false2021FY0001722684P3YP3YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP7Y5005.375http://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#Liabilitieshttp://fasb.org/us-gaap/2021-01-31#Liabilitieshttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2021-01-31#OtherLiabilitiesNoncurrent00017226842021-01-012021-12-3100017226842021-06-30iso4217:USD00017226842022-01-31xbrli:shares0001722684wh:RoyaltiesandFranchiseFeesMember2021-01-012021-12-310001722684wh:RoyaltiesandFranchiseFeesMember2020-01-012020-12-310001722684wh:RoyaltiesandFranchiseFeesMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMember2021-01-012021-12-310001722684wh:MarketingReservationandLoyaltyMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMember2019-01-012019-12-310001722684wh:HotelManagementServicesMember2021-01-012021-12-310001722684wh:HotelManagementServicesMember2020-01-012020-12-310001722684wh:HotelManagementServicesMember2019-01-012019-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2021-01-012021-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2020-01-012020-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2019-01-012019-12-310001722684wh:OtherProductsandServicesMember2021-01-012021-12-310001722684wh:OtherProductsandServicesMember2020-01-012020-12-310001722684wh:OtherProductsandServicesMember2019-01-012019-12-3100017226842020-01-012020-12-3100017226842019-01-012019-12-310001722684wh:CostReimbursementsMember2021-01-012021-12-310001722684wh:CostReimbursementsMember2020-01-012020-12-310001722684wh:CostReimbursementsMember2019-01-012019-12-31iso4217:USDxbrli:shares0001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-3100017226842021-12-3100017226842020-12-310001722684us-gaap:TrademarksMember2021-12-310001722684us-gaap:TrademarksMember2020-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2021-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2020-12-3100017226842019-12-3100017226842018-12-310001722684us-gaap:CommonStockMember2018-12-310001722684us-gaap:TreasuryStockMember2018-12-310001722684us-gaap:AdditionalPaidInCapitalMember2018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2018-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2018-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2019-01-012019-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-01-012019-12-310001722684us-gaap:CommonStockMember2019-01-012019-12-310001722684us-gaap:TreasuryStockMember2019-01-012019-12-310001722684us-gaap:AdditionalPaidInCapitalMember2019-01-012019-12-310001722684us-gaap:CommonStockMember2019-12-310001722684us-gaap:TreasuryStockMember2019-12-310001722684us-gaap:AdditionalPaidInCapitalMember2019-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2019-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2019-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2020-01-012020-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-01-012020-12-310001722684us-gaap:CommonStockMember2020-01-012020-12-310001722684us-gaap:TreasuryStockMember2020-01-012020-12-310001722684us-gaap:AdditionalPaidInCapitalMember2020-01-012020-12-310001722684us-gaap:RetainedEarningsAppropriatedMembersrt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-010001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2020-01-010001722684us-gaap:CommonStockMember2020-12-310001722684us-gaap:TreasuryStockMember2020-12-310001722684us-gaap:AdditionalPaidInCapitalMember2020-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2020-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2021-01-012021-12-310001722684us-gaap:CommonStockMember2021-01-012021-12-310001722684us-gaap:TreasuryStockMember2021-01-012021-12-310001722684us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001722684us-gaap:CommonStockMember2021-12-310001722684us-gaap:TreasuryStockMember2021-12-310001722684us-gaap:AdditionalPaidInCapitalMember2021-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2021-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-31wh:countrywh:hotel0001722684wh:LoyaltyProgramMember2021-12-310001722684wh:LoyaltyProgramMember2020-12-310001722684wh:LoyaltyProgramMember2020-01-012020-12-310001722684us-gaap:BuildingMember2021-01-012021-12-310001722684wh:BuildingAndLeaseholdImprovementsMember2021-01-012021-12-310001722684srt:MinimumMemberus-gaap:FurnitureAndFixturesMember2021-01-012021-12-310001722684us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2021-01-012021-12-310001722684srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-012021-12-310001722684srt:MaximumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-012021-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2020-12-310001722684srt:MinimumMember2021-01-012021-12-310001722684srt:MaximumMember2021-01-012021-12-310001722684wh:InitialFranchiseFeesMember2021-12-310001722684wh:InitialFranchiseFeesMember2020-12-310001722684us-gaap:ProductAndServiceOtherMember2021-12-310001722684us-gaap:ProductAndServiceOtherMember2020-12-3100017226842022-01-01wh:InitialFranchiseFeesMember2021-12-310001722684wh:InitialFranchiseFeesMember2023-01-012021-12-310001722684wh:InitialFranchiseFeesMember2024-01-012021-12-310001722684wh:InitialFranchiseFeesMember2025-01-012021-12-3100017226842022-01-01wh:LoyaltyProgramMember2021-12-310001722684wh:LoyaltyProgramMember2023-01-012021-12-310001722684wh:LoyaltyProgramMember2024-01-012021-12-310001722684wh:LoyaltyProgramMember2025-01-012021-12-3100017226842022-01-01wh:OtherProductsandServicesMember2021-12-310001722684wh:OtherProductsandServicesMember2023-01-012021-12-310001722684wh:OtherProductsandServicesMember2024-01-012021-12-310001722684wh:OtherProductsandServicesMember2025-01-012021-12-310001722684wh:OtherProductsandServicesMember2021-12-3100017226842022-01-012021-12-3100017226842023-01-012021-12-3100017226842024-01-012021-12-3100017226842025-01-012021-12-310001722684wh:HotelFranchisingSegmentMemberwh:RoyaltiesandFranchiseFeesMember2021-01-012021-12-310001722684wh:HotelFranchisingSegmentMemberwh:RoyaltiesandFranchiseFeesMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMemberwh:RoyaltiesandFranchiseFeesMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:LicenseandOtherFeeFromFormerParentMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:LicenseandOtherFeeFromFormerParentMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:LicenseandOtherFeeFromFormerParentMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2019-01-012019-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2019-01-012019-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:ManagedHotelRevenuesMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberwh:CostReimbursementsMember2019-01-012019-12-310001722684wh:OtherProductsandServicesMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:OtherProductsandServicesMemberwh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:OtherProductsandServicesMemberwh:HotelManagementSegmentMember2019-01-012019-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2019-01-012019-12-310001722684us-gaap:CorporateNonSegmentMember2021-01-012021-12-310001722684us-gaap:CorporateNonSegmentMember2020-01-012020-12-310001722684us-gaap:CorporateNonSegmentMember2019-01-012019-12-310001722684us-gaap:OtherCurrentAssetsMember2021-12-310001722684us-gaap:OtherCurrentAssetsMember2020-12-310001722684us-gaap:OtherNoncurrentAssetsMember2021-12-310001722684us-gaap:OtherNoncurrentAssetsMember2020-12-310001722684wh:HotelManagementServicesMember2022-01-012021-12-310001722684wh:HotelManagementServicesMember2023-01-012021-12-310001722684wh:HotelManagementServicesMember2024-01-012021-12-310001722684wh:HotelManagementServicesMember2025-01-012021-12-310001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-010001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2020-01-012020-01-010001722684srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2019-12-310001722684wh:FinancingReceivablewithDeferredIncomeOffsetMember2021-12-310001722684wh:FinancingReceivablewithDeferredIncomeOffsetMember2020-12-310001722684wh:HotelManagementSegmentMember2021-01-012021-12-310001722684us-gaap:LandMember2021-12-310001722684us-gaap:LandMember2020-12-310001722684us-gaap:BuildingAndBuildingImprovementsMember2021-12-310001722684us-gaap:BuildingAndBuildingImprovementsMember2020-12-310001722684us-gaap:ComputerEquipmentMember2021-12-310001722684us-gaap:ComputerEquipmentMember2020-12-310001722684us-gaap:FurnitureAndFixturesMember2021-12-310001722684us-gaap:FurnitureAndFixturesMember2020-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2021-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2020-12-310001722684us-gaap:ConstructionInProgressMember2021-12-310001722684us-gaap:ConstructionInProgressMember2020-12-310001722684wh:SeniorUnsecuredNotesdueApril2026Member2020-08-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesdueApril2026Member2018-04-30xbrli:pure0001722684wh:ImpairedAssetsMember2020-04-012020-06-3000017226842020-04-012020-06-3000017226842021-04-012021-06-300001722684wh:ImpairedAssetsMemberwh:OwnedHotelReportingUnitMember2020-06-300001722684wh:ImpairedAssetsMemberwh:LaQuintatrademarkMember2020-06-300001722684wh:ImpairedAssetsMemberwh:LaQuintatrademarkMember2020-04-012020-06-300001722684wh:ImpairedAssetsMemberwh:OtherimpairedtrademarksMember2020-06-300001722684wh:ImpairedAssetsMemberwh:OtherimpairedtrademarksMember2020-04-012020-06-300001722684wh:ImpairedAssetsMember2020-06-3000017226842020-06-30wh:trademark0001722684us-gaap:TrademarksMember2021-12-310001722684us-gaap:TrademarksMember2020-12-310001722684us-gaap:FranchiseRightsMember2021-12-310001722684us-gaap:FranchiseRightsMember2020-12-310001722684wh:ManagementAgreementsMember2021-12-310001722684wh:ManagementAgreementsMember2020-12-310001722684us-gaap:TrademarksMember2021-12-310001722684us-gaap:TrademarksMember2020-12-310001722684us-gaap:OtherIntangibleAssetsMember2021-12-310001722684us-gaap:OtherIntangibleAssetsMember2020-12-310001722684wh:HotelFranchisingSegmentMember2019-12-310001722684wh:HotelFranchisingSegmentMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMember2021-12-310001722684wh:HotelManagementSegmentMember2019-12-310001722684wh:HotelManagementSegmentMember2020-01-012020-12-310001722684wh:HotelManagementSegmentMember2021-12-310001722684us-gaap:FranchiseRightsMember2021-01-012021-12-310001722684us-gaap:FranchiseRightsMember2020-01-012020-12-310001722684us-gaap:FranchiseRightsMember2019-01-012019-12-310001722684wh:ManagementAgreementsMember2021-01-012021-12-310001722684wh:ManagementAgreementsMember2020-01-012020-12-310001722684wh:ManagementAgreementsMember2019-01-012019-12-310001722684us-gaap:OtherIntangibleAssetsMember2021-01-012021-12-310001722684us-gaap:OtherIntangibleAssetsMember2020-01-012020-12-310001722684us-gaap:OtherIntangibleAssetsMember2019-01-012019-12-310001722684us-gaap:FranchiseMember2021-01-012021-12-310001722684us-gaap:FranchiseMember2020-01-012020-12-310001722684us-gaap:FranchiseMember2019-01-012019-12-310001722684wh:FranchiseesAndHotelOwnersMember2021-12-310001722684wh:FranchiseesAndHotelOwnersMember2020-12-310001722684wh:ForgivenessOfNoteReceivableMember2021-01-012021-12-310001722684wh:ForgivenessOfNoteReceivableMember2020-01-012020-12-310001722684wh:ForgivenessOfNoteReceivableMember2019-01-012019-12-310001722684wh:DeferredIncomeTaxesMember2021-12-310001722684wh:DeferredIncomeTaxesMember2020-12-310001722684wh:NetOperatingLossCarryforwardMember2021-12-310001722684wh:DeferredTaxAssetMember2021-12-310001722684wh:ForeignTaxCreditMember2021-12-310001722684wh:NetOperatingLossCarryforwardMember2020-12-310001722684wh:DeferredTaxAssetMember2020-12-310001722684wh:ForeignTaxCreditMember2020-12-310001722684srt:MinimumMemberus-gaap:DomesticCountryMember2021-12-310001722684us-gaap:DomesticCountryMembersrt:MaximumMember2021-12-310001722684wh:LaQuintaHoldingsInc.Memberwh:DomesticandStateandLocalAuthorityMember2019-01-012019-12-310001722684us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2021-12-310001722684us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2020-12-310001722684wh:TermLoandue2025Memberus-gaap:LongTermDebtMember2021-12-310001722684wh:TermLoandue2025Memberus-gaap:LongTermDebtMember2020-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesdueApril2026Member2021-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesdueApril2026Member2020-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2021-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2020-12-310001722684us-gaap:CapitalLeaseObligationsMemberwh:WyndhamWorldwideMember2021-12-310001722684us-gaap:CapitalLeaseObligationsMemberwh:WyndhamWorldwideMember2020-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2021-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2020-12-310001722684us-gaap:RevolvingCreditFacilityMember2021-12-310001722684us-gaap:RevolvingCreditFacilityMember2018-05-310001722684srt:MinimumMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2018-05-012018-05-310001722684srt:MinimumMemberus-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:LondonInterbankOfferedRateLIBORMemberus-gaap:RevolvingCreditFacilityMembersrt:MaximumMember2018-05-012018-05-310001722684us-gaap:RevolvingCreditFacilityMember2018-05-012018-05-310001722684us-gaap:RevolvingCreditFacilityMember2020-04-300001722684wh:TermLoandue2025Memberus-gaap:LongTermDebtMember2018-05-310001722684us-gaap:BaseRateMemberwh:TermLoandue2025Member2018-05-012018-05-310001722684us-gaap:LondonInterbankOfferedRateLIBORMemberwh:TermLoandue2025Member2018-05-012018-05-310001722684wh:TermLoandue2025Member2018-05-012018-05-310001722684wh:CreditAgreementMember2018-05-310001722684wh:CreditAgreementMember2018-05-312018-05-310001722684wh:SeniorUnsecuredNotesdueApril2026Member2018-04-012018-04-300001722684wh:SeniorUnsecuredNotesdueApril2026Member2021-04-150001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesdueApril2026Member2021-04-150001722684wh:SeniorUnsecuredNotesdueApril2026Member2021-04-012021-06-300001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2020-08-310001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-310001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-012020-08-310001722684us-gaap:RevolvingCreditFacilityMember2020-12-310001722684us-gaap:InterestRateSwapMember2018-05-310001722684wh:InterestRateSwap1Member2018-05-310001722684srt:WeightedAverageMemberwh:InterestRateSwap1Member2021-12-310001722684wh:InterestRateSwap2Member2018-05-310001722684srt:WeightedAverageMemberwh:InterestRateSwap2Member2021-12-310001722684us-gaap:InterestRateSwapMember2021-01-012021-12-310001722684us-gaap:InterestRateSwapMember2020-01-012020-12-310001722684us-gaap:InterestRateSwapMember2019-01-012019-12-310001722684us-gaap:CarryingReportedAmountFairValueDisclosureMember2021-12-310001722684us-gaap:EstimateOfFairValueFairValueDisclosureMember2021-12-310001722684stpr:TXus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684stpr:FLus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684stpr:TXus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684stpr:FLus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684stpr:TXus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684stpr:FLus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684stpr:FL2021-01-012021-12-310001722684stpr:FL2020-01-012020-12-310001722684stpr:FL2019-01-012019-12-310001722684wh:CorePointMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684wh:CorePointMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684wh:CorePointMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684wh:CorePointMemberwh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684wh:CorePointMemberwh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2019-01-012019-12-310001722684wh:CorePointMemberwh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2020-01-012020-12-310001722684srt:MaximumMember2021-12-310001722684us-gaap:ContractTerminationMemberus-gaap:AccountsReceivableMember2020-04-012020-06-300001722684us-gaap:PaymentGuaranteeMember2021-12-310001722684wh:FairValueOfGuaranteesMember2021-12-310001722684wh:GuaranteeReceivableFromFormerParentMember2021-12-310001722684wh:GuaranteeReceivableFromFormerParentMember2020-12-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2018-05-140001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2021-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2020-12-310001722684us-gaap:PerformanceSharesMember2020-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001722684us-gaap:PerformanceSharesMember2021-01-012021-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2021-12-310001722684us-gaap:PerformanceSharesMember2021-12-310001722684us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001722684us-gaap:RestructuringChargesMember2020-01-012020-12-310001722684us-gaap:RestructuringChargesMember2019-01-012019-12-310001722684wh:SeparationRelatedCostsMember2019-01-012019-12-310001722684us-gaap:CorporateAndOtherMember2021-01-012021-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2021-12-310001722684us-gaap:AllOtherSegmentsMember2021-12-310001722684us-gaap:CorporateAndOtherMember2020-01-012020-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2020-12-310001722684us-gaap:AllOtherSegmentsMember2020-12-310001722684us-gaap:CorporateAndOtherMember2019-01-012019-12-310001722684wh:HotelFranchisingSegmentMemberus-gaap:OperatingSegmentsMember2019-12-310001722684wh:HotelManagementSegmentMemberus-gaap:OperatingSegmentsMember2019-12-310001722684us-gaap:AllOtherSegmentsMember2019-12-310001722684wh:NonseparationrelatedMemberwh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2020-01-012020-12-310001722684wh:NonseparationrelatedMemberwh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2019-01-012019-12-310001722684country:US2021-01-012021-12-310001722684us-gaap:NonUsMember2021-01-012021-12-310001722684country:US2021-12-310001722684us-gaap:NonUsMember2021-12-310001722684country:US2020-01-012020-12-310001722684us-gaap:NonUsMember2020-01-012020-12-310001722684country:US2020-12-310001722684us-gaap:NonUsMember2020-12-310001722684country:US2019-01-012019-12-310001722684us-gaap:NonUsMember2019-01-012019-12-310001722684country:US2019-12-310001722684us-gaap:NonUsMember2019-12-310001722684us-gaap:ContractTerminationMemberus-gaap:AccountsReceivableMember2020-01-012020-12-310001722684wh:PreviouslyimpairedassetMember2020-01-012020-12-310001722684us-gaap:ContractTerminationMemberus-gaap:FinanceReceivablesMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMemberus-gaap:OtherAssetsMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMemberus-gaap:OtherLiabilitiesMember2019-01-012019-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2020-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2021-01-012021-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2021-12-310001722684us-gaap:FacilityClosingMemberwh:A2020RestructuringPlansMember2020-12-310001722684us-gaap:FacilityClosingMemberwh:A2020RestructuringPlansMember2021-01-012021-12-310001722684us-gaap:FacilityClosingMemberwh:A2020RestructuringPlansMember2021-12-310001722684wh:A2020RestructuringPlansMember2020-12-310001722684wh:A2020RestructuringPlansMember2021-01-012021-12-310001722684wh:A2020RestructuringPlanMember2020-01-012020-12-31wh:employee0001722684wh:A2019RestructuringPlanMember2019-12-310001722684wh:A2019RestructuringPlanMember2020-01-012020-12-310001722684wh:A2019RestructuringPlanMember2020-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2019-12-310001722684us-gaap:EmployeeSeveranceMemberwh:A2020RestructuringPlansMember2020-01-012020-12-310001722684us-gaap:FacilityClosingMemberwh:A2020RestructuringPlansMember2019-12-310001722684us-gaap:FacilityClosingMemberwh:A2020RestructuringPlansMember2020-01-012020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2019-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2020-01-012020-12-310001722684wh:A2020RestructuringPlansMemberus-gaap:OtherRestructuringMember2020-12-310001722684wh:A2020RestructuringPlansMember2019-12-310001722684wh:A2020RestructuringPlansMember2020-01-012020-12-310001722684wh:CorePointtaxmatterMember2019-01-012019-12-310001722684us-gaap:ContractTerminationMember2019-01-012019-12-310001722684wh:ContractTerminationOtherMember2019-01-012019-12-310001722684wh:ContractTerminationIndemnificationObligationMember2019-01-012019-12-3100017226842019-07-012019-09-300001722684wh:SeparationAndDistributionAgreementMembersrt:AffiliatedEntityMember2021-01-012021-12-310001722684wh:SeparationAndDistributionAgreementMembersrt:AffiliatedEntityMember2020-01-012020-12-310001722684wh:SeparationAndDistributionAgreementMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2021-01-012021-12-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2020-01-012020-12-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2019-01-012019-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2021-01-012021-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2020-01-012020-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2021-01-012021-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2020-01-012020-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberwh:ContractTerminationIndemnificationObligationMember2019-01-012019-12-310001722684us-gaap:OtherNoncurrentLiabilitiesMember2021-12-310001722684us-gaap:OtherNoncurrentLiabilitiesMember2020-12-310001722684us-gaap:OtherCurrentLiabilitiesMember2021-12-310001722684us-gaap:OtherCurrentLiabilitiesMember2020-12-310001722684srt:AffiliatedEntityMemberus-gaap:OtherAssetsMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2019-01-012019-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2021-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2018-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2018-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2019-01-012019-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-01-012019-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2019-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2019-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-01-012020-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2020-01-012020-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2019-01-012019-12-310001722684wh:WyndhamHotelsDefinedContributionPlansMember2021-01-012021-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38432

