UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2019

OR

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission file number 001-38432

(Exact Name of Registrant as Specified in Its Charter)

(State or Other Jurisdiction of Incorporation or Organization) | (I.R.S. Employer Identification No.) | ||

(Zip Code) | |||

(Address of Principal Executive Offices) | |||

(973 ) 753-6000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

☑ | Accelerated filer | ☐ | |||||

Non-accelerated filer | ☐ | Smaller reporting company | |||||

Emerging growth company | |||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 28, 2019, was $5.31 billion. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of January 31, 2020, the registrant had outstanding 93,695,321 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the 2020 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

1

TABLE OF CONTENTS

Page | ||

PART I | ||

Item 1. | ||

Item 1A. | ||

Item 1B. | ||

Item 2. | ||

Item 3. | ||

Item 4. | ||

PART II | ||

Item 5. | ||

Item 6. | ||

Item 7. | ||

Item 7A. | ||

Item 8. | ||

Item 9. | ||

Item 9A. | ||

Item 9B. | ||

PART III | ||

Item 10. | ||

Item 11. | ||

Item 12. | ||

Item 13. | ||

Item 14. | ||

PART IV | ||

Item 15. | ||

Item 16. | ||

1

PART I

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our expectations regarding our strategy and the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Wyndham Hotels to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Factors that could cause actual results to differ materially from those in the forward-looking statements include without limitation general economic conditions, the performance of the financial and credit markets, the economic environment for the hospitality industry, operating risks associated with the hotel franchising and management businesses, the impact of war, terrorist activity or political strife, concerns with or threats of pandemics, contagious diseases or health epidemics, risks related to our relationship with CorePoint Lodging, our spin-off as a newly independent company and risks related to our ability to obtain financing as well as the risks described under Part I, Item 1A - Risk Factors. Except as required by law, Wyndham Hotels undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, subsequent events or otherwise.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements, reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at https://www.sec.gov. Our SEC filings are also available on our website at https://www.wyndhamhotels.com as soon as reasonably practicable after they are filed with or furnished to the SEC. We maintain an internet site at https://www.wyndhamhotels.com. Our website and the information contained on or connected to that site are not incorporated into this Annual Report.

We may use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Disclosures of this nature will be included on our website in the “Investors” section, which can currently be accessed at www.investor.wyndhamhotels.com. Accordingly, investors should monitor this section of our website in addition to following our press releases, filings submitted with the SEC and any public conference calls or webcasts.

Item 1. Business.

Wyndham Hotels & Resorts, Inc. (“Wyndham Hotels”, the “Company”, or “we”) is the world’s largest hotel franchising company by number of hotels, with nearly 9,300 affiliated hotels with 831,025 rooms located in approximately 90 countries and welcoming nearly 150 million guests annually worldwide. Our 20 brands are primarily located in secondary and tertiary cities and approximately 80% of the U.S. population lives within ten miles of at least one of our affiliated hotels. Our mission is to make hotel travel possible for all. Wherever people go, Wyndham will be there to welcome them. We boast a remarkably asset-light business model with only two of our nearly 9,300 hotels being owned, dramatically limiting our capital needs and our exposure to real estate and the rising wage environment.

2

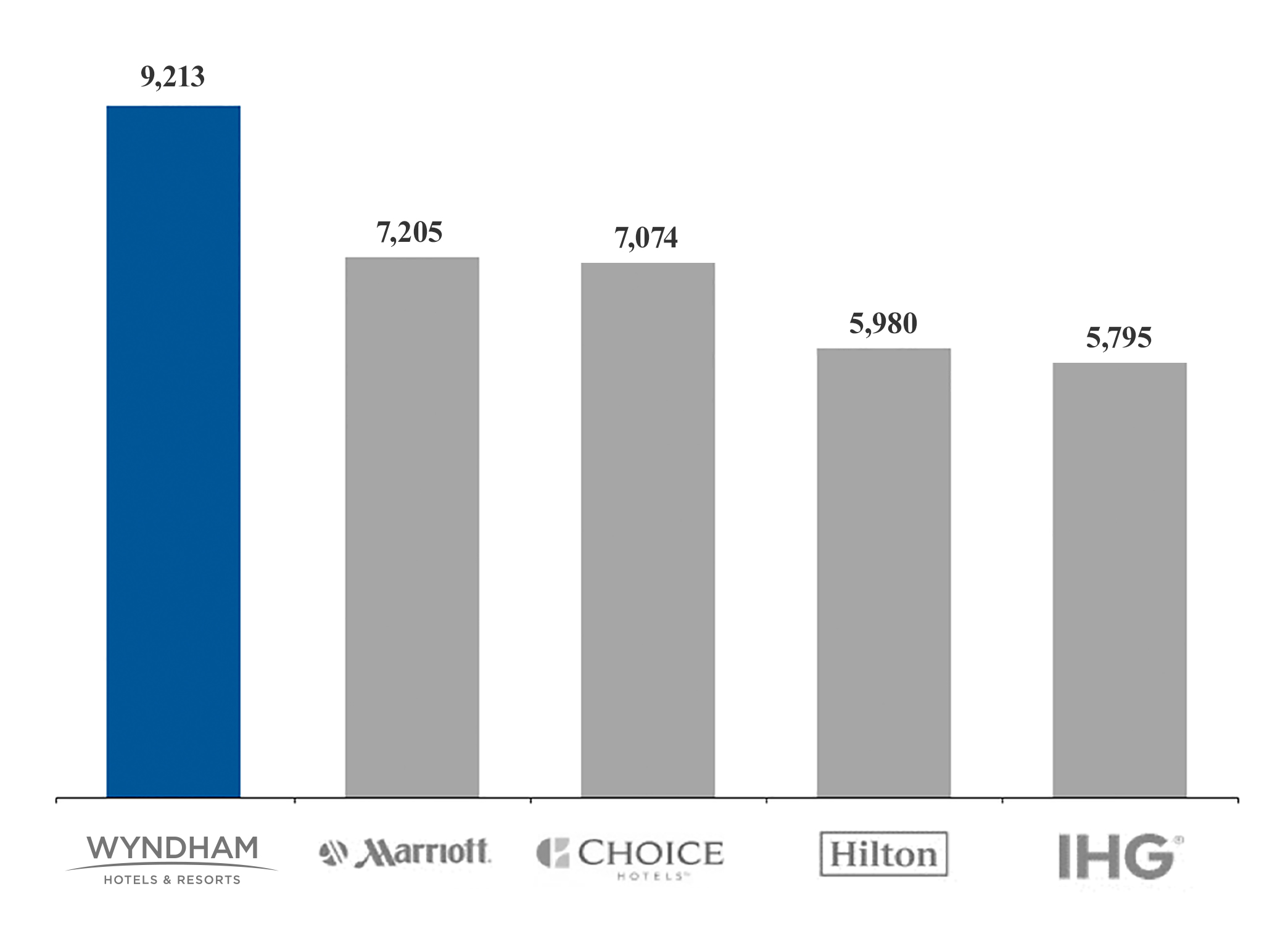

The following chart presents the number of branded hotels associated with each of the five largest traditional hotel franchise companies as of September 30, 2019:

Source: Companies' public disclosures

Our widely recognized brands with select-service focus offer a breadth of options for franchisees and a wide range of price points and experiences for our guests. We are a global leader in the economy and midscale chain scales where our brands represent nearly 35% of branded rooms in the United States, and we also have a growing presence in the upper midscale, lifestyle and upscale chain scales. With many of our affiliated hotels located along major highways, our brands not only drive online and voice reservations to hotels in our system, but they also attract walk-in guests. With the addition of the “by Wyndham” endorsement in 2018, our brands now enjoy even higher awareness.

