false2023FY0001722684P3YP3YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1YP1Yhttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#PropertyPlantAndEquipmentNethttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#Liabilitieshttp://fasb.org/us-gaap/2023#Liabilitieshttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent00017226842023-01-012023-12-3100017226842023-06-30iso4217:USD00017226842024-01-31xbrli:shares0001722684wh:RoyaltiesandFranchiseFeesMember2023-01-012023-12-310001722684wh:RoyaltiesandFranchiseFeesMember2022-01-012022-12-310001722684wh:RoyaltiesandFranchiseFeesMember2021-01-012021-12-310001722684wh:MarketingReservationandLoyaltyMember2023-01-012023-12-310001722684wh:MarketingReservationandLoyaltyMember2022-01-012022-12-310001722684wh:MarketingReservationandLoyaltyMember2021-01-012021-12-310001722684wh:HotelManagementServicesMember2023-01-012023-12-310001722684wh:HotelManagementServicesMember2022-01-012022-12-310001722684wh:HotelManagementServicesMember2021-01-012021-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2023-01-012023-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2022-01-012022-12-310001722684wh:LicenseandOtherFeeFromFormerParentMember2021-01-012021-12-310001722684wh:OtherProductsandServicesMember2023-01-012023-12-310001722684wh:OtherProductsandServicesMember2022-01-012022-12-310001722684wh:OtherProductsandServicesMember2021-01-012021-12-3100017226842022-01-012022-12-3100017226842021-01-012021-12-310001722684wh:CostReimbursementsMember2023-01-012023-12-310001722684wh:CostReimbursementsMember2022-01-012022-12-310001722684wh:CostReimbursementsMember2021-01-012021-12-31iso4217:USDxbrli:shares0001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-3100017226842023-12-3100017226842022-12-310001722684us-gaap:TrademarksMember2023-12-310001722684us-gaap:TrademarksMember2022-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2023-12-310001722684wh:FranchiseAgreementsAndOtherIntangibleAssetsMember2022-12-3100017226842021-12-3100017226842020-12-310001722684us-gaap:CommonStockMember2020-12-310001722684us-gaap:TreasuryStockCommonMember2020-12-310001722684us-gaap:AdditionalPaidInCapitalMember2020-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2020-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2021-01-012021-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-12-310001722684us-gaap:CommonStockMember2021-01-012021-12-310001722684us-gaap:TreasuryStockCommonMember2021-01-012021-12-310001722684us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001722684us-gaap:CommonStockMember2021-12-310001722684us-gaap:TreasuryStockCommonMember2021-12-310001722684us-gaap:AdditionalPaidInCapitalMember2021-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2021-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2022-01-012022-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001722684us-gaap:CommonStockMember2022-01-012022-12-310001722684us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001722684us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001722684us-gaap:CommonStockMember2022-12-310001722684us-gaap:TreasuryStockCommonMember2022-12-310001722684us-gaap:AdditionalPaidInCapitalMember2022-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2022-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2023-01-012023-12-310001722684us-gaap:CommonStockMember2023-01-012023-12-310001722684us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001722684us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001722684us-gaap:CommonStockMember2023-12-310001722684us-gaap:TreasuryStockCommonMember2023-12-310001722684us-gaap:AdditionalPaidInCapitalMember2023-12-310001722684us-gaap:RetainedEarningsAppropriatedMember2023-12-310001722684us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-31wh:country0001722684wh:LoyaltyProgramMember2023-12-310001722684wh:LoyaltyProgramMember2022-12-310001722684srt:MaximumMember2023-01-012023-12-310001722684wh:BuildingAndLeaseholdImprovementsMember2023-12-310001722684us-gaap:FurnitureAndFixturesMembersrt:MinimumMember2023-12-310001722684us-gaap:FurnitureAndFixturesMembersrt:MaximumMember2023-12-310001722684srt:MinimumMemberus-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMembersrt:MaximumMember2023-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2023-01-012023-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2022-01-012022-12-310001722684us-gaap:SoftwareAndSoftwareDevelopmentCostsMember2021-01-012021-12-310001722684srt:MinimumMember2023-01-012023-12-31wh:hotel0001722684wh:InitialFranchiseFeesMember2023-12-310001722684wh:InitialFranchiseFeesMember2022-12-310001722684wh:CobrandedcreditcardsprogramMember2023-12-310001722684wh:CobrandedcreditcardsprogramMember2022-12-310001722684us-gaap:ProductAndServiceOtherMember2023-12-310001722684us-gaap:ProductAndServiceOtherMember2022-12-3100017226842024-01-01wh:InitialFranchiseFeesMember2023-12-3100017226842025-01-01wh:InitialFranchiseFeesMember2023-12-310001722684wh:InitialFranchiseFeesMember2026-01-012023-12-3100017226842027-01-01wh:InitialFranchiseFeesMember2023-12-3100017226842024-01-01wh:LoyaltyProgramMember2023-12-3100017226842025-01-01wh:LoyaltyProgramMember2023-12-310001722684wh:LoyaltyProgramMember2026-01-012023-12-3100017226842027-01-01wh:LoyaltyProgramMember2023-12-3100017226842024-01-01wh:CobrandedcreditcardsprogramMember2023-12-3100017226842025-01-01wh:CobrandedcreditcardsprogramMember2023-12-310001722684wh:CobrandedcreditcardsprogramMember2026-01-012023-12-3100017226842027-01-01wh:CobrandedcreditcardsprogramMember2023-12-3100017226842024-01-01wh:OtherProductsandServicesMember2023-12-3100017226842025-01-01wh:OtherProductsandServicesMember2023-12-310001722684wh:OtherProductsandServicesMember2026-01-012023-12-3100017226842027-01-01wh:OtherProductsandServicesMember2023-12-310001722684wh:OtherProductsandServicesMember2023-12-3100017226842024-01-012023-12-3100017226842025-01-012023-12-3100017226842026-01-012023-12-3100017226842027-01-012023-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:RoyaltiesandFranchiseFeesMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:MarketingReservationandLoyaltyMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:ManagedHotelRevenuesMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:ManagedHotelRevenuesMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:ManagedHotelRevenuesMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2023-01-012023-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2022-01-012022-12-310001722684wh:HotelFranchisingSegmentMemberwh:LicenseandOtherFeeFromFormerParentMember2021-01-012021-12-310001722684wh:CostReimbursementsMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:CostReimbursementsMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:CostReimbursementsMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:OtherProductsandServicesMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2022-01-012022-12-310001722684wh:HotelManagementSegmentMemberwh:RoyaltiesandFranchiseFeesMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:MarketingReservationandLoyaltyMember2022-01-012022-12-310001722684wh:HotelManagementSegmentMemberwh:MarketingReservationandLoyaltyMember2021-01-012021-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2022-01-012022-12-310001722684wh:OwnedHotelRevenuesMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:ManagedHotelRevenuesMemberwh:HotelManagementSegmentMember2022-01-012022-12-310001722684wh:ManagedHotelRevenuesMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:CostReimbursementsMemberwh:HotelManagementSegmentMember2022-01-012022-12-310001722684wh:CostReimbursementsMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684wh:HotelManagementSegmentMemberwh:OtherProductsandServicesMember2022-01-012022-12-310001722684wh:HotelManagementSegmentMemberwh:OtherProductsandServicesMember2021-01-012021-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelManagementSegmentMember2022-01-012022-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelManagementSegmentMember2021-01-012021-12-310001722684us-gaap:OtherCurrentAssetsMember2023-12-310001722684us-gaap:OtherCurrentAssetsMember2022-12-310001722684us-gaap:OtherNoncurrentAssetsMember2023-12-310001722684us-gaap:OtherNoncurrentAssetsMember2022-12-310001722684wh:PrepaidExpenseMember2022-12-310001722684us-gaap:EmployeeStockOptionMember2023-01-012023-12-310001722684us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001722684wh:FinancingReceivablewithDeferredIncomeOffsetMember2023-12-310001722684wh:FinancingReceivablewithDeferredIncomeOffsetMember2022-12-310001722684wh:ViennaHouseMember2022-01-012022-12-310001722684wh:ViennaHouseMember2023-09-300001722684us-gaap:FranchiseRightsMember2022-12-310001722684us-gaap:FranchiseRightsMemberwh:ViennaHouseMember2022-09-300001722684us-gaap:TrademarksMemberwh:ViennaHouseMember2022-09-300001722684wh:ViennaHouseMember2022-01-012022-09-300001722684us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001722684us-gaap:BuildingAndBuildingImprovementsMember2022-12-310001722684us-gaap:ComputerEquipmentMember2023-12-310001722684us-gaap:ComputerEquipmentMember2022-12-310001722684us-gaap:FurnitureAndFixturesMember2023-12-310001722684us-gaap:FurnitureAndFixturesMember2022-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-12-310001722684us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2022-12-310001722684us-gaap:ConstructionInProgressMember2023-12-310001722684us-gaap:ConstructionInProgressMember2022-12-310001722684us-gaap:TrademarksMember2023-12-310001722684us-gaap:TrademarksMember2022-12-310001722684us-gaap:FranchiseRightsMember2023-12-310001722684wh:ManagementAgreementsMember2023-12-310001722684wh:ManagementAgreementsMember2022-12-310001722684us-gaap:TrademarksMember2023-12-310001722684us-gaap:TrademarksMember2022-12-310001722684us-gaap:OtherIntangibleAssetsMember2023-12-310001722684us-gaap:OtherIntangibleAssetsMember2022-12-310001722684wh:HotelFranchisingSegmentMember2021-12-310001722684wh:HotelFranchisingSegmentMember2022-01-012022-12-310001722684wh:HotelFranchisingSegmentMember2023-01-012023-12-310001722684wh:HotelFranchisingSegmentMember2023-12-310001722684wh:HotelManagementSegmentMember2021-12-310001722684wh:HotelManagementSegmentMember2022-01-012022-12-310001722684wh:HotelManagementSegmentMember2023-01-012023-12-310001722684wh:HotelManagementSegmentMember2023-12-310001722684us-gaap:FranchiseRightsMember2023-01-012023-12-310001722684us-gaap:FranchiseRightsMember2022-01-012022-12-310001