false2020FY0001722684P3YP3YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP7Yus-gaap:AccountsPayableAndAccruedLiabilitiesCurrentus-gaap:AccountsPayableAndAccruedLiabilitiesCurrent33us-gaap:OtherLiabilitiesNoncurrentus-gaap:OtherLiabilitiesNoncurrent00017226842020-01-012020-12-31iso4217:USD00017226842020-06-30xbrli:shares00017226842021-01-310001722684wh:RoyaltiesandFranchiseFeesMember2020-01-012020-12-310001722684wh:RoyaltiesandFranchiseFeesMember2019-01-012019-12-310001722684wh:RoyaltiesandFranchiseFeesMember2018-01-012018-12-310001722684wh:MarketingReservationandLoyaltyMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMember2018-01-012018-12-310001722684wh:HotelManagementServicesMember2020-01-012020-12-310001722684wh:HotelManagementServicesMember2019-01-012019-12-310001722684wh:HotelManagementServicesMember2018-01-012018-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2020-01-012020-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2019-01-012019-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2018-01-012018-12-310001722684wh:CostReimbursementsMember2020-01-012020-12-310001722684wh:CostReimbursementsMember2019-01-012019-12-310001722684wh:CostReimbursementsMember2018-01-012018-12-310001722684wh:OtherProductsandServicesMember2020-01-012020-12-310001722684wh:OtherProductsandServicesMember2019-01-012019-12-310001722684wh:OtherProductsandServicesMember2018-01-012018-12-3100017226842019-01-012019-12-3100017226842018-01-012018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2020-01-012020-12-31iso4217:USDxbrli:shares0001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-3100017226842020-12-3100017226842019-12-310001722684us-gaap:TrademarksMember2020-12-310001722684us-gaap:TrademarksMember2019-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2020-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2019-12-3100017226842018-12-3100017226842017-12-310001722684us-gaap:CommonStockMember2017-12-310001722684us-gaap:TreasuryStockMember2017-12-310001722684wh:ParentsNetInvestmentMember2017-12-310001722684us-gaap:AdditionalPaidInCapitalMember2017-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2017-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2017-12-310001722684wh:ParentsNetInvestmentMember2018-01-012018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2018-01-012018-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-01-012018-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberwh:ParentsNetInvestmentMember2017-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2017-12-310001722684us-gaap:AdditionalPaidInCapitalMember2018-01-012018-12-310001722684us-gaap:CommonStockMember2018-01-012018-12-310001722684us-gaap:TreasuryStockMember2018-01-012018-12-310001722684us-gaap:CommonStockMember2018-12-310001722684us-gaap:TreasuryStockMember2018-12-310001722684wh:ParentsNetInvestmentMember2018-12-310001722684us-gaap:AdditionalPaidInCapitalMember2018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2018-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2019-01-012019-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001722684us-gaap:TreasuryStockMember2019-01-012019-12-310001722684us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001722684us-gaap:CommonStockMember2019-12-310001722684us-gaap:TreasuryStockMember2019-12-310001722684wh:ParentsNetInvestmentMember2019-12-310001722684us-gaap:AdditionalPaidInCapitalMember2019-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2019-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001722684us-gaap:TreasuryStockMember2020-01-012020-12-310001722684us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsAppropriatedMember2019-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2019-12-310001722684us-gaap:CommonStockMember2020-12-310001722684us-gaap:TreasuryStockMember2020-12-310001722684wh:ParentsNetInvestmentMember2020-12-310001722684us-gaap:AdditionalPaidInCapitalMember2020-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2020-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-31wh:countryxbrli:pure00017226842018-05-312018-05-31wh:hotel0001722684wh:LoyaltyProgramMember2020-12-310001722684wh:LoyaltyProgramMember2019-12-310001722684wh:LoyaltyProgramMember2020-04-012020-06-300001722684us-gaap:BuildingMember2020-01-012020-12-310001722684wh:BuildingAndLeaseholdImprovementsMember2020-01-012020-12-310001722684us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2020-01-012020-12-310001722684us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2020-01-012020-12-310001722684srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-01-012020-12-310001722684srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-01-012020-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2019-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2018-01-010001722684srt:MinimumMember2020-01-012020-12-310001722684srt:MaximumMember2020-01-012020-12-310001722684wh:InitialFranchiseFeesMember2020-12-310001722684wh:InitialFranchiseFeesMember2019-12-310001722684wh:CobrandedcreditcardsprogramMember2020-12-310001722684wh:CobrandedcreditcardsprogramMember2019-12-310001722684wh:HotelManagementServicesMember2020-12-310001722684wh:HotelManagementServicesMember2019-12-310001722684us-gaap:ProductAndServiceOtherMember2020-12-310001722684us-gaap:ProductAndServiceOtherMember2019-12-3100017226842021-01-01wh:InitialFranchiseFeesMember2020-12-3100017226842022-01-01wh:InitialFranchiseFeesMember2020-12-3100017226842023-01-01wh:InitialFranchiseFeesMember2020-12-3100017226842024-01-01wh:InitialFranchiseFeesMember2020-12-3100017226842021-01-01wh:LoyaltyProgramMember2020-12-3100017226842022-01-01wh:LoyaltyProgramMember2020-12-3100017226842023-01-01wh:LoyaltyProgramMember2020-12-310001722684wh:LoyaltyProgramMember2024-01-012020-12-3100017226842021-01-01wh:HotelManagementServicesMember2020-12-3100017226842022-01-01wh:HotelManagementServicesMember2020-12-3100017226842023-01-01wh:HotelManagementServicesMember2020-12-3100017226842024-01-01wh:HotelManagementServicesMember2020-12-3100017226842021-01-01wh:OtherProductsandServicesMember2020-12-3100017226842022-01-01wh:OtherProductsandServicesMember2020-12-3100017226842023-01-01wh:OtherProductsandServicesMember2020-12-3100017226842024-01-01wh:OtherProductsandServicesMember2020-12-310001722684wh:OtherProductsandServicesMember2020-12-3100017226842021-01-012020-12-3100017226842022-01-012020-12-3100017226842023-01-012020-12-3100017226842024-01-012020-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2018-01-012018-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2018-01-012018-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2019-01-012019-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2018-01-012018-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2018-01-012018-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2018-01-012018-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2018-01-012018-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2018-01-012018-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2018-01-012018-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2018-01-012018-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2018-01-012018-12-310001722684wh:HotelManagementSegmentMemberwh:OtherProductsandServicesMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:OtherProductsandServicesMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:OtherProductsandServicesMember2018-01-012018-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2018-01-012018-12-310001722684us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001722684us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001722684us-gaap:CorporateNonSegmentMember2018-01-012018-12-310001722684us-gaap:OtherCurrentAssetsMember2020-12-310001722684us-gaap:OtherCurrentAssetsMember2019-12-310001722684us-gaap:OtherNoncurrentAssetsMember2020-12-310001722684us-gaap:OtherNoncurrentAssetsMember2019-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-010001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-012020-01-010001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2019-12-310001722684wh:FinancingReceivablewithDeferredIncomeOffsetMember2020-12-310001722684us-gaap:LandMember2020-12-310001722684us-gaap:LandMember2019-12-310001722684us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001722684us-gaap:BuildingAndBuildingImprovementsMember2019-12-310001722684us-gaap:ComputerEquipmentMember2020-12-310001722684us-gaap:ComputerEquipmentMember2019-12-310001722684us-gaap:FurnitureAndFixturesMember2020-12-310001722684us-gaap:FurnitureAndFixturesMember2019-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2019-12-310001722684us-gaap:ConstructionInProgressMember2020-12-310001722684us-gaap:ConstructionInProgressMember2019-12-310001722684wh:LaQuintaHoldingsInc.Member2018-05-302018-05-300001722684wh:LaQuintaHoldingsInc.Member2018-05-30wh:rooms0001722684wh:SeniorUnsecuredNotesdueApril2026Member2018-04-300001722684wh:TermLoandue2025Member2018-05-300001722684us-gaap:TrademarksMemberwh:LaQuintaHoldingsInc.Member2018-05-300001722684wh:LaQuintaHoldingsInc.Memberus-gaap:FranchiseRightsMember2018-05-300001722684wh:LaQuintaHoldingsInc.Memberwh:ManagementContractsMember2018-05-300001722684wh:LaQuintaHoldingsInc.Memberwh:CorePointLodgingMember2018-07-012018-09-300001722684wh:LaQuintaHoldingsInc.Memberwh:CorePointLodgingMember2019-01-012019-12-310001722684wh:LaQuintaHoldingsInc.Memberwh:CorePointLodgingMember2018-01-012018-12-310001722684wh:CorePointLodgingMember2018-05-302018-05-300001722684wh:LaQuintaHoldingsInc.Memberwh:TrademarksandFranchiseAgreementsMember2018-05-302018-05-300001722684wh:LaQuintaHoldingsInc.Memberwh:ManagementContractsMember2018-05-302018-05-300001722684wh:CorePointLodgingMemberwh:FranchiseRightsandManagementContractsMember2018-05-300001722684us-gaap:FranchiseRightsMemberwh:CorePointLodgingMember2018-05-300001722684wh:CorePointLodgingMemberwh:ManagementContractsMember2018-05-300001722684wh:LaQuintaHoldingsInc.Member2018-10-012018-12-310001722684wh:LaQuintaHoldingsInc.Member2018-01-012018-12-3100017226842020-04-012020-06-300001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2020-04-012020-06-300001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2020-04-012020-06-300001722684wh:ImpairedAssetsMemberwh:OwnedHotelReportingUnitMember2020-06-300001722684wh:ImpairedAssetsMember2020-04-012020-06-300001722684wh:LaQuintatrademarkMemberwh:ImpairedAssetsMember2020-06-300001722684wh:LaQuintatrademarkMemberwh:ImpairedAssetsMember2020-04-012020-06-300001722684wh:ImpairedAssetsMemberwh:OtherimpairedtrademarksMember2020-06-300001722684wh:ImpairedAssetsMemberwh:OtherimpairedtrademarksMember2020-04-012020-06-300001722684wh:ImpairedAssetsMember2020-06-30wh:trademark0001722684us-gaap:TrademarksMember2020-12-310001722684us-gaap:TrademarksMember2019-12-310001722684us-gaap:FranchiseRightsMember2020-12-310001722684us-gaap:FranchiseRightsMember2019-12-310001722684wh:ManagementAgreementsMember2020-12-310001722684wh:ManagementAgreementsMember2019-12-310001722684us-gaap:TrademarksMember2020-12-310001722684us-gaap:TrademarksMember2019-12-310001722684us-gaap:OtherIntangibleAssetsMember2020-12-310001722684us-gaap:OtherIntangibleAssetsMember2019-12-310001722684srt:MinimumMemberus-gaap:FranchiseRightsMember2020-01-012020-12-310001722684srt:MaximumMemberus-gaap:FranchiseRightsMember2020-01-012020-12-310001722684srt:WeightedAverageMemberus-gaap:FranchiseRightsMember2020-01-012020-12-310001722684srt:MinimumMemberwh:ManagementAgreementsMember2020-01-012020-12-310001722684srt:MaximumMemberwh:ManagementAgreementsMember2020-01-012020-12-310001722684srt:WeightedAverageMemberwh:ManagementAgreementsMember2020-01-012020-12-310001722684us-gaap:TrademarksMember2020-01-012020-12-310001722684us-gaap:OtherIntangibleAssetsMembersrt:MinimumMember2020-01-012020-12-310001722684us-gaap:OtherIntangibleAssetsMembersrt:MaximumMember2020-01-012020-12-310001722684us-gaap:OtherIntangibleAssetsMembersrt:WeightedAverageMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMember2018-12-310001722684wh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:HotelFranchisingSegmentMember2019-12-310001722684wh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMember2020-12-310001722684wh:HotelManagementSegmentMember2018-12-310001722684wh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMember2019-12-310001722684wh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMember2020-12-310001722684us-gaap:FranchiseRightsMember2020-01-012020-12-310001722684us-gaap:FranchiseRightsMember2019-01-012019-12-310001722684us-gaap:FranchiseRightsMember2018-01-012018-12-310001722684wh:ManagementAgreementsMember2020-01-012020-12-310001722684wh:ManagementAgreementsMember2019-01-012019-12-310001722684wh:ManagementAgreementsMember2018-01-012018-12-310001722684us-gaap:TrademarksMember2019-01-012019-12-310001722684us-gaap:TrademarksMember2018-01-012018-12-310001722684us-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001722684us-gaap:OtherIntangibleAssetsMember2019-01-012019-12-310001722684us-gaap:OtherIntangibleAssetsMember2018-01-012018-12-310001722684us-gaap:FranchiseMember2020-01-012020-12-310001722684us-gaap:FranchiseMember2019-01-012019-12-310001722684us-gaap:FranchiseMember2018-01-012018-12-310001722684wh:FranchiseesAndHotelOwnersMember2020-12-310001722684wh:FranchiseesAndHotelOwnersMember2019-12-310001722684wh:ForgivenessOfNoteReceivableMember2020-01-012020-12-310001722684wh:ForgivenessOfNoteReceivableMember2019-01-012019-12-310001722684wh:ForgivenessOfNoteReceivableMember2018-01-012018-12-310001722684us-gaap:AccruedLiabilitiesMember2020-12-310001722684us-gaap:AccruedLiabilitiesMember2019-12-310001722684us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2020-12-310001722684us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2019-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoandue2025Member2020-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoandue2025Member2019-12-310001722684wh:SeniorUnsecuredNotesdueApril2026Memberus-gaap:SeniorNotesMember2020-12-310001722684wh:SeniorUnsecuredNotesdueApril2026Memberus-gaap:SeniorNotesMember2019-12-310001722684wh:SeniorUnsecuredNotesDueAugust2028Memberus-gaap:SeniorNotesMember2020-12-310001722684wh:SeniorUnsecuredNotesDueAugust2028Memberus-gaap:SeniorNotesMember2019-12-310001722684wh:WyndhamWorldwideMemberus-gaap:CapitalLeaseObligationsMember2020-12-310001722684wh:WyndhamWorldwideMemberus-gaap:CapitalLeaseObligationsMember2019-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2020-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2019-12-310001722684us-gaap:RevolvingCreditFacilityMember2020-12-310001722684srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684srt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:LondonInterbankOfferedRateLIBORMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:RevolvingCreditFacilityMember2020-04-300001722684us-gaap:BaseRateMemberwh:TermLoandue2025Member2018-05-012018-05-310001722684us-gaap:LondonInterbankOfferedRateLIBORMemberwh:TermLoandue2025Member2018-05-012018-05-310001722684wh:TermLoandue2025Member2018-05-012018-05-310001722684wh:CreditAgreementMember2018-05-310001722684wh:CreditAgreementMember2018-05-312018-05-310001722684wh:SeniorUnsecuredNotesdueApril2026Member2018-04-012018-04-300001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-310001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-012020-08-300001722684us-gaap:RevolvingCreditFacilityMember2019-12-310001722684us-gaap:InterestRateSwapMember2018-05-300001722684wh:InterestRateSwap1Member2018-05-300001722684wh:InterestRateSwap1Membersrt:WeightedAverageMember2018-05-300001722684wh:InterestRateSwap2Member2018-05-300001722684wh:InterestRateSwap2Membersrt:WeightedAverageMember2018-05-300001722684us-gaap:InterestRateSwapMember2020-01-012020-12-310001722684us-gaap:InterestRateSwapMember2019-01-012019-12-310001722684wh:DeferredIncomeTaxesMember2020-12-310001722684wh:DeferredIncomeTaxesMember2019-12-310001722684wh:NetOperatingLossCarryforwardMember2020-12-310001722684wh:DeferredTaxAssetMember2020-12-310001722684wh:ForeignTaxCreditMember2020-12-310001722684wh:NetOperatingLossCarryforwardMember2019-12-310001722684wh:DeferredTaxAssetMember2019-12-310001722684wh:ForeignTaxCreditMember2019-12-310001722684us-gaap:DomesticCountryMembersrt:MinimumMember2020-12-310001722684us-gaap:DomesticCountryMembersrt:MaximumMember2020-12-310001722684wh:LaQuintaHoldingsInc.Memberwh:DomesticandStateandLocalAuthorityMember2019-01-012019-12-310001722684wh:DomesticandStateandLocalAuthorityMemberwh:ParentsNetInvestmentMember2018-01-012018-12-310001722684wh:DomesticandStateandLocalAuthorityMember2018-01-012018-12-310001722684us-gaap:ForeignCountryMember2018-01-012018-12-310001722684us-gaap:CarryingReportedAmountFairValueDisclosureMember2020-12-310001722684us-gaap:EstimateOfFairValueFairValueDisclosureMember2020-12-310001722684stpr:TXus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684stpr:FLus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684stpr:TXus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684stpr:FLus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684stpr:TXus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001722684stpr:FLus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001722684stpr:FL2020-01-012020-12-310001722684stpr:FL2019-01-012019-12-310001722684stpr:FL2018-01-012018-12-310001722684us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2020-01-012020-12-310001722684us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2019-01-012019-12-310001722684us-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2018-01-012018-12-310001722684wh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684wh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684wh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2018-01-012018-12-310001722684srt:MaximumMember2020-12-310001722684us-gaap:ContractTerminationMemberus-gaap:ReceivableTypeDomain2020-04-012020-06-3000017226842019-10-012019-12-310001722684us-gaap:ContractTerminationMember2019-12-310001722684us-gaap:ContractTerminationMemberus-gaap:ReceivableTypeDomain2019-07-012