The following table summarizes our brand portfolio as of December 31, 2019:

3

As of December 31, 2019, our brand portfolio consisted of the following:

North America | Asia Pacific | Europe, | |||||||||||||||||||||||

Global RevPAR | U.S. | Canada | Greater China | Rest of Asia | Middle East and Africa | Latin America | Total | ||||||||||||||||||

Economy | |||||||||||||||||||||||||

Super 8 | $ | 27.16 | Properties | 1,551 | 125 | 1,242 | — | 7 | — | 2,925 | |||||||||||||||

Rooms | 93,175 | 8,034 | 75,520 | — | 1,226 | — | 177,955 | ||||||||||||||||||

Days Inn | $ | 36.17 | Properties | 1,432 | 114 | 62 | 16 | 60 | 7 | 1,691 | |||||||||||||||

Rooms | 107,429 | 8,954 | 9,535 | 2,349 | 3,713 | 514 | 132,494 | ||||||||||||||||||

Travelodge | $ | 37.89 | Properties | 349 | 101 | — | — | — | — | 450 | |||||||||||||||

Rooms | 23,913 | 8,285 | — | — | — | — | 32,198 | ||||||||||||||||||

Microtel | $ | 43.17 | Properties | 303 | 19 | 3 | 14 | — | 7 | 346 | |||||||||||||||

Rooms | 21,423 | 1,657 | 550 | 1,037 | — | 835 | 25,502 | ||||||||||||||||||

Howard Johnson | $ | 29.43 | Properties | 174 | 26 | 66 | 3 | 5 | 48 | 322 | |||||||||||||||

Rooms | 13,956 | 1,807 | 21,259 | 1,107 | 500 | 3,059 | 41,688 | ||||||||||||||||||

Midscale | |||||||||||||||||||||||||

La Quinta | $ | 60.04 | Properties | 911 | 2 | — | — | 1 | 14 | 928 | |||||||||||||||

Rooms | 88,415 | 133 | — | — | 404 | 1,937 | 90,889 | ||||||||||||||||||

Ramada | $ | 37.35 | Properties | 341 | 82 | 112 | 78 | 215 | 27 | 855 | |||||||||||||||

Rooms | 40,883 | 7,857 | 24,997 | 14,246 | 30,492 | 3,538 | 122,013 | ||||||||||||||||||

Baymont | $ | 38.78 | Properties | 521 | 3 | — | — | — | 1 | 525 | |||||||||||||||

Rooms | 40,563 | 350 | — | — | — | 118 | 41,031 | ||||||||||||||||||

AmericInn | $ | 51.40 | Properties | 205 | — | — | — | — | — | 205 | |||||||||||||||

Rooms | 12,151 | — | — | — | — | — | 12,151 | ||||||||||||||||||

Wingate | $ | 53.89 | Properties | 169 | 9 | 2 | — | — | 1 | 181 | |||||||||||||||

Rooms | 15,335 | 889 | 329 | — | — | 176 | 16,729 | ||||||||||||||||||

Wyndham Garden | $ | 49.36 | Properties | 72 | 3 | 7 | 4 | 17 | 24 | 127 | |||||||||||||||

Rooms | 11,855 | 651 | 1,246 | 541 | 2,838 | 3,236 | 20,367 | ||||||||||||||||||

Ramada Encore | $ | 26.29 | Properties | — | — | 25 | 16 | 20 | 10 | 71 | |||||||||||||||

Rooms | — | — | 4,228 | 4,557 | 2,331 | 1,425 | 12,541 | ||||||||||||||||||

Extended Stay | |||||||||||||||||||||||||

Hawthorn | $ | 54.94 | Properties | 103 | — | — | — | 6 | — | 109 | |||||||||||||||

Rooms | 9,737 | — | — | — | 549 | — | 10,286 | ||||||||||||||||||

Lifestyle | |||||||||||||||||||||||||

Trademark | $ | 74.32 | Properties | 39 | 10 | — | 1 | 49 | 2 | 101 | |||||||||||||||

Rooms | 11,657 | 1,489 | — | 90 | 8,793 | 67 | 22,096 | ||||||||||||||||||

TRYP | $ | 55.89 | Properties | 9 | — | 1 | 2 | 65 | 20 | 97 | |||||||||||||||

Rooms | 1,099 | — | 95 | 256 | 9,141 | 2,932 | 13,523 | ||||||||||||||||||

Dazzler | $ | 57.37 | Properties | — | — | — | — | — | 13 | 13 | |||||||||||||||

Rooms | — | — | — | — | — | 1,687 | 1,687 | ||||||||||||||||||

Esplendor | $ | 45.00 | Properties | — | — | — | — | — | 8 | 8 | |||||||||||||||

Rooms | — | — | — | — | — | 909 | 909 | ||||||||||||||||||

Upscale | |||||||||||||||||||||||||

Wyndham | $ | 58.51 | Properties | 35 | — | 29 | 15 | 16 | 39 | 134 | |||||||||||||||

Rooms | 10,432 | — | 8,697 | 3,007 | 3,150 | 8,764 | 34,050 | ||||||||||||||||||

Wyndham Grand | $ | 65.54 | Properties | 11 | — | 23 | 2 | 13 | — | 49 | |||||||||||||||

Rooms | 3,055 | — | 8,130 | 384 | 3,292 | — | 14,861 | ||||||||||||||||||

Dolce | $ | 93.00 | Properties | 8 | 3 | — | — | 8 | — | 19 | |||||||||||||||

Rooms | 1,639 | 276 | — | — | 2,298 | — | 4,213 | ||||||||||||||||||

Affiliated properties (a) | |||||||||||||||||||||||||

Properties | 109 | 3 | — | 11 | — | 1 | 124 | ||||||||||||||||||

Rooms | 3,446 | 315 | — | 47 | — | 34 | 3,842 | ||||||||||||||||||

Total | $ | 40.92 | Properties | 6,342 | 500 | 1,572 | 162 | 482 | 222 | 9,280 | |||||||||||||||

Rooms | 510,163 | 40,697 | 154,586 | 27,621 | 68,727 | 29,231 | 831,025 | ||||||||||||||||||

______________________

(a) | Affiliated properties represent properties under affiliation arrangements with Wyndham Destinations. |

4

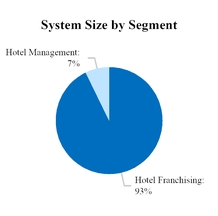

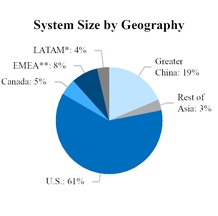

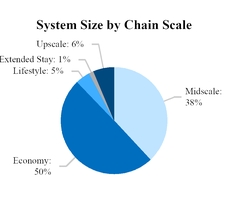

The following charts illustrate our system size (by rooms) as of December 31, 2019:

______________________

* LATAM is representative of Latin America and the Caribbean.

** EMEA is representative of Europe, the Middle East and Africa.

The following table presents the changes in our portfolio for the last three years:

As of December 31, | |||||||||||||||||

2019 | 2018 | 2017 | |||||||||||||||

Properties | Rooms | Properties | Rooms | Properties | Rooms | ||||||||||||

Beginning balance | 9,157 | 809,900 | 8,422 | 728,200 | 8,035 | 697,600 | |||||||||||

Additions (a) | 523 | 63,500 | 1,512 | 145,800 | 811 | 72,200 | |||||||||||

Deletions (b) | (400 | ) | (42,400 | ) | (777 | ) | (64,100 | ) | (424 | ) | (41,600 | ) | |||||

Ending balance | 9,280 | 831,000 | 9,157 | 809,900 | 8,422 | 728,200 | |||||||||||

______________________

(a) | 2018 includes the addition of 905 properties and 88,600 rooms from the acquisition of the La Quinta brand and 2017 includes the addition of 202 properties and 11,900 rooms from the acquisition of the AmericInn brand. |

(b) | 2018 includes the deletion of 351 properties and 21,300 rooms from the disposition of the Knights Inn brand. |

In addition to our existing franchisees, we have nearly 1,500 properties and 193,400 rooms under development. As of December 31, 2019, approximately 43% of our pipeline was located in the U.S. and 57% was located internationally; approximately 70% of our pipeline was for new construction properties and 30% represented conversion opportunities.

Our pipeline is typically only a subset of our development activity in any given period as some of our hotel additions are executed and opened in less than 90 days and therefore may never appear in our pipeline. However, we use the pipeline to gauge interest in our brands and our continued ability to drive our net room growth projections. Our development pipeline represents 23.3% of our beginning system size for 2020 as compared to a pipeline in 2019 that represented 22.2% of the then-beginning system size.

OUR FRANCHISING BUSINESS |

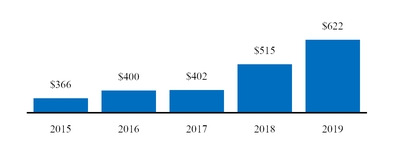

Hotel Franchising Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a) | See Part II Item 6. Selected Financial Data for our definition of adjusted EBITDA and the reconciliation of net income to adjusted EBITDA. |

5

We license our brands and associated trademarks to over 6,000 franchisees globally, which provides for a highly diversified owner base with limited concentration. Our franchisees range from sole proprietors to institutional investors such as public real estate investment trusts. Our franchise agreements are typically 10 to 20 years in length, providing significant visibility into future cash flows. Under these agreements, our franchisees generally pay us a royalty fee of 4% to 5% of gross room revenue and a marketing and reservation fee of 3% to 5% of gross room revenue. We occasionally provide financial support in the form of loans or development advances to help generate new business.

