Exhibit 99.(a)(1)(V)

March 11, 2024 Dear Shareholder, We are asking for your support at our 2024 Annual Meeting of Shareholders – your vote is important for the future of your investment in Wyndham. Choice Hotels, our largest and most direct competitor, is attempting a hostile takeover of Wyndham with an offer that is inadequate and subject to numerous risky conditions. Your Board has been diligent in its review and consideration of Choice’s proposals to date: 13 Wyndham Board meetings to evaluate Choice’s offer 25+ Meetings and calls with Choice and its advisors Your Board has focused its evaluation on the entirety of Choice’s proposal. Your Board has been explicitly clear that – in order to make a proposal viable for shareholders – Choice must adequately address the three key issues we have repeatedly raised: Despite our efforts to engage, Choice has demonstrated that it is unable, or simply unwilling, to propose a complete offer package addressing these key issues. Instead, Choice is opportunistically attempting to take over our Company on the cheap by nominating a full slate of eight individuals who we believe are conflicted and have been entrusted with a single, self-serving task: rubber stamping Choice’s inadequate offer and handing Wyndham over at an insufficient value. We believe these individuals would act solely in the economic interests of Choice’s existing shareholders, not yours.

Choice’s Offer Continues to Miss the Mark on Value and Consideration Mix Insufficient Valuation Choice’s offer represents no change of control premium The Street agrees: • Choice’s offer is below Wyndham’s consensus price target • 11 out of 12 Wall Street analysts covering Wyndham have “Buy” ratings on Wyndham Given the high likelihood for the regulatory timeline to extend well into 2025, the offer should be analyzed off a 2025E EBITDA multiple A 12.9x 2025E EBITDA offer multiple is in line with Wyndham’s current trading multiple and a significant discount to the 16.7x median for comparable change-of-control deals, which ranged from 14x to 21x Undervalues Wyndham’s Superior Standalone Growth Prospects Wyndham’s standalone plan has significantly greater value than Choice’s offer • Standalone plan with line of sight to potential $26 to $48 of stock price upside Wyndham’s resilient, pure-play franchise business model has continuously generated earnings growth, stable cash flows and strong shareholder returns • Historical EBITDA growth of +6%1 and expected to accelerate to 7 to 10% • Returned over 30% of market cap to Wyndham shareholders since going public in mid-2018 Highly Unattractive Consideration Mix Choice’s proposal includes a significant stock component and exposes Wyndham shareholders to value degradation • Every single day since Choice’s public offer, the value of its offer has been below the $90 advertised by Choice and has averaged only $87 Choice’s trading multiple has contracted more than 2 turns over the last 18 months and is at risk of further deterioration • Choice has inferior growth prospects with declining organic system growth and development pipeline • Pro forma leverage of 6.3x is over twice the peer average and would limit the combined company’s ability to invest in future growth A survey from the Asian American Hotel Owners Association (AAHOA) suggests significant potential for franchisee attrition, which represents further risk to the stock component To learn more, visit StayWyndham.com