722684us-gaap:FranchiseRightsMember2021-01-012021-12-310001722684wh:ManagementAgreementsMember2023-01-012023-12-310001722684wh:ManagementAgreementsMember2022-01-012022-12-310001722684wh:ManagementAgreementsMember2021-01-012021-12-310001722684us-gaap:FranchiseMember2023-01-012023-12-310001722684us-gaap:FranchiseMember2022-01-012022-12-310001722684us-gaap:FranchiseMember2021-01-012021-12-310001722684wh:FranchiseesAndHotelOwnersMember2023-12-310001722684wh:FranchiseesAndHotelOwnersMember2022-12-310001722684wh:ForgivenessOfNoteReceivableMember2023-01-012023-12-310001722684wh:ForgivenessOfNoteReceivableMember2022-01-012022-12-310001722684wh:ForgivenessOfNoteReceivableMember2021-01-012021-12-310001722684wh:DeferredIncomeTaxesMember2023-12-310001722684wh:DeferredIncomeTaxesMember2022-12-310001722684wh:NetOperatingLossCarryforwardMember2023-12-310001722684wh:DeferredTaxAssetMember2023-12-310001722684wh:ForeignTaxCreditMember2023-12-310001722684wh:NetOperatingLossCarryforwardMember2022-12-310001722684wh:DeferredTaxAssetMember2022-12-310001722684wh:ForeignTaxCreditMember2022-12-31xbrli:pure0001722684srt:MinimumMemberus-gaap:DomesticCountryMember2023-12-310001722684us-gaap:DomesticCountryMembersrt:MaximumMember2023-12-310001722684us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2023-12-310001722684us-gaap:LineOfCreditMemberus-gaap:RevolvingCreditFacilityMember2022-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2027Member2023-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2027Member2022-12-310001722684wh:TermLoandue2025Memberus-gaap:LongTermDebtMember2023-12-310001722684wh:TermLoandue2025Memberus-gaap:LongTermDebtMember2022-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2030Member2023-12-310001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2030Member2022-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2023-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2022-12-310001722684wh:WyndhamWorldwideMemberus-gaap:CapitalLeaseObligationsMember2023-12-310001722684wh:WyndhamWorldwideMemberus-gaap:CapitalLeaseObligationsMember2022-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2023-12-310001722684wh:TermLoanandSeniorUnsecuredNotesMember2022-12-310001722684us-gaap:RevolvingCreditFacilityMember2023-12-310001722684us-gaap:RevolvingCreditFacilityMember2018-05-310001722684us-gaap:RevolvingCreditFacilityMember2023-01-012023-12-310001722684srt:MinimumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-04-082022-04-080001722684srt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberus-gaap:BaseRateMember2022-04-082022-04-080001722684srt:MinimumMemberwh:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberwh:VariableRateComponentOneMember2022-04-082022-04-080001722684wh:SecuredOvernightFinancingRateSOFRMembersrt:MaximumMemberus-gaap:RevolvingCreditFacilityMemberwh:VariableRateComponentOneMember2022-04-082022-04-080001722684wh:SecuredOvernightFinancingRateSOFRMemberus-gaap:RevolvingCreditFacilityMemberwh:VariableRateComponentTwoMember2022-04-082022-04-080001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2027Member2022-04-080001722684srt:MinimumMemberwh:TermLoanDue2027Memberus-gaap:BaseRateMember2022-04-082022-04-080001722684wh:TermLoanDue2027Membersrt:MaximumMemberus-gaap:BaseRateMember2022-04-082022-04-080001722684srt:MinimumMemberwh:TermLoanDue2027Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-04-082022-04-080001722684wh:TermLoanDue2027Membersrt:MaximumMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-04-082022-04-080001722684wh:TermLoanDue2027Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2022-04-082022-04-080001722684us-gaap:LongTermDebtMemberwh:TermLoanDue2027Member2022-04-082022-04-080001722684us-gaap:LineOfCreditMember2023-12-310001722684wh:TermLoanDue2030Memberus-gaap:BaseRateMember2023-05-252023-05-250001722684wh:SecuredOvernightFinancingRateSOFROvernightIndexSwapAdjustmentRatePerAnnumMemberwh:TermLoanDue2030Member2023-05-252023-05-250001722684wh:TermLoanDue2030Memberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMember2023-05-252023-05-250001722684wh:CreditAgreementMember2023-12-310001722684us-gaap:SeniorNotesMemberwh:SeniorUnsecuredNotesDueAugust2028Member2020-08-310001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-310001722684wh:SeniorUnsecuredNotesDueAugust2028Member2020-08-012020-08-310001722684us-gaap:RevolvingCreditFacilityMember2022-12-310001722684us-gaap:InterestRateSwapMember2018-05-310001722684wh:InterestRateSwap1Member2018-05-310001722684wh:InterestRateSwap1Membersrt:WeightedAverageMember2023-12-310001722684wh:InterestRateSwap2Member2018-05-310001722684wh:InterestRateSwap2Membersrt:WeightedAverageMember2023-12-310001722684wh:InterestRateSwap3Member2018-05-310001722684wh:InterestRateSwap3Membersrt:WeightedAverageMember2023-12-310001722684wh:InterestRateSwap4Member2018-05-310001722684wh:InterestRateSwap4Membersrt:WeightedAverageMember2023-12-310001722684us-gaap:InterestRateSwapMember2023-01-012023-12-310001722684us-gaap:InterestRateSwapMember2022-01-012022-12-310001722684us-gaap:InterestRateSwapMember2021-01-012021-12-310001722684wh:SeniorUnsecuredNotesdueApril2026Member2020-08-310001722684us-gaap:CarryingReportedAmountFairValueDisclosureMember2023-12-310001722684us-gaap:EstimateOfFairValueFairValueDisclosureMember2023-12-310001722684us-gaap:SalesRevenueNetMemberstpr:TXus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001722684us-gaap:SalesRevenueNetMemberstpr:FLus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001722684us-gaap:SalesRevenueNetMemberstpr:TXus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001722684us-gaap:SalesRevenueNetMemberstpr:FLus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001722684us-gaap:SalesRevenueNetMemberstpr:TXus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684us-gaap:SalesRevenueNetMemberstpr:FLus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684stpr:FL2023-01-012023-12-310001722684stpr:FL2022-01-012022-12-310001722684stpr:FL2021-01-012021-12-310001722684wh:CorePointMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684wh:CorePointMemberwh:RevenueExcludingCostReimbursementsBenchmarkMemberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001722684srt:MaximumMember2023-12-310001722684us-gaap:PaymentGuaranteeMember2023-12-310001722684wh:FairValueOfGuaranteesMember2023-12-310001722684wh:GuaranteeReceivableFromFormerParentMember2023-12-310001722684wh:GuaranteeReceivableFromFormerParentMember2022-12-310001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2018-05-140001722684wh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2023-12-310001722684wh:KeyEmployeesAndSeniorOfficersMemberus-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001722684wh:KeyEmployeesAndSeniorOfficersMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001722684wh:KeyEmployeesAndSeniorOfficersMembersrt:MinimumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001722684wh:KeyEmployeesAndSeniorOfficersMembersrt:MaximumMemberus-gaap:PerformanceSharesMember2023-01-012023-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2022-12-310001722684us-gaap:PerformanceSharesMember2022-12-310001722684us-gaap:PerformanceSharesMember2023-01-012023-12-310001722684us-gaap:RestrictedStockUnitsRSUMember2023-12-310001722684us-gaap:PerformanceSharesMember2023-12-310001722684us-gaap:CorporateAndOtherMember2023-01-012023-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2023-12-310001722684us-gaap:AllOtherSegmentsMember2023-12-310001722684us-gaap:CorporateAndOtherMember2022-01-012022-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2022-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelManagementSegmentMember2022-12-310001722684us-gaap:AllOtherSegmentsMember2022-12-310001722684us-gaap:CorporateAndOtherMember2021-01-012021-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelFranchisingSegmentMember2021-12-310001722684us-gaap:OperatingSegmentsMemberwh:HotelManagementSegmentMember2021-12-310001722684us-gaap:AllOtherSegmentsMember2021-12-310001722684wh:NonseparationrelatedMemberwh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2022-01-012022-12-310001722684wh:NonseparationrelatedMemberwh:WyndhamHotelsResortsInc.2018EquityandIncentivePlanMember2021-01-012021-12-310001722684country:US2023-01-012023-12-310001722684us-gaap:NonUsMember2023-01-012023-12-310001722684country:US2023-12-310001722684us-gaap:NonUsMember2023-12-310001722684country:US2022-01-012022-12-310001722684us-gaap:NonUsMember2022-01-012022-12-310001722684country:US2022-12-310001722684us-gaap:NonUsMember2022-12-310001722684country:US2021-01-012021-12-310001722684us-gaap:NonUsMember2021-01-012021-12-310001722684country:US2021-12-310001722684us-gaap:NonUsMember2021-12-310001722684wh:WyndhamGrandBonnetCreekResortSaleMember2022-01-012022-12-310001722684wh:WyndhamGrandBonnetCreekResortSaleMember2022-03-012022-03-310001722684wh:WyndhamGrandRioMarResortSaleMember2022-05-012022-05-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2023-01-012023-12-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2022-01-012022-12-310001722684wh:WyndhamWorldwideMemberus-gaap:LicensingAgreementsMember2021-01-012021-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2023-01-012023-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2022-01-012022-12-310001722684wh:WyndhamRewardsMembersrt:AffiliatedEntityMember2021-01-012021-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2022-01-012022-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2023-01-012023-12-310001722684srt:AffiliatedEntityMemberus-gaap:LicensingAgreementsMember2021-01-012021-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2020-01-012020-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2023-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2022-12-310001722684srt:AffiliatedEntityMemberwh:SaleofEuropeanVacationRentalsBusinessMember2023-07-012023-09-300001722684us-gaap:AccumulatedTranslationAdjustmentMember2020-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2020-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2021-01-012021-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-01-012021-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2021-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-01-012022-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2022-12-310001722684us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001722684us-gaap:AccumulatedNetGainLossFromDesignatedOrQualifyingCashFlowHedgesMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K

☑ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from to

Commission file number 001-38432

Wyndham Hotels & Resorts, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | | | | |

Delaware | | 82-3356232 |

(State or Other Jurisdiction of Incorporation or Organization) | | (I.R.S. Employer Identification No.) |

| | | |

22 Sylvan Way | | 07054 |

Parsippany, | New Jersey | | (Zip Code) |

(Address of Principal Executive Offices) | | |

(973) 753-6000

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, Par Value $0.01 per share | WH | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of Class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☑ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☑

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | | | | | | | | | | |

Large accelerated filer | ☑ | | | | | Accelerated filer | ☐ |

Non-accelerated filer | ☐ | | | | | Smaller reporting company | ☐ |

| | | | | | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☑

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D–1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☑

The aggregate market value of the registrant’s common stock held by non-affiliates of the registrant as of June 30, 2023, was $5.72 billion. All executive officers and directors of the registrant have been deemed, solely for the purpose of the foregoing calculation, to be “affiliates” of the registrant.

As of January 31, 2024, the registrant had outstanding 81,000,261 shares of common stock.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Proxy Statement prepared for the 2024 Annual Meeting of Stockholders are incorporated by reference into Part III of this report.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| PART I | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| | |

| PART II | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| | |

| PART III | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| | |

| PART IV | |

| Item 15. | | |

| Item 16. | | |

| | |

PART I

Forward-Looking Statements

This Annual Report on Form 10-K (this “Annual Report” or “report”) contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended. These statements include, but are not limited to, statements related to our views and expectations regarding our strategy and the performance of our business, our financial results, our liquidity and capital resources, share repurchases and dividends and other non-historical statements. We claim the protection of the Safe Harbor contained in the Private Securities Litigation Reform Act of 1995 for forward-looking statements other than with respect to statements made in connection with the unsolicited exchange offer by Choice Hotels International, Inc. (“Choice”) to acquire all outstanding shares of our common stock (the “Exchange Offer”). Forward-looking statements include those that convey management’s expectations as to the future based on plans, estimates and projections at the time we make the statements and may be identified by words such as “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “goal,” “future,” “outlook,” “guidance,” “target,” “objective,” “estimate,” “projection” and similar words or expressions, including the negative version of such words and expressions. Such forward-looking statements involve known and unknown risks, uncertainties and other factors, which may cause the actual results, performance or achievements of the Company to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this report.

Factors that could cause actual results to differ materially from those in the forward-looking statements include without limitation, factors relating to the Exchange Offer, including actions taken by Choice in connection with such offer, actions taken by Wyndham or its stockholders in respect of the Exchange Offer or other actions or developments involving Choice, such as a potential proxy contest, the completion or failure to complete the Exchange Offer, the effects of such offer on our business, such as the cost, loss of time and disruption; general economic conditions, including inflation, higher interest rates and potential recessionary pressures; global or regional health crises or pandemics (such as the COVID-19 pandemic) including the resulting impact on our business operations, financial results, cash flows and liquidity, as well as the impact on our franchisees, guests and team members, the hospitality industry and overall demand for and possible restrictions on travel; the performance of the financial and credit markets; the economic environment for the hospitality industry; operating risks associated with the hotel franchising business; our relationships with franchisees; the ability to realize the potential benefits of business development activity including acquisitions and licensing arrangements; the impact of war, terrorist activity, political instability or political strife, including the ongoing conflicts between Russia and Ukraine and Israel and Hamas, respectively; the Company’s ability to satisfy obligations and agreements under its outstanding indebtedness, including the payment of principal and interest and compliance with the covenants thereunder; risks related to our ability to obtain financing and the terms of such financing, including access to liquidity and capital; and the Company’s ability to make or pay, plans for and the timing and amount of any future share repurchases and/or dividends, as well as the risks described under Part I, Item 1A – Risk Factors.

Where You Can Find More Information

We file annual, quarterly and current reports, proxy statements, reports that are filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 and other information with the Securities and Exchange Commission (“SEC”). Our SEC filings are available free of charge to the public over the Internet at the SEC’s website at https://www.sec.gov. Our SEC filings are also available on our website at https://www.wyndhamhotels.com as soon as reasonably practicable after they are filed with or furnished to the SEC. We maintain an internet site at https://www.wyndhamhotels.com. Our website and the information contained on or connected to that site are not incorporated into this Annual Report.

We may use our website as a means of disclosing material non-public information and for complying with our disclosure obligations under Regulation FD. Disclosures of this nature will be included on our website in the “Investors” section, which can currently be accessed at www.investor.wyndhamhotels.com. Accordingly, investors should monitor this section of our website in addition to following our press releases, filings submitted with the SEC and any public conference calls or webcasts.

Item 1. Business.

Wyndham Hotels & Resorts, Inc. (“Wyndham Hotels”, the “Company”, “we”, “our” or “us”) is the world’s largest hotel franchising company by number of hotels, with approximately 9,200 affiliated hotels with approximately 872,000 rooms located in over 95 countries and welcoming nearly 140 million guests annually worldwide. We operate a hotel portfolio of 24 brands. Our 24 brands are primarily located in secondary and tertiary cities and approximately 80% of the U.S. population lives within ten miles of at least one of our affiliated hotels. Our mission is to make hotel travel possible for all. Wherever

people go, Wyndham will be there to welcome them. We boast a remarkably asset-light business model dramatically limiting our capital needs and our exposure to the rising wage environment.

