, the Wyndham Board held a meeting with management present to discuss Choice’s public disclosures and the response issued by Wyndham.

Subsequent public press releases and materials were released by the parties during the course of October and November 2023 relating to Choice’s unsolicited proposal.

On November 2, 2023, the Federal Trade Commission (the “FTC”) notified the General Counsel of Wyndham by telephone that the FTC was opening an initial investigation into the proposed combination despite there being no transaction to review or any HSR filing.