Wyndham Hotels & Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

Delaware | | 82-3356232 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

22 Sylvan Way | | 07054 |

Parsippany, | New Jersey | | (Zip Code) |

(Address of Principal Executive Offices) | | |

(973) 753-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, Par Value $0.01 per share | WH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☑ | | | | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | | | | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2021, was $6.70 billion. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of January 31, 2022, the registrant had outstanding 92,305,604 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the 2022 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| | |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report” or “report”) contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our views and expectations regarding our strategy and the performance of our business, our financial results, our liquidity and capital resources and other non-historical statements. Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate,” “projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Factors that could cause actual results to differ materially from those in the forward-looking statements include without limitation general economic conditions; the continuation or worsening of the effects from the coronavirus pandemic, (“COVID-19”); its scope, duration, resurgence and impact on our business operations, financial results, cash flows and liquidity, as well as the impact on our franchisees and property owners, guests and team members, the hospitality industry and overall demand for and restrictions on travel; the success of our mitigation efforts in response to COVID-19; our continued performance during the recovery from COVID-19, and any resurgence or mutations of the virus; various actions governments, businesses and individuals continue to take in response to the pandemic, including stay-in-place directives (including, for instance, quarantine and isolation guidelines and mandates), safety mitigation guidance, as well as the timing, availability and adoption rates of vaccinations, booster shots and other treatments for COVID-19; concerns with or threats of other pandemics, contagious diseases or health epidemics, including the effects of COVID-19; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising and management businesses; our relationships with franchisees and property owners; the impact of war, terrorist activity, political instability or political strife; risks related to restructuring or strategic initiatives; risks related to our relationship with CorePoint Lodging Inc. (“CorePoint”) and our relationship with Highgate Holdings, Inc. and certain of its affiliates or subsidiaries (collectively referred to herein as “Highgate”) following the closing of CorePoint’s sale; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to our ability to obtain financing and the terms of such financing, including access to liquidity and capital; and the Company’s ability to make or pay, plans for, and the timing and amount of any future share repurchases and/or dividends, as well as the risks described under Part I, Item 1A – Risk Factors.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements, reports that are filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at https://www.sec.gov. Our SEC filings are also available on our website at https://www.wyndhamhotels.com as soon as reasonably practicable after they are filed with or furnished to the SEC. We maintain an internet site at https://www.wyndhamhotels.com. Our website and the information contained on or connected to that site are not incorporated into this Annual Report.

We may use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Disclosures of this nature will be included on our website in the “Investors” section, which can currently be accessed at www.investor.wyndhamhotels.com. Accordingly, investors should monitor this section of our website in addition to following our press releases, filings submitted with the SEC and any public conference calls or webcasts.

Item 1. Business.

Wyndham Hotels & Resorts, Inc. (“Wyndham Hotels”, the “Company”, “we”, “our” or “us”) is the world’s largest hotel franchising company by number of hotels, with approximately 9,000 affiliated hotels with over 810,000 rooms located in approximately 95 countries and welcoming over 120 million guests annually worldwide. We operate a hotel portfolio of 22 brands, including two new brands introduced in 2021, Registry Collection Hotels, our first luxury brand, and Wyndham Alltra our first all-inclusive brand. Our 22 brands are primarily located in secondary and tertiary cities and approximately

80% of the U.S. population lives within ten miles of at least one of our affiliated hotels. Our mission is to make hotel travel possible for all. Wherever people go, Wyndham will be there to welcome them. We boast a remarkably asset-light business model with only two of our 9,000 hotels being owned, dramatically limiting our capital needs and our exposure to the rising wage environment.

During 2020, the hotel industry experienced a sharp decline in travel demand due to COVID-19 and the related government preventative and protective actions to slow the spread of the virus, including travel restrictions. We and the entire industry experienced significant revenue losses in 2020 as a result of steep RevPAR declines. Yet, the impact on our business was mitigated by characteristics unique to our business model. With approximately 70% of bookings at our hotels being leisure-oriented, our hotel owners are less reliant on business travel, which only makes up approximately 30% of bookings. Within this business segment, corporate transient and group bookings are the smallest component, where less than 5% of our bookings come from this segment. Our business customers are substantially comprised of truckers, contractors, construction workers, utility crews and others whose office is the road and who do not have the ability to conduct their work remotely. These customers provide a steady state of business for the majority of our hotel owners and in fact, our infrastructure accounts, which represent 70% of the domestic business demand that our brands drive, contributed 10% more revenue to our U.S. hotels during the second half of 2021 than the same period in 2019, a trend that we see continuing given the passage of President Biden’s infrastructure bill late last year. In addition, nearly 90% of hotels within our U.S. system are located along highways and in suburban and small metro areas, on the way to or near outdoor destinations such as national parks and beach communities. Our hotels are in locations that travelers felt safe visiting and we invested in sales and marketing efforts to reach travel seekers and instill confidence that our hotels were clean, safe and welcoming guests. Finally, over 95% of our U.S. business is originated domestically. As a result, our platform was naturally set up to capture returning demand throughout the pandemic and the recovery and our business was able to substantially recover from COVID’s impact during 2021.