019-09-300001722684us-gaap:OtherAssetsMemberus-gaap:ContractTerminationMember2019-07-012019-09-300001722684us-gaap:ContractTerminationMemberus-gaap:OtherLiabilitiesMember2019-07-012019-09-300001722684us-gaap:ContractTerminationMember2019-07-012019-09-300001722684us-gaap:PaymentGuaranteeMember2018-05-310001722684wh:FairValueOfGuaranteesMember2018-05-310001722684wh:GuaranteeReceivableFromFormerParentMember2018-05-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2018-05-140001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2020-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2019-12-310001722684us-gaap:PerformanceSharesMember2019-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2020-01-012020-12-310001722684us-gaap:PerformanceSharesMember2020-01-012020-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2020-12-310001722684us-gaap:PerformanceSharesMember2020-12-310001722684us-gaap:EmployeeStockOptionMember2020-01-012020-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2018-05-092018-05-090001722684us-gaap:PerformanceSharesMember2018-05-092018-05-090001722684us-gaap:RestructuringChargesMember2020-01-012020-12-310001722684us-gaap:RestructuringChargesMember2019-01-012019-12-310001722684wh:SeparationRelatedCostsMember2019-01-012019-12-310001722684wh:SeparationRelatedCostsMember2018-01-012018-12-310001722684wh:SeparationRelatedCostsModificationofStockPlanMember2018-01-012018-12-310001722684us-gaap:CorporateAndOtherMember2020-01-012020-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2020-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001722684us-gaap:AllOtherSegmentsMember2020-12-310001722684us-gaap:CorporateAndOtherMember2019-01-012019-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2019-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2019-12-310001722684us-gaap:AllOtherSegmentsMember2019-12-310001722684us-gaap:CorporateAndOtherMember2018-01-012018-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2018-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2018-12-310001722684us-gaap:AllOtherSegmentsMember2018-12-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMemberwh:NonseparationrelatedMember2020-01-012020-12-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMemberwh:NonseparationrelatedMember2019-01-012019-12-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMemberwh:NonseparationrelatedMember2018-01-012018-12-310001722684country:US2020-01-012020-12-310001722684us-gaap:NonUsMember2020-01-012020-12-310001722684country:US2020-12-310001722684us-gaap:NonUsMember2020-12-310001722684country:US2019-01-012019-12-310001722684us-gaap:NonUsMember2019-01-012019-12-310001722684country:US2019-12-310001722684us-gaap:NonUsMember2019-12-310001722684country:US2018-01-012018-12-310001722684us-gaap:NonUsMember2018-01-012018-12-310001722684country:US2018-12-310001722684us-gaap:NonUsMember2018-12-310001722684us-gaap:ContractTerminationMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001722684wh:PreviouslyimpairedassetMember2020-10-012020-12-310001722684us-gaap:ContractTerminationMemberus-gaap:ReceivableTypeDomain2019-01-012019-12-310001722684us-gaap:OtherAssetsMemberus-gaap:ContractTerminationMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMemberus-gaap:OtherLiabilitiesMember2019-01-012019-12-310001722684wh:A2020RestructuringPlanMember2020-01-012020-12-310001722684wh:A2019RestructuringPlanMember2019-12-310001722684wh:A2019RestructuringPlanMember2020-01-012020-12-310001722684wh:A2019RestructuringPlanMember2020-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2019-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2020-01-012020-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:FacilityClosingMember2019-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:FacilityClosingMember2020-01-012020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:FacilityClosingMember2020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2019-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2020-01-012020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2020-12-310001722684wh:A2020RestructuringPlansMember2019-12-310001722684wh:A2020RestructuringPlansMember2020-01-012020-12-310001722684wh:A2020RestructuringPlansMember2020-12-310001722684wh:CorePointtaxmatterMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMember2019-01-012019-09-300001722684wh:ContractTerminationIndemnificationObligationMember2019-01-012019-12-3100017226842019-01-012019-09-300001722684wh:SeparationAndDistributionAgreementMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684wh:SeparationAndDistributionAgreementMembersrt:AffiliatedEntityMember2018-01-012018-12-310001722684us-gaap:LicensingAgreementsMemberwh:WyndhamWorldwideMember2020-01-012020-12-310001722684us-gaap:LicensingAgreementsMemberwh:WyndhamWorldwideMember2019-01-012019-12-310001722684us-gaap:LicensingAgreementsMemberwh:WyndhamWorldwideMember2018-01-012018-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2020-01-012020-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2018-01-012018-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2020-01-012020-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2018-01-012018-12-310001722684wh:ContractTerminationIndemnificationObligationMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001722684us-gaap:OtherNoncurrentLiabilitiesMember2019-12-310001722684us-gaap:OtherCurrentLiabilitiesMember2020-12-310001722684us-gaap:OtherCurrentLiabilitiesMember2019-12-310001722684us-gaap:OtherAssetsMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684wh:SaleofEuropeanVacationRentalsBusinessMembersrt:AffiliatedEntityMember2018-01-012018-12-310001722684wh:SaleofEuropeanVacationRentalsBusinessMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberwh:CashPoolingandGeneralFinancingActivitiesMember2018-12-310001722684srt:AffiliatedEntityMemberwh:IndirectGeneralCorporateOverheadMember2018-12-310001722684wh:CorporateSharedServicesMembersrt:AffiliatedEntityMember2018-12-310001722684wh:StockBasedCompensationMembersrt:AffiliatedEntityMember2018-12-310001722684wh:IncomeTaxesMembersrt:AffiliatedEntityMember2018-12-310001722684srt:AffiliatedEntityMember2018-01-012018-12-310001722684srt:AffiliatedEntityMember2018-12-310001722684wh:InformationTechnologySupportFinancialServicesHumanResourcesandOtherSharedServicesMembersrt:AffiliatedEntityMember2018-01-012018-12-310001722684srt:AffiliatedEntityMemberwh:IndirectGeneralCorporateOverheadMember2018-01-012018-12-310001722684wh:InsuranceMembersrt:AffiliatedEntityMember2018-01-012018-12-310001722684wh:SaleofEuropeanVacationRentalsBusinessMembersrt:AffiliatedEntityMember2020-01-012020-12-310001722684us-gaap:AccountingStandardsUpdate201602Member2019-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2017-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2017-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2018-01-012018-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-01-012018-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-01-012019-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001722684srt:AffiliatedEntityMemberwh:DefinedContributionBenefitPlanMember2018-01-012018-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2020-01-012020-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2019-01-012019-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2018-01-012018-12-310001722684wh:HotelFranchisingSegmentMember2020-01-012020-03-310001722684wh:HotelFranchisingSegmentMember2020-04-012020-06-300001722684wh:HotelFranchisingSegmentMember2020-07-012020-09-300001722684wh:HotelFranchisingSegmentMember2020-10-012020-12-310001722684wh:HotelManagementSegmentMember2020-01-012020-03-310001722684wh:HotelManagementSegmentMember2020-04-012020-06-300001722684wh:HotelManagementSegmentMember2020-07-012020-09-300001722684wh:HotelManagementSegmentMember2020-10-012020-12-310001722684us-gaap:CorporateAndOtherMember2020-01-012020-03-310001722684us-gaap:CorporateAndOtherMember2020-04-012020-06-300001722684us-gaap:CorporateAndOtherMember2020-07-012020-09-300001722684us-gaap:CorporateAndOtherMember2020-10-012020-12-3100017226842020-01-012020-03-3100017226842020-07-012020-09-3000017226842020-10-012020-12-310001722684wh:HotelFranchisingSegmentMember2019-01-012019-03-310001722684wh:HotelFranchisingSegmentMember2019-04-012019-06-300001722684wh:HotelFranchisingSegmentMember2019-07-012019-09-300001722684wh:HotelFranchisingSegmentMember2019-10-012019-12-310001722684wh:HotelManagementSegmentMember2019-01-012019-03-310001722684wh:HotelManagementSegmentMember2019-04-012019-06-300001722684wh:HotelManagementSegmentMember2019-07-012019-09-300001722684wh:HotelManagementSegmentMember2019-10-012019-12-310001722684us-gaap:CorporateAndOtherMember2019-01-012019-03-310001722684us-gaap:CorporateAndOtherMember2019-04-012019-06-300001722684us-gaap:CorporateAndOtherMember2019-07-012019-09-300001722684us-gaap:CorporateAndOtherMember2019-10-012019-12-3100017226842019-01-012019-03-3100017226842019-04-012019-06-3000017226842019-07-012019-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38432