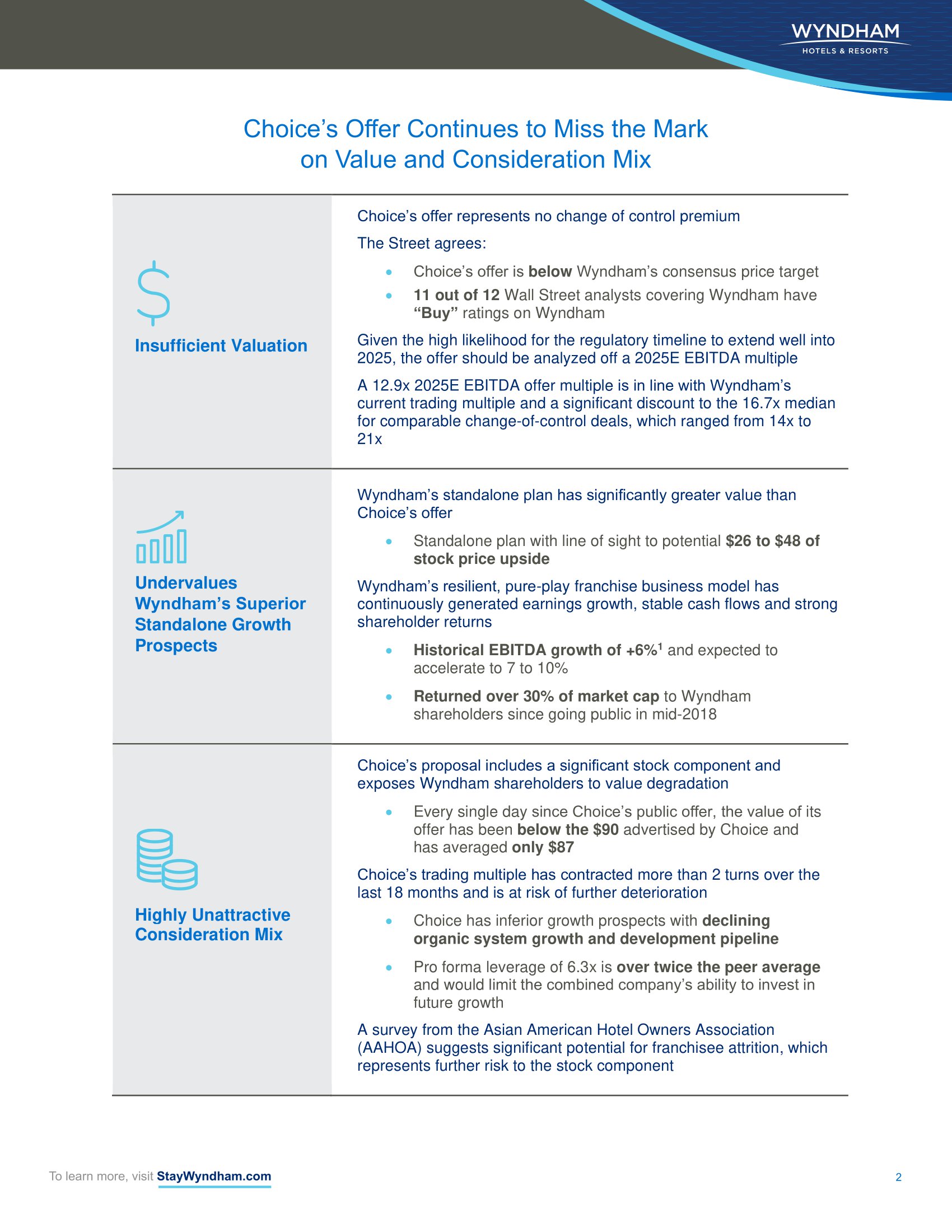

Wyndham Has a Clear Path to Deliver Shareholder Value Wyndham’s standalone growth plan has the potential to deliver significantly greater upside than what Choice is offering. Continuing +6% Historical EBITDA Growth1 Free Cash Flow Generation Balance Sheet Capacity 7-10% Anticipated EBITDA Growth Re-Rating of Multiple Growth +$13 +$8 +$5 +$12 +$10 Achievability strongly supported by historical EBITDA growth of +6%1 Expected ~$650M free cash flow generation over the next two years Ability to deploy ~$400M of additional leverage capacity, based on midpoint target net leverage of 3.5x Incremental 1-4% growth strongly supported by ongoing initiatives that are expected to drive EBITDA growth to 7-10%, as well as incremental value creation from related free cash flow and balance sheet deployment Reflects continued re-rating of multiple; every 1.0x increase in Wyndham’s multiple increases share price by +$10 The key issues with Choice’s offer – insufficient valuation, unattractive consideration mix and asymmetrical regulatory risk – present a stark contrast to Wyndham’s far superior standalone growth prospects under our proven Board and management team. To learn more, visit StayWyndham.com