Our economy and midscale brands in the U.S. have outperformed the industry’s higher-end chain scales consistently since the onset of the pandemic and have led the industry’s recovery in 2021. Our RevPAR recovered to 97% of 2019 levels in the U.S. International recovery has trailed the U.S. due to a heavier reliance on cross boarder travel and localized travel restrictions at various points throughout the year. However, we have experienced significant improvement over the last few quarters and international RevPAR, on a constant currency basis, has recovered to 78% of its pre-pandemic levels during the second half of 2021 compared to 56% in the first half of this year. Our 2021 adjusted EBITDA recovered to 95% of 2019 levels.

The Company does not anticipate the pandemic to further materially impact the results from operations, however should there be a resurgence of COVID-19, our results of operations may be negatively impacted and certain intangible assets, such as our trademarks, and our franchised and managed goodwill may be exposed to impairments. For further discussion on the effect of COVID-19 on our financial condition and liquidity, see Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations.

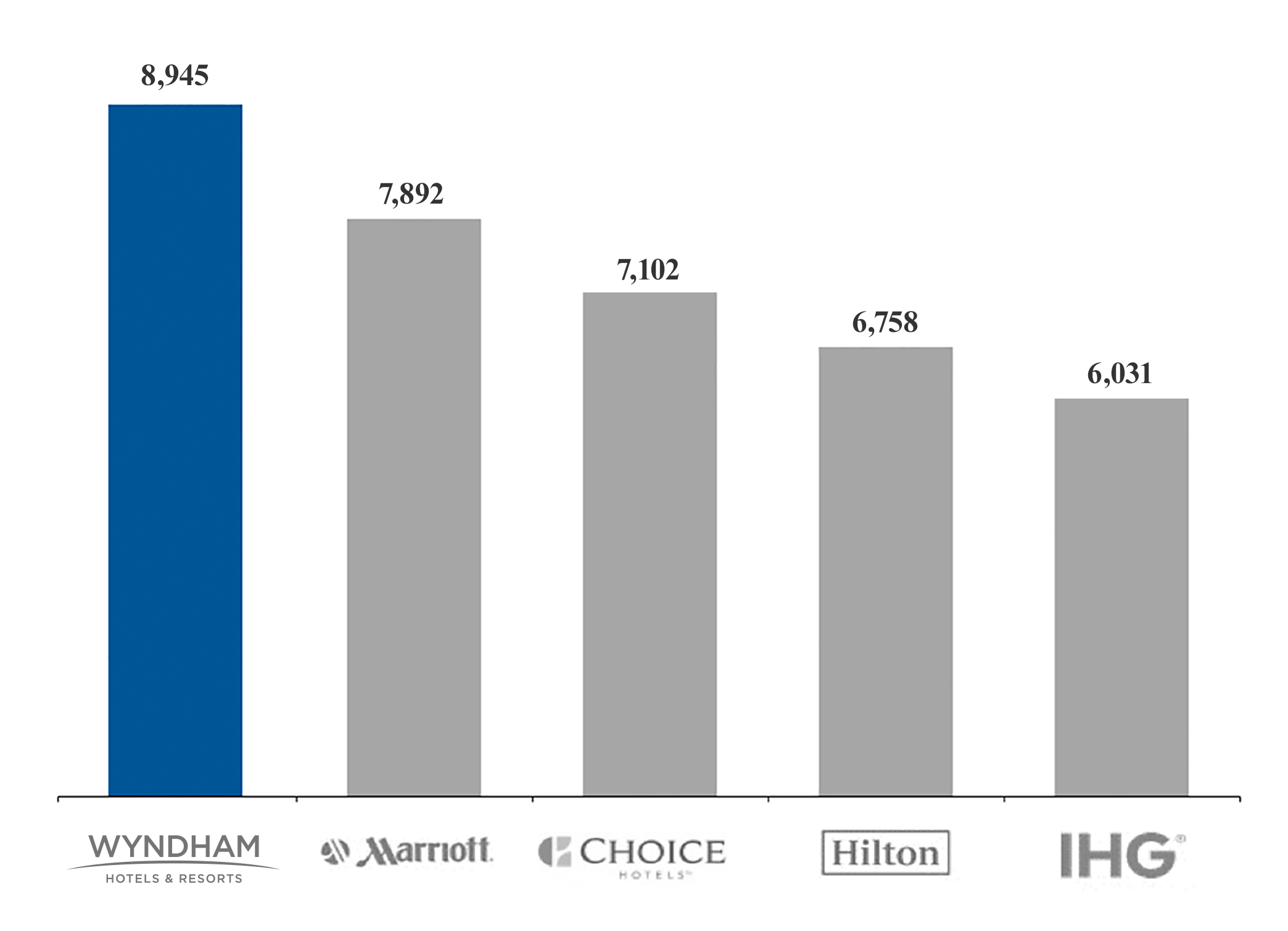

The following chart presents the number of branded hotels associated with each of the five largest traditional hotel franchise companies as of September 30, 2021:

Source: Companies’ public disclosures

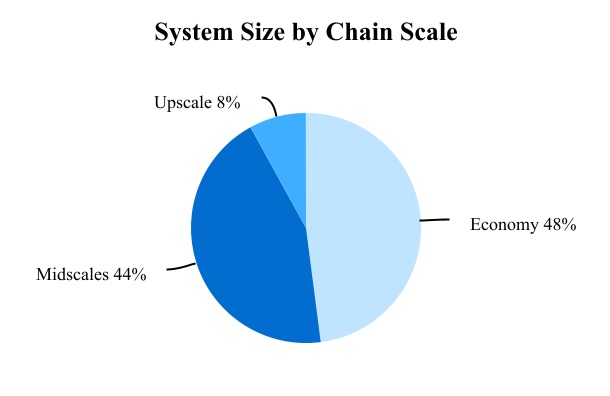

Our widely recognized brands with select-service focus offer a breadth of options for franchisees and a wide range of price points and experiences for our guests. We are a global leader in the economy and midscale chain scales where our brands represent over 30% of branded rooms in the United States, and also have a strong presence in the upper midscale chain scale.

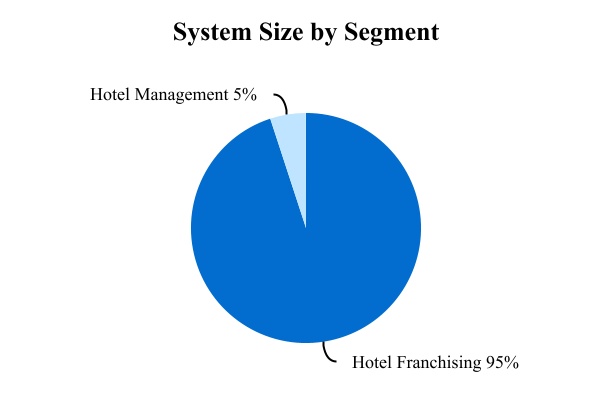

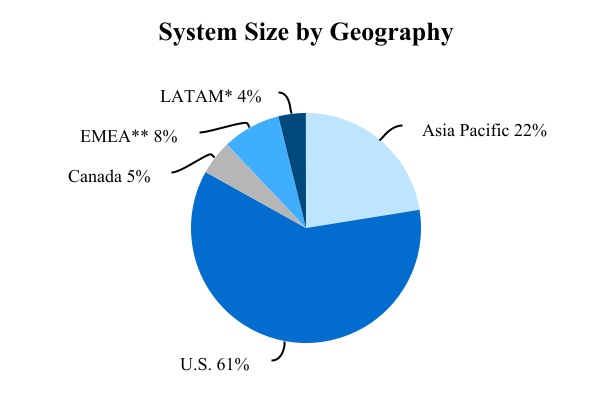

The following charts illustrate our system size (by rooms) as of December 31, 2021:

______________________

* LATAM is representative of Latin America and the Caribbean.