Wyndham Hotels & Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

Delaware | | 82-3356232 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

22 Sylvan Way | | 07054 |

Parsippany, | New Jersey | | (Zip Code) |

(Address of Principal Executive Offices) | | |

(973) 753-6000

(Registrant’s Telephone Number, Including Area Code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, Par Value $0.01 per share | WH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☑ | | | | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | | | | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2020, was $3.93 billion. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of January 31, 2021, the registrant had outstanding 93,169,663 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the 2021 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| | |

PART I

Forward-Looking Statements

This report contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our views and expectations regarding our strategy and the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate,” “projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of Wyndham Hotels & Resorts to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Factors that could cause actual results to differ materially from those in the forward-looking statements include without limitation general economic conditions; the continuation or worsening of the effects from the coronavirus pandemic, (“COVID-19”); its scope, duration and impact on our business operations, financial results, cash flows and liquidity, as well as the impact on our franchisees and property owners, guests and team members, the hospitality industry and overall demand for travel; the success of our mitigation efforts in response to COVID-19; our performance in any recovery from COVID-19, the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising and management businesses; our relationships with franchisees and property owners; the impact of war, terrorist activity, political instability or political strife; concerns with or threats of pandemics, contagious diseases or health epidemics, including the effects of COVID-19 and any resurgence or mutations of the virus and actions governments, businesses and individuals take in response to the pandemic, including stay-in-place directives and other travel restrictions; risks related to restructuring or strategic initiatives; risks related to our relationship with CorePoint Lodging; our spin-off as a newly independent company; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to our ability to obtain financing and the terms of such financing, including access to liquidity and capital as a result of COVID-19; and the Company's limitations related to share repurchases and ability to pay dividends under its credit facility and the timing and amount of any future dividends, as well as the risks described under Part I, Item 1A – Risk Factors.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements, reports that are filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at https://www.sec.gov. Our SEC filings are also available on our website at https://www.wyndhamhotels.com as soon as reasonably practicable after they are filed with or furnished to the SEC. We maintain an internet site at https://www.wyndhamhotels.com. Our website and the information contained on or connected to that site are not incorporated into this Annual Report.

We may use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Disclosures of this nature will be included on our website in the “Investors” section, which can currently be accessed at www.investor.wyndhamhotels.com. Accordingly, investors should monitor this section of our website in addition to following our press releases, filings submitted with the SEC and any public conference calls or webcasts.

Item 1. Business.

Wyndham Hotels & Resorts, Inc. (“Wyndham Hotels”, the “Company”, “we”, “our” or “us”) is the world’s largest hotel franchising company by number of hotels, with over 8,900 affiliated hotels with approximately 796,000 rooms located in nearly 95 countries and welcoming over 90 million guests annually worldwide. Our 20 brands are primarily located in secondary and tertiary cities and approximately 80% of the U.S. population lives within ten miles of at least one of our affiliated hotels. Our mission is to make hotel travel possible for all. Wherever people go, Wyndham will be there to welcome them. We boast a remarkably asset-light business model with only two of our over 8,900 hotels being owned, dramatically limiting our capital needs and our exposure to the rising wage environment.

During 2020, the hotel industry experienced a sharp decline in travel demand due to the coronavirus pandemic, (“COVID-19”) and the related government preventative and protective actions to slow the spread of the virus, including

travel restrictions. We and the entire industry experienced significant revenue losses as a result of steep RevPAR declines, which may continue for some time.

As a result of the financial impact of COVID-19, we undertook a number of preventative measures to conserve our liquidity, strengthen our balance sheet and support our franchisees through these unprecedented times, including:

•Issuing $500 million of senior unsecured notes at 4.375% due in August 2028;

•Suspending our share repurchase program as of March 17, 2020;

•Reducing our quarterly cash dividend per share to $0.08 per share from $0.32 per share, beginning with the dividend that was declared by the Board of Directors (“Board”) during the second quarter of 2020;

•Workforce reductions, including the elimination of 846 team members across the globe;

•Advertising reductions and elimination of all discretionary spend;

•Capital expenditures reductions to focus on only the highest priority projects;

•Temporary closure of our two owned hotels for April and May 2020; and

•Our Chief Executive Officer elected to forgo his base salary and our Board elected to forgo the cash portion of their fees for a portion of the year.

Our franchisees’ financial health and long-term success is a top priority for us, and we have taken the following proactive steps to help them preserve cash during this period:

•Suspended non-room revenue related fees, such as Wyndham Rewards retraining fees;

•Deferred property improvement plans and certain non-essential brand standards requiring cash outlays, such as hot breakfast requirements;

•Provided payment relief by deferring receivables and suspending interest charges and late fees through September 1, 2020;

•Partnered with industry associations to advocate for government relief for our franchisees and their employees;

•Guided owners through the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act and its evolving guidance and urged the government to expand and clarify these loan programs, for which the majority of our owners qualify;

•Revised cleaning protocols and secured critical cleaning and disinfection supplies pursuant to new U.S. Centers for Disease Control and Prevention (“CDC”) guidelines through our procurement network at reduced costs for our franchisees as well as funding and deferring repayment of these costs to help our franchisees conserve cash during this pandemic; and

•Continued marketing and sales efforts during the higher demand summer travel season to drive bookings for our hotel owners.

For our guests whose travel plans have changed, we have modified cancellation policies, paused Wyndham Rewards point expirations until June 30, 2021 and are maintaining loyalty member level status through the end of 2021. Over 99% of our domestic and approximately 97% of our global portfolio remain open today.

Nearly 90% of our domestic hotels are located along highways and in suburban and small metro areas. Our portfolio generates approximately 70% of bookings from leisure customers and 30% from business travel. Our business customers are substantially comprised of truckers, contractors, construction workers, healthcare workers, emergency crews and others who must travel for work and do not have the ability to conduct their work remotely. These travelers are looking for well-known and high quality brands they can depend on for quality and enhanced safety measures. Less than 5% of our bookings come from corporate business travel or group business. As a result of the strength of leisure demand, these traveling everyday workers and our continued investment in sales and marketing efforts, our economy and midscale brands have outperformed the industry's higher-end chain scales throughout the pandemic. For further discussion on the effect of COVID-19 on our financial condition and liquidity, see Part II, Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations.

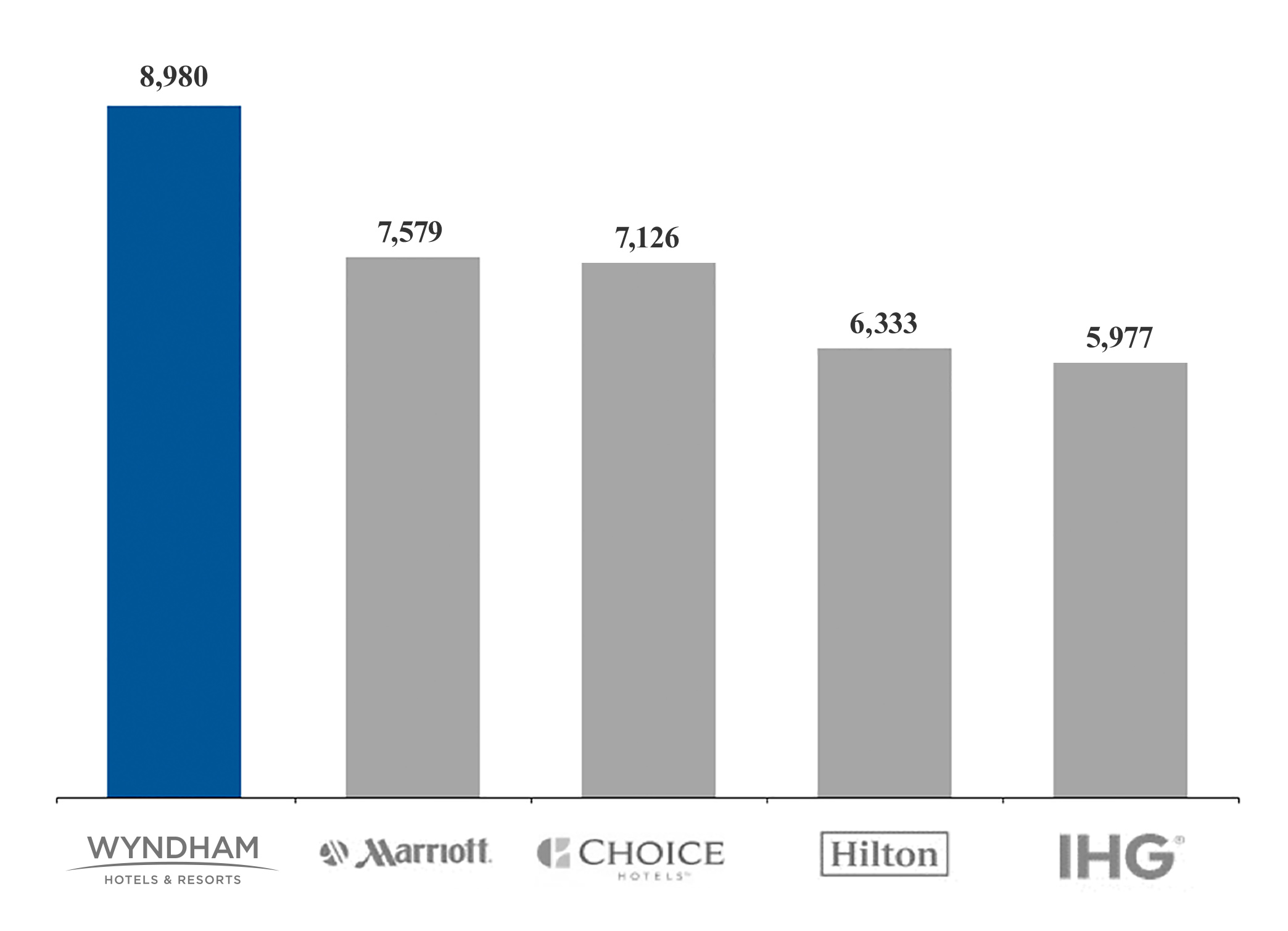

The following chart presents the number of branded hotels associated with each of the five largest traditional hotel franchise companies as of September 30, 2020:

Source: Companies' public disclosures

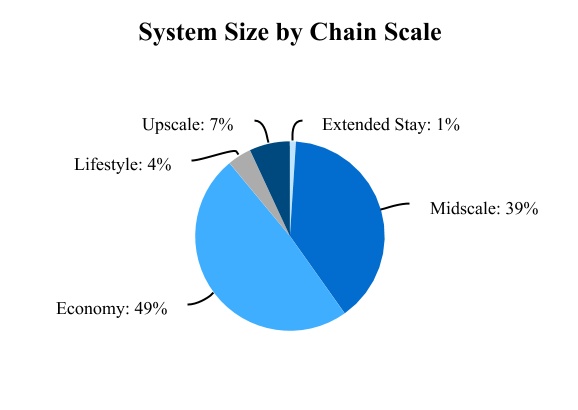

Our widely recognized brands with select-service focus offer a breadth of options for franchisees and a wide range of price points and experiences for our guests. We are a global leader in the economy and midscale chain scales where our brands represent over 30% of branded rooms in the United States, and also have a strong presence in the upper midscale and lifestyle chain scales.

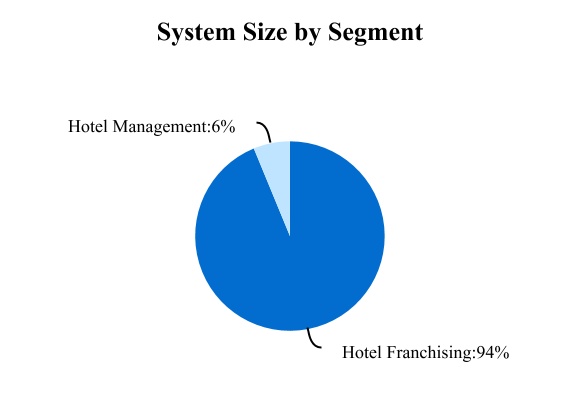

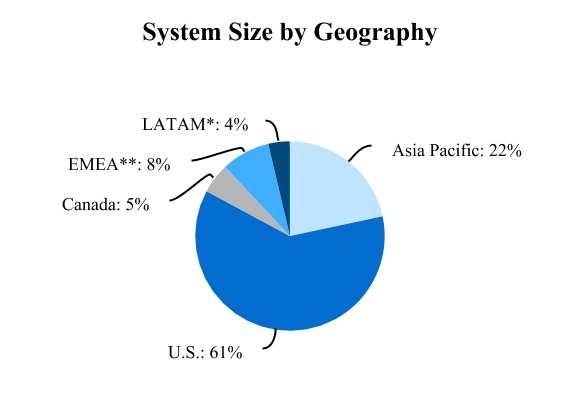

The following charts illustrate our system size (by rooms) as of December 31, 2020:

______________________

* LATAM is representative of Latin America and the Caribbean.

** EMEA is representative of Europe, the Middle East, Eurasia and Africa.

As of December 31, 2020, our brand portfolio consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | North America | | Asia Pacific | | | | | | |

| 2020 Global RevPAR | | | | U.S. | | Canada | | Greater China | | Rest of Asia | | EMEA | | LATAM | | Total |

| Economy | | | | | | | | | | | | | | | | | |

| Super 8 | $ | 18.88 | | | Properties | | 1,506 | | 125 | | 1,082 | | — | | | 10 | | — | | | 2,723 |

| | | Rooms | | 90,530 | | 8,061 | | 64,599 | | — | | | 1,690 | | — | | | 164,880 |

| Days Inn | $ | 25.20 | | | Properties | | 1,370 | | 113 | | 44 | | 14 | | 54 | | 5 | | 1,600 |

| | | Rooms | | 101,756 | | 8,874 | | 7,206 | | 1,999 | | 3,059 | | 458 | | 123,352 |

| Travelodge | $ | 26.21 | | | Properties | | 351 | | 104 | | — | | | — | | | — | | | — | | | 455 |

| | | Rooms | | 24,091 | | 8,511 | | — | | | — | | | — | | | — | | | 32,602 |

| Microtel | $ | 28.65 | | | Properties | | 300 | | 20 | | 4 | | | 14 | | — | | | 7 | | 345 |

| | | Rooms | | 21,200 | | 1,719 | | 579 | | | 1,037 | | — | | | 835 | | 25,370 |

| Howard Johnson | $ | 17.61 | | | Properties | | 168 | | 20 | | 69 | | 2 | | 5 | | 46 | | 310 |

| | | Rooms | | 13,143 | | 1,384 | | 21,437 | | 924 | | 500 | | 2,923 | | 40,311 |

| Total Economy | $ | 22.01 | | | Properties | | 3,695 | | 382 | | 1,199 | | 30 | | 69 | | 58 | | 5,433 |

| | | Rooms | | 250,720 | | 28,549 | | 93,821 | | 3,960 | | 5,249 | | 4,216 | | 386,515 |

| Midscale | | | | | | | | | | | | | | | | | |

| La Quinta | $ | 37.37 | | | Properties | | 919 | | 2 | | — | | | 1 | | | 3 | | | 12 | | 937 |

| | | Rooms | | 89,200 | | 133 | | — | | | 188 | | | 665 | | | 1,625 | | 91,811 |

| Ramada | $ | 18.36 | | | Properties | | 321 | | 80 | | 123 | | 75 | | 210 | | 29 | | 838 |

| | | Rooms | | 37,866 | | 7,695 | | 26,251 | | 14,141 | | 28,886 | | 3,774 | | 118,613 |

| Baymont | $ | 27.03 | | | Properties | | 513 | | 5 | | — | | | — | | | — | | | 1 | | 519 |

| | | Rooms | | 39,056 | | 470 | | — | | | — | | | — | | | 118 | | 39,644 |

| AmericInn | $ | 34.68 | | | Properties | | 204 | | — | | | — | | | — | | | — | | | — | | | 204 |

| | | Rooms | | 12,107 | | — | | | — | | | — | | | — | | | — | | | 12,107 |

| Wingate | $ | 31.80 | | | Properties | | 160 | | 10 | | 3 | | — | | | — | | | 1 | | 174 |

| | | Rooms | | 14,541 | | 1,011 | | 449 | | — | | | — | | | 176 | | 16,177 |

| Wyndham Garden | $ | 24.21 | | | Properties | | 65 | | 3 | | 11 | | 5 | | 17 | | 22 | | 123 |

| | | Rooms | | 10,873 | | 651 | | 2,166 | | 636 | | 2,835 | | 3,055 | | 20,216 |

| Ramada Encore | $ | 11.69 | | | Properties | | — | | | — | | | 21 | | 15 | | 22 | | 12 | | 70 |

| | | Rooms | | — | | | — | | | 3,216 | | 4,288 | | 2,584 | | 1,699 | | 11,787 |

| Total Midscale | $ | 26.50 | | | Properties | | 2,182 | | 100 | | 158 | | 96 | | 252 | | 77 | | 2,865 |

| | | Rooms | | 203,643 | | 9,960 | | 32,082 | | 19,253 | | 34,970 | | 10,447 | | 310,355 |

| Extended Stay | | | | | | | | | | | | | | | | | |

| Hawthorn | $ | 36.72 | | | Properties | | 84 | | — | | | — | | | — | | | 5 | | — | | | 89 |

| | | Rooms | | 7,527 | | — | | | — | | | — | | | 487 | | — | | | 8,014 |

| Lifestyle | | | | | | | | | | | | | | | | | |

| Trademark | $ | 28.75 | | | Properties | | 48 | | 11 | | — | | | 1 | | | 49 | | 4 | | | 113 |

| | | Rooms | | 7,338 | | 1,639 | | — | | | 90 | | | 8,751 | | 309 | | | 18,127 |

| TRYP | $ | 21.23 | | | Properties | | 9 | | — | | | 1 | | 1 | | 55 | | 20 | | 86 |

| | | Rooms | | 1,101 | | — | | | 95 | | 191 | | 7,530 | | 2,889 | | 11,806 |

| Dazzler | $ | 16.67 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 13 | | 13 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 1,687 | | 1,687 |

| Esplendor | $ | 12.46 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 7 | | 7 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 668 | | 668 |