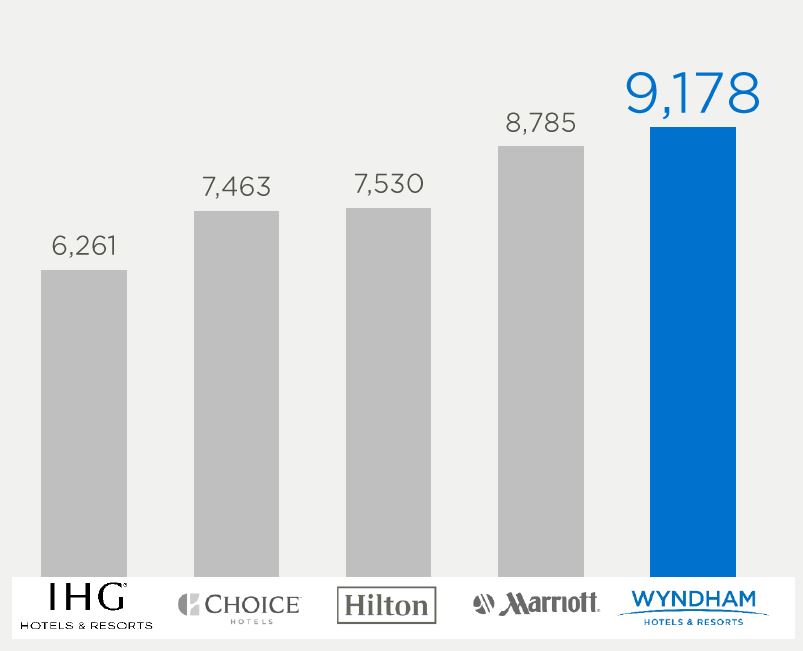

The following chart presents the number of branded hotels associated with each of the five largest traditional hotel franchise companies as of December 31, 2023, except for Choice and IHG which are as of September 30, 2023:

Source: Companies’ public disclosures

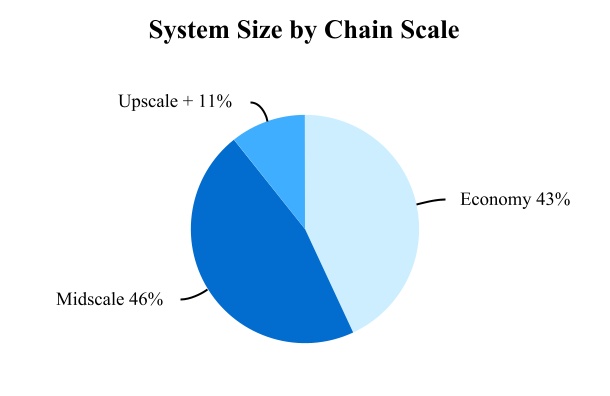

Our widely recognized brands with select-service focus offer a breadth of options for franchisees and a wide range of price points and experiences for our guests. We are a global leader in the economy and midscale chain scales where our brands represent approximately 30% of branded rooms in the United States. Additionally, we have a strong presence in the upper midscale chain scale.

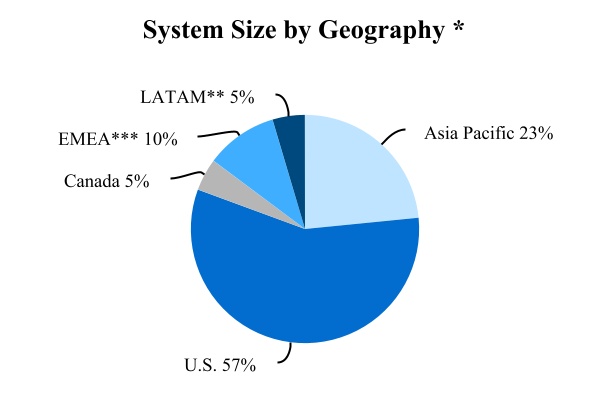

The following charts illustrate our system size (by rooms) as of December 31, 2023:

______________________

* Royalty contribution by geography for 2023 was as follows: U.S. 80%, Canada 5%, EMEA 7%, Asia Pacific 5% and LATAM 3%.

** LATAM is representative of Latin America and the Caribbean.

*** EMEA is representative of Europe, the Middle East, Eurasia and Africa.

As of December 31, 2023, our brand portfolio consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Global Full Year RevPAR | | | | North America | | Asia Pacific | | | | | | |

| | | | U.S. | | Canada | | Greater China | | Rest of Asia | | EMEA | | LATAM | | Total |

| Economy | | | | | | | | | | | | | | | | | |

| Super 8 | $ | 29.13 | | | Properties | | 1,419 | | 119 | | 1,110 | | 1 | | | 13 | | 1 | | | 2,663 |

| | | Rooms | | 85,091 | | 7,717 | | 68,105 | | 50 | | | 2,015 | | 50 | | | 163,028 |

| Days Inn | $ | 40.00 | | | Properties | | 1,257 | | 106 | | 62 | | 11 | | 55 | | 10 | | 1,501 |

| | | Rooms | | 90,758 | | 8,388 | | 9,539 | | 1,377 | | 3,335 | | 819 | | 114,216 |

| Travelodge | $ | 40.14 | | | Properties | | 339 | | 100 | | — | | | — | | | — | | | — | | | 439 |

| | | Rooms | | 22,941 | | 7,713 | | — | | | — | | | — | | | — | | | 30,654 |

| Microtel | $ | 47.54 | | | Properties | | 293 | | 28 | | 19 | | | 15 | | — | | | 8 | | 363 |

| | | Rooms | | 20,705 | | 2,430 | | 2,309 | | | 1,118 | | — | | | 955 | | 27,517 |

| Howard Johnson | $ | 30.85 | | | Properties | | 143 | | 19 | | 74 | | 3 | | 7 | | 39 | | 285 |

| | | Rooms | | 11,259 | | 1,275 | | 21,996 | | 2,004 | | 790 | | 2,664 | | 39,988 |

| Total Economy | $ | 34.90 | | | Properties | | 3,451 | | 372 | | 1,265 | | 30 | | 75 | | 58 | | 5,251 |

| | | Rooms | | 230,754 | | 27,523 | | 101,949 | | 4,549 | | 6,140 | | 4,488 | | 375,403 |

| Midscale | | | | | | | | | | | | | | | | | |

| La Quinta | $ | 64.09 | | | Properties | | 899 | | 2 | | 2 | | | 2 | | | 4 | | | 9 | | 918 |

| | | Rooms | | 86,285 | | 133 | | 704 | | | 434 | | | 765 | | | 1,070 | | 89,391 |

| Ramada | $ | 36.05 | | | Properties | | 279 | | 73 | | 148 | | 70 | | 243 | | 31 | | 844 |

| | | Rooms | | 31,395 | | 7,066 | | 29,675 | | 13,445 | | 33,268 | | 4,224 | | 119,073 |

| Baymont | $ | 40.80 | | | Properties | | 539 | | 6 | | — | | | — | | | — | | | 1 | | 546 |

| | | Rooms | | 40,835 | | 404 | | — | | | — | | | — | | | 118 | | 41,357 |

| AmericInn | $ | 57.93 | | | Properties | | 218 | | — | | | — | | | — | | | — | | | — | | | 218 |

| | | Rooms | | 12,866 | | — | | | — | | | — | | | — | | | — | | | 12,866 |

| Wingate | $ | 56.54 | | | Properties | | 189 | | 8 | | 8 | | — | | | — | | | — | | 205 |

| | | Rooms | | 16,598 | | 822 | | 1,232 | | — | | | — | | | — | | 18,652 |

| Wyndham Alltra | NM | | Properties | | — | | — | | — | | — | | — | | 3 | | 3 |

| | | Rooms | | — | | — | | — | | — | | — | | 974 | | 974 |

| Wyndham Garden | $ | 44.95 | | | Properties | | 65 | | 4 | | 30 | | 12 | | 27 | | 24 | | 162 |

| | | Rooms | | 10,155 | | 696 | | 6,241 | | 2,468 | | 4,469 | | 3,196 | | 27,225 |

| Ramada Encore | $ | 27.40 | | | Properties | | — | | | — | | | 28 | | 11 | | 29 | | 10 | | 78 |

| | | Rooms | | — | | | — | | | 3,694 | | 2,814 | | 3,358 | | 1,443 | | 11,309 |

| Hawthorn | $ | 57.82 | | | Properties | | 68 | | — | | | 2 | | | — | | | 5 | | — | | | 75 |

| | | Rooms | | 5,284 | | — | | | 306 | | | — | | | 542 | | — | | | 6,132 |

| Trademark Collection | $ | 59.72 | | | Properties | | 87 | | 16 | | — | | | 14 | | | 131 | | 23 | | | 271 |

| | | Rooms | | 12,844 | | 2,256 | | — | | | 918 | | | 17,327 | | 5,541 | | | 38,886 |

| TRYP | $ | 54.44 | | | Properties | | 8 | | — | | | 2 | | 3 | | 26 | | 15 | | 54 |

| | | Rooms | | 841 | | — | | | 201 | | 388 | | 3,627 | | 1,805 | | 6,862 |

| Total Midscale | $ | 48.88 | | | Properties | | 2,352 | | 109 | | 220 | | 112 | | 465 | | 116 | | 3,374 |

| | | Rooms | | 217,103 | | 11,377 | | 42,053 | | 20,467 | | 63,356 | | 18,371 | | 372,727 |

| Upscale | | | | | | | | | | | | | | | | | |

| Wyndham | $ | 51.25 | | | Properties | | 47 | | 2 | | | 50 | | 22 | | 27 | | 35 | | 183 |