** EMEA is representative of Europe, the Middle East, Eurasia and Africa.

As of December 31, 2021, our brand portfolio consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Global Full Year RevPAR | | | | North America | | Asia Pacific | | | | | | |

| | | | U.S. | | Canada | | Greater China | | Rest of Asia | | EMEA | | LATAM | | Total |

| Economy | | | | | | | | | | | | | | | | | |

| Super 8 | $ | 28.41 | | | Properties | | 1,486 | | 119 | | 1,077 | | — | | | 11 | | — | | | 2,693 |

| | | Rooms | | 88,992 | | 7,758 | | 65,395 | | — | | | 1,862 | | — | | | 164,007 |

| Days Inn | $ | 36.60 | | | Properties | | 1,326 | | 108 | | 49 | | 14 | | 54 | | 8 | | 1,559 |

| | | Rooms | | 97,015 | | 8,476 | | 7,749 | | 1,999 | | 3,174 | | 687 | | 119,100 |

| Travelodge | $ | 35.42 | | | Properties | | 352 | | 101 | | — | | | — | | | — | | | — | | | 453 |

| | | Rooms | | 23,866 | | 8,107 | | — | | | — | | | — | | | — | | | 31,973 |

| Microtel | $ | 42.30 | | | Properties | | 296 | | 23 | | 6 | | | 14 | | — | | | 8 | | 347 |

| | | Rooms | | 20,884 | | 1,955 | | 885 | | | 1,037 | | — | | | 955 | | 25,716 |

| Howard Johnson | $ | 25.61 | | | Properties | | 159 | | 18 | | 69 | | 2 | | 7 | | 44 | | 299 |

| | | Rooms | | 12,336 | | 1,250 | | 21,588 | | 1,902 | | 790 | | 2,797 | | 40,663 |

| Total Economy | $ | 32.24 | | | Properties | | 3,619 | | 369 | | 1,201 | | 30 | | 72 | | 60 | | 5,351 |

| | | Rooms | | 243,093 | | 27,546 | | 95,617 | | 4,938 | | 5,826 | | 4,439 | | 381,459 |

| Midscale | | | | | | | | | | | | | | | | | |

| La Quinta | $ | 56.37 | | | Properties | | 906 | | 2 | | — | | | 1 | | | 4 | | | 9 | | 922 |

| | | Rooms | | 87,950 | | 133 | | — | | | 188 | | | 765 | | | 1,062 | | 90,098 |

| Ramada | $ | 26.34 | | | Properties | | 317 | | 78 | | 136 | | 67 | | 223 | | 29 | | 850 |

| | | Rooms | | 37,186 | | 7,526 | | 28,231 | | 13,611 | | 30,338 | | 3,927 | | 120,819 |

| Baymont | $ | 39.79 | | | Properties | | 507 | | 5 | | — | | | — | | | — | | | 1 | | 513 |

| | | Rooms | | 38,687 | | 361 | | — | | | — | | | — | | | 118 | | 39,166 |

| AmericInn | $ | 52.28 | | | Properties | | 206 | | — | | | — | | | — | | | — | | | — | | | 206 |

| | | Rooms | | 12,099 | | — | | | — | | | — | | | — | | | — | | | 12,099 |

| Wingate | $ | 48.04 | | | Properties | | 164 | | 9 | | 5 | | — | | | — | | | 1 | | 179 |

| | | Rooms | | 14,793 | | 905 | | 799 | | — | | | — | | | 176 | | 16,673 |

| Wyndham Alltra | NM | | Properties | | — | | — | | — | | — | | — | | 2 | | 2 |

| | | Rooms | | — | | — | | — | | — | | — | | 745 | | 745 |

| Wyndham Garden | $ | 33.69 | | | Properties | | 66 | | 4 | | 19 | | 8 | | 20 | | 22 | | 139 |

| | | Rooms | | 10,798 | | 723 | | 4,040 | | 1,158 | | 3,236 | | 3,046 | | 23,001 |

| Ramada Encore | $ | 16.36 | | | Properties | | — | | | — | | | 25 | | 14 | | 22 | | 12 | | 73 |

| | | Rooms | | — | | | — | | | 3,701 | | 4,059 | | 2,593 | | 1,610 | | 11,963 |

| Hawthorn | $ | 51.44 | | | Properties | | 72 | | — | | | — | | | — | | | 5 | | — | | | 77 |

| | | Rooms | | 6,081 | | — | | | — | | | — | | | 504 | | — | | | 6,585 |

| Trademark Collection | $ | 40.64 | | | Properties | | 56 | | 11 | | — | | | 10 | | | 54 | | 14 | | | 145 |

| | | Rooms | | 9,097 | | 1,639 | | — | | | 307 | | | 9,166 | | 2,043 | | | 22,252 |

| TRYP | $ | 25.91 | | | Properties | | 8 | | — | | | 1 | | 1 | | 26 | | 18 | | 54 |

| | | Rooms | | 1,006 | | — | | | 95 | | 191 | | 3,746 | | 2,102 | | 7,140 |

| Total Midscale | $ | 39.08 | | | Properties | | 2,302 | | 109 | | 186 | | 101 | | 354 | | 108 | | 3,160 |

| | | Rooms | | 217,697 | | 11,287 | | 36,866 | | 19,514 | | 50,348 | | 14,829 | | 350,541 |

| Upscale | | | | | | | | | | | | | | | | | |

| Dazzler | $ | 13.65 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 13 | | 13 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 1,738 | | 1,738 |

| Esplendor | $ | 14.64 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 9 | | 9 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 806 | | 806 |

| Wyndham | $ | 35.67 | | | Properties | | 41 | | — | | | 35 | | 14 | | 22 | | 41 | | 153 |

| | | Rooms | | 11,064 | | — | | | 10,173 | | 2,642 | | 3,592 | | 9,236 | | 36,707 |

| Wyndham Grand | $ | 48.61 | | | Properties | | 10 | | — | | | 34 | | 6 | | 15 | | — | | | 65 |

| | | Rooms | | 3,009 | | — | | | 11,104 | | 1,542 | | 3,611 | | — | | | 19,266 |

| Dolce | $ | 71.91 | | | Properties | | 7 | | 3 | | | — | | 1 | | 9 | | — | | | 20 |

| | | Rooms | | 1,400 | | 276 | | — | | | 342 | | | 2,738 | | — | | | 4,756 |

| Total Upscale | $ | 41.90 | | | Properties | | 58 | | 3 | | 69 | | 21 | | 46 | | 63 | | 260 |

| | | Rooms | | 15,473 | | 276 | | 21,277 | | 4,526 | | 9,941 | | 11,780 | | 63,273 |

| Luxury | | | | | | | | | | | | | | | | | |

| Registry Collection | NM | | Properties | | — | | — | | | — | | — | | — | | 2 | | | 2 |

| | | Rooms | | — | | — | | | — | | — | | — | | 274 | | | 274 |

Affiliated properties (a) | | | | | | | | | | | | | | | | | |

| | | Properties | | 160 | | 3 | | — | | | 11 | | — | | | 3 | | 177 |

| | | Rooms | | 14,336 | | 44 | | — | | | 47 | | — | | | 77 | | 14,504 |

| Total | $ | 35.95 | | | Properties | | 6,139 | | 484 | | 1,456 | | 163 | | 472 | | 236 | | 8,950 |

| | | Rooms | | 490,599 | | 39,153 | | 153,760 | | 29,025 | | 66,115 | | 31,399 | | 810,051 |

______________________

(a)Affiliated properties represent properties under affiliation arrangements with former Parent or other third parties.

The following table presents the changes in our portfolio for the last three years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, |

| 2021 | | 2020 | | 2019 |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| Beginning balance | 8,941 | | | 795,900 | | | 9,280 | | | 831,000 | | | 9,157 | | | 809,900 | |

Additions | 415 | | | 53,100 | | | 322 | | | 35,600 | | | 523 | | | 63,500 | |

Deletions (a) | (406) | | | (38,900) | | | (661) | | | (70,700) | | | (400) | | | (42,400) | |

| Ending balance | 8,950 | | | 810,100 | | | 8,941 | | | 795,900 | | | 9,280 | | | 831,000 | |

______________________

(a)2020 includes the deletion of 214 properties and approximately 18,500 rooms from the termination of non-compliant and brand detracting rooms, 20 properties and approximately 2,900 unprofitable rooms in connection with a guaranteed management contract and three properties and approximately 5,300 low-royalty rooms in connection with hotel sales by a strategic partner.

In addition to our current hotel portfolio, we have over 1,500 properties and over 194,000 rooms in our development pipeline throughout 60 countries. As of December 31, 2021, approximately 35% of our pipeline was located in the U.S. and 65% was located internationally; 79% of our pipeline was for new construction properties, of which 35% have broken ground and 21%, represented conversion opportunities.

Our pipeline is typically only a subset of our development activity in any given period as some of our hotel additions are executed and opened in less than 90 days and therefore may never appear in our pipeline. However, we use the pipeline to gauge interest in our brands and our continued ability to drive our net room growth projections.

Our franchise sales team consists of nearly 130 sales professionals throughout the world. Our sales team is focused on growing our franchise business through conversions of existing branded and independent hotels and partnering with developers to brand newly constructed hotels. In addition to a regional presence in the United States, we currently have sales teams located in London, Istanbul, Dubai, China, Singapore, Canada, Delhi, Mexico City, Sao Paulo, Buenos Aires, Seoul and Australia. Our international presence in key countries allows us to quickly adapt to changes in the increasingly dynamic global marketplace and to capitalize on new opportunities as they emerge.