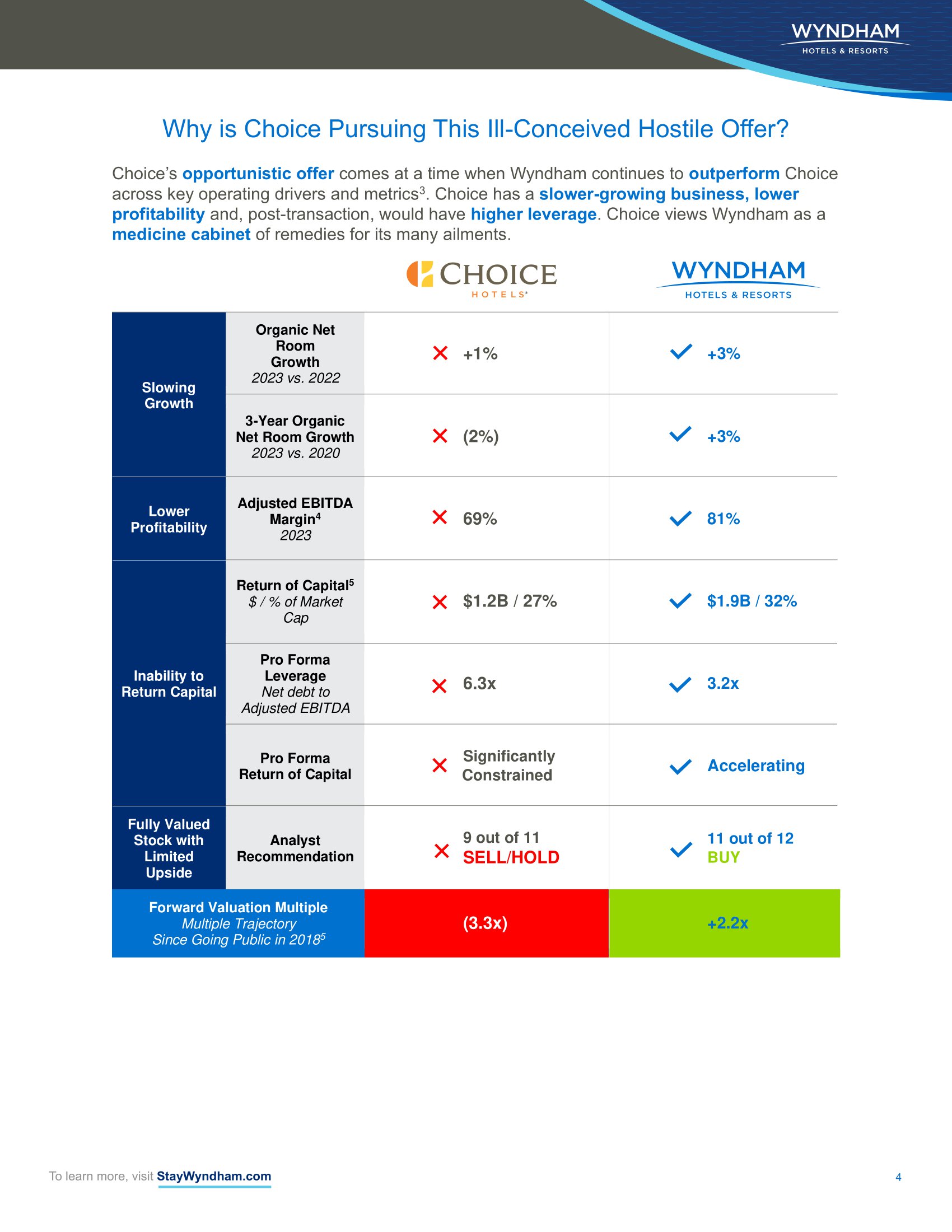

Why is Choice Pursuing This Ill-Conceived Hostile Offer? Choice’s opportunistic offer comes at a time when Wyndham continues to outperform Choice across key operating drivers and metrics3. Choice has a slower-growing business, lower profitability and, post-transaction, would have higher leverage. Choice views Wyndham as a medicine cabinet of remedies for its many ailments. Slowing Growth Organic Net Room Growth 2023 vs. 2022 +1% +3% 3-Year Organic Net Room Growth 2023 vs. 2020 (2%) +3% Lower Profitability Adjusted EBITDA Margin4 2023 69% 81% Inability to Return Capital Return of Capital5 $ / % of Market Cap $1.2B / 27% $1.9B / 32% Pro Forma Leverage Net debt to Adjusted EBITDA 6.3x 3.2x Pro Forma Return of Capital Significantly Constrained Accelerating Fully Valued Stock with Limited Upside Analyst Recommendation 9 out of 11 SELL/HOLD 11 out of 12 BUY Forward Valuation Multiple Multiple Trajectory Since Going Public in 20185 (3.3x) +2.2x To learn more, visit StayWyndham.com