| | | Rooms | | 12,112 | | 640 | | | 14,362 | | 5,487 | | 4,318 | | 6,121 | | 43,040 |

| Wyndham Grand | $ | 56.14 | | | Properties | | 10 | | — | | | 42 | | 8 | | 16 | | 2 | | | 78 |

| | | Rooms | | 3,037 | | — | | | 12,783 | | 3,663 | | 3,777 | | 770 | | | 24,030 |

| Dazzler | $ | 63.90 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 14 | | 14 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 1,798 | | 1,798 |

| Esplendor | $ | 59.66 | | | Properties | | — | | | — | | | — | | | — | | | — | | | 9 | | 9 |

| | | Rooms | | — | | | — | | | — | | | — | | | — | | | 806 | | 806 |

| Dolce | $ | 74.84 | | | Properties | | 4 | | 2 | | | — | | 1 | | 9 | | 1 | | | 17 |

| | | Rooms | | 921 | | 275 | | — | | | 342 | | | 2,747 | | 341 | | | 4,626 |

| Vienna House | $ | 61.73 | | | Properties | | — | | — | | | — | | — | | 42 | | — | | | 42 |

| | | Rooms | | — | | — | | — | | | — | | | 6,584 | | — | | | 6,584 |

| Total Upscale | $ | 55.45 | | | Properties | | 61 | | 4 | | 92 | | 31 | | 94 | | 61 | | 343 |

| | | Rooms | | 16,070 | | 915 | | 27,145 | | 9,492 | | 17,426 | | 9,836 | | 80,884 |

| Luxury | | | | | | | | | | | | | | | | | |

| Registry Collection | $ | 79.19 | | | Properties | | — | | — | | | — | | — | | 5 | | 16 | | | 21 |

| | | Rooms | | — | | — | | | — | | — | | 1,800 | | 7,156 | | | 8,956 |

Affiliated properties (a) | | | | | | | | | | | | | | | | | |

| | | Properties | | 172 | | 3 | | — | | | 11 | | — | | | 3 | | 189 |

| | | Rooms | | 33,656 | | 44 | | — | | | 47 | | — | | | 77 | | 33,824 |

Total (b) | $ | 43.10 | | | Properties | | 6,036 | | 488 | | 1,577 | | 184 | | 639 | | 254 | | 9,178 |

| | | Rooms | | 497,583 | | 39,859 | | 171,147 | | 34,555 | | 88,722 | | 39,928 | | 871,794 |

______________________

(a)Affiliated properties represent properties under affiliation arrangements with former Parent or other third parties.

(b)Excludes ECHO Suites Extended Stay by Wyndham, which did not have any open hotels. As of December 31, 2023, we had 268 hotels in our pipeline, of which 11 have broken ground.

NM - not meaningful.

The following table presents the changes in our portfolio for the last three years:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| As of December 31, |

| 2023 | | 2022 | | 2021 |

| Properties | | Rooms | | Properties | | Rooms | | Properties | | Rooms |

| Beginning balance | 9,059 | | | 842,500 | | | 8,950 | | | 810,100 | | | 8,941 | | | 795,900 | |

Additions | 500 | | | 66,000 | | | 490 | | | 70,400 | | | 415 | | | 53,100 | |

Deletions | (381) | | | (36,700) | | | (381) | | | (38,000) | | | (406) | | | (38,900) | |

| Ending balance | 9,178 | | | 871,800 | | | 9,059 | | | 842,500 | | | 8,950 | | | 810,100 | |

In addition to our current hotel portfolio, we have over 1,900 properties and approximately 240,000 rooms in our development pipeline throughout 57 countries including 8 where we do not currently have a presence. As of December 31, 2023, approximately 42% of our pipeline was located in the U.S. and 58% was located internationally; 79% of our pipeline was for new construction properties, of which 34% have broken ground and 21% represented conversion opportunities.

Our pipeline is typically only a subset of our development activity in any given period as some of our hotel additions are executed and opened in less than 90 days and therefore may never appear in our pipeline. However, we use the pipeline to gauge interest in our brands and our continued ability to drive our net room growth projections.

Our franchise sales team consists of nearly 150 professionals throughout the world. Our sales team is focused on growing our franchise business through conversions of existing branded and independent hotels and partnering with developers to brand newly constructed hotels. In addition to a regional presence in the United States, we currently have sales teams located in England, Turkey, United Arab Emirates, China, Singapore, Canada, India, Mexico, Brazil, Argentina, Colombia and Australia. Our international presence in key countries allows us to quickly adapt to changes in the increasingly dynamic global marketplace and to capitalize on new opportunities as they emerge.

In 2023, our sales team executed 864 contracts representing nearly 104,000 rooms. A key component of driving our net room growth is our ability to retain properties within our system. Our 2023 global retention rate was 95.6%, which was a 30 basis point improvement from 2022. Our 2023 U.S. retention rate was 95.4%.

Our Guest Loyalty Program

Wyndham Rewards is our award-winning guest loyalty program that supports our portfolio of brands. The program generates significant repeat business by rewarding guests with points for each qualified stay at all of our participating properties. Members can use points for stays at over 60,000 hotels, vacation club resorts and vacation rentals globally as well as merchandise, gift cards, airlines, charities, and tours and activities. Affiliation with our loyalty programs encourages members to allocate more of their travel spending to our hotels.

Wyndham Rewards has been recognized as one of the simplest, most rewarding loyalty programs in the hotel industry, providing more value to members than any other program. It has won more than 100 awards and accolades in recent years and was recently ranked #1 “Best Hotel Loyalty Program” in USA TODAY 10 Best Readers’ Choice Awards for six consecutive years and as one of the “Best Travel Rewards Programs” by US News & World Report for nine years running.

Wyndham Rewards has over 106 million enrolled members. Our members accounted for over 35% of check-ins at our affiliated hotels globally and over 48% in the United States. Total membership grew 7% annually in each 2021, 2022 and 2023, with approximately 7 million new enrolled members added in 2023. Our franchisees benefit from the program through repeat stays and members benefit through free night stays, as well as other redemption options for their points, such as gift cards, merchandise and experiences. The program is funded by contributions from eligible revenues generated by Wyndham Rewards members and collected by us from hotels in our system. These funds are applied to reimburse hotels and partners for Wyndham Rewards points redemptions by loyalty members and to pay for administrative expenses and marketing initiatives that support the program.

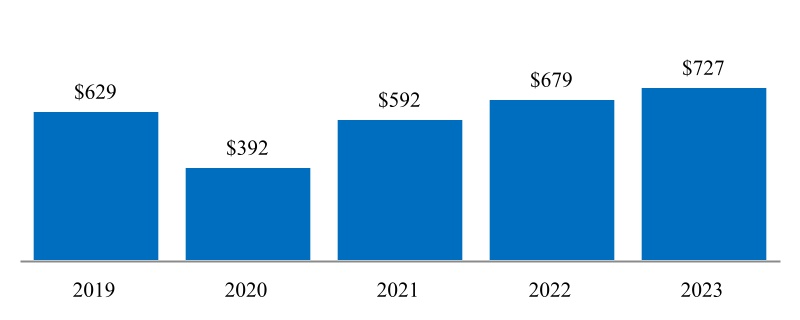

Hotel Franchising Segment Adjusted EBITDA (a) ($ in millions)

______________________

(a)See Part II Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations for our definition of adjusted EBITDA and the reconciliation of net income/(loss) to adjusted EBITDA. Adjusted EBITDA has been recasted to conform with the current year presentation for 2019 through 2020. 2020 adjusted EBITDA was impacted by COVID-19.

We license our brands and associated trademarks to over 6,100 franchisees globally, which provides for a highly diversified owner base with limited concentration. Our franchisees range from sole proprietors to institutional investors such as public real estate investment trusts. Our franchise agreements are typically 10 to 20 years in length, providing significant visibility into future cash flows. Under these agreements, our direct franchisees generally pay us a royalty fee of 4% to 5% of gross room revenue and a marketing and reservation fee of 3% to 5% of gross room revenue. We occasionally provide financial support in the form of loans or development advances to help generate new business.

As the world’s largest hotel franchising company by number of hotels, with approximately 9,200 hotels under 24 brands across over 95 countries, Wyndham Hotels & Resorts is an asset-light business with significant cash generation capabilities. Our company’s mission is to make hotel travel possible for all and we aim to be the world’s leading provider of select-service hotel brands by delivering the best value to owners and guests.

In support of our mission and vision, our strategic priorities are organized around the following primary goals and objectives:

•Growing our direct franchising system by 3-4% in 2024, with an ambition to accelerate to 3-5% annually by 2026 by continuing to improve our franchisee retention rates, investing in our brands and expanding into adjacent market segments and new geographies while supporting the roll-out of our ECHO Suites by Wyndham pipeline.

•Targeting new development efforts in high FeePAR (RevPAR + royalty rates) brands and regions.