In 2021, our sales team executed 655 contracts representing over 82,000 rooms. A key component of driving our net room growth is our ability to retain properties within our system. Our 2021 global retention rate improved 35 basis points compared to 2019 to over 95% and our 2021 domestic retention rate was also over 95%, consistent with 2019. In 2020 we experienced some large, discrete non-recurring termination events depressing our retention rates:

•we removed 21,400 rooms primarily relating to master franchise agreements (18,500) and unprofitable hotel management guarantee agreements (2,900); and

•a strategic partner unexpectedly sold certain hotels, triggering termination of the underlying license agreement and the removal of 5,300 rooms.

Adjusting for these unusual termination events, our 2020 global and domestic retention rates would have been 95%. Our goal is to continue to improve our retention rate over time to support higher overall net room growth.

Our Guest Loyalty Program

Wyndham Rewards is our award-winning guest loyalty program that supports our portfolio of brands. The program generates significant repeat business by rewarding guests with points for each qualified stay at all of our properties, which are then redeemable for free nights and other goods and services. Members can also use points earned at over 50,000 redemption options, including stays at thousands of hotels, vacation club results and vacation rentals globally as well as gas stations, airlines, charities, and tours or activities. Affiliation with our loyalty programs encourages members to allocate more of their travel spending to our hotels.

Wyndham Rewards has been recognized as one of the simplest, most rewarding loyalty programs in the hotel industry, providing more value to members than any other program. It has won more than 100 awards in recent years, including “Best Hotel Loyalty Program” from US News & World Report, “Best Hotel Loyalty Program” in USA TODAY 10 Best Readers’ Choice Awards and in May 2021, was ranked #1 on WalletHub’s list of “Best Hotel Rewards Programs” for the sixth time in a row.

Wyndham Rewards has over 92 million enrolled members and accounts for over 39% of occupancy at our affiliated hotels globally and 47% in the United States, up from 38% globally and 46% in the United States in 2020. Total membership

had been growing by over 10% annually pre COVID-19 from 2013 to 2019 and grew 6% and 7% in 2020 and 2021, respectively, with approximately 5 million and 6 million new members added in 2020 and 2021, respectively. Our franchisees benefit from the program through repeat stays and members benefit through free night stays, as well as other redemption options for their points, such as gift cards, merchandise and experiences. The program is funded by contributions from eligible revenues generated by Wyndham Rewards members and collected by us from hotels in our system. These funds are applied to reimburse hotels and partners for Wyndham Rewards points redemptions by loyalty members and to pay for administrative expenses and marketing initiatives that support the program.

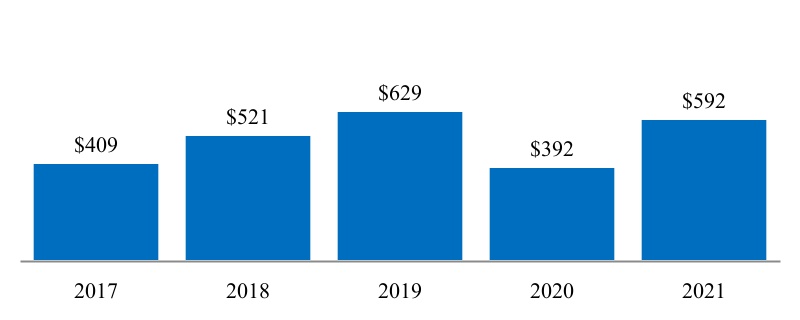

Hotel Franchising Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a)See Part II Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for our definition of adjusted EBITDA and the reconciliation of net income/(loss) to adjusted EBITDA. Adjusted EBITDA has been recasted to conform with the current year presentation. 2020 adjusted EBITDA was impacted by COVID-19.

We license our brands and associated trademarks to nearly 6,000 franchisees globally, which provides for a highly diversified owner base with limited concentration. Our franchisees range from sole proprietors to institutional investors such as public real estate investment trusts. Our franchise agreements are typically 10 to 20 years in length, providing significant visibility into future cash flows. Under these agreements, our direct franchisees generally pay us a royalty fee of 4% to 5% of gross room revenue and a marketing and reservation fee of 3% to 5% of gross room revenue. We occasionally provide financial support in the form of loans or development advances to help generate new business.

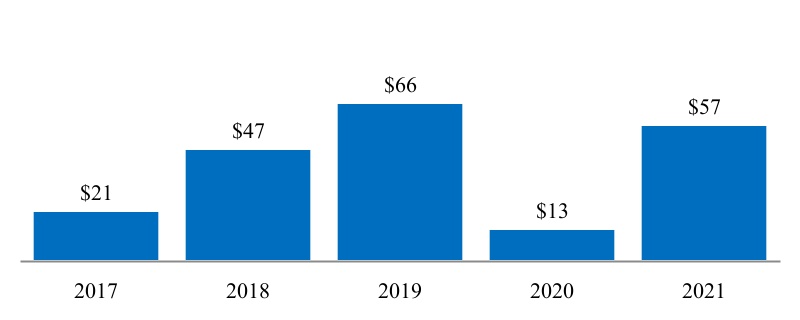

Hotel Management Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a)See Part II Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for our definition of adjusted EBITDA and the reconciliation of net income/(loss) to adjusted EBITDA. 2020 adjusted EBITDA was impacted by COVID-19.

As of December 31, 2021, we had 228 hotels under management contracts and two owned hotels - the Wyndham Grand Rio Mar Beach Resort and Spa in Puerto Rico and the Wyndham Grand Orlando Bonnet Creek. We manage properties under our brands, primarily under the Wyndham, Wyndham Grand, Wyndham Garden, Dolce, La Quinta, Ramada and Dazzler brands in major markets and resort destinations globally. The duration of our management agreements is typically 10 to 20 years. We earn a base management fee, which is based on a percentage of the hotel’s total revenue, and in some cases we earn an incentive fee, which is based on achieving performance metrics agreed upon with hotel owners. Under our management arrangements, we provide all the benefits of a franchising agreement and also conduct the day-to-day-operations of the hotel on behalf of the owner.

On November 8, 2021, CorePoint announced the sale of its business, including 121 La Quinta-branded hotels that CorePoint expects to own at the time of closing, which is targeted to occur in the first quarter of 2022. Wyndham and CorePoint have entered into a definitive agreement concerning the termination of all remaining hotel management contracts with Wyndham, which termination is conditioned upon the closing of their sale transaction. Under the terms of the agreement, CorePoint will pay to Wyndham a termination fee of approximately $84 million upon termination of the hotel management agreements, which represents the recovery of our outstanding hotel management contract balance. Wyndham’s franchise agreements for these hotels are expected to remain in-place at the current fee structure (5% royalties plus 4.5% for marketing and reservation services). This transaction will mark Wyndham’s exit from the lower margin, resource intensive select-service management business and allows for enhanced focus on the highly profitable and cash generative franchising business.

With significant interest from buyers of leisure real estate and our strong preference to concentrate on our asset-light franchised business, during the fourth quarter of 2021, our Board approved a plan to sell its two owned hotels.

As the world’s largest hotel franchising company by number of hotels, with approximately 9,000 hotels under 22 brands across approximately 95 countries, Wyndham Hotels & Resorts is an asset-light business with significant cash generation capabilities. Our company’s mission is to make hotel travel possible for all, and our vision is to be the world’s leading provider of select-service hotel brands by delivering the best value to owners and guests.

In support of our mission and vision, our 2022 strategic priorities are organized around the following primary goals and objectives:

•drive net room growth of 2-4%, including retaining approximately 95% of our current global system and expanding our portfolio to include an economy extended stay brand;

•increase owners’ profitability by optimizing property revenue and maximizing market share through continued investment in our direct channels and reducing on-property labor and operating costs by leveraging our scale and providing our franchisees innovative, contactless technology solutions and services that improve guest experience and increase hotel operating efficiencies; and

•simplify our business model by finalizing the exit from our select-service management business and pursuing the sale of our two owned hotels in order to refocus resources on our highly-profitable and asset-light franchise business.

We are committed to operating our business in a way that is socially, ethically and environmentally responsible. Now more than ever, we must help ensure the future remains bright for travelers around the world. As the world’s largest hotel franchising company by number of hotels, we have a unique opportunity to make a meaningful impact on the world while advancing our mission to make hotel travel possible for all.

As a hospitality company, service and volunteering is deeply rooted in our history and corporate culture. Our teams and franchisees around the world actively engage in their communities, generously giving in ways that enhance the lives of others. We support various charitable programs, including youth and education, military, community and environmental programs. Our philanthropy captures the dedication of our team members, leaders and business partners who have pledged to make lasting, important contributions to the communities in which we operate.