| Total Lifestyle | $ | 25.23 | | | Properties | | 57 | | 11 | | 1 | | 2 | | 104 | | 44 | | 219 |

| | | Rooms | | 8,439 | | 1,639 | | 95 | | 281 | | 16,281 | | 5,553 | | 32,288 |

| Upscale | | | | | | | | | | | | | | | | | |

| Wyndham | $ | 23.66 | | | Properties | | 31 | | — | | | 30 | | 14 | | 17 | | 40 | | 132 |

| | | Rooms | | 9,109 | | — | | | 8,712 | | 2,517 | | 3,344 | | 9,117 | | 32,799 |

| Wyndham Grand | $ | 35.06 | | | Properties | | 10 | | — | | | 30 | | 6 | | 14 | | — | | | 60 |

| | | Rooms | | 3,009 | | — | | | 9,810 | | 1,404 | | 3,555 | | — | | | 17,778 |

| Dolce | $ | 42.83 | | | Properties | | 7 | | 3 | | — | | | 1 | | | 8 | | — | | | 19 |

| | | Rooms | | 1,400 | | 276 | | — | | | 342 | | | 2,300 | | — | | | 4,318 |

| Total Upscale | $ | 28.98 | | | Properties | | 48 | | 3 | | 60 | | 21 | | 39 | | 40 | | 211 |

| | | Rooms | | 13,518 | | 276 | | 18,522 | | 4,263 | | 9,199 | | 9,117 | | 54,895 |

Affiliated properties (a) | | | | | | | | | | | | | | | | | |

| | | Properties | | 109 | | 3 | | — | | | 11 | | — | | | 1 | | 124 |

| | | Rooms | | 3,446 | | 315 | | — | | | 47 | | — | | | 34 | | 3,842 |

| Total | $ | 24.51 | | | Properties | | 6,175 | | 499 | | 1,418 | | 160 | | 469 | | 220 | | 8,941 |

| | | Rooms | | 487,293 | | 40,739 | | 144,520 | | 27,804 | | 66,186 | | 29,367 | | 795,909 |

______________________

(a)Affiliated properties represent properties under affiliation arrangements with Wyndham Destinations or other third parties.

The following table presents the changes in our portfolio for the last three years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, |

| 2020 | | 2019 | | 2018 |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| Beginning balance | 9,280 | | | 831,000 | | | 9,157 | | | 809,900 | | | 8,422 | | | 728,200 | |

Additions (a) | 322 | | | 35,600 | | | 523 | | | 63,500 | | | 1,512 | | | 145,800 | |

Deletions (b) | (661) | | | (70,700) | | | (400) | | | (42,400) | | | (777) | | | (64,100) | |

| Ending balance | 8,941 | | | 795,900 | | | 9,280 | | | 831,000 | | | 9,157 | | | 809,900 | |

______________________

(a)2018 includes the addition of 905 properties and approximately 88,600 rooms from the acquisition of the La Quinta brand.

(b)2020 includes the deletion of 214 properties and approximately 18,500 rooms from the termination of non-compliant and brand detracting rooms, 20 properties and approximately 2,900 unprofitable rooms in connection with a guaranteed management contract and three properties and approximately 5,300 low-royalty rooms in connection with hotel sales by a strategic partner. 2018 includes the deletion of 351 properties and approximately 21,300 rooms from the disposition of the Knights Inn brand.

In addition to our current hotel portfolio, we have nearly 1,400 properties and 185,000 rooms in our development pipeline throughout 60 countries, where we debuted 35 brands and 13 countries where we do not currently have any open hotels. As of December 31, 2020, approximately 36% of our pipeline was located in the U.S. and 64% was located internationally; approximately 75% of our pipeline was for new construction properties and 25% represented conversion opportunities.

Our pipeline is typically only a subset of our development activity in any given period as some of our hotel additions are executed and opened in less than 90 days and therefore may never appear in our pipeline. However, we use the pipeline to gauge interest in our brands and our continued ability to drive our net room growth projections.

Our franchise sales team consists of nearly 140 sales professionals throughout the world. Our sales team is focused on growing our franchise business through conversions of existing branded and independent hotels and partnering with developers to brand newly constructed hotels. In addition to a regional presence in the United States, we currently have sales teams located in London, Istanbul, Dubai, Shanghai, Singapore, Canada, Delhi, Mexico City, Sao Paulo, Buenos Aires and Australia. Our international presence in key countries allows us to quickly adapt to changes in the increasingly dynamic global marketplace and to capitalize on new opportunities as they emerge.

In 2020, our sales team executed 558 franchise and 23 management contracts representing nearly 65,000 rooms. A key component of driving our net room growth is our ability to retain properties within our system. Our overall global and domestic retention rate was 95% in 2019, compared to 93% in 2015. However, in 2020 we experienced some large, discrete non-recurring termination events depressing our retention rates:

•we removed 21,400 rooms primarily relating to master franchise agreements (18,500) and unprofitable hotel management guarantee agreements (2,900); and

•a strategic partner unexpectedly sold certain hotels, triggering termination of the underlying license agreement and the removal of 5,300 rooms.

Adjusting for these unusual termination events, our global and domestic retention rates would have been 95% in 2020. We expect our retention rates to normalize in 2021 and our goal is to continue to improve them over time to support overall net room growth.

Our guest loyalty program

Wyndham Rewards is our award-winning guest loyalty program that supports our portfolio of brands. The program generates significant repeat business by rewarding guests with points for each qualified stay at all of our properties, which are then redeemable for free nights and other goods and services. Members can also use points earned to transact with nearly 20 partners, including gas stations and airlines. Additionally, Wyndham Rewards members can redeem their points for stays at thousands of hotels, vacation club resorts and vacation rentals globally. Affiliation with our loyalty programs encourages members to allocate more of their travel spending to our hotels.

Wyndham Rewards has been recognized as one of the simplest, most rewarding loyalty programs in the hotel industry, providing more value to members than any other program. It has won more than 100 awards in the past five years, including “Best Hotel Loyalty Program” from US News & World Report, “Best Hotel Loyalty Program” in USA TODAY, “10 Best

Readers’ Choice Awards”, “Most Rewarding Hotel Loyalty Program” from IdeaWorks and in December 2019, was ranked #1 on WalletHub’s list of “Best Hotel Rewards Programs” for the fifth consecutive year.

Wyndham Rewards has 86 million enrolled members and accounts for approximately 38% of occupancy at our affiliated hotels globally and 46% in the United States, up from 36% globally and 40% in the United States in 2019. Total membership has been growing by over 10% annually pre COVID-19 from 2013 to 2019 and grew 6% in 2020 with approximately 5 million new members added in 2020. Our franchisees benefit from the program through repeat stays and members benefit through free night stays as well as other redemption options for their points, such as gift cards, merchandise and experiences. The program is funded by contributions from eligible revenues generated by Wyndham Rewards members and collected by us from hotels in our system. These funds are applied to reimburse hotels and partners for Wyndham Rewards points redemptions by loyalty members and to pay for administrative expenses and marketing initiatives that support the program.

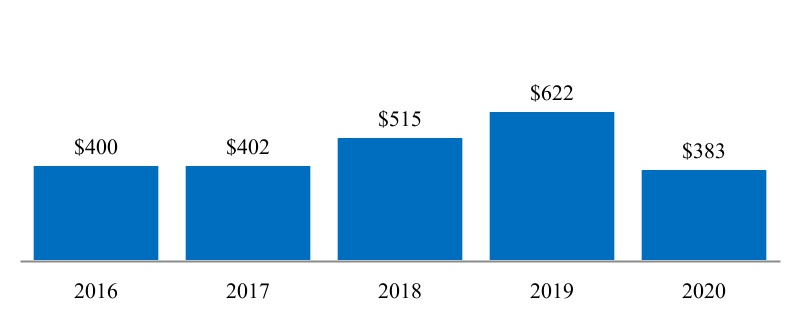

Hotel Franchising Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a)See Part II Item 6. Selected Financial Data for our definition of adjusted EBITDA and the reconciliation of net income (loss) to adjusted EBITDA. 2020 adjusted EBITDA was impacted by the decline in RevPAR due to lower travel demand as a result of COVID-19.

We license our brands and associated trademarks to nearly 6,000 franchisees globally, which provides for a highly diversified owner base with limited concentration. Our franchisees range from sole proprietors to institutional investors such as public real estate investment trusts. Our franchise agreements are typically 10 to 20 years in length, providing significant visibility into future cash flows. Under these agreements, our direct franchisees generally pay us a royalty fee of 4% to 5% of gross room revenue and a marketing and reservation fee of 3% to 5% of gross room revenue. We occasionally provide financial support in the form of loans or development advances to help generate new business.