OUR MANAGEMENT BUSINESS |

Hotel Management Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a) | See Part II Item 6. Selected Financial Data for our definition of adjusted EBITDA and the reconciliation of net income to adjusted EBITDA. |

As of December 31, 2019, we had 392 hotels under management contracts and two owned hotels - the Wyndham Grand Rio Mar Beach Resort and Spa in Puerto Rico and the Wyndham Grand Orlando Bonnet Creek. We only manage properties under our brands, primarily under the Wyndham, Wyndham Grand, La Quinta, Dolce, Hawthorn and Ramada brands in major markets and resort destinations globally. The duration of our management agreements is typically 10 to 20 years. We earn a base management fee, which is based on a percentage of the hotel’s total revenue, and in some cases we earn an incentive fee, which is based on achieving performance metrics agreed upon with hotel owners. Under our management arrangements, we provide all the benefits of a franchising agreement and also conduct the day-to-day-operations of the hotel on behalf of the owner.

OUR STRATEGY |

Our objective is to be the world’s leading provider of select-service hotel brands by delivering the best value to owners and guests. We expect to achieve our objective by focusing on our core strategic goals:

Drive net room growth

We intend to drive net room growth by providing exceptional value to franchisees that enables them to optimize the return on their investment. We do this by driving an increasing number of reservations to our franchisees through our direct channels, leveraging our scale to lower operating costs, reduce third party commissions, providing best-in-class technology solutions and offering new prototypes that reduce the cost to both build and operate hotels under our brands.

Our franchise sales team consists of nearly 150 sales professionals throughout the world. Our sales team is focused on growing our franchise business through conversions of existing branded and independent hotels and partnering with developers to brand newly constructed hotels. In addition to a regional presence in the United States, we currently have sales teams located in London, Istanbul, Dubai, Shanghai, Singapore, Canada, Delhi, Mexico City, Sao Paulo and Buenos Aires. Our international presence in key countries allows us to quickly adapt to changes in the increasingly dynamic global marketplace and to capitalize on new opportunities as they emerge.

With a diverse, global network of brands already represented in approximately 90 countries, we intend to introduce our brands into new international markets and to grow in existing markets. As international tourism continues to grow, we are well positioned to capitalize on the rising demand for trusted lodging options for all travelers, particularly everyday travelers and the growing global middle class. Our international development efforts are focused on building scale in key cities and markets, increasing our brand recognition and broadening our appeal to domestic and international guests. Over the past five

6

years, our international portfolio has grown at a compound annual rate of 8%, to nearly 3,000 hotels, and now represents over 30% of the hotels in our system.

In 2019, our sales team executed new contracts representing nearly 92,000 rooms, an increase of 6% from 2018. As a result, we welcomed 523 new hotels globally in 2019 or an average of one and a half new hotels into our system every day.

A key component of our net room growth strategy is our ability to retain properties within our system. With a heavy concentration in the economy and midscale chain scales, our retention rate will naturally be lower than our competitors with less concentration in these chain scales. Industry-wide, our data suggest economy hotels in the U.S. average 93% retention, while midscale hotels average 96% industry-wide. As we move up the chain scales, our retention rates will continue to improve. Upper midscale retention rates average 97% and upscale brands average 99%. Both globally and in the United States, our retention rate was 95% in 2019, compared to 93% in 2015. In 2019, we retained 96% of the hotels in our economy brands, three points higher than the industry average, and 96% of the hotels in our midscale brands, the same as industry average. Internationally, our retention rate was 94%, one point better than 2015. Our goal is to continue to improve our retention rates to support overall net room growth.

Elevate the brand experience

Our brands are among the most respected in the industry and have won numerous awards for their quality and consistency. J.D. Power 2019 North America Hotel Guest Satisfaction Index Study awarded Wyndham brands two of the top three spots in both the economy and midscale segments with Microtel by Wyndham, the leading economy brand for 16 of the last 18 years, and Wingate by Wyndham, the leading midscale brand for the fifth consecutive year. We will continue to drive guest satisfaction and a quality experience at every price point through our brand standards, hotel management training, quality assurance programs, and strong operations support model.

We are investing in our brands with several new value-engineered prototypes and redesign packages launched in 2019 including the Microtel Moda prototype, Days Inn Dawn interior redesign, AmericInn Gen-4 interior redesign and La Quinta Del Sol and Hawthorn dual-brand prototype, and recently announced the Wyndham Garden Arbor prototype. These prototypes join existing designs for Super 8, Howard Johnson and La Quinta to create value-engineered, cost efficient options for our franchisees that elevate the experience for the everyday traveler.

Capture greater market share

We continue to focus on delivering value through our direct channels and growing market share for our franchisees through loyalty, sales, marketing, distribution, and technology programs.

Our loyalty program, Wyndham Rewards, has been recognized as one of the simplest, most rewarding loyalty programs in the hotel industry, providing more value to members than any other program. It has won more than 90 awards in the past five years, including “Best Hotel Loyalty Program” from US News & World Report, “Best Hotel Loyalty Program” in USA TODAY, “10 Best Readers’ Choice Awards”, “Most Rewarding Hotel Loyalty Program” from IdeaWorks and in December 2019, was ranked #1 on WalletHub’s list of “Best Hotel Rewards Programs” for the fifth consecutive year.

Wyndham Rewards has over 81 million enrolled members and accounts for approximately 36% of occupancy at our affiliated hotels globally and over 40% in the United States, up from 30% globally and 37% in the United States in 2018. Total membership has been growing by over 10% annually for the past seven years with approximately 7 million new members added in 2019. Our franchisees benefit from the program through repeat stays and members benefit through free night stays as well as other redemption options for their points, such as gift cards, merchandise and experiences. Additionally, Wyndham Rewards members can redeem their points for stays at thousands of vacation ownership and rental properties globally.

Our global sales organization leverages the size and diversification of our portfolio to gain a larger share of business for each of our hotels through relationship-based selling to a broad range of clients, including corporate business travel clients, corporate group clients, association markets, consortium and travel agent clients, wholesale leisure clients, social group clients, and specialty markets such as trucking companies and travel clubs.

Our cross-channel marketing efforts are designed to build awareness of our 20 brands and Wyndham Rewards and drive revenue to our franchisees through central channels. We offer revenue management services that help franchisees maximize revenue by optimizing rate and managing inventory. We have continued to invest in the effectiveness and responsiveness of our mobile and our brand sites. We also offer Signature Reservation Services from our global customer contact centers to

7

help franchisees manage direct-to-property reservation calls and provide seamless integration to third-party distribution channels.

A key element of our value proposition to franchisees is reservation delivery and profit optimization. Our cloud-based, web-enabled, state-of-the-art technology platform, which includes a fully integrated property management, reservation and revenue management system, is provided to our franchisees at an affordable price. We provide our franchisees with the types of tools used by larger hotels, a capability that was effectively unaffordable to hotels in the economy and midscale sectors. Our scale enables franchisees to take advantage of attractive pricing, and this cloud-based, web-enabled solution eliminates the need for our franchisees to purchase or maintain an on-site server, which traditionally has been a significant burden to hotel owners.

Foster a values-driven culture

With approximately 14,200 team members, we strive to foster a values-driven culture grounded in the strong foundation established by our former parent company. We remain guided by our core values and signature Count on Me service promise in order to attract, retain and engage the best people in our industry.

Use cash flow to create value for stockholders

Our asset-light business model, with stable, recurring franchise fee revenue and low fixed capital needs generates predictable cash flows. Approximately 90% of our revenues are fee-for-service primarily from long-term agreements. At a 95% retention, this means we begin each year with a high degree of certainty regarding the majority of our revenue.

We expect to use the cash we generate to either invest in the business, including through acquisitions, or to return capital to our stockholders through dividends and share repurchases. We returned $356 million to stockholders over the past twelve months by repurchasing 4.5 million shares, or 5%, of our common stock for $244 million and paying dividends of $112 million to stockholders. Since our spin-off, we have returned $553 million to stockholders through the repurchase of 7% of our common stock and the payment of $1.91 in dividends per share. We expect to continue to pay a regular dividend and to continue repurchasing our stock.