Choice Continues to Be Wrong About Everything Antitrust-Related Choice has consistently ignored the antitrust risk inherent in this combination. The extended timeline and strong opposition from franchisees risk irreparable damage to Wyndham’s standalone initiatives, gifting Choice with a no-lose outcome, regardless of whether the deal is approved by the FTC. We have been transparent with our shareholders, focusing on obtaining a fast and fair outcome to resolve any uncertainty and minimize further damage to our business. Choice Claimed… But the Truth Is… FTC would clear a transaction in <60 days without a “Second Request” – recently changing forecasted timeline to 12 months while also seeking 24 months to get approval • The FTC reached out to Wyndham unsolicited and started investigating the deal more than a month before Choice launched its formal offer. The FTC has launched an intensive Second Request with an unclear and elongated timeline – which occurs in only ~1% of deals it reviews • The offer has separately attracted investigations from four State Attorneys General, including two AGs that recently sued to block another transaction, as well as bipartisan scrutiny from four U.S. Senators • Any resulting FTC or AG lawsuit to block the deal will force Wyndham to expend significant time and money – potentially lasting well into 2025 Regulatory hurdles would be minimal and the deal is pro-competitive • The combined market shares in certain chainscales – 57% in economy and 67% in midscale – are at levels deemed presumptively illegal under the FTC’s 2023 Merger Guidelines and are based on STR and other data which the FTC compelled each party to provide • 92% of significant merger investigations in 2023 resulted in a lawsuit or an abandoned transaction6 • Multiple deals recently scrutinized by the FTC have been challenged, blocked or abandoned by the parties just since the beginning of 2024 Franchisees would be supportive of a combination • Franchisees of both Wyndham and Choice are vehemently opposed; as is AAHOA, which represents approximately two-thirds of Wyndham and Choice franchisees • Franchisees – which are the heart of any franchise system – are concerned the loss of competition would result in higher system fees and diminished brand innovation and investment • The reaction of affected customers – in this case franchisees – is something the FTC always weighs heavily in deciding whether to challenge a transaction This transaction requires no special antitrust-related protections or compensation for Wyndham shareholders • Transaction requires heightened antitrust protections given the uncertain timeline and potential risks to our business during any review • An uncertain and extended regulatory review period, especially following an agreement to merge, would hinder Wyndham's ability to execute on its growth pillars, negatively impacting standalone and pro forma valuation • Choice’s exchange offer provides NO protection if the transaction does not close. Its previously proposed reverse termination fee (RTF) of 6% would not have begun to compensate Wyndham shareholders for the value destroyed over a prolonged review period leading to a failed deal, and its previously proposed ‘ticking fee’ would only be paid if a deal closes To learn more, visit StayWyndham.com

Protect Your Investment: Support the Wyndham Board Your Board is more qualified with the right mix of skills and expertise to deliver the most value to shareholders from the execution of our standalone plan. We’re protecting shareholders from an unsolicited, hostile offer that undervalues Wyndham, ignores future growth prospects and exposes shareholders to significant, asymmetrical regulatory risk. Choice claims its nominees are “highly qualified” – but we believe these nominees, who have conflicted ties to Choice and its advisors, have been hand-picked by our largest competitor for the sole purpose of pushing through their ill-advised hostile offer. In the event Choice’s slate is elected and the transaction is either delayed or blocked by regulators, Wyndham would be steered by a new board that does not have a plan or the history, expertise and experience to continue to oversee our global strategy. Thank you for your continued support. The Wyndham Board of Directors Stephen P. Holmes Geoffrey A. Ballotti Myra J. Biblowit James E. Buckman Bruce B. Churchill Mukul Deoras Ronald L. Nelson Pauline D.E. Richards To learn more, visit StayWyndham.com

Questions? If you have any questions about how to vote your shares, please call the firm assisting us with the solicitation of proxies or visit StayWyndham.com. Innisfree M&A Incorporated Important Additional Information This communication is not an offer to purchase or a solicitation of an offer to sell any securities or the solicitation of any vote or approval. Wyndham Hotels & Resorts, Inc. (“Wyndham” or the “Company”) has filed with the U.S. Securities and Exchange Commission (the “SEC”) a solicitation/recommendation statement on Schedule 14D-9. The Company has mailed the solicitation/recommendation statement filed by the Company to Company stockholders. COMPANY STOCKHOLDERS ARE ADVISED TO READ THE COMPANY’S SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14D-9 AS WELL AS ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BEFORE MAKING ANY DECISION WITH RESPECT TO ANY EXCHANGE OFFER BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Company stockholders may obtain a copy of the Solicitation/Recommendation Statement on Schedule 14D-9, as well as any other documents filed by the Company in connection with any exchange offer by Choice Hotels International, Inc. or one of its affiliates, free of charge at the SEC’s website at www.sec.gov. In addition, investors and security holders will be able to obtain free copies of these documents from the Company by directing a request to Matt Capuzzi, Senior Vice President, Investor Relations at matthew.capuzzi@wyndham.com or by calling 973.753.6453. The Company filed a preliminary proxy statement and accompanying form of WHITE proxy card with the SEC on February 26, 2024 (as amended on March 11, 2024, the “Preliminary Proxy Statement”), with respect to the Company’s 2024 Annual Meeting of Stockholders (the “2024 Annual Meeting”). The Company will file and mail a definitive proxy statement (the “Proxy Statement”) and accompanying WHITE proxy card to stockholders of the Company. The Company’s stockholders are strongly encouraged to read the Proxy Statement (including any amendments or supplements thereto) and the accompanying WHITE proxy card as well as other documents filed by the Company with the SEC carefully in their entirety because they contain important information. The Company’s stockholders may obtain copies of the Proxy Statement, any amendments or supplements to the Proxy Statement and other documents filed by the Company with the SEC free of charge at the SEC’s website at www.sec.gov. Copies will also be available free of charge at the Company’s website at https://investor.wyndhamhotels.com.