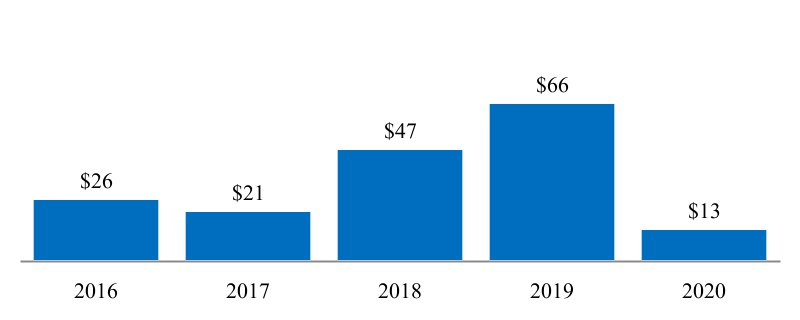

Hotel Management Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a)See Part II Item 6. Selected Financial Data for our definition of adjusted EBITDA and the reconciliation of net income (loss) to adjusted EBITDA. 2020 adjusted EBITDA was impacted by the decline in RevPAR due to lower travel demand as a result of COVID-19.

As of December 31, 2020, we had 300 hotels under management contracts and two owned hotels - the Wyndham Grand Rio Mar Beach Resort and Spa in Puerto Rico and the Wyndham Grand Orlando Bonnet Creek. We manage properties under our brands, primarily under the Wyndham, Wyndham Grand, Wyndham Garden, Dolce, La Quinta, Ramada and Dazzler brands in major markets and resort destinations globally. The duration of our management agreements is typically 10 to 20 years. We earn a base management fee, which is based on a percentage of the hotel’s total revenue, and in some cases we earn an incentive fee, which is based on achieving performance metrics agreed upon with hotel owners. Under our management arrangements, we provide all the benefits of a franchising agreement and also conduct the day-to-day-operations of the hotel on behalf of the owner.

As the world’s largest hotel franchising company by the number of hotels, with over 8,900 hotels, approximately 796,000 rooms and 20 brands across nearly 95 countries, Wyndham Hotels & Resorts is an asset-light business with significant cash generation capabilities.

With the leading economy and midscale brands in the attractive select-service space, we feature a primarily leisure-focused, “drive to” portfolio of hotels. Our non-urban portfolio is not reliant on international travel, group business or corporate transient business.

Our industry-leading Wyndham Rewards program, which helps connect hotel owners to guests, is 86 million enrolled members strong. Our loyalty members spend two times more than non-members on average and drive 46% of all our U.S. hotel stays.

Owners are at the center of everything we do. Our powerful marketing and sales programs drive bookings to hotels while our competitive online travel agencies and supplier pricing reduces costs for hotel owners. Our size and scale enable us to offer resources, support, and new opportunities to our franchisees and ultimately, to deliver on our mission to make hotel travel possible for all.

We are committed to operating our business in a way that is socially, ethically and environmentally responsible. Now more than ever, we must help ensure the future remains bright for travelers around the world. As the world’s largest hotel franchising company by number of hotels, we have a unique opportunity to make a meaningful impact on the world while advancing our mission to make hotel travel possible for all.

As a hospitality company, service and volunteering is in our DNA. Our teams and franchisees around the world actively engage in their communities, generously giving in ways that enhance the lives of others. We support various charitable programs, including youth and education, military, community and environmental programs. Our philanthropy captures the dedication of our team members, leaders and business partners who have pledged to make lasting, important contributions to the communities in which we operate.

As of December 31, 2020, we had approximately 9,000 employees, consisting of approximately 1,000 employees outside of the United States. Our workforce is comprised of approximately 2,000 corporate employees and approximately 7,000 managed property employees. Approximately 7% of our employees are subject to collective bargaining agreements governing their employment at our managed properties with the Company.

Culture

At Wyndham, our values underpin our inclusive culture, drive our growth, nurture innovation, and inspire the great experiences we create for team members and the people we serve. Our signature “Count on Me” service culture encourages each team member to be responsive, respectful, and deliver great experiences to our guests, partners, communities and each other. As a leader in hospitality, we recognize the critical role that service plays for our Company. Our Count on Me promise aligns with our core values – integrity, accountability, inclusiveness, caring and fun – and is embedded and celebrated at all levels of our organization.

Ethical leadership starts with our Board of Directors, and is shared by managers, supervisors and team members across every brand and business at Wyndham Hotels & Resorts. Our Business Principles guide our interactions and set the standard for how every one of us should approach our work in service to our mission. All team members are expected to embrace our shared values and principles, and do their part in maintaining the highest ethical standards and behavior as we continue to grow in communities around the world.

Career Development

Our team members’ career development is key to our long-term success of attracting, rewarding, and retaining the best people and a top priority of the Company. We actively seek to identify and develop talent throughout the Company and provide a variety of learning experiences and flexible delivery methods for a diverse learning audience. This includes on-the-job practice, coaching and counseling, effective performance appraisals and honest and timely feedback as well as formal programs such as:

•Leading 4 Success – Development at this level focuses on two integral areas – Managing: the day-to-day operational functions, and Leading: the inspirational and motivational skills required to lead a team.

•Thayer Leadership “Leadership Experience at West Point” – enables growth for executive-level leadership in the areas of increasing innovation, leading internal organizational growth, improving overall leadership quality and increasing employee commitment and retention.

•Castell Leadership Program – Is dedicated to accelerating the careers of women professionals in the hospitality industry. Castell delivers impactful development opportunities for talented women professionals who have demonstrated strong leadership potential.

•Wyndham University – Provides a variety of learnings experiences that develop the knowledge, skills, and abilities of our team members.

Diversity and Inclusion

We respect differences in people, ideas and experiences. Our core values, grounded in caring, respect, inclusiveness and fundamental human rights, infuse different perspectives that reflect our diverse customers, team members, and communities around the world. While we have been recognized for the progress we have made on our Diversity and Inclusion journey, we know we can do more. This year, we added a diversity and inclusion goal to performance reviews of all senior team leaders; bolstered our efforts to recruit, retain and promote diverse talent; expanded our supplier diversity program; and continued our robust diversity and inclusion training programs – all to inspire our people to contribute to meaningful change in our company, our industry, our communities, and the world.

Wyndham has six affinity business groups that serve as fully inclusive networks where empowered team members actively engage to foster innovation, help us grow, and enhance diversity and inclusion globally. Members of our executive committee serve as sponsors of the affinity groups where they serve as allies, mentors, and advocates.

Our company was named a best place to work for LGBTQ Equality by earning a perfect score, for three consecutive years, on the Human Rights Campaign’s Corporate Equality Index—a national benchmarking survey on practices related to LGBTQ equality. The company was also named a 2020 Noteworthy Company for Diversity by Diversity Inc., a 2020 Best for Vets Employer by Military Times, and a 2021 Military Friendly Employer by VIQTORY. Our La Quinta brand was again named to “Best of the Best” lists by U.S. Veterans Magazine for top veteran-friendly companies and top supplier diversity programs. Our company was also named one of the Best Places to Work in New Jersey by New Jersey Business Magazine in 2020.

Throughout our value chain, from team members, franchisees, partners and suppliers to the community and our guests, we believe that diversity of backgrounds, cultures and experiences helps drive our company’s success.

Wellness

Be Well – We are committed to offering programs that focus on nutrition, exercise, lifestyle management, physical and emotional wellness, financial health and the quality of the environment in which we work and live. We believe that health and wellness promotes both professional and personal productivity, achievement and fulfillment. To support all of our team members to lead healthier lifestyles while balancing family, work and other responsibilities, we offer several resources under our Be Well program, including free clinic services, an onsite fitness facility, and a Wyndham Relief Fund to help employees who are facing financial hardship.

COVID-19

The health and safety of our team members is of the highest importance. Our focus on the safety of our team members is evident in our response to COVID-19 by:

•Adding work from home flexibility for positions that can be done remotely

•Increasing cleaning protocols with our Count on Us program

•Providing regular communications regarding impacts of COVID-19, including health and safety protocols and procedures

•Implementing onsite screening protocols including temperature checks where applicable

•Providing additional personal protective equipment and cleaning supplies as needed

•Implementing protocols to address actual and suspected COVID-19 cases and potential exposure

•Establishing new physical distancing procedures for team members who are onsite

•Requiring masks to be worn by our team members and guests

We partnered with the American Hotel & Lodging Association (“AHLA”) to support the 5-Star Promise, a voluntary commitment to enhance policies, trainings, and resources for hotel employees and guests. We are dedicated to our team members’ safety and security and we are proud to unite with our industry in support of a shared commitment to the incredible people who help make our guests’ travels memorable.

We, along with other leaders in our industry, remain committed to supporting our industry’s efforts to end human trafficking. We have worked to enhance our policies and we have mandated training for all our team members to help them identify and report trafficking activities.

We are proud to work with a number of organizations including ECPAT-USA, an organization whose mission is to protect every child’s human right to grow up free from the threat of sexual exploitation and trafficking.