8

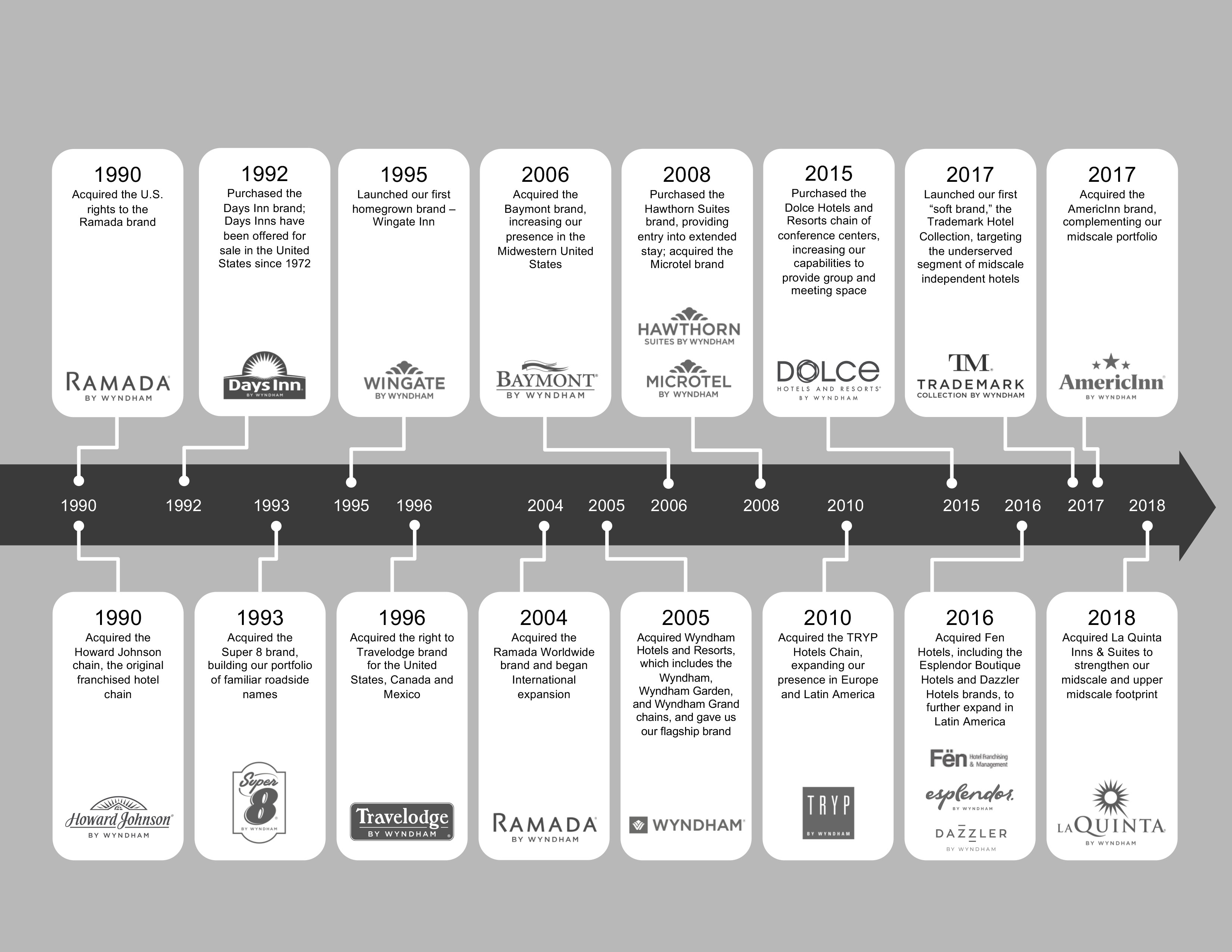

OUR HISTORY |

Our business was initially incorporated as Hospitality Franchise Systems, Inc. in 1990 to acquire the Howard Johnson brand and the franchise rights to the Ramada brand in the United States. It was an integral part of Wyndham Worldwide Corporation and its predecessor from 1997 to 2018. Wyndham Hotels became an independent, public company in May 2018 when it was spun-off from Wyndham Worldwide. Our business has grown substantially over time through acquisitions and organic expansion.

COMPETITION |

We encounter competition among hotel franchisors and lodging operators. We believe franchisees make decisions based principally upon the perceived value and quality of the brand and the services offered. We further believe that the perceived value of a brand name is partially a function of the success of the existing hotels franchised under the brand.

The ability of an individual franchisee to compete may be affected by the location and quality of its property, the number of competitors in the vicinity, community reputation and other factors. A franchisee’s success may also be affected by general, regional and local economic conditions. The potential effect of these conditions on our performance is substantially reduced by virtue of the diverse locations of our affiliated hotels and by the scale of our base. Our system is dispersed among approximately 6,000 franchisees, which reduces our exposure to any one franchisee. One master franchisor in China for the Super 8 brand accounts for 13% of our hotels. Apart from this relationship, no one franchisee accounts for more than 3% of our hotels.

9

SEASONALITY |

While the hotel industry is seasonal in nature, periods of higher revenues vary property-by-property and performance is dependent on location and guest base. Based on historical performance, revenues from franchise and management fees are generally higher in the second and third quarters than in the first or fourth quarters due to increased leisure travel during the spring and summer months. Our cash provided by operating activities tends to be lower in the first half of the year and substantially higher than in the second half of the year. The seasonality of our business may cause fluctuations in our quarterly operating results, earnings, profit margins and cash flows. As we expand into new markets and geographical locations, we may experience increased or different seasonality dynamics that create fluctuations in operating results different from the fluctuations we have experienced in the past.

INTELLECTUAL PROPERTY |

Wyndham Hotels owns the trademarks and other intellectual property rights related to our hotel brands, including the “Wyndham” trademark. We actively use, directly or through our licensees, these trademarks and other intellectual property rights. We operate in a highly competitive industry in which the trademarks and other intellectual property rights related to our hotel brands are very important to the marketing and sales of our services. We believe that our hotel brand names have come to represent high standards of quality, caring, service and value to our franchisees and guests. We register the trademarks that we own in the United States Patent and Trademark Office, as well as with other relevant authorities, where we deem appropriate, and otherwise seek to protect our trademarks and other intellectual property rights from unauthorized use as permitted by law.

GOVERNMENT REGULATION |

Our business is subject to various foreign and U.S. federal and state laws and regulations. In particular, our franchisees are subject to the local laws and regulations in each country in which such hotels are operated, including employment laws and practices, privacy laws and tax laws, which may provide for tax rates that exceed those of the United States and which may provide that our foreign earnings are subject to withholding requirements or other restrictions, unexpected changes in regulatory requirements or monetary policy and other potentially adverse tax consequences. Our franchisees and other aspects of our business are also subject to various foreign and U.S. federal and state laws and regulations, including the Americans with Disabilities Act and similar legislation in certain jurisdictions outside of the United States.

The Federal Trade Commission, various states and other foreign jurisdictions regulate the offer and sale of franchises. The Federal Trade Commission requires us to furnish to prospective franchisees a franchise disclosure document containing prescribed information prior to execution of a binding franchise agreement or payment of money by the prospective franchisee. State regulations also require franchisors to make extensive disclosure to prospective franchisees, and a number of states also require registration of the franchise disclosure document prior to sale of any franchise within the state. Non-compliance with disclosure and registration laws can affect the timing of our ability to sell franchises in these jurisdictions. Additionally, laws in many states and foreign jurisdictions also govern the franchise relationship, such as imposing limits on a franchisor’s ability to terminate franchise agreements or to withhold consent to the renewal or transfer of these agreements. Failure to comply with these laws and regulations has the potential to result in fines, injunctive relief, and/or payment of damages or restitution to individual franchisees or regulatory bodies, or negative publicity impairing our ability to sell franchises.

ENVIRONMENTAL AND SOCIAL RESPONSIBILITY |

Our social responsibility initiatives reflect our commitment to valuing diversity and inclusion, protecting human rights, fostering environmental sustainability and supporting our communities. Our 2019 Social Responsibility Report, which is available on our corporate website, contains additional information regarding our commitment to social responsibility.

10

EMPLOYEES |

As of December 31, 2019, we had approximately 14,200 employees, including approximately 1,300 employees outside of the United States. Approximately 6% of our employees are subject to collective bargaining agreements governing their employment with our Company.