Certain Information Concerning Participants Wyndham and certain of its directors and executive officers will be participants in the solicitation of proxies from Wyndham stockholders by and on behalf of its Board in connection with the matters to be considered at the 2024 Annual Meeting. Information regarding the Company’s directors and executive officers and their respective interests in the Company by security holdings or otherwise is available in its most recent Annual Report on Form 10-K filed with the SEC on February 15, 2024, and the Preliminary Proxy Statement filed with the SEC on February 26, 2024 (and amended on March 11, 2024).To the extent holdings of the Company’s securities reported in the Preliminary Proxy Statement have changed, such changes have been or will be reflected in the Proxy Statement and on Statements of Change in Ownership on Form 4 filed with the SEC. These documents can be obtained free of charge from the sources indicated above. Cautionary Statement on Forward-Looking Statements Certain statements either contained in or incorporated by reference into this communication, other than purely historical information, and assumptions upon which those statements are based, are “forward-looking statements.” Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections at the time Wyndham makes the statements and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate,” “projection” and similar words or expressions, including the negative version of To learn more, visit StayWyndham.com

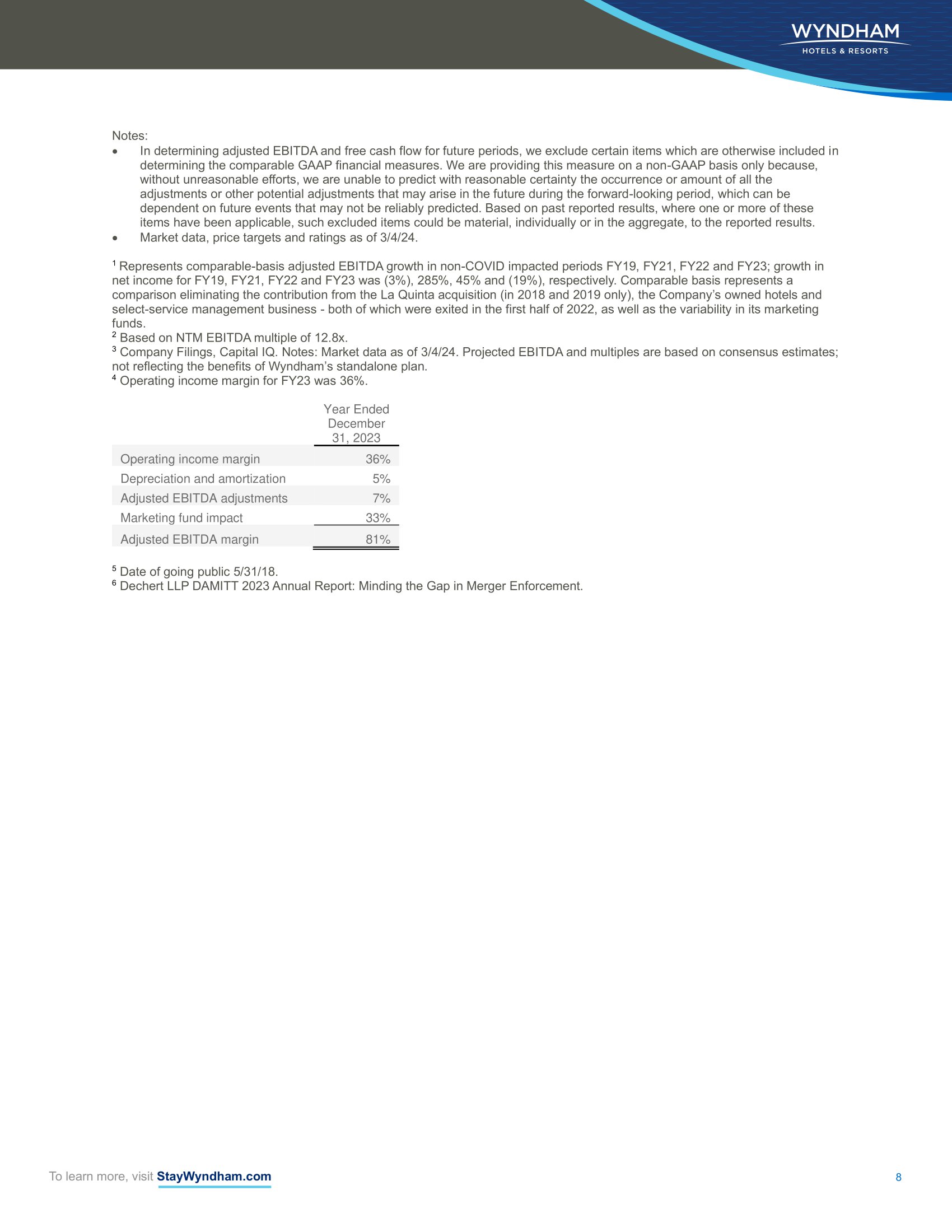

such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Wyndham to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of hereof. Factors that could cause actual results to differ materially from those in the forward-looking statements include, without limitation, factors relating to the unsolicited exchange offer by Choice Hotels International, Inc. (“Choice”) to acquire all outstanding shares of our common stock (the “Exchange Offer”), including actions taken by Choice in connection with such offer, actions taken by Wyndham or its stockholders in respect of the Exchange Offer or other actions or developments involving Choice, such as a potential proxy contest, the completion or failure to complete the Exchange Offer, the effects of such offer on our business, such as the cost, loss of time and disruption; general economic conditions, including inflation, higher interest rates and potential recessionary pressures; global or regional health crises or pandemics (such as the COVID-19 pandemic) including the resulting impact on the Company’s business operations, financial results, cash flows and liquidity, as well as the impact on its franchisees, guests and team members, the hospitality industry and overall demand for