We also support Polaris, a non-profit organization that spearheads the effort to fight against human trafficking and operates the U.S. National Human Trafficking Hotline, to which Wyndham donates Wyndham Rewards points to provide victims with temporary safe housing. As part of our giving efforts, Wyndham Rewards and its members have donated over 113 million points – the equivalent of approximately $1.5 million – since inception to various non-profit organizations to redeem for travel and other related goods and services.

We are committed to operating sustainably in a way that provides outstanding experiences for those we serve through places to stay that are socially, ethically and environmentally responsible. We engage team members, owners and operators around the world to uphold and leverage our core values to think globally and execute locally.

We developed the Wyndham Green Program, a five-level certification program that helps hotels reduce their environmental footprint. The program includes a proprietary environmental management tool that tracks data to help hotels improve energy efficiency, reduce emissions, conserve water, and reduce waste – thus minimizing environmental impact.

The UN Sustainable Development Goals serve as a strategic guide for our sustainability program, which helps advance our company’s mission of making hotel travel possible for all. Our focus includes:

•Promoting best practices around water conservation at our hotels through our Wyndham Green program; supporting the access to sanitation to all through our community partnerships; and reducing single-use plastics to keep our waterways and oceans pollution-free and safe for wildlife.

•Embarking on a multi-decade journey to reduce our greenhouse gas emissions in alignment with what is required to limit the rise in global temperatures in part by providing our managed and franchised hotels with tools and best practices through our Wyndham Green program.

•Promoting and expanding best practices for biodiversity protection across our properties; partnering with suppliers to make a meaningful impact to protect forests and biodiversity; and sharing best practices around waste diversion through our Wyndham Green program in order to reduce waste sent to landfills.

As more travelers are looking for environmentally friendly lodging options, it is critical to position our hotels optimally and provide new environmentally responsible options for our guests. Our 2020 Social Responsibility Report, which is available on our corporate website, contains additional information regarding our commitment to social responsibility.

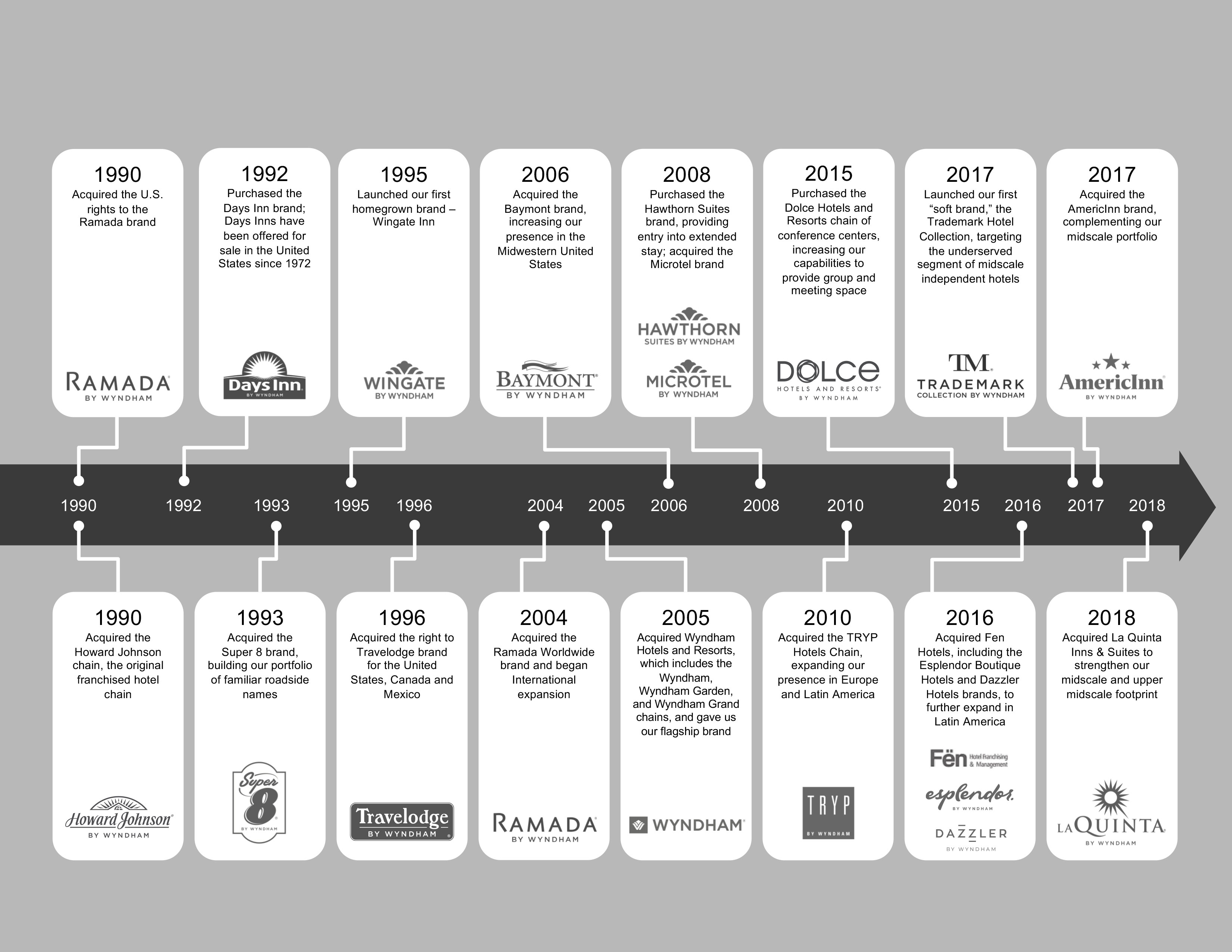

Our business was initially incorporated as Hospitality Franchise Systems, Inc. in 1990 to acquire the Howard Johnson brand and the franchise rights to the Ramada brand in the United States. It was an integral part of Wyndham Worldwide Corporation and its predecessor from 1997 to 2018. Wyndham Hotels became an independent, public company in May 2018 when it was spun-off from Wyndham Worldwide. Our business has grown substantially over time through acquisitions and organic expansion.

We encounter competition among hotel franchisors and lodging operators. We believe franchisees make decisions based principally upon the perceived value and quality of the brand and the services offered. We further believe that the perceived value of a brand name is partially a function of the success of the existing hotels franchised under the brand.

The ability of an individual franchisee to compete may be affected by the location and quality of its property, the number of competitors in the vicinity, community reputation and other factors. A franchisee’s success may also be affected by general, regional and local economic conditions. The potential effect of these conditions on our performance is substantially reduced by virtue of the diverse locations of our affiliated hotels and by the scale of our base. Our system is dispersed among nearly 6,000 franchisees, which reduces our exposure to any one franchisee. One master franchisor in China for the Super 8 brand accounts for 12% of our hotels. CorePoint accounts for approximately 2% of our hotels and approximately 70% of our managed hotels. Apart from these relationships, no one franchisee accounts for more than 2% of our hotels.

While the hotel industry is seasonal in nature, periods of higher revenues vary property-by-property and performance is dependent on location and guest base. Based on historical performance, prior to 2020, revenues from franchise and management contracts are generally higher in the second and third quarters than in the first or fourth quarters due to increased leisure travel during the spring and summer months. Our cash provided by operating activities tends to be lower in the first half of the year and substantially higher in the second half of the year. However, given the impact of COVID-19, the historical seasonality of our business is not relevant to 2020 operating results. Our second quarter was the most severely impacted and as such, we had higher revenues and cash flows in the third and fourth quarters. While we believe in many cases our select service hotels have performed more favorably than hotels in other chain scales, and we believe we will be among the first to recover once the pandemic abates, the ultimate timing of any recovery remains uncertain. In the meantime, our results of operations may continue to be negatively impacted and we are unable to predict when our operations will resume the normal hotel industry seasonality.

Wyndham Hotels owns the trademarks and other intellectual property rights related to our hotel brands, including the “Wyndham” trademark. We actively use, directly or through our licensees, these trademarks and other intellectual property rights. We operate in a highly competitive industry in which the trademarks and other intellectual property rights related to our hotel brands are very important to the marketing and sales of our services. We believe that our hotel brand names have come to represent high standards of quality, caring, service and value to our franchisees and guests. We register the trademarks that we own in the United States Patent and Trademark Office, as well as with other relevant authorities, where we deem appropriate, and otherwise seek to protect our trademarks and other intellectual property rights from unauthorized use as permitted by law.

Our business is subject to various foreign and U.S. federal and state laws and regulations. In particular, our franchisees are subject to the local laws and regulations in each country in which such hotels are operated, including employment laws and practices, privacy laws and tax laws, which may provide for tax rates that exceed those of the United States and which may provide that our foreign earnings are subject to withholding requirements or other restrictions, unexpected changes in regulatory requirements or monetary policy and other potentially adverse tax consequences. Our franchisees and other aspects of our business are also subject to various foreign and U.S. federal and state laws and regulations, including the Americans with Disabilities Act and similar legislation in certain jurisdictions outside of the United States.