INFORMATION ABOUT OUR EXECUTIVE OFFICERS |

Geoffrey A. Ballotti, 58, serves as our President and Chief Executive Officer and member of our Board of Directors ("Board"). From March 2014 to March 2018, Mr. Ballotti served as President and Chief Executive Officer of Wyndham Hotel Group. From March 2008 to March 2014, Mr. Ballotti served as Chief Executive Officer of Wyndham Destination Network. From October 2003 to March 2008, Mr. Ballotti was President of the North America Division of Starwood Hotels and Resorts Worldwide. From 1989 to 2003, Mr. Ballotti held leadership positions of increasing responsibility at Starwood Hotels and Resorts Worldwide including President of Starwood North America, Executive Vice President, Operations, Senior Vice President, Southern Europe and Managing Director, Ciga Spa, Italy. Prior to joining Starwood Hotels and Resorts Worldwide, Mr. Ballotti was a Banking Officer in the Commercial Real Estate Group at the Bank of New England.

Michele Allen, 45, serves as our Chief Financial Officer. From May 2018 to December 2019, Ms. Allen served as Executive Vice President and Treasurer. From April 2015 to May 2018, Ms. Allen served as Senior Vice President of Finance for Wyndham Worldwide. From August 2006 to March 2015, Ms. Allen served in positions of increasing responsibility at Wyndham Hotel Group including Senior Vice President of Finance and Controller. Ms. Allen began her career as an independent auditor at Deloitte & Touche LLP.

Tom H. Barber, 48, serves as our Global Chief Development Officer. From January 2012 to May 2018, Mr. Barber served as Senior Vice President, M&A and Operational Excellence at Wyndham Worldwide. From June 2004 until January 2012, Mr. Barber served as Director, Mergers & Acquisitions at Credit Suisse Securities. Prior to joining Credit Suisse Securities, he served as Manager, Strategy Consulting at Gemini Consulting and as a business development and product manager at Microsoft Corporation.

Paul F. Cash, 50, serves as our General Counsel, Chief Compliance Officer and Corporate Secretary. From October 2017 to May 2018, Mr. Cash served as Executive Vice President and General Counsel of Wyndham Hotel Group. From April 2005 to September 2017, Mr. Cash served as Executive Vice President and General Counsel and in legal executive positions with increasing leadership responsibility for Wyndham Destination Network. From January 2003 to April 2005, Mr. Cash was a partner in the Mergers and Acquisitions, International and Entertainment and New Media practice groups of Alston & Bird LLP and from February 1997 to December 2002 he was an associate at Alston & Bird LLP. From August 1995 until February 1997, Mr. Cash was an associate at the law firm Pünder, Volhard, Weber & Axster in Frankfurt, Germany.

Lisa Borromeo Checchio, 39, serves as our Chief Marketing Officer. From May 2018 to January 2019, Ms. Checchio served as our Senior Vice President and Chief Marketing Officer. From April 2017 to May 2018, Ms. Checchio served as Senior Vice President, Global Brands for Wyndham Hotel Group. From August 2015 to April 2017, Ms. Checchio served as Vice President, Brand Marketing for Wyndham Hotel Group. From July 2004 to August 2015, Ms. Checchio held several marketing positions of increasing responsibility and served as Brand Marketing and Advertising Director for JetBlue Airways.

Mary R. Falvey, 59, serves as our Chief Administrative Officer. From August 2006 to May 2018, Ms. Falvey served as Executive Vice President and Chief Human Resources Officer of Wyndham Worldwide. Ms. Falvey was Executive Vice President, Global Human Resources for Cendant Corporation’s Vacation Network Group from April 2005 to July 2006. From March 2000 to April 2005, Ms. Falvey served as Executive Vice President, Human Resources for RCI. From January 1998 to March 2000, Ms. Falvey was Vice President of Human Resources for Cendant Corporation’s Hotel Division and Corporate Contact Center group. Prior to joining Cendant Corporation, Ms. Falvey held various leadership positions in the human resources division of Nabisco Foods Company.

Robert D. Loewen, 55, serves as our Chief Operating Officer. From March 2013 to May 2018, Mr. Loewen served as Executive Vice President and Chief Operating Officer for Wyndham Hotel Group. From April 2002 to March 2013, Mr. Loewen served as Chief Financial Officer for Wyndham Hotel Group. Mr. Loewen joined Wyndham Worldwide in April 2000 as Director, Corporate Audit.

11

Nicola Rossi, 53, serves as our Chief Accounting Officer. From July 2006 to May 2018, Mr. Rossi served as Senior Vice President and Chief Accounting Officer for Wyndham Worldwide. Mr. Rossi was Vice President and Controller of Cendant’s Hotel Group from June 2004 to July 2006. From April 2002 to June 2004, Mr. Rossi served as Vice President, Corporate Finance for Cendant. From April 2000 to April 2002, Mr. Rossi was Corporate Controller and from June 1999 to March 2000 was Assistant Corporate Controller of Jacuzzi Brands, Inc.

Scott R. Strickland, 49, serves as our Chief Information Officer. From March 2017 to May 2018, Mr. Strickland served as Chief Information Officer of Wyndham Hotel Group. From November 2011 to March 2017, Mr. Strickland served as Chief Information Officer for Denon Marantz Electronics. From February 2005 to June 2010, Mr. Strickland served as Chief Information Officer for Black & Decker HHI. From 1999 to 2005, Mr. Strickland served as an Associate Partner with PricewaterhouseCoopers.

Item 1A. Risk Factors.

RISK FACTORS |

You should carefully consider each of the following risk factors and all of the other information set forth in this report. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting our Company. However, the risks and uncertainties we face are not limited to those set forth in the risk factors described below. Additional risks and uncertainties not presently known to us or that we currently believe to be immaterial may also adversely affect our business. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods.

If any of the following risks and uncertainties develops into actual events, these events could have a material adverse effect on our business, financial condition or results of operations. In such case, the trading price of our common stock could decline.

Risks Relating to Our Business and Industry

The lodging industry is highly competitive, and we are subject to risks related to competition that may adversely affect our performance and growth.

Our continued success depends upon our ability to compete effectively in markets that contain numerous competitors, some of whom may have significantly greater financial, marketing and other resources than we have. We compete with other hotel franchisors for franchisees and we may not be able to grow our franchise system. New hotels may be constructed and these additions to supply create new competitors, in some cases without corresponding increases in demand for lodging. Competition may reduce fee structures, potentially causing us to lower our fees, and may require us to offer terms to prospective franchisees less favorable to us than current franchise agreements, which may adversely impact our profits. Our franchisees also compete with alternative lodging channels, including third-party providers of short-term rental properties and serviced apartments. Increasing use of these alternative lodging channels could adversely affect the occupancy and/or average rates at franchised hotels and our revenues. The use of business models by competitors that are different from ours may require us to change our model so that we can remain competitive.

We are subject to business, financial, operating and other risks common to the hotel, hotel franchising and hotel management industries which also affect our franchisees and hotel owners, any of which could reduce our revenues, limit our growth or otherwise impact our business.

A significant portion of our revenue is derived from fees based on room revenues at hotels franchised under our brands. As such, our business is subject, directly or through our franchisees, to risks common in the hotel, hotel franchising and hotel management industries, including risks related to:

• | our ability to meet our objectives for growth in the number of our franchised hotels, hotel rooms in our franchise system and hotels under management and to retain and renew franchisee and hotel management contracts, all on favorable terms; |

• | the number, occupancy and room rates of hotels operating under our franchise and management agreements; |

• | the delay of hotel openings in our pipeline; |

• | changes in the supply and demand for hotel rooms; |

12

• | our ability to develop and maintain positive relations and contractual arrangements with current and potential franchisees and hotel owners under our hotel management agreements and other third parties, including marketing alliances and affiliations with e-commerce channels; |

• | our franchisees’ pricing decisions; |

• | the quality of the services provided by franchisees and their investment in the maintenance and improvement of properties; |

• | the bankruptcy or insolvency of a significant number of our franchised or managed hotels; |

• | the financial condition of franchisees, owners or other developers and the availability of financing to them; |

• | adverse events occurring at franchised or managed hotel locations, including personal injuries, food tampering, contamination or the spread of illness, including the 2019 Novel Coronavirus; |

• | negative publicity, which could damage our hotel brands; |

• | our ability to successfully market our current or any future hotel brands and programs, including our rewards program, and to service or pilot new initiatives; |

• | our management contract or relationship with CorePoint Lodging, Inc. (“CorePoint”), which in aggregate owns approximately 69% of our managed hotels and any decision by CorePoint to divest additional hotels; |

• | changes in the laws, regulations and legislation affecting our business, internationally and domestically; |

• | our failure to adequately protect and maintain our trademarks and other intellectual property rights; |

• | the relative mix of branded hotels in the various hotel industry price categories; |

• | corporate budgets and spending and cancellations, deferrals or renegotiations of group business; |

• | seasonal or cyclical volatility in our business; |

• | operating costs, including as a result of inflation, energy costs and labor costs, such as minimum wage increases and unionization, workers’ compensation and health-care related costs and insurance; and |

• | disputes, claims and litigation and other legal proceedings concerning our or our franchised or managed hotels’ operations regarding human trafficking or other matters, including with consumers, government regulators, other businesses, franchisees and hotel owners, organized labor activities and class actions. |

Any of these factors could reduce our revenues, increase our costs or otherwise limit our opportunities for growth.