As of December 31, 2021, we had approximately 8,000 employees, consisting of approximately 1,000 employees outside of the United States. Our workforce is comprised of approximately 2,000 corporate employees and approximately 6,000 managed property employees. Approximately 7% of our employees are subject to collective bargaining agreements governing their employment at our managed properties with the Company. Upon the termination of the CorePoint management agreements following the closing of CorePoint’s sale, we expect to have only approximately 3,000 managed property employees.

Culture

At Wyndham, our values underpin our inclusive culture, drive our growth, nurture innovation, and inspire the great experiences we create for team members and the people we serve. Our signature “Count on Me” service culture encourages

each team member to be responsive, respectful, and deliver great experiences to our guests, partners, communities and each other. As a leader in hospitality, we recognize the critical role that service plays for our Company. Our Count on Me promise aligns with our core values – integrity, accountability, inclusiveness, caring and fun – and is embedded and celebrated at all levels of our organization.

Ethical leadership starts with our Board of Directors, and is shared by senior management with every team member across every brand and business at Wyndham Hotels & Resorts. Our Business Principles guide our interactions and set the standard for how every one of us should approach our work in service to our mission. All team members are expected to embrace our shared values and principles, and do their part in maintaining the highest ethical standards and behavior as we continue to grow in communities around the world.

Career Development

Our team members’ career development is key to our ability to attract, reward, and retain the best talent and a top priority at Wyndham. We actively seek to identify and develop talent throughout the organization and maintain a long-standing practice to support the growth and development of all our team members at every stage of their career. We develop and curate a variety of learning content in partnership with external providers to ensure that team members maintain the knowledge, skills, and abilities they need to be successful. These experiences include on-the-job practice, coaching and counseling, effective performance appraisals and honest, timely feedback as well as a vast array of formal leadership programs. Wyndham University, our global learning system, provides our team members with access to a robust learning library that is flexible and accessible to help our team members learn, grow and thrive.

Diversity, Equity and Inclusion

We respect differences in people, ideas and experiences. Our core values, grounded in caring, respect, inclusiveness and fundamental human rights, infuse different perspectives that reflect our diverse customers, team members, and communities around the world. While we continue to be recognized for the progress we have made on our Diversity, Equity and Inclusion journey, we know we can do more. This year, we added a diversity, equity and inclusion goal to performance reviews of all team members; bolstered our efforts to recruit, retain and promote diverse talent; expanded our supplier diversity program; and continued our robust diversity, equity and inclusion training programs – all to inspire our people to contribute to meaningful change in our company, our industry, our communities and the world.

Wyndham has six global affinity business groups and we launched a new regional affinity business group in 2021. These affinity groups serve as fully inclusive networks where empowered team members actively engage to foster innovation, help us grow, and enhance diversity, equity and inclusion globally. Members of our executive committee serve as sponsors of the affinity groups where they serve as allies, mentors and advocates.

Our company was named a best place to work for LGBTQ Equality by earning a perfect score, for the fourth consecutive year, on the Human Rights Campaign’s Corporate Equality Index—a national benchmarking survey on practices related to LGBTQ equality. The Company was also named a 2021 Noteworthy Company for Diversity by Diversity Inc., awarded the VETS Indexes Recognized Employer designation as part of the 2021 VETS Indexes Employer Awards, a 2021 Best for Vets Employer by Military Times, and a 2021 Military Friendly Employer and Military Friendly Supplier Diversity Program by VIQTORY in acknowledgement of our commitment to create sustainable and meaningful benefits for our military community. For the second consecutive year, Wyndham was named one of the Best Places to Work in New Jersey by New Jersey Business Magazine in 2021, we were ranked #4 on Newsweek’s 2021 Most Loved Workplaces list and Forbes recognized Wyndham on its 2022 list of America’s Best Employers.

Throughout our value chain, from team members, franchisees, partners and suppliers to the community and our guests, we believe that diversity of backgrounds, cultures and experiences helps drive our company’s success.

Wellness: Our “Be Well” Program

We are committed to offering programs that focus on the total well-being of all our team members. We also understand that nutrition, exercise, lifestyle management, physical, mental, and emotional wellness, financial health and the quality of the environment in which we work and live are also critical priorities to each of our team members. We believe that health and wellness promote both professional and personal productivity, achievement, and fulfillment, ultimately making us stronger across the organization. To encourage all our team members to lead healthier lifestyles while balancing family, work and other responsibilities, we offer several resources under our Be Well program, including free clinic services, an onsite fitness facility and a Wyndham Relief Fund to help employees who are facing financial hardship.

COVID-19

The health and safety of our team members is of the highest importance. Our focus on the safety of our team members is evident in our ongoing response to the ever-changing COVID-19 protocols and recommendations. We strive to maintain work environments that place the highest degree of care and attention to safety by:

•Continuing to support flexibility to work where you are most comfortable, whether from home, the office or a hybrid of both;

•Increasing cleaning protocols with our Count on Us program;

•Providing regular communications regarding changes and impacts of COVID-19, including health and safety protocols, practices and procedures;

•Extending onsite screening protocols including daily health checks where applicable;

•Providing additional personal protective equipment and cleaning supplies as needed;

•Carrying forward protocols to address actual and suspected COVID-19 cases and potential exposure;

•Maintaining physical distancing procedures for team members who are onsite; and

•Requiring masks to be worn by our team members and guests where applicable.

Human rights are a basic right entitled to all. We remain committed to the well-being and safety of our team members, guests and all those that connect to our industry. In 2021 we continued to donate and activate our team members and 92 million enrolled Wyndham Rewards members to support humanitarian causes around the world.

We partnered with the American Hotel & Lodging Association (“AHLA”) to support the 5-Star Promise, a voluntary commitment to enhance policies, trainings, and resources for hotel employees and guests. We are dedicated to our team members’ safety and security and we are proud to unite with our industry in support of a shared commitment to the incredible people who help make our guests’ travels memorable.

We, along with other leaders in our industry, remain committed to supporting our industry’s efforts to end human trafficking. We have worked to enhance our policies and we have mandated training for all our team members to help them identify and report trafficking activities.

We are proud to work with a number of organizations including ECPAT-USA, an organization whose mission is to protect every child’s human right to grow up free from the threat of sexual exploitation and trafficking.

We also support Polaris, a non-profit organization that spearheads the effort to fight against human trafficking and operates the U.S. National Human Trafficking Hotline, to which Wyndham donates Wyndham Rewards points to provide victims with temporary safe housing. As part of our giving efforts, Wyndham Rewards and its members have donated approximately 123 million points since inception to various non-profit organizations, including organizations supporting humanitarian causes to redeem for travel and other related goods and services.

We are committed to operating sustainably in a way that provides outstanding experiences for those we serve through places to stay that are environmentally responsible. We engage team members, owners and operators around the world to uphold and leverage our core values to think globally and execute locally.

We developed the Wyndham Green Program, which was designed to show how hotels can reduce operating costs through efficiency, help drive revenue from environmentally conscious travelers, remain competitive in the market and increase brand loyalty. The Wyndham Green Program consists of two integral components: 1) the Wyndham Green Certification Program, our internal five-level certification program with five to seven best practices per level that address energy and water conservation, waste diversion, operational efficiency, as well as guest, team member and franchisee education and engagement, and 2) the Wyndham Green Toolbox, a proprietary environmental management tool that tracks, measures and reports environmental performance data to help hotels improve energy efficiency, reduce emissions, conserve water, and reduce waste – thus minimizing environmental impact.

The UN Sustainable Development Goals serve as a strategic guide for our sustainability program, which helps advance our company’s mission of making hotel travel possible for all. Our focus includes:

•Promoting best practices around water conservation at our hotels through our Wyndham Green Program; supporting the access to clean water to all through our community partnerships; and reducing single-use plastics to keep our waterways and oceans pollution-free and safe for wildlife.

•Embarking on a multi-decade journey to reduce our greenhouse gas emissions in alignment with efforts to limit the rise in global temperatures in part by providing our managed hotels with tools and best practices through our Wyndham Green Program that are also available to our franchisees.

•Promoting and expanding best practices for biodiversity protection across our owned and managed properties; partnering with suppliers to make a meaningful impact to protect forests and biodiversity; and sharing best practices around waste diversion through our Wyndham Green Program in order to reduce waste sent to landfills.

We remain committed to reducing our energy, water and carbon footprint across our owned and managed hotels as we work towards achieving our 2025 environmental targets. We continuously evaluate opportunities to increase efficiencies and the usage of renewable energy where feasible as we update our decarbonization plans with longer term targets in alignment with climate science.

We continually monitor and prioritize climate-related risks based on the financial and strategic impacts on our business. Enterprise risks, including those related to sustainability, climate and energy, are identified and assessed on an ongoing basis.