•Optimizing top-line performance and market share for our franchisees by embracing continuous digital innovation and best practices, as well as capitalizing on the growing government spend tied to the U.S. Infrastructure and Chips Acts.

•Boosting franchisee profitability by reducing on-property labor and operating costs by deploying state-of-the-art owner-first technology solutions that not only streamline operations but also elevate guest experiences.

•Capitalizing on ancillary revenue opportunities by expanding our co-branded credit card offerings, introducing new products and services, building new strategic marketing partnerships and leveraging our unique "blue-tread' licensing partnership with Travel + Leisure Group.

Our strategic priorities are more than just goals; they are a commitment to our shareholders, franchisees, and guests that we will continue to drive growth, operational excellence, and profitability in all we do.

We are committed to operating our business in a way that is socially, ethically and environmentally responsible. Now more than ever, we must help ensure the future remains bright for travelers around the world. As the world’s largest hotel franchising company by number of hotels, we have a unique opportunity to make a meaningful impact on the world while advancing our mission to make hotel travel possible for all.

As a hospitality company, service and volunteering is deeply rooted in our history and corporate culture. Our teams and franchisees around the world actively engage in their communities, generously giving in ways that enhance the lives of others. We support various charitable programs, including youth and education, military, community and environmental programs. Our philanthropy captures the dedication of our team members, leaders and business partners who have pledged to make lasting, important contributions to the communities in which we operate.

As of December 31, 2023, we had approximately 2,300 employees, consisting of approximately 1,200 employees outside of the United States.

Culture

As a leader in hospitality, we recognize the critical role that service plays for our company. At Wyndham, our values underpin our inclusive culture, drive our growth, nurture innovation, and inspire the great experiences we create for team members and the people we serve. Our signature “Count on Me” service culture encourages each team member to be responsive, respectful, and deliver great experiences to our guests, partners, communities and each other. Our Count on Me promise aligns with our core values – integrity, accountability, inclusiveness, caring and fun – and is embedded and celebrated at all levels of our organization.

Ethical leadership starts with our Board of Directors (the “Board”) and is shared by senior management with every team member across every brand and business at Wyndham Hotels & Resorts. Our Business Principles guide our interactions and set the standard for how every one of us should approach our work in service to our mission. All team members are expected to embrace our shared values and principles, and do their part in maintaining the highest ethical standards and behavior as we grow in communities worldwide.

Career Development

Our team members’ career development is key to our ability to attract, reward, and retain the best talent and a top priority at Wyndham. We actively seek to identify and develop talent throughout the organization and maintain a long-standing practice to support the growth and development of all our team members at every stage of their careers. We develop and curate various learning content in partnership with external providers to ensure that team members maintain the knowledge, skills and abilities they need to succeed. These experiences include on-the-job practice, coaching and counseling, effective performance appraisals and honest, timely feedback as well as a vast array of formal leadership programs. Wyndham University, our global learning system, provides our team members with access to a robust learning library that is flexible and accessible to help our team members learn, grow and thrive.

Diversity, Equity and Inclusion

We respect differences in people, ideas and experiences. Our core values, grounded in caring, respect, inclusiveness and fundamental human rights, infuse different perspectives that reflect our diverse customers, team members, and communities worldwide. While we continue to be recognized for the progress we have made on our Diversity, Equity and Inclusion journey, we know we can do more. We added a diversity, equity and inclusion goal to performance reviews of all team members; bolstered our efforts to recruit, retain and promote diverse talent; expanded our supplier diversity program; and continued our robust diversity, equity and inclusion training programs – all to inspire our people to contribute to meaningful change in our company, our industry, our communities and the world.

Wyndham has seven global affinity business groups. These affinity groups serve as fully inclusive networks where empowered team members foster innovation, help us grow, and enhance diversity, equity and inclusion globally. Members of our executive committee serve as sponsors of the affinity groups where they serve as allies, mentors and advocates.

Our company was named to the 2023 Top 50 Companies for Diversity List by DiversityInc. We were also recognized by Forbes as one of The Best Employers for Diversity for the second consecutive year and named to Newsweek’s list of America’s Greatest Workplaces for Diversity showcasing Wyndham’s continued commitment to providing a workplace that promotes diversity, equity and inclusion for all. Our commitment to supporting the military community afforded Wyndham the VETS Indexes 4 Star Employer designation as part of the 2023 VETS Indexes Employer Awards, a 2023 Military Friendly Employer Silver Award and Military Friendly – Top 10 Supplier Diversity Program Award for the second consecutive year. We were further named to the Newsweek 2023 List of Most Loved Workplaces for the second consecutive year and named one of the 2023 Best Places to Work in New Jersey by New Jersey Business Magazine for the fourth consecutive year. These accolades build on our growing resume of workplace awards.

Throughout our value chain, from team members, franchisees, partners and suppliers to the community and our guests, we believe that diversity of backgrounds, cultures and experiences helps drive our company’s success.

Wellness: Our “Be Well” Program

We are committed to offering programs that focus on the total well-being of all our team members. We also understand that nutrition, exercise, lifestyle management, physical, mental, and emotional wellness, financial health and the quality of the environment in which we work and live are also critical priorities for each of our team members. We believe that health and wellness promote both professional and personal productivity, achievement, and fulfillment, ultimately making us stronger across the organization. To encourage all our team members to lead healthier lifestyles while balancing family, work and other responsibilities, we offer several resources under our Be Well program, including free clinic services, an onsite fitness facility and a Wyndham Relief Fund to help employees who are facing financial hardship.

Human rights are a basic right entitled to all. We remain committed to the well-being and safety of our team members, guests and all those that connect to our industry. In 2023, we continued to donate and encourage our team members and over 106 million enrolled Wyndham Rewards members to support humanitarian causes around the world.

We partnered with the American Hotel & Lodging Association (“AHLA”) to support the 5-Star Promise, a voluntary commitment to enhance policies, trainings, and resources for hotel employees and guests. We are dedicated to our team members’ safety and security and we are proud to unite with our industry in support of a shared commitment to the incredible people who help make our guests’ travels memorable.

We, along with other leaders in our industry, remain committed to supporting our industry’s efforts to end human trafficking. We have worked to enhance our policies and mandated training for all our team members to help them identify and report trafficking activities.

We are proud to work with a number of organizations including ECPAT-USA, an organization whose mission is to protect every child’s human right to grow up free from the threat of sexual exploitation and trafficking.

We also support Polaris, a non-profit organization that spearheads the effort to fight against human trafficking and operates the U.S. National Human Trafficking Hotline, to which Wyndham donates Wyndham Rewards points to provide victims with temporary safe housing. As part of our giving efforts, Wyndham Rewards and its members have donated approximately 181 million points since inception to various non-profit organizations, including organizations supporting humanitarian causes to redeem for travel and other related goods and services.

As the world’s largest hotel franchising company, we have the opportunity to make a meaningful impact on the world and we take that opportunity seriously. We are committed to operating our business in a way that is socially, ethically and environmentally responsible. We engage team members, owners and operators around the world to uphold and leverage our core values to think globally and execute locally.

Through the Wyndham Green Program, we support franchisees by helping them to reduce operating costs through efficiency measures, drive revenue from environmentally conscious travelers, and remain competitive in the market, while increasing brand loyalty. The Wyndham Green Program consists of two integral components: 1) the Wyndham Green Certification, our internal certification with best practices to address energy and water conservation, waste diversion, responsible purchasing, as well as guest, team member and franchisee education and engagement, and 2) the Wyndham Green Toolbox, an environmental management tool that tracks, measures and reports environmental performance data to help franchisees improve energy efficiency, reduce greenhouse gas or (“GHG”), emissions, conserve water, and reduce waste – thus minimizing environmental impact.

The UN Sustainable Development Goals serve as a strategic guide for our sustainability program, which helps advance our company’s mission of making hotel travel possible for all. Our focus includes:

•Embarking on a long-term journey to help our franchisees reduce their GHG emissions in alignment with efforts to limit the rise in global temperatures in part by providing tools and best practices through our Wyndham Green Program.

•Promoting best practices around water conservation at these hotels through our Wyndham Green Program; supporting the access to clean water through our community partnerships; and reducing single-use plastics to promote clean waterways and oceans.

•Sharing best practices around waste diversion through our Wyndham Green Program to reduce waste sent to landfills and the environmental impact.

•Promoting and expanding best practices for biodiversity protection across Wyndham's franchised hotels; engaging with suppliers to make a meaningful impact to protect forests and biodiversity.

We remain committed to helping our franchisees reduce the energy, water and carbon footprint of their hotels as we work towards achieving our 2025 environmental targets. We continue to evaluate opportunities to increase efficiencies and the usage of renewable energy where feasible as we update our decarbonization plans with longer term targets in alignment with climate science.

We continually monitor and prioritize climate-related risks based on the financial and strategic impacts on our business. Enterprise risks, including those related to sustainability, climate and energy, are identified and assessed on an ongoing basis.