Declines in or disruptions to the travel industry may adversely affect us.

We face risks affecting the travel and hotel industries that include: economic slowdown and recession; economic factors such as increased costs of living and reduced discretionary income adversely impacting decisions by consumers and businesses to use travel accommodations; terrorist incidents and threats and associated heightened travel security measures; political and regional strife; acts of God such as earthquakes, hurricanes, fires, floods, volcanoes and other natural disasters; war; concerns with or threats of pandemics, contagious diseases or health epidemics, such as the 2019 Novel Coronavirus; environmental disasters; lengthy power outages; increased pricing, financial instability and capacity constraints of air carriers; airline job actions and strikes; and increases in gasoline and other fuel prices. Any such decline in or disruptions to the travel or hotel industries may adversely affect our franchised hotels, the operations of current and potential franchisees, developers and hotel owners with which we have hotel management contracts.

Third-party Internet travel intermediaries and peer-to-peer online networks.

Consumers increasingly use third-party Internet travel intermediaries, including search engines, and peer-to-peer online networks to search for and book their lodging accommodations. As the percentage of internet reservations increases, travel intermediaries may be able to obtain higher commissions and reduced room rates to the detriment of our business. Additionally, such travel intermediaries may divert reservations away from our direct online channels or increase the overall cost of Internet reservations for our affiliated hotels through their fees and a variety of online marketing methods, including the purchase by certain travel intermediaries of keywords consisting of or containing our hotel brands from Internet search engines to influence search results and direct guests to their websites. If we fail to reach satisfactory agreements with intermediaries, our affiliated hotels may not appear on their websites and we could lose business as a result.

Our revenues could be impacted if we are unable to maintain our contractual relationships with CorePoint.

In connection with the La Quinta acquisition, we entered into hotel-management agreements and hotel franchise agreements with CorePoint. We are also subject to certain agreements related to CorePoint’s previously completed spin-off of its real estate business. In October 2019, we entered into an additional agreement with CorePoint to collaborate on a number of new technology and operating initiatives, support CorePoint’s efforts to enhance its portfolio and resolve open issues between CorePoint and us; our obligations under our amended hotel-management agreements include, among other things, the obligation to develop and launch enhanced automated revenue management, sales and reservations technology by

13

specified dates and timely deliver a satisfactory annual System and Organization Control Report (SOC-1) commencing in 2021 for the calendar year 2020. If we are unable to maintain a good relationship with CorePoint, if we are unable to perform our obligations to CorePoint under our agreements and CorePoint terminates these agreements, if CorePoint is unable to perform its obligations to us under our agreements and we terminate these agreements, or CorePoint or we do not renew these agreements following their expiration, our profitability and revenues could decrease and our growth potential may be adversely affected.

Our license and other revenues from former Parent could be impacted by any softness in Wyndham Destinations’ sales of vacation ownership interests or decline in the volume of affinity leads which we generate for Wyndham Destinations.

In connection with the spin-off, we entered into a number of agreements with Wyndham Destinations that govern our ongoing relationship with Wyndham Destinations. Our success depends, in part, on the maintenance of our ongoing relationship with Wyndham Destinations, Wyndham Destinations’ performance of its obligations under these agreements, including Wyndham Destinations’ maintenance of the quality of products and services it sells under the “Wyndham” trademark and certain other trademarks and intellectual property that we license to Wyndham Destinations. Under the license, development and noncompetition agreement, Wyndham Destinations pays us significant royalties and other fees based on the volume of Wyndham Destinations’ sales of vacation ownership interests and other vacation products and services. If Wyndham Destinations is unable to compete effectively for sales of vacation ownership interests, our royalty fees under such agreement could be adversely impacted. If we are unable to maintain a good relationship with Wyndham Destinations, or if Wyndham Destinations does not perform its obligations under these agreements, fails to maintain the quality of the products and services it sells under the “Wyndham” trademark and certain other trademarks or fails to pay such royalties, our earnings could decrease.

Our international operations are subject to additional risks not generally applicable to our domestic operations.

Our international operations are subject to numerous risks including: exposure to local economic conditions; potential adverse changes in the diplomatic relations of foreign countries with the United States; hostility from local populations; political instability, including potential disruptions from the United Kingdom’s exit from the European Union, trade disputes with trade partners, including China and other geopolitical risks; threats or acts of terrorism; the effect of disruptions caused by severe weather, natural disasters, outbreak of disease, such as the 2019 Novel Coronavirus or other events that make travel to a particular region less attractive or more difficult; the presence and acceptance of varying levels of business corruption in international markets; restrictions and taxes on the withdrawal of foreign investment and earnings; government policies against businesses or properties owned by foreigners; investment restrictions or requirements; diminished ability to legally enforce our contractual rights in foreign countries; forced nationalization of hotel properties by local, state or national governments; foreign exchange restrictions; fluctuations in foreign currency exchange rates; conflicts between local laws and U.S. laws, including laws that impact our rights to protect our intellectual property; withholding and other taxes on remittances and other payments by subsidiaries; and changes in and application of foreign taxation structures including value added taxes. Any adverse outcome resulting from the financial instability or performance of foreign economies, the instability of other currencies and the related volatility on foreign exchange and interest rates could adversely impact our results of operations, financial position or cash flows.

Changes in U.S. federal, state and local or foreign tax law, interpretations of existing tax law or adverse determinations by tax authorities could increase our tax burden or otherwise adversely affect our financial condition or results of operations.

We are subject to taxation at the federal, state and local levels in the United States and various other countries and jurisdictions. Our future effective tax rate and cash flows could be affected by changes in the composition of earnings in jurisdictions with differing tax rates, changes in statutory rates and other legislative changes, changes in the valuation of our deferred tax assets and liabilities, changes in determinations regarding the jurisdictions in which we are subject to tax, and our ability to repatriate earnings from foreign jurisdictions. From time to time, U.S. federal, state and local and foreign governments make substantive changes to tax rules and their application, which could result in materially higher corporate taxes than would be incurred under existing tax law and could adversely affect our financial condition or results of operations. We are subject to ongoing and periodic tax audits and disputes in U.S. federal and various state, local and foreign jurisdictions. An unfavorable outcome from any tax audit could result in higher tax costs, penalties and interest, thereby adversely affecting our financial condition or results of operations.

In addition, we are directly and indirectly affected by new tax legislation and regulation and the interpretation of tax laws and regulations worldwide. Changes in such legislation, regulation or interpretation could increase our taxes and have an

14

adverse effect on our operating results and financial condition. This includes potential changes in tax laws or the interpretation of tax laws arising out of the Base Erosion Profit Shifting project initiated by the Organization for Economic Co-operation and Development.

We are subject to risks related to our debt, hedging transactions, our extension of credit and the cost and availability of capital.

As of December 31, 2019, we had aggregate outstanding debt of $2,122 million. We may incur additional indebtedness in the future, which may intensify the risks related to our debt. Our debt instruments contain restrictions, covenants and events of default that, among other things, could limit our ability to respond to changing business and economic conditions; take advantage of business opportunities; incur or guarantee additional debt; pay dividends or make distributions; make investments or acquisitions; sell, transfer or otherwise dispose of certain assets; create liens; consolidate or merge; enter into transactions with affiliates; and prepay and repurchase or redeem certain indebtedness. Failure to meet our payment obligations or comply with other financial covenants could result in a default and acceleration of the underlying debt and under other debt instruments that contain cross-default provisions.

In order to reduce or hedge our financial exposure to the effects of currency and interest rate fluctuations, we may use financial instruments. As a result, changes in interest rates may adversely affect our financing costs and/or change the market value of our hedging instruments. Any failure or non-performance of counterparties to foreign exchange and interest rate hedging transactions could result in losses.