and restrictions on travel; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising business; the Company’s relationships with franchisees; the impact of war, terrorist activity, political instability or political strife, including the ongoing conflicts between Russia and Ukraine and between Israel and Hamas; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to the Company’s ability to obtain financing and the terms of such financing, including access to liquidity and capital; and the Company’s ability to make or pay, plans for and the timing and amount of any future share repurchases and/or dividends, as well as the risks described in the Company’s most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission and any subsequent reports filed with the Securities and Exchange Commission. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, subsequent events or otherwise, except as required by law. Notes: • In determining adjusted EBITDA and free cash flow for future periods, we exclude certain items which are otherwise included in determining the comparable GAAP financial measures. We are providing this measure on a non-GAAP basis only because, without unreasonable efforts, we are unable to predict with reasonable certainty the occurrence or amount of all the adjustments or other potential adjustments that may arise in the future during the forward-looking period, which can be dependent on future events that may not be reliably predicted. Based on past reported results, where one or more of these items have been applicable, such excluded items could be material, individually or in the aggregate, to the reported results. • Market data, price targets and ratings as of 3/4/24. 1 Represents comparable-basis adjusted EBITDA growth in non-COVID impacted periods FY19, FY21, FY22 and FY23; growth in net income for FY19, FY21, FY22 and FY23 was (3%), 285%, 45% and (19%), respectively. Comparable basis represents a comparison eliminating the contribution from the La Quinta acquisition (in 2018 and 2019 only), the Company’s owned hotels and select-service management business - both of which were exited in the first half of 2022, as well as the variability in its marketing funds. 2 Based on NTM EBITDA multiple of 12.8x. 3 Company Filings, Capital IQ. Notes: Market data as of 3/4/24. Projected EBITDA and multiples are based on consensus estimates; not reflecting the benefits of Wyndham’s standalone plan. 4 Operating income margin for FY23 was 36%. Year Ended December 31, 2023 Operating income margin 36% Depreciation and amortization 5% Adjusted EBITDA adjustments 7% Marketing fund impact 33% Adjusted EBITDA margin 81% 5 Date of going public 5/31/18. 6 Dechert LLP DAMITT 2023 Annual Report: Minding the Gap in Merger Enforcement. To learn more, visit StayWyndham.com