We review climate-related risks using the Task Force for Climate-Related Financial Disclosures (“TFCD”) on an annual basis, which include both transition and physical risks. Some risks that we consider include:

•Current and emerging regulations, like those pertaining to energy efficiency, energy consumption reporting and green building codes and standards at the local, state, and national levels, are considered as risks for our business.

•Acute physical risks (extreme weather events), including hurricanes and wildfires, are increasing in frequency can impact travel demand in specific markets, supply chains and cause physical damage to our assets.

•Chronic physical risks, such as include rising sea levels, rising mean temperatures, changes in precipitation patterns (including droughts) and extreme variability in weather patterns, can influence demand for travel and tourism in key markets adversely by decreasing revenue and/or causing property damage.

Our business model is asset-light, which dramatically limits our capital needs and exposure to the effects of climate change while providing us the ability to mitigate and transfer some of the risks associated with physical risks to third parties. Many factors influence our reputation and the value of our hotel brands including the perception held by our guests, our franchisees, our other key stakeholders and the communities in which we do business. The environmental information that we provide is used to inform their purchasing decisions and can directly impact our revenue associated with both franchisee and management fees.

During the fourth quarter of 2021, Newsweek named Wyndham among the “Most Responsible Companies,” which honors companies with superior environmental and social responsibility practices. As more travelers are looking for environmentally friendly lodging options, it is critical to position our hotels optimally and provide new environmentally responsible options for our guests. Our 2021 ESG Report, which is available on our corporate website and not incorporated by reference into this Annual Report, contains additional information regarding our commitment to social responsibility.

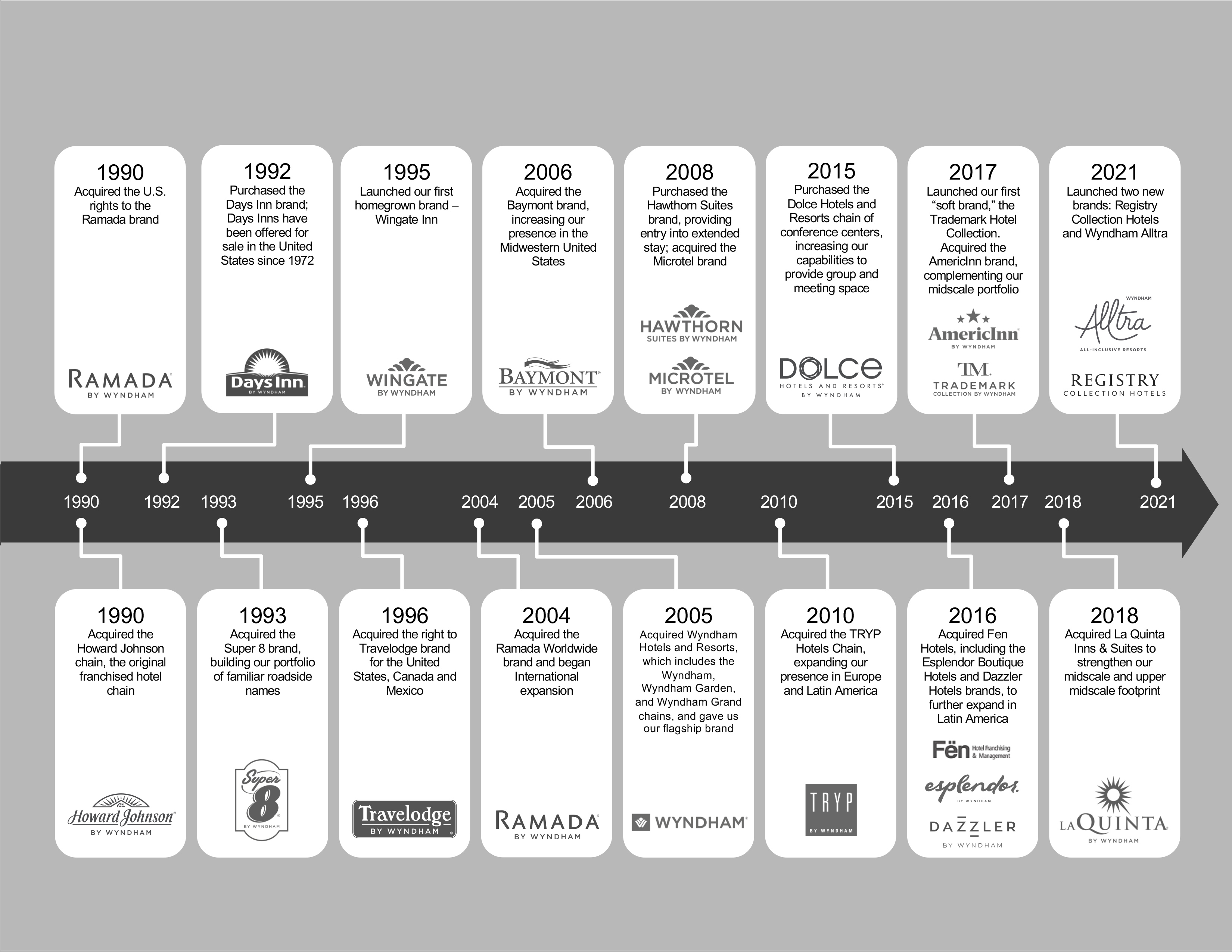

Our business was initially incorporated as Hospitality Franchise Systems, Inc. in 1990 to acquire the Howard Johnson brand and the franchise rights to the Ramada brand in the United States. It was an integral part of Wyndham Worldwide Corporation and its predecessor from 1997 to 2018. Wyndham Hotels became an independent, public company in May 2018 when it was spun-off from Wyndham Worldwide. Our business has grown substantially over time through acquisitions and organic expansion.

We encounter competition among hotel franchisors and lodging operators. We believe franchisees make decisions based principally upon the perceived value and quality of the brand and the services offered. We further believe that the perceived value of a brand name is partially a function of the success of the existing hotels franchised under the brand.

The ability of an individual franchisee to compete may be affected by the location and quality of its property, the number of competitors in the vicinity, community reputation and other factors. A franchisee’s success may also be affected by general, regional and local economic conditions. The potential effect of these conditions on our performance is substantially reduced by virtue of the diverse locations of our affiliated hotels and by the scale of our base. Our system is dispersed among nearly 6,000 franchisees, which reduces our exposure to any one franchisee. One master franchisor in China for the Super 8 brand accounts for 12% of our hotels. CorePoint currently accounts for approximately 2% of our hotels and approximately 60% of our managed hotels. Apart from these relationships, no one franchisee accounts for more than 2% of our hotels.

While the hotel industry is seasonal in nature, periods of higher revenues vary property-by-property and performance is dependent on location and guest base. Based on historical performance, revenues from franchise and management contracts are generally higher in the second and third quarters than in the first or fourth quarters due to increased leisure travel during the spring and summer months. Our cash provided by operating activities tends to be lower in the first half of the year and substantially higher in the second half of the year. However, given the impact of COVID-19 in 2020, our second quarter was the most severely impacted and as such, we had higher revenues and cash flows in the third and fourth quarters. However, during 2021, our revenues and cash provided by operating activities returned to the historic seasonality as our business recovered from the pandemic. The seasonality of our business may cause fluctuations in our quarterly operating results, earnings, profit margins and cash flows. As we expand into new markets and geographical locations, we may experience increased or different seasonality dynamics that create fluctuations in operating results different from the fluctuations we have experienced in the past.

Wyndham Hotels owns the trademarks and other intellectual property rights related to our hotel brands, including the “Wyndham” trademark. We actively use, directly or through our licensees, these trademarks and other intellectual property rights. We operate in a highly competitive industry in which the trademarks and other intellectual property rights related to our hotel brands are very important to the marketing and sales of our services. We believe that our hotel brand names have come to represent high standards of quality, caring, service and value to our franchisees and guests. We register the trademarks that we own in the United States Patent and Trademark Office, as well as with other relevant authorities, where we deem appropriate, and otherwise seek to protect our trademarks and other intellectual property rights from unauthorized use as permitted by law.

Our business is subject to various foreign and U.S. federal and state laws and regulations. In particular, our franchisees are subject to the local laws and regulations in each country in which such hotels are operated, including employment laws and practices, privacy laws and tax laws, which may provide for tax rates that exceed those of the United States and which may provide that our foreign earnings are subject to withholding requirements or other restrictions, unexpected changes in regulatory requirements or monetary policy and other potentially adverse tax consequences. Our franchisees and other aspects of our business are also subject to various foreign and U.S. federal and state laws and regulations, including the Americans with Disabilities Act and similar legislation in certain jurisdictions outside of the United States.