Our credit facility gives us the option to use the London Interbank Offered Rate (“LIBOR”) as a base rate and our interest rate swaps are based on the one-month U.S. dollar LIBOR rate. The Federal Reserve has established the Alternative Reference Rates Committee to identify alternative reference rates in the event that LIBOR ceases to exist after 2021. Our credit facility allows us and the administrative agent to replace LIBOR with an alternative benchmark rate, subject to the rejection of the majority of the lenders as set forth in the credit facility. The International Swaps and Derivatives Association is expected to issue protocols to allow swap parties to amend their existing contracts. Any such discontinuation of LIBOR or the use of an alternative benchmark rate could cause our costs to increase.

In addition, we extend credit to assist franchisees and hotel owners in converting to or building a new hotel under one of our hotel brands through development advance notes and mezzanine or other forms of subordinated financing. The inability of franchisees and hotel owners to pay back such loans could materially and adversely affect our cash flows and business.

We may need to dedicate a significant portion of our cash flows to the payment of principal and interest. Our ability to obtain additional financing for working capital, capital expenditures, acquisitions, debt service requirements, or general corporate or other purposes may be limited, and we may be unable to renew or refinance our debt on terms as favorable as our existing debt or at all. Additionally, certain market liquidity factors, including uncertainty or volatility in the equity and credit markets, outside of our control could affect our access to credit and capital in the future and adversely impact our business plans and operating model. Our credit rating and the market value of our common stock could also be affected. While we believe we have adequate sources of liquidity to meet our anticipated requirements for working capital, debt service and capital expenditures for the foreseeable future, if we are unable to refinance or repay our outstanding debt when due, our results of operations and financial condition will be materially and adversely affected.

Changes to estimates or projections used to assess the fair value of our assets or operating results that are lower than our current estimates may cause us to incur impairment losses and require us to write-off all or a portion of the remaining value of our goodwill or other intangibles of companies we have acquired.

Our total assets include goodwill and other intangible assets. We evaluate our goodwill for impairment on an annual basis or at other times during the year if events or circumstances indicate that it is more likely than not that the fair value is below the carrying value. We may be required to record a significant non-cash impairment charge in our financial statements during the period in which any impairment of our goodwill, other intangible assets or other assets is determined, which would negatively impact our results of operations and stockholders’ equity.

15

Acquisitions and other strategic transactions may not prove successful and could result in operating difficulties and failure to realize anticipated benefits.

We regularly consider a wide array of acquisitions and other potential strategic transactions, including acquisitions of hotel brands, businesses and real property, joint ventures, business combinations, strategic investments and dispositions. Any of these transactions could be material to our business. We often compete for these opportunities with third parties, which may cause us to lose potential opportunities or to pay more than we may otherwise have paid absent such competition. We may not be able to identify and consummate strategic transactions and opportunities on favorable terms and any such strategic transactions or opportunities, if consummated, may not be successful.

We are subject to risks related to litigation.

We are subject to a number of disputes, claims, litigation and other legal proceedings as described in this report, and any unfavorable rulings or outcomes in current or future litigation and other legal proceedings may materially harm our business. Along with many of its competitors, the Company and/or certain of its subsidiaries have been named as defendants in litigation matters filed in state and federal courts, alleging statutory and common law claims related to purported incidents of sex trafficking at certain franchised and managed hotel facilities. For additional information, see our Commitments and Contingencies note (Note 13) in the notes to our financial statements.

Our operations are subject to extensive regulation and the cost of compliance or failure to comply with regulations may adversely affect us.

Our operations are regulated by federal, state and local governments in the countries in which we operate. In addition, U.S. and international federal, state and local regulators may enact new laws and regulations that may reduce our profits or require us to modify our business practices substantially. If we are not in compliance with applicable laws and regulations, including, among others, those governing franchising, hotel operations, lending, information security, data protection and privacy (such as the General Data Protection Regulation or similar laws or regulations), credit card security standards, marketing, including sales, consumer protection and advertising, unfair and deceptive trade practices, fraud, bribery and corruption, licensing, labor, employment, anti-discrimination, health care, health and safety, accessibility, immigration, gaming, environmental, intellectual property, securities, stock exchange listing, accounting, tax and regulations applicable under the Dodd-Frank Act, the Office of Foreign Assets Control, the Americans with Disabilities Act, the Sherman Act, the Foreign Corrupt Practices Act and local equivalents in international jurisdictions, including the United Kingdom Bribery Act, we may be subject to regulatory investigations or actions, fines, civil and/or criminal penalties, injunctions and potential criminal prosecution. Changes to such laws and regulations and the cost of compliance or failure to comply with such regulations may adversely affect us.

Failure to maintain the security of personally identifiable and proprietary information, non-compliance with our contractual obligations regarding such information or a violation of our privacy and security policies with respect to such information could adversely affect us.

In connection with our business, we and our service providers collect and retain large volumes of certain types of personal and proprietary information pertaining to guests, franchisees, stockholders and employees. Such information includes, but is not limited to, large volumes of guest credit and payment card information. We are at risk of attack by cyber-criminals operating on a global basis attempting to gain access to such information. In connection with data security incidents involving a group of Wyndham brand hotels that occurred between 2008 and 2010, one of our subsidiaries is subject to a stipulated order with the U.S. Federal Trade Commission (the “FTC”), pursuant to which, among other things, it is required to maintain an information security program for payment card information within its network, and which provides it with a safe harbor provided it continues to meet certain requirements for reasonable data security as outlined in the stipulated order.

While we maintain what we believe are reasonable security controls over personal and proprietary information, a breach of or breakdown in our systems that results in the unauthorized release of personal or proprietary information could nevertheless occur or our subsidiary could fail to comply with the stipulated order with the FTC. Additionally, the legal and regulatory environment surrounding information security and privacy in the U.S. and international jurisdictions is constantly evolving. Violation or non-compliance with any of these laws or regulations, contractual requirements relating to data security and privacy, or with our own privacy and security policies, either intentionally or unintentionally, or through the acts of intermediaries could have a material adverse effect on our hotel brands, reputation, business, financial condition and results of operations, as well as subject us to significant fines, litigation, losses, third-party damages and other liabilities.

16

We rely on information technologies and systems to operate our business, which involves reliance on third-party service providers and on uninterrupted operation of service facilities.

We rely on information technologies and systems to operate our business, which involves reliance on third-party service providers such as Sabre Corporation and its SynXis Platform and uninterrupted operations of service facilities, including those used for reservation systems, hotel/property management, communications, procurement, call centers, operation of our loyalty program and administrative systems. We and our vendors also maintain physical facilities to support these systems and related services. As a result, in addition to failures that occur from time to time in the ordinary course, we and our vendors may be vulnerable to system failures, computer hacking, cyber-terrorism, computer viruses and other intentional or unintentional interference, negligence, fraud, misuse and other unauthorized attempts to access or interfere with these systems and our personal and proprietary information. The increased scope and complexity of our information technology infrastructure and systems could contribute to the potential risk of security breaches or breakdown. Any natural disaster, disruption or other impairment in our technology capabilities and service facilities or those of our vendors could adversely affect our business. In addition, failure to keep pace with developments in technology could impair our operations or competitive position.

We are dependent on our senior management and the loss of any member of our senior management could harm our business.

We believe that our future growth depends in part on the continued services of our senior management team. Losing the services of any members of our senior management team could adversely affect our strategic relationships and impede our ability to execute our business strategies. The market for qualified individuals may be highly competitive and finding and recruiting suitable replacements for senior management may be difficult, time-consuming and costly.

The insurance we carry may not always pay, or be sufficient to pay or reimburse us, for our liabilities, losses or replacement costs.

We carry insurance for general liability, property, business interruption and other insurable risks with respect to our business and franchised, managed and owned hotels. We also self-insure for certain risks up to certain monetary limits. The insurance coverage we carry, subject to our deductible, may not be sufficient to pay or reimburse us for the amount of our liabilities, losses or replacement costs, and there may also be risks for which we do not obtain insurance in the full amount or any amount concerning a potential loss or liability, or at all, due to the cost or availability of such insurance. As a result, we may incur liabilities or losses in the operation of our business that are not sufficiently covered by the insurance we maintain, or at all, which could have a material adverse effect on our business, financial condition and results of operations.

We are subject to risks related to corporate social responsibility.