We review climate-related risks using the TCFD recommendations on an annual basis, which include both transition and physical risks. Some risks that we consider include:

•Current and emerging regulations, including those pertaining to energy efficiency, energy and GHG emissions reporting and green building codes and standards at the local, state, and national levels, are considered as risks for franchised business.

•Acute physical risks (extreme weather events), including hurricanes and wildfires, are increasing in frequency and can impact travel demand in specific markets, supply chains and cause physical damage to franchisee's assets.

•Chronic physical risks, such as rising sea levels, rising mean temperatures, changes in precipitation patterns (including droughts) and extreme variability in weather patterns, can influence demand for travel and tourism in key markets adversely by decreasing revenue and/or causing property damage for franchisees.

Our business model is asset-light, which dramatically limits our capital needs and exposure to the effects of climate change while providing us the ability to mitigate and transfer some of the risks associated with physical risks to third parties. Many factors influence our reputation and the value of our hotel brands including the perception held by our guests, our franchisees, our other key stakeholders and the communities in which we do business. The environmental information that we provide is used to inform their purchasing decisions and can directly impact our revenue associated with both franchisee and management fees.

During 2023, Wyndham was named one of the Net-Zero Leaders by Forbes for 2023 (©2023 Forbes. All rights reserved. Used under license), which identifies leading companies that are progressing to a low-carbon economy by 2050 and are also adapting their business model to achieve sustainability targets. As more travelers are looking for environmentally-friendly lodging options, it is critical to position Wyndham-branded hotels optimally to provide environmentally responsible options and to make it simpler for our guests to locate and book stays with these types of hotels. Our 2023 ESG Report, which is available on our corporate website and not incorporated by reference into this Annual Report, contains additional information regarding our commitment to social responsibility and sustainability.

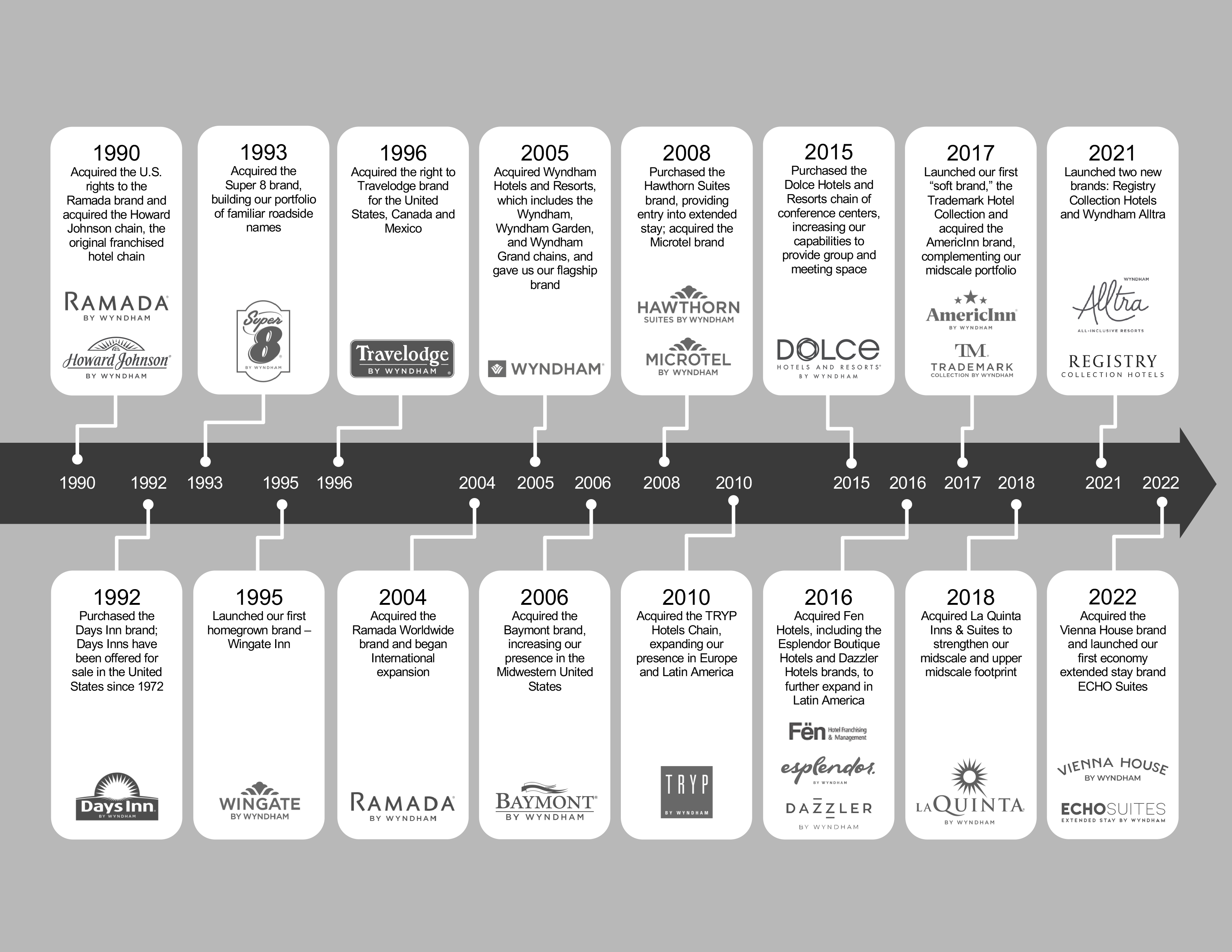

Our business was initially incorporated as Hospitality Franchise Systems, Inc. in 1990 to acquire the Howard Johnson brand and the franchise rights to the Ramada brand in the United States. It was an integral part of Wyndham Worldwide Corporation and its predecessor from 1997 to 2018. Wyndham Hotels became an independent, public company in May 2018 when it was spun-off from Wyndham Worldwide, now known as Travel + Leisure Co. (“Travel + Leisure”).

We encounter competition among hotel franchisors and lodging operators. We believe franchisees make decisions based principally upon the perceived value and quality of the brand and the services offered. We further believe that the perceived value of a brand name is partially a function of the success of the existing hotels franchised under the brand.

The ability of an individual franchisee to compete may be affected by the location and quality of its property, the number of competitors in the vicinity, community reputation and other factors. A franchisee’s success may also be affected by general, regional and local economic conditions. The potential effect of these conditions on our performance is substantially reduced by virtue of the diverse locations of our affiliated hotels and by the scale of our base. Our system is dispersed among over 6,100 franchisees, which reduces our exposure to any one franchisee. One master franchisor in China for the Super 8 brand accounts for 12% of our hotels. Apart from this relationship, no one franchisee accounts for more than 2% of our hotels.

While the hotel industry is seasonal in nature, periods of higher revenues vary property-by-property and performance is dependent on location and guest base. Based on historical performance, revenues from franchise contracts are generally higher in the second and third quarters than in the first or fourth quarters due to increased leisure travel during the spring and

summer months. Our cash from operating activities may not necessarily follow the same seasonality as our revenues and may vary due to timing of working capital requirements and other investment activities. The seasonality of our business may cause fluctuations in our quarterly operating results, earnings, profit margins and cash flows. As we expand into new markets and geographical locations, we may experience increased or different seasonality dynamics that create fluctuations in operating results different from the fluctuations we have experienced in the past.

Wyndham Hotels owns the trademarks and other intellectual property rights related to our hotel brands, including the “Wyndham” trademark. We actively use, directly or through our licensees, these trademarks and other intellectual property rights. We operate in a highly competitive industry in which the trademarks and other intellectual property rights related to our hotel brands are very important to the marketing and sales of our services. We believe that our hotel brand names have come to represent high standards of quality, caring, service and value to our franchisees and guests. We register the trademarks we own in the United States Patent and Trademark Office, as well as with other relevant authorities, where we deem appropriate, and otherwise seek to protect our trademarks and other intellectual property rights from unauthorized use as permitted by law.

Our business is subject to various foreign and U.S. federal and state laws and regulations. In particular, our franchisees are subject to the local laws and regulations in each country in which such hotels are operated, including employment laws and practices, privacy laws and tax laws, which may provide for tax rates that vary from those of the United States and which may provide that our foreign earnings are subject to withholding requirements or other restrictions, unexpected changes in regulatory requirements or monetary policy and other potentially adverse tax consequences. Our franchisees and other aspects of our business are also subject to various foreign and U.S. federal and state laws and regulations, including the Americans with Disabilities Act and similar legislation in certain jurisdictions outside of the United States.

The Federal Trade Commission, various states and other foreign jurisdictions regulate the offer and sale of franchises. The Federal Trade Commission requires us to furnish to prospective franchisees a franchise disclosure document containing prescribed information prior to execution of a binding franchise agreement or payment of money by the prospective franchisee. State regulations also require franchisors to make extensive disclosure to prospective franchisees, and a number of states also require registration of the franchise disclosure document prior to sale of any franchise within the state. Non-compliance with disclosure and registration laws can affect the timing of our ability to sell franchises in these jurisdictions. Additionally, laws in many states and foreign jurisdictions also govern the franchise relationship, such as imposing limits on a franchisor’s ability to terminate franchise agreements or to withhold consent to the renewal or transfer of these agreements. Failure to comply with these laws and regulations has the potential to result in fines, injunctive relief, and/or payment of damages or restitution to individual franchisees or regulatory bodies, or negative publicity impairing our ability to sell franchises.

| | |

INFORMATION ABOUT OUR EXECUTIVE OFFICERS |

Geoffrey A. Ballotti, 62, serves as our President and Chief Executive Officer and member of our Board. From March 2014 to May 2018, Mr. Ballotti served as President and Chief Executive Officer of Wyndham Hotel Group. From March 2008 to March 2014, Mr. Ballotti served as Chief Executive Officer of Wyndham Destination Network. From October 2003 to March 2008, Mr. Ballotti was President of the North America Division of Starwood Hotels and Resorts Worldwide. From 1989 to 2003, Mr. Ballotti held leadership positions of increasing responsibility at Starwood Hotels and Resorts Worldwide, including President of Starwood North America, Executive Vice President, Operations, Senior Vice President, Southern Europe and Managing Director, Ciga Spa, Italy. Prior to joining Starwood Hotels and Resorts Worldwide, Mr. Ballotti was a Banking Officer in the Commercial Real Estate Group at the Bank of New England.

Michele Allen, 49, serves as our Chief Financial Officer. From May 2018 to December 2019, Ms. Allen served as Executive Vice President and Treasurer. From April 2015 to May 2018, Ms. Allen served as Senior Vice President of Finance for Wyndham Worldwide. From August 2006 to March 2015, Ms. Allen held leadership positions of increasing responsibility at Wyndham Hotel Group, including Senior Vice President of Finance and Controller. From 1999 to August 2006, Ms. Allen served in positions of increasing responsibility at Wyndham Worldwide’s predecessor. Ms. Allen began her career as an independent auditor at Deloitte & Touche LLP.

Paul F. Cash, 54, serves as our General Counsel, Chief Compliance Officer and Corporate Secretary. From October 2017 to May 2018, Mr. Cash served as Executive Vice President and General Counsel of Wyndham Hotel Group. From April 2005 to September 2017, Mr. Cash served as Executive Vice President and General Counsel and in legal executive positions

with increasing leadership responsibility for Wyndham Destination Network. From January 2003 to April 2005, Mr. Cash was a partner in the Mergers and Acquisitions, International and Entertainment and New Media practice groups of Alston & Bird LLP and from February 1997 to December 2002 he was an associate at Alston & Bird LLP. From August 1995 until February 1997, Mr. Cash was an associate at the law firm Pünder, Volhard, Weber & Axster in Frankfurt, Germany.

Lisa Borromeo Checchio, 43, serves as our Chief Marketing Officer. From May 2018 to January 2019, Ms. Checchio served as our Senior Vice President and Chief Marketing Officer. From August 2015 to May 2018, Ms. Checchio served in positions of increasing responsibility for Wyndham Hotel Group including Senior Vice President, Global Brands. From July 2004 to August 2015, Ms. Checchio held several marketing positions of increasing responsibility and served as Brand Marketing and Advertising Director for JetBlue Airways.

Monica Melancon, 56, serves as our Chief Human Resource Officer. From March 2020 to February 2021, Ms. Melancon served as Group Vice President, Human Resources – Managed. Ms. Melancon joined Wyndham Hotels & Resorts, Inc. in May 2018 and continued in her role as Vice President, Employee Relations following the Company’s acquisition of La Quinta in May 2018 where she had served in the same role from August 2016 to May 2018. Ms. Melancon previously served as Regional Employee Relations Manager of La Quinta from March 2015 to July 2016. Prior to joining La Quinta, Ms. Melancon served 15 years in various human resource positions of increasing responsibility at Target Corporation.

Nicola Rossi, 57, serves as our Chief Accounting Officer. From July 2006 to May 2018, Mr. Rossi served as Senior Vice President and Chief Accounting Officer for Wyndham Worldwide. Mr. Rossi was Vice President and Controller of Cendant’s Hotel Group from June 2004 to July 2006. From April 2002 to June 2004, Mr. Rossi served as Vice President, Corporate Finance for Cendant. From April 2000 to April 2002, Mr. Rossi was Corporate Controller and from June 1999 to March 2000 was Assistant Corporate Controller of Jacuzzi Brands, Inc. Mr. Rossi began his career as an independent auditor at Deloitte & Touche LLP.

Scott R. Strickland, 53, serves as our Chief Information and Distribution Officer. From May 2018 through November 2023, Mr. Strickland served as Chief Information Officer of the Company. From March 2017 to May 2018, Mr. Strickland served as Chief Information Officer of Wyndham Hotel Group. From November 2011 to March 2017, Mr. Strickland served as Chief Information Officer for Denon Marantz Electronics. From February 2005 to June 2010, Mr. Strickland served as Chief Information Officer for Black & Decker HHI. From 1999 to 2005, Mr. Strickland served as an Associate Partner with PricewaterhouseCoopers.

Item 1A. Risk Factors.

You should carefully consider each of the following risk factors and all of the other information set forth in this report. Based on the information currently known to us, we believe that the following information identifies the most significant risk factors affecting our Company. However, the risks and uncertainties we face are not limited to those set forth in the risk factors described below. Additional risks and uncertainties not presently known to us or that we currently believe to not presently create significant risk to us may also adversely affect our business. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. If any of the following risks and/or uncertainties develop into actual events, these events could have a material adverse effect on our business, financial condition or results of operations. In such case, the trading price of our common stock could decline.

Risks Relating to Our Industry

The lodging industry is highly competitive, and we are subject to risks related to competition that may adversely affect our performance and growth.

Our continued success depends upon our ability to compete effectively in markets that contain numerous competitors, some of whom may have significantly greater financial, marketing and other resources than we have. We compete with other hotel franchisors for franchisees and we may not be able to grow our franchise system. New hotels may be constructed and these additions to supply create new competitors, in some cases without corresponding increases in demand for lodging. Competition may reduce fee structures, potentially causing us to lower our fees and/or offer other incentives, and may require us to offer terms to prospective franchisees less favorable to us than current franchise agreements, which may adversely impact our profits. Our franchisees also compete with alternative lodging channels, including third-party providers of short-term rental properties and serviced apartments. Increasing use of these alternative lodging channels could adversely affect the

occupancy and/or average rates at franchised hotels and our revenues. The use of business models by competitors that are different from ours may require us to change our model so that we can remain competitive.

Declines in or disruptions to the travel and hotel industries may adversely affect us.

We face risks affecting the travel and hotel industries that include, but are not limited to: economic slowdown and potential recessionary pressures; economic factors such as inflation, rising interest rates, employment layoffs, increased costs of living and reduced discretionary income, which may adversely impact decisions by consumers and businesses to use travel accommodations; domestic unrest, terrorist incidents and threats and associated heightened travel security measures; political instability or political and regional strife, including the ongoing conflict between Russia and Ukraine; acts of God such as earthquakes, hurricanes, fires, floods, volcanoes and other natural disasters; war, including the Israel-Hamas war; concerns with or threats of known and novel contagious diseases or health epidemics or pandemics; environmental disasters; lengthy power outages; cyber threats, increased pricing, financial instability and capacity constraints of air carriers; airline job actions and strikes. Increases in the frequency and severity of extreme weather events and other consequences of climate change (including any related regulation) could impact travel demand generally, lead to supply chain interruptions, cause damage to physical assets or adversely impact the accessibility or desirability of travel to certain locations.

For example, certain of our franchisees’ properties are located in coastal areas that could be threatened should sea levels dramatically rise, or are located in areas where the risk of natural or climate-related disaster or other catastrophic losses exists, and the occurrence of such an event could cause substantial damage to our franchisees and/or the surrounding area. Because a significant portion of our revenues is derived from fees based on room revenues, disruptions at our franchised properties due to such occurrences may adversely impact the fees we collect from these properties. In the event of a substantial loss, the insurance coverage carried by our franchisees may not be sufficient to pay the full value of financial obligations, liabilities or the replacement cost of any lost investment or property held by our franchisees. Additionally, certain types of losses may be uninsurable or prohibitively expensive to insure, and other types of losses or risks that our franchisees may face could fall outside of the general coverage terms and limits of our policies. Such factors could lead to certain losses by our franchisees being completely uninsured in which case we could lose future franchisee fees and may be exposed to a potential impairment of any development advance notes funded to the franchisee should the underlying guarantees provided to us prove to be insufficient.