Our business, along with the hospitality industry generally, faces scrutiny related to environmental, social and governance activities and the risk of damage to our reputation and the value of our hotel brands if we fail to act responsibly or comply with regulatory requirements in a number of areas, such as safety and security, responsible tourism, environmental stewardship, supply chain management, climate change, diversity, philanthropy and support for local communities.

We are subject to risks related to human trafficking allegations.

Our business, along with the hospitality industry generally, faces risk that could cause damage to our reputation and the value of our hotel brands along with litigation-related fees and costs in connection with claims, actions, litigations and other legal proceedings alleging statutory and common law claims related to purported incidents of sex trafficking at hotel facilities.

Risks Relating to the Spin-Off

We may be unable to achieve some or all of the expected benefits from our spin-off from Wyndham Destinations.

As a result of our separation from Wyndham Destinations, we may be more susceptible to market fluctuations and other adverse events than we would have been were we still a part of Wyndham Destinations. If we fail to achieve some or all of the expected benefits or do not achieve them in the timeframe expected, our results of operations and financial condition could be materially and adversely affected.

17

We have a limited operating history as a separate public company, our financial information from before the spin-off from Wyndham Destinations may not reflect our current or future results as an independent company and we may not be able to make, on a timely or cost-effective basis, the changes necessary to operate as an independent company and, as a result, we may experience increased costs.

Prior to the spin-off, Wyndham Destinations performed various corporate functions for us, including tax administration, governance, compliance, accounting, internal audit and external reporting. Our historical financial results reflect allocations of corporate expenses from Wyndham Destinations for these and similar functions that may be less than the comparable expenses we would have incurred had we operated as a separate publicly traded company. In connection with the spin-off, we entered into transition agreements and licensing, marketing and other agreements that govern certain commercial and other relationships between us and Wyndham Destinations; however, those arrangements may not capture the benefits our business enjoyed as a result of being integrated with the other businesses of Wyndham Destinations prior to the spin-off. The loss of those benefits could have an adverse effect on our business, results of operations and financial condition.

Generally, our working capital requirements, including acquisitions and capital expenditures, were satisfied as part of the corporate-wide cash management policies of Wyndham Destinations before the spin-off. Since the completion of the spin-off, Wyndham Destinations has not and will not be providing us with funds to finance our working capital or other cash requirements, and we may need to obtain financing from banks, through public offerings or private placements of debt or equity securities, strategic relationships or other arrangements. We may be unable to replace in a timely manner or on comparable terms and costs the services or other benefits that Wyndham Destinations previously provided to us, which could have an adverse effect on our business, results of operation and financial condition. In addition, other significant changes may occur in our cost structure, management, financing and business operations as a result of our operations as a separate company.

We may have received better terms from unaffiliated third parties than the terms we received in our agreements with Wyndham Destinations entered into in connection with the spin-off.

We entered into agreements with Wyndham Destinations related to the spin-off while we were still part of Wyndham Destinations. Accordingly, these agreements may not reflect terms that would have resulted from arm’s-length negotiations among unaffiliated third parties and we may have received better terms from third parties because third parties may have competed with each other to secure our business.

Our failure to maintain effective internal controls or meet the financial reporting and other requirements to which we are now subject could have a material adverse effect on our business.

As a result of the spin-off, we are subject to reporting and other obligations under U.S. securities laws and are required to comply with applicable internal controls and reporting requirements. If we are unable to maintain adequate financial and management controls, reporting systems, information technology systems and procedures, our ability to comply with the financial reporting requirements and other rules that apply to reporting companies under U.S. securities laws may be impaired and could cause investors to lose confidence in our reported financial information, which could have a material adverse effect on our business.

In connection with the spin-off and Wyndham Destinations’ sale of its European vacation rentals business, we agreed to indemnify Wyndham Destinations and Wyndham Destinations agreed to indemnify us for certain liabilities, and if we are required to perform under these indemnities or if Wyndham Destinations is unable to satisfy its obligations under these indemnities, our financial results could be negatively affected.

The contingent liabilities we assumed in connection with the spin-off and Wyndham Destinations’ sale of its European vacation rentals business could adversely affect our results of operations and financial condition. In connection with the spin-off, Wyndham Destinations agreed to indemnify us for certain liabilities, and we agreed to indemnify Wyndham Destinations for certain liabilities, including cross-indemnities that are principally designed to place financial responsibility for the obligations and liabilities of our business with us, and financial responsibility for the obligations and liabilities of Wyndham Destinations’ business with Wyndham Destinations. Pursuant to the Separation and Distribution Agreement (the “SDA”), we assumed one-third and Wyndham Destinations assumed two-thirds of certain contingent and other corporate liabilities of Wyndham Destinations, which we refer to in this Report as “shared contingent liabilities,” incurred prior to the spin-off, including liabilities of Wyndham Destinations related to, arising out of or resulting from certain terminated or divested businesses, certain general corporate matters of Wyndham Destinations and any actions with respect to the spin-off brought by any third party.

18

Additionally, in connection with the sale of Wyndham Destinations’ European vacation rentals business, we provided certain post-closing credit support in the form of guarantees, which as of December 31, 2019 were approximately $127 million, to ensure that the business meets the requirements of certain service providers and regulatory authorities. Such post-closing credit support may be enforced or called upon if the European vacation rentals business fails to meet its primary obligation to pay certain amounts when due. The European vacation rentals business has provided an indemnity to Wyndham Destinations in the event that the post-closing credit support is enforced or called upon. Pursuant to the terms of the SDA, we assumed one-third and Wyndham Destinations assumed two-thirds of any such losses actually incurred by Wyndham Destinations or us in the event that these credit support arrangements are enforced or called upon by any beneficiary and any amounts paid by Wyndham Destinations or us in respect of any indemnification claims made in connection with the sale of the European vacation rentals business.

Should our indemnification obligations exceed applicable insurance coverage, our business, financial condition and results of operations could be adversely affected. Additionally, the indemnities from Wyndham Destinations may not be sufficient to protect us against the full amount of these and other liabilities. Third parties also could seek to hold us responsible for any of the liabilities that Wyndham Destinations has agreed to assume. Even if we ultimately succeed in recovering from Wyndham Destinations any amounts for which we are held liable, we may be temporarily required to bear those losses ourselves. Each of these risks could negatively affect our business, financial condition, results of operations and cash flows.

The spin-off and related transactions may expose us to potential liabilities arising out of state and federal fraudulent conveyance laws and legal distribution requirements.

Although we received a solvency opinion from an investment bank confirming that we and Wyndham Destinations were adequately capitalized immediately after the spin-off, the spin-off could be challenged under various state and federal fraudulent conveyance laws. An unpaid creditor could claim that Wyndham Destinations did not receive fair consideration or reasonably equivalent value in the spin-off, and that the spin-off left Wyndham Destinations insolvent or with unreasonably small capital or that Wyndham Destinations intended or believed it would incur debts beyond its ability to pay such debts as they mature. If a court were to void the spin-off as a fraudulent transfer, it could impose a number of different remedies, including, returning our assets or your shares in our company to Wyndham Destinations or providing Wyndham Destinations with a claim for money damages against us in an amount equal to the difference between the consideration received by Wyndham Destinations and the fair market value of our Company at the time of the spin-off.

Certain of our Directors and executive officers may have actual or potential conflicts of interest because of their ownership of Wyndham Destinations equity or their current or former positions at Wyndham Destinations.

Two of our Directors also serve on the Wyndham Destinations Board and certain of our executive officers and non-employee Directors own shares of Wyndham Destinations common stock because of their current or former positions with Wyndham Destinations. This could create, or appear to create, potential conflicts of interest when our or Wyndham Destinations’ management, officers and directors face decisions that could have different implications for us and Wyndham Destinations.

If the spin-off, together with certain related transactions, were to fail to qualify as a reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Code, then our stockholders, we and Wyndham Destinations might be required to pay substantial U.S. federal income taxes.

The spin-off was conditioned upon Wyndham Destinations’ receipt of opinions of its spin-off tax advisors to the effect that, subject to the assumptions and limitations described in the opinions, the spin-off, together with certain related transactions, would qualify as a reorganization for U.S. federal income tax purposes under Sections 368(a)(1)(D) and 355 of the Internal Revenue Code of 1986, as amended (the “Code”), in which no gain or loss would be recognized by Wyndham Destinations or its stockholders, except, in the case of Wyndham Destinations stockholders, for cash received in lieu of fractional shares, which opinions were delivered on the closing date of the spin-off. The opinions of the spin-off tax